Govt May Soon Slap 40% GST on 350cc+ Motorcycles: If you’ve been planning a big bike, you might wanna pump the brakes—because the Indian government is seriously considering a 40% GST (Goods and Services Tax) on motorcycles above 350cc engine capacity. That’s a major jump from the current ~31% effective tax, and it could push dream machines like Royal Enfield Himalayan 450, KTM 390, or Harley-Davidson models into a whole new price bracket. But what’s the story here? Is this really about luxury bikes, or is it another case of squeezing the middle class? Let’s break it all down in a friendly, easy-to-read way—so whether you’re a 10-year-old bike fan or an auto industry professional, you’ll get the full picture.

Govt May Soon Slap 40% GST on 350cc+ Motorcycles

| Topic | Details |

|---|---|

| Proposed Tax | 40% GST on motorcycles above 350cc |

| Current Rate | 28% GST + 3% cess = ~31% effective tax |

| Bikes Affected | Royal Enfield Himalayan 450/650, KTM 390, Triumph 400s, Harley, BMW, Honda BigWing |

| Beneficiaries | Bikes under 350cc may drop to 18% GST |

| Industry Reaction | Mixed—some call it unfair, others see relief for smaller bikes |

| Official Timeline | GST Council meeting in early September 2025 (GST Official Website) |

| Economic Stakes | Two-wheeler industry is 2nd largest in the world; premium segment may shrink |

| Expert Opinion | Rajiv Bajaj says flat 18% GST for all bikes is better |

| Impact on Consumers | Big bikes costlier by ₹30,000–₹60,000+, smaller bikes more affordable |

A Quick History of GST on Motorcycles

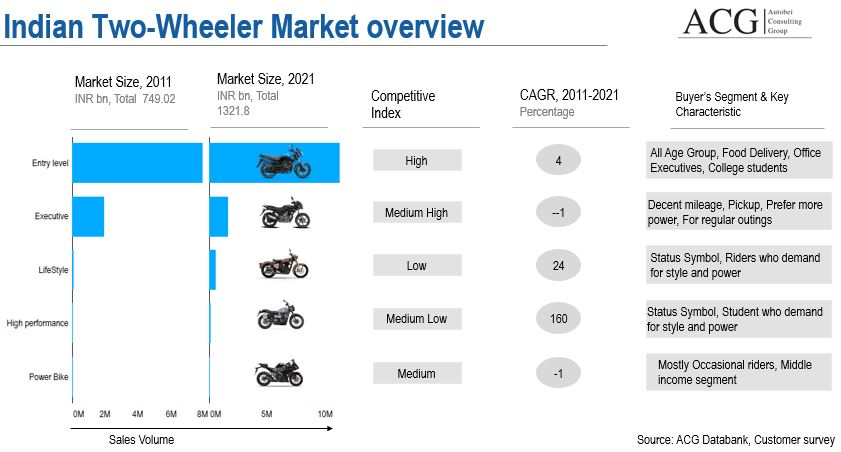

When GST rolled out in 2017, motorcycles were slapped with a 28% tax, plus an extra 3% cess for bigger engines (over 350cc). The logic? Bigger bikes = luxury goods. Since then, India’s motorcycle market has exploded. With 21 million+ two-wheelers sold annually, it’s the second-largest in the world after China. About 98% of these bikes are under 350cc. Premium motorcycles, while niche, have been steadily growing thanks to rising incomes and global brands entering India. Now, with the government eyeing a simplified GST slab, bigger bikes could be pushed back into the “elite” corner, while everyday commuters get some relief.

How India Compares Globally?

Let’s stack India against the rest of the world.

- USA: Motorcycles face only state-level sales tax, usually 4–10%, plus registration fees. No federal luxury tax.

- Europe (EU): VAT ranges 19–25%, but premium motorcycles aren’t singled out for extra taxes.

- Japan: Motorcycles are taxed around 10%, and ownership taxes depend on displacement, but nowhere near 40%.

- Southeast Asia: Countries like Thailand and Indonesia tax around 10–20%, often subsidizing local manufacturing.

If India slaps a 40% GST, it would rank among the highest tax regimes in the world for motorcycles, potentially discouraging global manufacturers from expanding operations here.

Price Impact: How Much More Will Bikes Cost?

Here’s what the new tax could mean for riders in hard numbers.

| Model | Current Ex-Showroom Price (₹) | Estimated Price After 40% GST (₹) | Difference (₹) |

|---|---|---|---|

| Royal Enfield Himalayan 450 | 2.85 lakh | 3.20 lakh | +35,000 |

| KTM Duke 390 | 3.10 lakh | 3.55 lakh | +45,000 |

| Triumph Speed 400 | 3.20 lakh | 3.65 lakh | +45,000 |

| Harley-Davidson X440 | 2.80 lakh | 3.15 lakh | +35,000 |

| BMW G310 GS | 3.30 lakh | 3.75 lakh | +45,000 |

| Harley-Davidson Iron 883 (import) | 12.50 lakh | 14.00 lakh | +1.5 lakh |

These hikes could turn “affordable premium” bikes into unattainable luxuries for many middle-class Indians.

The Real-World Impact of Govt May Soon Slap 40% GST on 350cc+ Motorcycles on Bikers

Example 1: The College Student

Ravi, a 21-year-old student, is saving for a KTM Duke 390. At today’s rate, it costs about ₹3.1 lakh. Under 40% GST, that could jump to ₹3.55 lakh. That’s half a year’s rent in a college city like Pune.

Example 2: The Touring Professional

Meera, a software engineer, wants a Royal Enfield Himalayan 450 for her weekend trips. She’s now looking at paying an extra ₹35,000, which might force her to settle for a Classic 350.

Example 3: The Enthusiast Rider

Arjun, a Harley-Davidson fan, was planning to upgrade to an Iron 883. Already ₹12.5 lakh, the price could climb to ₹14 lakh, making it unreachable for his budget.

Industry Voices: What the Experts Are Saying

Rajiv Bajaj (MD, Bajaj Auto):

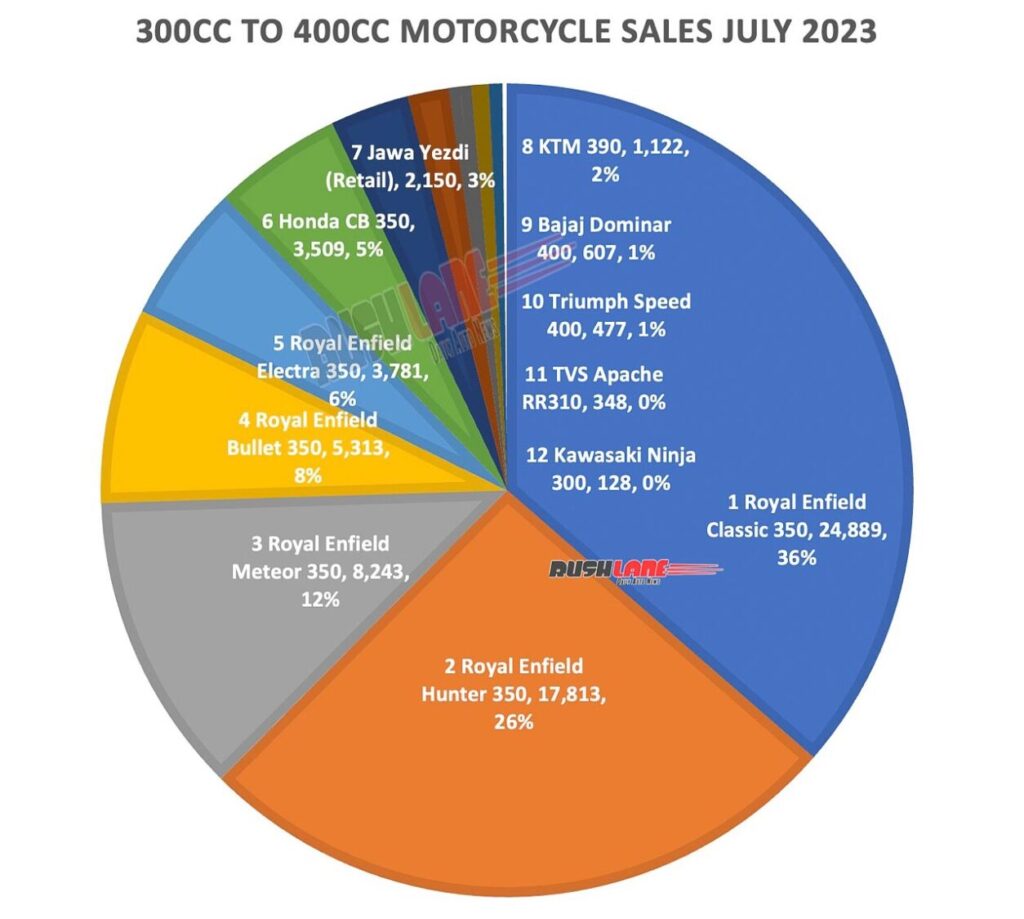

- Points out that 98% of two-wheeler sales are under 350cc.

- Says multiple slabs distort the market.

- Argues for a flat 18% GST on all motorcycles.

Royal Enfield’s Perspective (Unofficial):

- Gains for under-350cc lineup like the Hunter 350 and Classic 350.

- Flagship bikes like Himalayan 450 and 650 twins may lose sales momentum.

Analysts’ Take:

- India’s premium motorcycle market is tiny—less than 2% of sales.

- A 40% GST could stall growth and discourage global brands from investing further.

Who Wins and Who Loses?

Winners

- Everyday Riders: Sub-350cc bikes become more affordable with 18% GST.

- Domestic Brands: Especially Royal Enfield and Bajaj with popular <350cc models.

Losers

- Premium Buyers: Dream bikes get pushed further out of reach.

- Global Manufacturers: Expansion plans could take a hit.

- Employment & Ecosystem: Premium dealerships, workshops, and suppliers may suffer.

Practical Advice for Riders and Buyers

- Buy Big Bikes Now: If your dream ride is above 350cc, act before September 2025.

- Look at Sub-350cc Alternatives: Models like Classic 350, Pulsar N250, or Dominar 250 are solid options.

- Calculate Total Ownership Cost: Don’t forget insurance, fuel, and maintenance.

- Stay Updated: Follow GST announcements on GST Council’s website.

- Consider EVs: Electric motorcycles may receive favorable tax treatment in the near future.

Economic Angle: What’s at Stake?

The two-wheeler industry contributes nearly 3% to India’s GDP and employs millions of workers. Every policy shift creates ripple effects:

- Premium bike sales could shrink further, hurting foreign investment.

- Government revenue may rise, but consumer confidence could fall.

- Used bike market may grow, as buyers dodge high new-bike prices.

Economists warn that overtaxing premium segments could backfire by limiting industry innovation and stalling India’s dream of becoming a motorcycle export hub.

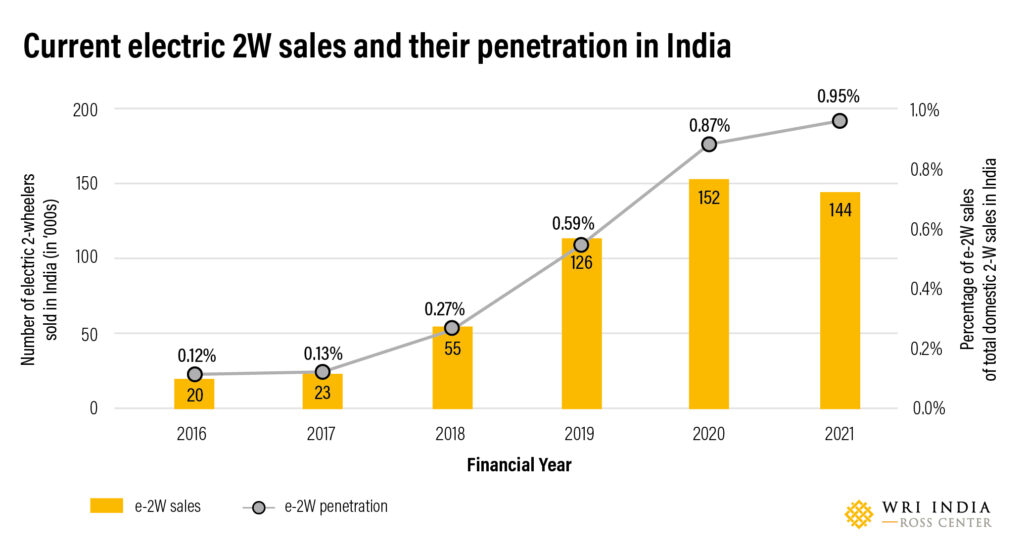

The Future: Could EVs Change the Game?

With the EV wave hitting India, electric motorcycles could benefit from lower GST slabs (already at 5%). If GST punishes ICE (internal combustion engine) big bikes, EVs may fill the gap.

But here’s reality: EV infrastructure—charging stations, battery networks—isn’t yet ready for large-scale motorcycle touring. For now, EVs remain urban toys, not full replacements for big adventure bikes.

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials