GST 2.0: When you hear the buzz about GST 2.0, it might sound like another heavy tax policy. But let’s break it down: this reform could be a game-changer. Prime Minister Narendra Modi’s Goods and Services Tax (GST) 2.0 reform could reshape India’s economy by cutting tax rates, boosting consumer demand, and breathing new life into industries like automobiles, FMCG (fast-moving consumer goods), and cement. If you’re from the U.S., imagine the feeling of Black Friday, when prices drop and everyone rushes to grab deals. GST 2.0 could be India’s version of that—but instead of store discounts, the government is slashing taxes. Cars, groceries, shampoos, even a bag of cement might soon be cheaper. And that’s not just good news for consumers—it’s a massive boost for the Indian economy.

GST 2.0

GST 2.0 is more than just a tax tweak—it’s a bold economic reset. By lowering taxes on autos, FMCG, and cement, it promises to boost affordability, stimulate demand, and accelerate growth. While challenges like state revenues and implementation hurdles remain, the long-term gains could be massive. For consumers, businesses, and investors, GST 2.0 feels like a long-awaited discount day—except this one comes courtesy of policy reform, not a seasonal sale.

| Category | Details |

|---|---|

| Reform Name | GST 2.0 (Goods and Services Tax Reform) |

| What’s Changing | Simplifying 4-tier GST system into 2 slabs: 5% and 18% (40% for luxury/sin goods) |

| Impact on Autos | Cars, bikes, tractors may see 8–10% price cuts |

| Impact on FMCG | Essentials shifting to 5% GST slab, small affordable packs return |

| Impact on Cement | GST reduced from 28% → 18%, fueling housing & infra demand |

| GDP Boost | Experts estimate +0.5%–0.7% GDP growth |

| Official GST Website | GST Council, India |

Looking Back: GST 1.0 and Its Lessons

When GST first launched in 2017, it was marketed as a unifier—a way to replace the messy patchwork of state and central taxes. India was often described as having “too many cooks in the kitchen” when it came to taxation. GST was supposed to change that.

And to some extent, it did. GST streamlined taxation, reduced cascading taxes, and brought millions of small businesses into the formal system. According to World Bank, GST was one of the most ambitious tax reforms ever attempted in a democracy.

But reality wasn’t always rosy:

- Four Tax Slabs: Instead of a simple system, India ended up with 5%, 12%, 18%, and 28%. Businesses found this confusing.

- High Rates on Key Goods: Cement and autos, both critical sectors, were taxed heavily, slowing demand.

- Compliance Burden: Filing multiple returns every month became a headache for small businesses.

GST 2.0 promises to fix these gaps by cutting slabs, lowering rates, and making compliance easier.

The Big Picture: Why GST 2.0 Matters

The reform boils down to a few key changes:

- Two major slabs—5% and 18%—instead of four.

- Luxury and sin goods like tobacco and alcohol remain at 40%.

- Simplified compliance for businesses, particularly small traders and startups.

Economists predict GST 2.0 could add 0.5%–0.7% to India’s GDP growth. For a $4 trillion economy, that’s an additional $20–30 billion a year in value creation. That’s like adding an economy the size of Estonia or Cyprus to India every single year.

