GoM Endorses Two-Slab GST and 40% Sin Tax: The Group of Ministers (GoM) endorsing a two-slab GST structure and a 40% “sin tax” is one of the boldest fiscal announcements India has seen since the introduction of GST in 2017. The proposal is sparking debates across industries, households, and state governments. If you’re wondering what this means for your shopping cart, your state’s budget, or your business strategy, let’s unpack the story in simple, straightforward terms.

India’s GST journey has been about balancing simplicity with revenue protection. The new model promises to simplify the four-rate system into just two slabs—5% for essentials and 18% for standard goods—while carving out a special 40% slab for sin and luxury goods. This may sound like a win for clarity, but as always in tax policy, the devil is in the details.

GoM Endorses Two-Slab GST and 40% Sin Tax

The GoM’s endorsement of a two-slab GST and 40% sin tax is a bold attempt to simplify India’s tax system while protecting revenues. Essentials and standard goods will become more affordable, but luxury buyers will continue to pay a premium. For consumers, it means smarter shopping. For businesses, it means recalibration. For states, it’s about balancing books. All eyes are now on the GST Council’s Diwali decision, which could shape India’s tax future for decades.

| Category | Details |

|---|---|

| New GST Structure | From four slabs (5%, 12%, 18%, 28%) → two slabs (5% & 18%) |

| Sin/Luxury Goods | New 40% GST for tobacco, alcohol, pan masala, luxury cars |

| Impact on Consumers | Essentials cheaper, standard goods stable, premium goods pricier |

| State Concerns | Possible revenue loss; states push for extra levy beyond 40% |

| Timeline | To be taken up by the GST Council before Diwali 2025 |

| Reference | Official GST Council Website |

Why GST Exists: A Quick Throwback

Before GST, India’s tax system was a messy tangle of state and central taxes. Every truck carrying goods across state lines faced delays at border checkpoints due to multiple levies like octroi, entry tax, and VAT. This slowed down logistics and made compliance a nightmare. GST was introduced in 2017 as a landmark reform to replace more than a dozen indirect taxes with one unified system.

But what was supposed to be “one nation, one tax” ended up being a patchwork of four slabs (5%, 12%, 18%, 28%) plus additional cesses. That complexity has frustrated both businesses and consumers. The current move is an attempt to fulfill GST’s original promise of simplicity.

Why Two Slabs Now?

There are three big reasons:

- Simplification for Businesses

With just two standard slabs, businesses can manage pricing and compliance more easily. No more confusion about whether a packaged food item falls in the 12% or 18% bracket. - Higher Compliance and Lower Evasion

A World Bank study highlighted that India’s GST compliance burden is among the highest globally. By reducing slabs, compliance time could fall by as much as 30 percent. Simpler rules mean fewer disputes and fewer opportunities for manipulation. - Balancing State Revenues

The big worry is state revenue. Currently, items taxed at 28% contribute significantly to state compensation. Moving them to 18% means potential shortfalls. To offset this, the government proposes a flat 40% sin tax on luxury and harmful goods, keeping the cash pipeline flowing.

The Political Angle: Centre vs States

While the GoM has endorsed the proposal, several states—especially those led by opposition parties—are skeptical. West Bengal and Telangana have argued that the 40% slab may not be enough to make up for revenue losses from collapsing the 12% and 28% slabs. They have even suggested adding an extra levy above the 40 percent.

The politics are important because GST decisions require consensus in the GST Council, which includes representatives from both the Centre and states. The Centre argues simplification is necessary for long-term growth. Some states fear losing fiscal autonomy and immediate revenue. This tug-of-war will likely dominate discussions leading up to the Diwali meeting.

International Comparison

Looking abroad helps put things in perspective:

- United States: No GST. Each state has its own sales tax ranging from 0% to 7%. It’s decentralized and messy but gives states more control.

- United Kingdom: VAT is 20% across most goods, with exemptions for essentials. Simple, but flat.

- Singapore: GST is 9% flat—straightforward and highly efficient.

India’s new model of two slabs plus a 40% luxury/sin rate is unique. It mixes social policy (discouraging harmful goods) with simplicity. The structure is more complicated than Singapore but more streamlined than the U.S.

Sector-Wise Impact

Essential Goods

Groceries, medicines, and basic services remain at 5%. This is a relief for households and politically popular. Some items earlier at 12% will now move to 5%, further lowering costs.

Standard Goods

Electronics, clothing, and consumer durables fall under 18%. If previously taxed at 28%, these goods may now see price drops. For example, a refrigerator priced at ₹50,000 could be ₹5,000 cheaper.

Luxury and Sin Goods

Tobacco, alcohol, pan masala, and luxury cars are locked in at 40%. These items already faced high taxes under the cess system, but the new rate could be harsher if states pile on additional levies. A ₹50 lakh luxury SUV could cost nearly ₹70 lakh after GST.

Consumer Psychology: Why This Matters

Behavioral economics tells us that price changes directly influence spending habits. Essentials like food and medicine have inelastic demand—people buy them regardless of price. But for luxury items, demand is elastic—when prices rise, consumers postpone or cancel purchases.

That’s why the government is okay with raising taxes on premium goods. High-income consumers can afford the increase, while everyday folks benefit from lower rates on essentials. It’s also politically safer to target luxury buyers rather than the masses.

Expert Opinions On GoM Endorses Two-Slab GST and 40% Sin Tax

Economists are cautiously optimistic.

- Economist R. Krishnan told the Economic Times: “The two-slab system is a long-pending demand of industry. But a 40% sin tax is aggressive and could dent luxury consumption.”

- Former Finance Secretary Subhash Chandra Garg told Reuters: “This is politically smart. Essentials get cheaper, the middle class gets relief, and luxury buyers continue paying.”

The consensus? Simplification is welcome, but execution and state buy-in are critical.

Professional and Career Impact

The reform doesn’t just affect shoppers—it has implications for careers and industries:

- Tax Consultants and Accountants: Demand will surge for advisory services as businesses adjust.

- Retail Managers: Pricing strategies must adapt to new slabs.

- Supply Chain Professionals: Input costs may shift, requiring renegotiation with vendors.

- Technology Experts: GST Network (GSTN) will need updates to billing and compliance systems.

For those in finance and policy, this reform could open opportunities in compliance tech, advisory services, and tax policy analysis.

Digital India and GST Tech Upgrades

India’s GST system already runs on the GST Network (GSTN), a digital platform handling billions of invoices. With the two-slab system, the government is expected to upgrade systems for:

- E-invoicing: Mandatory digital invoices for large businesses will soon extend to smaller firms.

- AI Monitoring: Artificial intelligence tools could flag suspicious transactions.

- Real-Time Reporting: Faster tax reconciliation between states and the Centre.

These upgrades not only improve compliance but also create new career opportunities in fintech and tax technology.

Future Outlook: Towards 2047

Government sources hint that the long-term vision is a single GST slab by 2047, India’s centenary of independence. The two-slab system is a stepping stone. Eventually, India could move to a flat rate like Singapore or the UK, truly achieving “One Nation, One Tax.”

For now, the 40% slab ensures states don’t lose revenue and luxury buyers continue paying their share. But the direction is clear—India wants to simplify, digitize, and globalize its tax system.

Practical Advice

For consumers:

- Plan big-ticket luxury purchases before the reform kicks in.

- Look for price drops in consumer durables as 28% goods shift to 18%.

- Budget for higher costs on alcohol and tobacco.

For businesses:

- Update billing systems in advance.

- Train staff in compliance changes.

- Reassess pricing strategies to stay competitive.

- Communicate clearly with customers to build trust.

Data and Stats

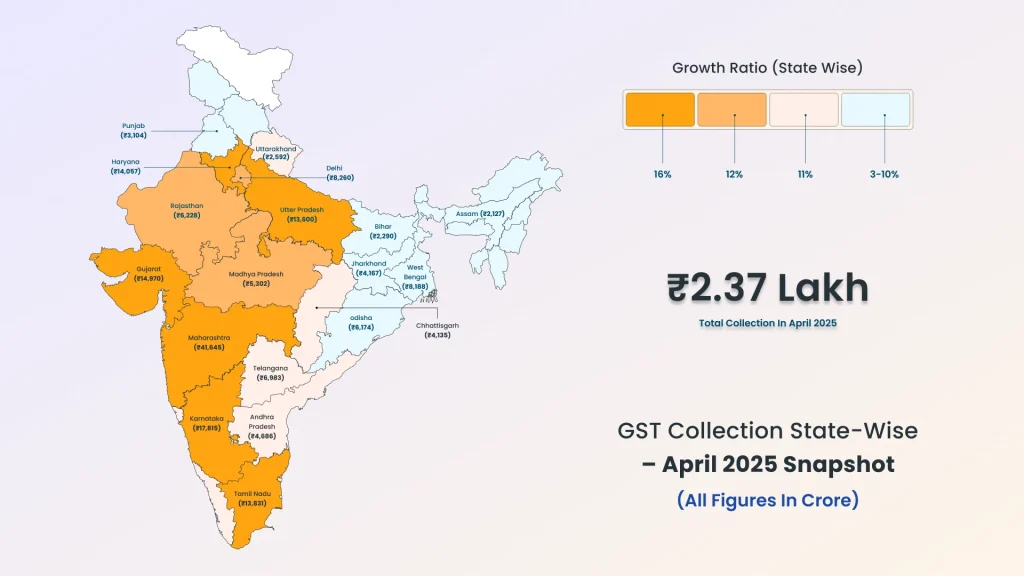

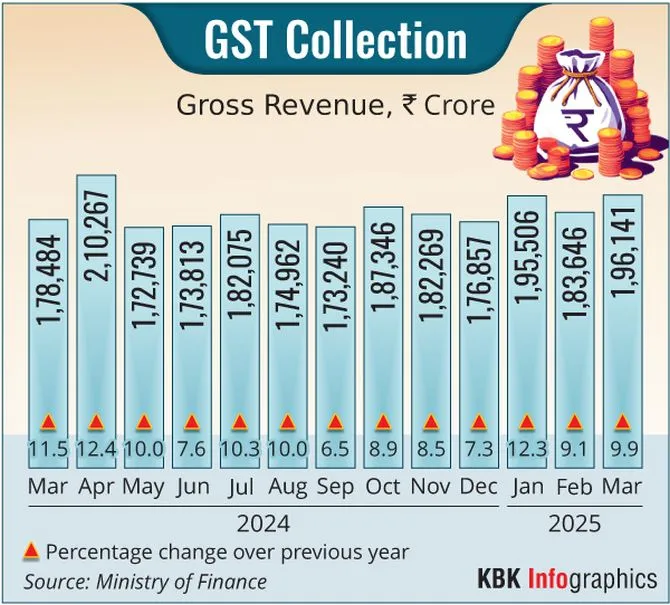

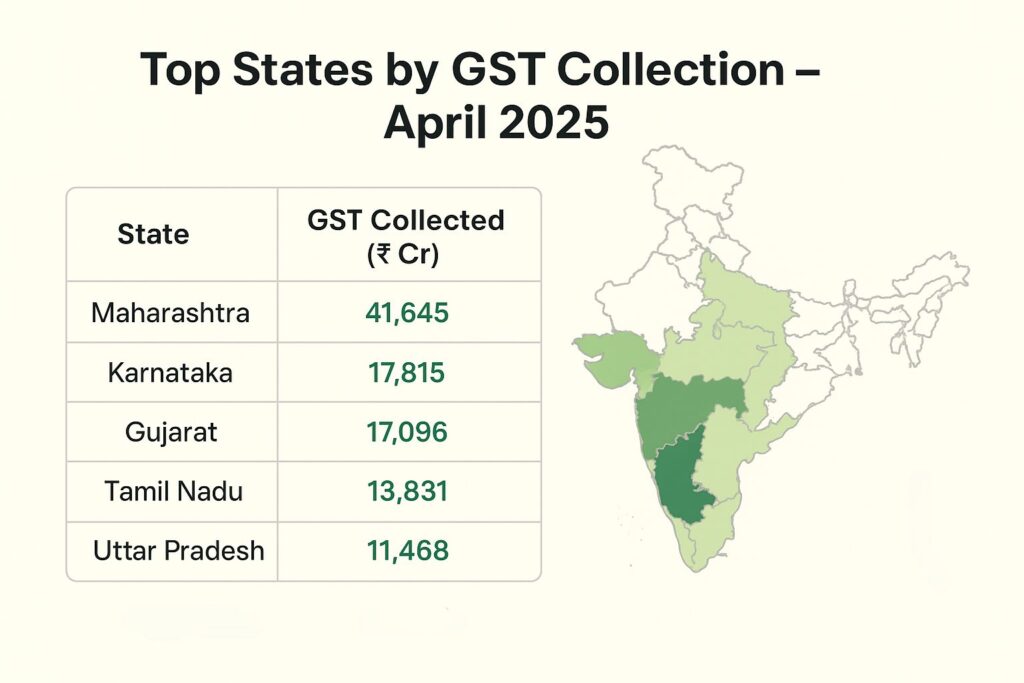

- GST collections reached ₹1.73 lakh crore in July 2025, according to Business Standard.

- Tobacco and alcohol contribute nearly 12% of cess revenues.

- Simplification could cut compliance time by 30%, according to the World Bank.

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials

Centre Plans Major GST Overhaul — Four Slabs May Shrink to Just Two

Banks Propose New GST Slab of ₹1 Crore to Prevent Merchants from Avoiding Digital Payments