Group Booked for Creating Fake GST Invoices to Con Govt: In a shocking development, a group of individuals has been charged with creating fake Goods and Services Tax (GST) invoices to defraud the government. The scale of this fraud has raised alarms among authorities and business owners alike, as it highlights the ease with which criminals can exploit the GST system. As the government ramps up its efforts to crack down on tax evasion, this case serves as a stark reminder of the importance of vigilance when it comes to GST compliance. This article delves deep into the mechanics of GST fraud, the specifics of this recent case, and what businesses can do to protect themselves from falling victim to similar scams. Whether you’re a business owner, an accountant, or simply someone interested in understanding the complexities of GST fraud, this guide will provide you with practical insights, useful data, and actionable advice to safeguard against fraud in the future.

Group Booked for Creating Fake GST Invoices to Con Govt

GST fraud is a serious crime that can have devastating consequences for businesses and the economy as a whole. The recent case of a group creating fake GST invoices to defraud the government is just one example of how criminals can exploit the system. However, by taking proactive steps such as verifying invoices, using compliance software, and staying updated with the latest regulations, businesses can protect themselves from falling victim to such scams. With GST fraud becoming more prevalent, it’s more important than ever for businesses to stay vigilant and ensure they are fully compliant with the law. By doing so, they can avoid costly penalties and contribute to a fair and transparent tax system.

| Topic | Details |

|---|---|

| Fraud Amount | Estimated crores in losses to the government |

| Method Used | Creation of fake GST invoices and submission of forged documents |

| Investigation | Directorate General of GST Intelligence (DGGI) and Delhi Police Crime Branch |

| Recent Cases | ₹266 Crore GST Scam, ₹512 Crore Fraud, ₹524 Crore GST Fraud |

| Criminal Charges | Cheating, Forgery, Criminal Conspiracy |

| Action Steps for Businesses | Verify GST invoices, use GST software, report discrepancies |

Understanding Group Booked for Creating Fake GST Invoices to Con Govt and How It Impacts the Economy

To truly understand the severity of GST invoice fraud, it’s important to first understand how the GST system works. The Goods and Services Tax is a value-added tax levied on the sale of goods and services in India. It has been lauded for simplifying tax collection, but like any system, it has its vulnerabilities. Fraudsters often exploit these vulnerabilities by creating fake invoices for non-existent transactions, which they then use to claim fraudulent input tax credits (ITC).

Input Tax Credit is a key feature of the GST system that allows businesses to claim a refund on the tax paid on their purchases. The problem arises when criminals create fake invoices for non-existent goods or services, thus falsely claiming the ITC. This is exactly what the group in the recent case did, generating fake GST invoices to illegally claim tax credits, defrauding the government of a large sum of money.

The Mechanics of the Fraud: How Did They Do It?

This recent GST invoice scam involved a group of individuals who went to great lengths to manipulate the system. According to the investigation, the criminals created fake GST invoices by establishing shell companies and conducting fake transactions. The invoices appeared legitimate, but the goods and services listed in them did not exist.

The criminals even went so far as to forge official documents, including show-cause notices (SCNs), and submitted them to the courts to reinstate previously canceled GST registrations. By submitting altered digital copies of court orders, they managed to secure favorable rulings. These fraudulent activities allowed the group to continue conducting their operations, without raising red flags with authorities.

The scale of the fraud was staggering, and it involved significant manipulation of the legal and administrative systems. Investigators uncovered discrepancies in court orders and traced back the documents to identify their forgery. As a result, the Directorate General of GST Intelligence (DGGI) and Delhi Police Crime Branch were able to register a case and take action against the accused.

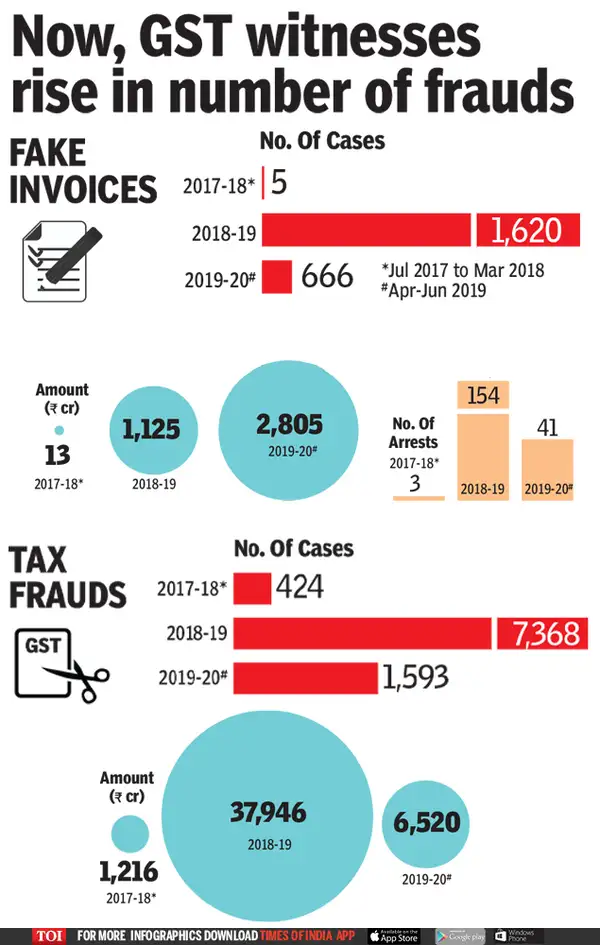

The Broader Context: How Widespread Is GST Fraud?

While this case is shocking, it is not an isolated incident. GST fraud is a growing problem across India, with authorities discovering multiple large-scale scams in recent years. For example, the DGGI recently uncovered a ₹266 crore GST invoice scam, which involved shell companies and fake invoices. Another case in Madhya Pradesh uncovered a ₹512 crore scam, while a gang in Jodhpur was responsible for a ₹524 crore fraud, creating 240 fake firms using forged documents.

These incidents highlight the ongoing efforts by authorities to combat GST fraud, but they also underscore the need for businesses to be extra cautious when it comes to their own tax compliance. It’s crucial for businesses to understand how these scams operate and to take steps to protect themselves.

The Government’s Role in Combatting GST Fraud

In response to the rise in GST fraud, the Indian government has implemented several measures to strengthen the system. The Directorate General of GST Intelligence (DGGI) plays a key role in investigating fraud cases, conducting raids, and issuing penalties. Additionally, the GST Council has introduced more stringent compliance norms, and businesses are now required to file regular GST returns and maintain detailed records.

The government has also been rolling out technology solutions to make it harder for fraudsters to manipulate the system. For instance, the use of artificial intelligence (AI) and data analytics allows the government to monitor transactions in real-time and identify discrepancies more effectively. The creation of the GSTIN (Goods and Services Tax Identification Number) database also enables authorities to cross-check the authenticity of businesses and transactions more easily.

Legal Implications for Businesses Involved in GST Invoice Fraud

GST fraud carries severe legal implications for businesses. Companies found guilty of being involved in fraudulent activities can face hefty fines and criminal charges, including:

- Cheating: Businesses may be charged with cheating if they intentionally deceive the government to evade tax.

- Forgery: The creation of fake invoices and documents is classified as forgery, a criminal offense.

- Criminal Conspiracy: If a business is found to be part of a larger conspiracy to evade taxes, the owners and employees may face charges under criminal conspiracy laws.

Even businesses that unknowingly deal with fraudulent invoices can face serious penalties. Authorities may consider negligence or lack of due diligence as a factor, leading to fines and possible audits.

Practical Advice for Businesses: How to Protect Yourself from GST Fraud

As a business owner or accountant, it’s essential to be proactive in ensuring that your business is not unintentionally involved in fraudulent activities. Here are some practical steps you can take to safeguard your business:

1. Verify GST Invoices

Ensure that the GST invoices you receive are legitimate. Cross-check the GSTIN numbers with the official GST portal to confirm that the supplier is registered. Additionally, make sure that the details on the invoice, such as the goods or services, the tax amounts, and the GSTIN, match up with the actual transaction.

2. Use GST Compliance Software

Invest in reliable GST compliance software that helps track invoices, maintain records, and generate accurate reports. This can significantly reduce the chances of human error and help ensure that your business is staying compliant.

3. Regular Audits and Reconciliation

Regularly audit your GST filings and reconcile the tax paid with your financial records. This can help you spot discrepancies early and correct them before they snowball into a bigger issue.

4. Report Suspicious Activity

If you suspect that a supplier is involved in fraudulent activities, report them to the relevant authorities. The government has set up systems to report tax fraud anonymously, and it’s crucial to take action if something seems off.

5. Educate Employees

Ensure that your team is well-informed about GST rules and compliance. Regular training and updates can help prevent mistakes and identify potential fraud early.

6. Stay Updated with Legal Changes

The GST system is constantly evolving, and staying up-to-date with the latest rules and regulations is crucial for ensuring compliance. Subscribe to official notifications from the GST Council and keep an eye on any changes that could affect your business operations.

Real-World Case Studies: How GST Fraud Has Affected Industries

Let’s look at some examples of industries affected by GST fraud:

1. Textile Industry – ₹100 Crore Scam

In 2023, a major textile trader in Surat was arrested for generating fake invoices amounting to ₹100 crore. The trader created non-existent transactions and exploited input tax credits to evade taxes. The industry, already struggling with high compliance costs, was severely impacted as authorities tightened regulations.

2. Construction Sector – ₹150 Crore Fraud

A construction company in Bangalore was found to have created fake invoices for cement and construction materials. The scam led to a ₹150 crore tax evasion. The company used fake firms to supply materials and submit forged GST returns to claim credits. The case led to a nationwide crackdown on fraudulent construction-related businesses.

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

How to Add or Update Bank Details on the GST Portal Without Errors

Telangana High Court Delivers Major Relief for NRSC in GST Dispute