GST 2.0: If you’ve been following the buzz around GST 2.0 in India, you’ve probably heard folks calling it the “good and simple tax.” Sounds neat, right? But let’s be real—things aren’t that simple. While the government is pitching GST 2.0 as a way to cut down the clutter, boost growth, and make life easier for businesses, the truth is… it’s still got a long road ahead before it earns that “good and simple” label. In this article, we’ll break it down for you—like we’re chatting over coffee in a diner. We’ll keep it easy enough for a 10-year-old to follow, but detailed enough for professionals, policymakers, and entrepreneurs to find serious value.

GST 2.0

GST 2.0 is a welcome step, but not the endgame. It reduces slabs, promises simpler compliance, and may boost consumption. But with key sectors excluded, states nervous about revenue, and transition challenges ahead, it falls short of being the truly “good and simple tax” envisioned in 2017. For now, GST 2.0 is progress—but the final destination is still GST 3.0, where India achieves one truly unified tax system.

| Aspect | Details |

|---|---|

| Target Reform | GST 2.0 aims to simplify India’s Goods and Services Tax by reducing slabs and easing compliance. |

| Proposed Rates | Two primary slabs: 5% and 18%, plus a “sin tax” around 40%. |

| Excluded Sectors | Petroleum, alcohol, electricity, agriculture, and real estate remain outside GST. |

| Revenue Concerns | Estimated ₹85,000 crore (~$10 billion) annual revenue loss for states. |

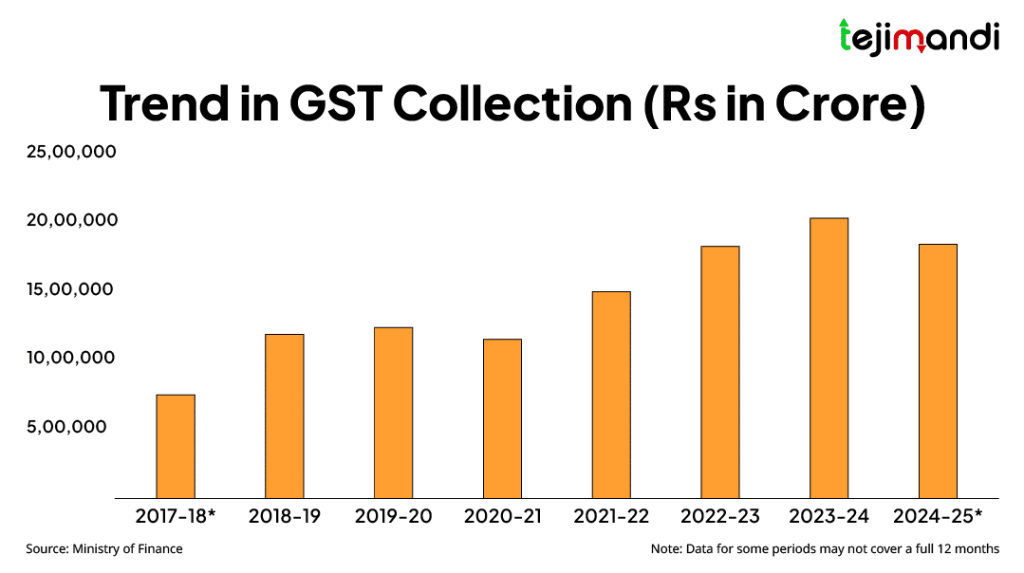

| GST’s Contribution | Over 17.5 million taxpayers registered; GST contributes ~30% of India’s tax revenues. |

| Average Monthly Collections | ₹1.6–1.7 lakh crore in 2024–25, up from ₹92,000 crore in 2017–18. |

| Impact on Consumers | Lower rates on essentials may ease inflation; luxury items still taxed high. |

| Official Resource | GST Portal |

A Quick Throwback – What’s GST Anyway?

Before GST, India’s tax system looked like a messy stack of pancakes. Every state had its own mix—VAT, service tax, excise duty, entry taxes. Businesses, especially small ones, spent hours juggling paperwork just to stay compliant.

When GST 1.0 launched in July 2017, the government promised “One Nation, One Tax.” For the first time, goods and services across India were taxed under one umbrella. It was a huge leap forward. But like any first version, it had glitches—multiple slabs, technical hiccups, compliance headaches, and confusion over classifications.

Seven years later, GST is a big revenue engine. Monthly collections have crossed ₹1.7 lakh crore, compared to ₹92,000 crore in its early years. But businesses and states still complain it hasn’t lived up to the promise of being truly “good and simple.” That’s where GST 2.0 comes in.

What GST 2.0 Promises?

The government’s pitch with GST 2.0 is all about simplicity. Instead of five slabs, India would have just two: 5% and 18%, with a heavy luxury/sin tax slab (40%) for products like tobacco, alcohol, and high-end cars.

The goals are clear:

- Make compliance easier.

- Reduce endless litigation over classification.

- Boost consumption by lowering tax on essentials.

- Improve India’s “Ease of Doing Business” rankings.

Sounds like a dream—but reality is trickier.

Why GST 2.0 Still Isn’t Truly “Simple”?

1. Big Sectors Still Left Out

Petroleum, alcohol, electricity, and real estate are excluded. That means businesses still face multiple tax regimes. For example, a logistics company pays GST on trucks but state taxes on diesel. That’s messy and defeats the purpose of a uniform tax.

2. Classification Headaches Will Continue

Even with fewer slabs, disputes won’t vanish. In GST 1.0, courts debated whether parathas (stuffed Indian bread) counted as “bread” or “processed food.” Similar fights will likely pop up in GST 2.0.

3. MSMEs Still Carry the Burden

Micro, small, and medium enterprises (MSMEs) are India’s backbone, employing over 110 million people. Yet for them, GST filings are still a nightmare—monthly returns, refund delays, portal glitches. Unless GST 2.0 slashes compliance red tape, MSMEs won’t see much relief.

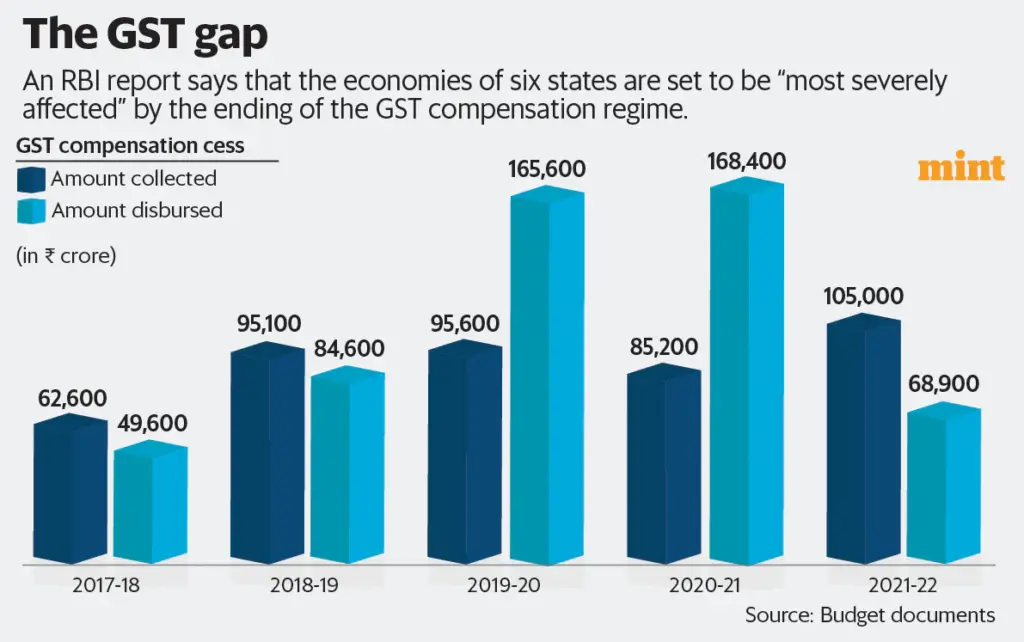

4. States Fear Losing Revenue

India’s states worry about losing ₹85,000 crore annually under the new slab structure. Once the GST compensation cess (which helps states cover losses) ends in 2026, the fiscal stress could deepen.

5. Transition Glitches Are Inevitable

Remember 2017, when GST’s IT portal crashed under heavy traffic? Businesses fear history may repeat. Updating ERP systems, retraining staff, and clearing old inventory will bring chaos before stability.

The Pros and Cons of GST 2.0

| Pros | Cons |

|---|---|

| Simpler slab structure | Big sectors excluded |

| Reduced litigation | States fear major revenue loss |

| Transparency in pricing | MSMEs still face compliance hurdles |

| Boost to consumer demand | Transition glitches likely |

How GST 2.0 Affects Consumers?

The everyday consumer naturally asks: Will my costs go down?

- Food and essentials: Many packaged foods may fall under 5%, offering minor relief.

- Housing: Affordable housing may benefit if GST rates on construction are rationalized.

- Digital services: Apps and OTT subscriptions are likely to stay under 18%, so no big relief.

- Luxury goods: SUVs, premium smartphones, and five-star hotels remain pricey due to the “sin tax.”

- Fuel and alcohol: Since they’re outside GST, expect no change.

So yes, consumers may feel a little relief in their grocery bill, but the dream of “cheap everything” isn’t on the horizon.

Real-Life Example – A Tale of Two Businesses

- Small Kirana Store: The shopkeeper already struggles with GST filings. If 2.0 actually streamlines refunds and reduces filing frequency, it could help. But if it’s just “new rates, same problems,” nothing much changes.

- Large FMCG Company: For giants like Hindustan Unilever or ITC, fewer slabs mean less litigation and easier nationwide pricing. Big corporates stand to benefit far more than mom-and-pop shops.

Practical Advice for Businesses

Step 1 – Audit Your Taxes

Check if your input costs are taxed higher than outputs. Adjust sourcing now to avoid future shocks.

Step 2 – Upgrade Your Tech

Adopt GST-compliant accounting tools like Tally or Zoho Books. They’ll auto-update when slabs change.

Step 3 – Manage Inventory

Don’t get stuck with wrongly priced stock. Build flexibility into your pricing strategy.

Step 4 – Watch for Notifications

Only trust GST.gov.in for updates. Avoid misinformation circulating on social media.

Global Lessons for India

- Canada: Their GST/HST works because provinces get autonomy within a unified structure.

- Australia: One flat GST rate of 10%—simple and effective.

- Singapore: Extremely clean system, recently raised from 8% to 9%.

- EU VAT: Harmonized, but countries still fight over product classification.

India’s big lesson? Keep it uniform, broaden the base, and avoid over-engineering.

What’s Next – The Road to GST 3.0

Experts believe GST 2.0 isn’t the final stop. Eventually, India needs:

- Inclusion of petroleum, alcohol, and real estate.

- Uniform GST across states without exemptions.

- Stronger IT infrastructure to prevent glitches.

- A move toward a single rate system like Australia.

That would be GST 3.0: One Nation, One Tax—the dream promised in 2017. Until then, businesses and consumers must prepare for a halfway reform.

GST 2.0 Promises Consumption Boost – Can Lower Taxes Also Tame Inflation?

Congress Warns GST 2.0 Could Crush Growth Unless One Big Change Is Made

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts