Gold and Silver Traders Demand GST Reduction to 1% on Gold Jewellery: If you’ve been keeping an eye on the jewelry market lately, you’ve probably heard the buzz — gold and silver traders are pushing for a Goods and Services Tax (GST) cut on gold jewellery from 3% to just 1%. Sounds like a small change, right? But in the precious metals game, a tiny shift in taxes can shake the whole industry — from big-city retail showrooms to small-town family-run shops, from high-end diamond-studded sets to simple wedding bands. And here’s the kicker — this isn’t just about cheaper gold bangles for your aunt or a better deal on your cousin’s wedding ring. It’s about industry growth, job creation, curbing smuggling, and keeping trade above board. In other words, we’re talking about a big deal in a shiny package.

Gold and Silver Traders Demand GST Reduction to 1% on Gold Jewellery

The call to cut GST on gold jewellery from 3% to 1% is more than just an industry wish list — it’s a proposal that could reshape India’s gold economy. By making gold more affordable, supporting job growth, reducing smuggling, and promoting compliance, the move could benefit consumers, traders, and the government alike. The decision now lies with policymakers. In a nation where gold is as much about tradition as it is about investment, every percentage point in tax can make a world of difference.

| Aspect | Details |

|---|---|

| Current GST on Gold Jewellery | 3% total (1.5% Central GST + 1.5% State GST) |

| Proposed GST Rate | 1% (as per trader demand) |

| Reason for Demand | Reduce burden on consumers, boost demand, curb illegal trade |

| Industry Body Leading the Call | All India Gem & Jewellery Domestic Council (GJC) |

| Making Charges GST | 5% (unchanged in demand) |

| Recent Policy Context | India cut gold import duty from 15% to 6% in July 2024 |

| Potential Benefits | More affordable gold, higher sales, job creation, transparency |

| Official Source | GST Council of India |

Historical Context: How We Got Here

Before GST was rolled out in July 2017, gold sales in India attracted around 2% in total taxes — split between excise duty and VAT. This meant gold was relatively more affordable, and the jewellery trade remained vibrant even in smaller markets.

The introduction of GST was meant to simplify India’s tax structure, but gold found itself in the 3% tax bracket. Add the 5% GST on making charges, and the final bill for jewellery purchases rose sharply overnight.

For urban buyers, this was an annoyance. For rural India — where gold is not just an ornament but a form of savings, security, and dowry — it was a noticeable barrier.

Why Gold and Silver Traders Demand GST Reduction to 1% on Gold Jewellery Matters?

GST works much like sales tax in the United States. The higher it is, the more you pay when you check out. But gold is not like buying a pair of sneakers — it’s a cultural staple and a store of value.

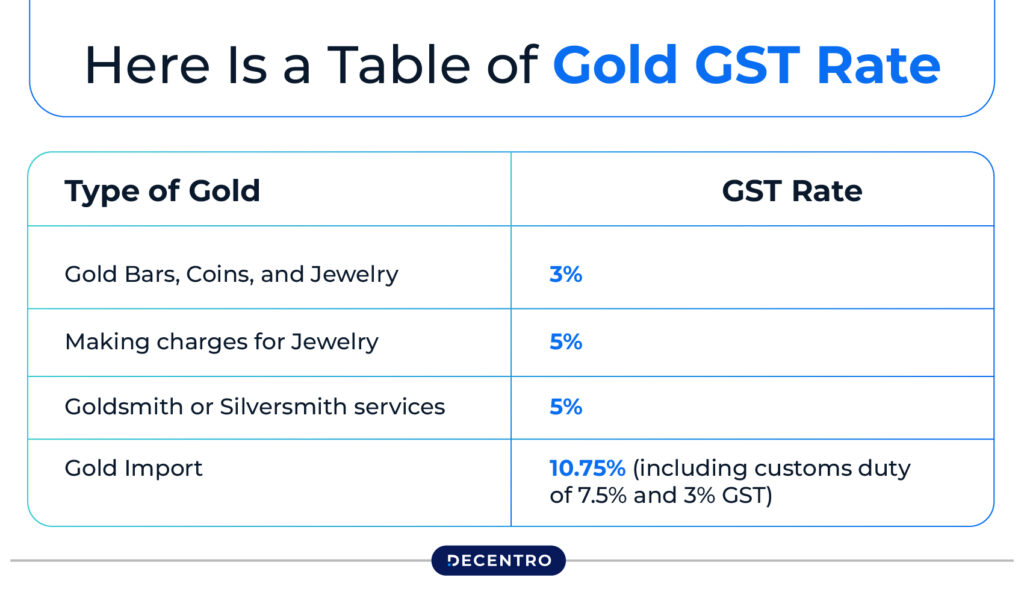

At present:

- You pay 3% GST on the gold value

- You pay 5% GST on making charges — the cost of crafting your jewellery

For a big-ticket purchase, the tax amount can run into tens of thousands of rupees. On a ₹5,00,000 necklace, the GST portion alone can add more than ₹16,000 to your bill.

What Traders Are Saying?

The All India Gem & Jewellery Domestic Council (GJC) — representing thousands of jewelers, wholesalers, artisans, and bullion traders — has formally urged the GST Council to bring the tax down to 1%.

Their reasons include:

- Revenue Neutrality – Even with lower rates, higher sales volumes can keep government earnings steady.

- Boost Demand – Lower prices can trigger more purchases, particularly in tier-2 and tier-3 cities.

- Curb Smuggling – Lower tax rates reduce the price gap between legal and illegal markets.

- Support “Make in India” – Domestic jewellery manufacturing benefits from stronger demand.

GJC Chairman Saiyam Mehra told the Economic Times, “The current GST rate on gold is above pre-GST levels and out of sync with consumer expectations. Lowering it will help the industry grow, create jobs, and increase compliance.”

The Import Duty Factor

While GST is a domestic tax, import duty is charged when gold enters India.

In July 2024, the Indian government slashed gold import duty from 15% to 6% — the lowest level in over a decade. The move was aimed at:

- Lowering domestic prices

- Reducing gold smuggling

- Supporting official trade channels

The reduction helped bring down gold prices in India, but industry leaders argue that without a GST cut, the final retail price still discourages some buyers.

Economic Impact: The Numbers Behind the Glitter

According to the World Gold Council, India’s annual gold demand is roughly 750–800 tonnes. If GST were reduced from 3% to 1%, analysts estimate official demand could rise by 10–15% annually.

That could mean:

- Billions of dollars in additional legal trade

- Thousands of new jobs across the supply chain

- Stronger domestic jewellery manufacturing and export potential

A 2019 ASSOCHAM report also pointed out that every ₹1 spent in the gold industry generates ₹2.5 in related economic activity, underscoring gold’s multiplier effect on the economy.

Consumer Sentiment: Voices from the Ground

In Mumbai, high-end buyers say GST is more of an irritant than a deterrent — but in smaller cities, it’s a deal-breaker. In Tamil Nadu, traders report customers opting for lighter designs or switching to silver due to price hikes.

In rural Rajasthan, where gold is part of marriage customs, families are reducing the amount of jewellery gifted at weddings. One shop owner in Jaipur remarked, “Earlier, a bride would receive 500 grams of gold; now families settle for half that, just to keep the bill manageable.”

Challenges & Criticisms

Not everyone believes a GST cut is a silver bullet. Some economists warn:

- Lower GST could lead to a short-term drop in government tax revenue.

- A surge in demand might increase imports, impacting the current account deficit.

- The benefit might be skewed toward wealthier buyers who purchase large amounts of gold.

The government will also have to weigh the proposal against other sectors clamoring for tax relief.

Investment Angle: Why This Matters to Gold Buyers

Gold isn’t just a fashion statement — it’s a long-term investment. Lower GST means:

- Lower entry cost for investors buying gold bars, coins, or jewellery

- Better resale margins when selling

- Increased attractiveness compared to taxable investment options like property or certain bonds

If the GST cut goes through, it could strengthen gold’s position as a safe-haven asset in India.

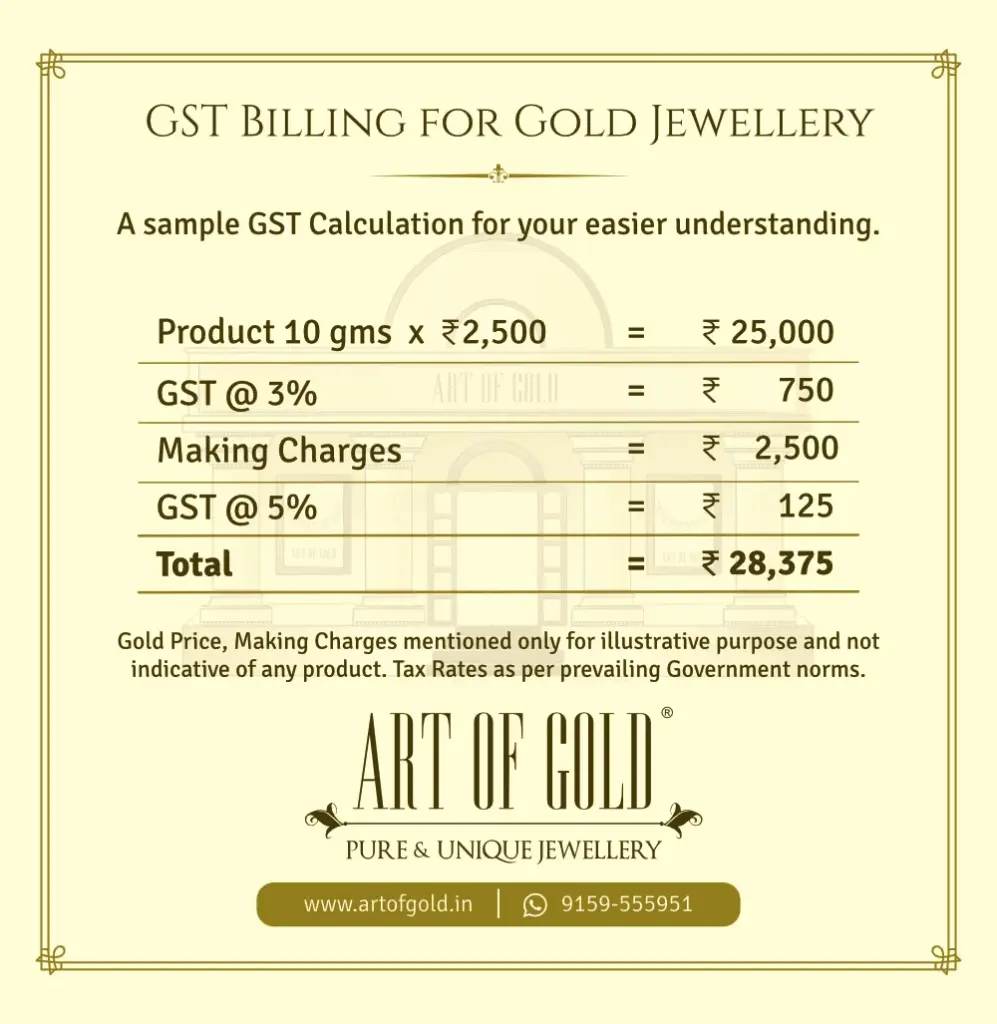

Practical Example: The Math of Savings

Let’s say you buy a necklace worth ₹5,00,000 with ₹30,000 in making charges.

At 3% GST on gold:

- Gold value tax = ₹15,000

- Making charges tax = ₹1,500

- Total GST = ₹16,500

At 1% GST on gold:

- Gold value tax = ₹5,000

- Making charges tax = ₹1,500

- Total GST = ₹6,500

That’s a saving of ₹10,000 — enough for another small piece of jewellery or to invest elsewhere.

Step-by-Step: Possible Chain Reaction of a GST Cut

Step 1: GST cut announced → prices drop

Step 2: More buyers purchase jewellery legally

Step 3: Higher sales → industry hires more workers

Step 4: Govt tax revenue stays stable due to volume growth

Step 5: Smuggling drops as price gaps shrink

Future Outlook

If the GST Council approves the cut, changes could take effect in the 2025-26 fiscal year. Industry insiders expect:

- Festive season sales to hit record highs

- Stronger demand for hallmarked jewellery

- Positive spillover effects in silver and platinum sales

If rejected, traders are likely to intensify lobbying efforts, possibly linking the issue to rural economic priorities during election cycles.

Actionable Tips for Buyers and Sellers

For Buyers:

- Monitor GST Council announcements before major purchases

- Buy hallmarked gold to ensure quality and resale value

- Compare prices across multiple jewelers to account for making charges

For Jewelers:

- Prepare inventory for a potential demand spike

- Train staff to explain tax changes to customers

- Promote the benefits of legal, hallmarked gold purchases

Global Perspective

In the United States, sales tax on gold depends on the state. Some, like Delaware, have no sales tax on precious metals. Others impose taxes, but rates are often lower than India’s combined GST and import duty.

This flexibility keeps gold investment competitive in the U.S. India, as the second-largest gold consumer, faces the challenge of balancing affordability with revenue needs.

Government Appoints 33 Experts to GST Appellate Tribunal – What This Means for GST Appeals!

Supreme Court Denies Plea Challenging GST ECL Blocking Relief