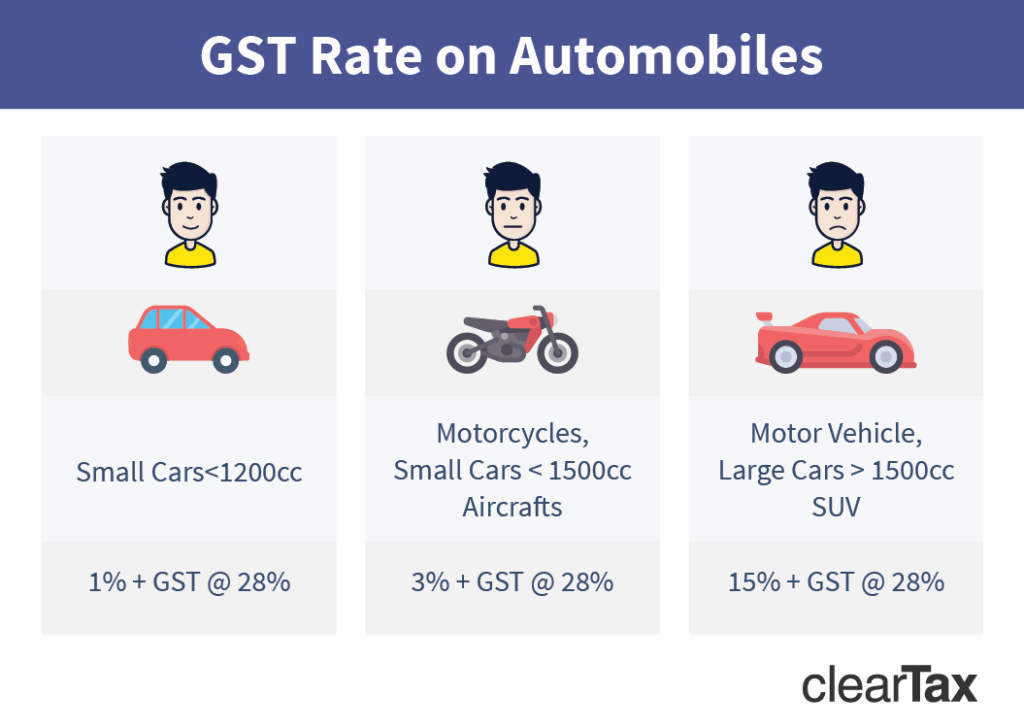

How GST 2.0 Could Transform the Auto Industry?

The automobile sector is often called the “engine of economic growth” because it creates jobs, supports industries like steel and rubber, and drives consumer spending. But in recent years, it’s faced:

- Declining exports due to global tariffs.

- Higher fuel prices dampening demand.

- Pandemic-related supply chain disruptions.

GST 2.0 offers relief:

- Cars and SUVs: Tax cut from 28% to 18% could drop prices by 8–10%. For example, a ₹10 lakh car may cost ₹80,000–90,000 less.

- Two-Wheelers: Still the most common form of transport in India, two-wheelers could shift to the 5% slab, boosting rural demand.

- Tractors and Farm Vehicles: Cheaper tractors support farmers and agriculture-linked businesses.

The stock market is already reacting positively. Companies like Maruti Suzuki, Mahindra & Mahindra, and Hyundai are reporting strong investor interest.

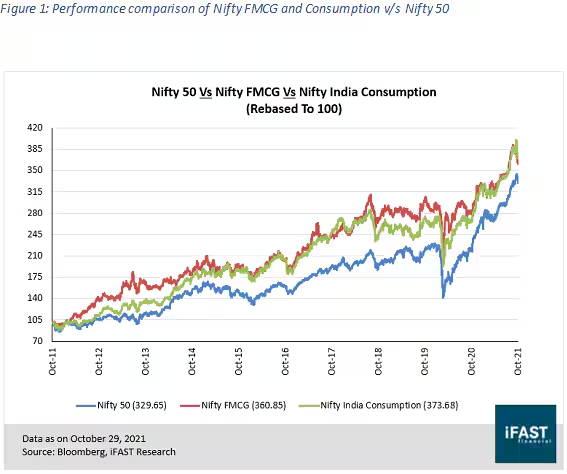

FMCG: Cheaper Everyday Essentials

The FMCG sector is the heart of everyday life. From toothpaste and biscuits to soaps and shampoos, these are the products consumers buy daily.

What GST 2.0 means for FMCG:

- Tax Rate Cuts: Essentials like biscuits, tea, and personal care items move from 12–18% to 5%.

- Reversal of Shrinkflation: Remember when chocolate bars or chips bags shrank while prices stayed the same? With tax cuts, companies like Nestlé, HUL, and Dabur are restoring pack sizes, particularly in the ₹5–₹10 range.

- Rural Impact: Affordable pack sizes could significantly boost rural demand, where price sensitivity is highest.

According to Economic Times, FMCG players are already preparing new launches in response.

Cement: Building India’s Future

Cement doesn’t grab headlines, but it’s crucial for housing, infrastructure, and industrial growth.

- GST Reduction: From 28% to 18%—a big deal for the sector.

- Housing Affordability: Even though cement is only about 6% of construction costs, any price drop makes homes more affordable.

- Infrastructure Growth: Cheaper cement means cost-effective highways, bridges, and public works projects.

Analysts project a ₹20,000–25,000 crore revenue increase for cement companies like UltraTech, Ambuja, and Shree Cement.

Small Businesses and Startups: Winners or Strugglers?

For small businesses, GST 2.0 is a mixed bag.

Advantages:

- Fewer tax slabs mean less confusion.

- Streamlined processes could reduce disputes with tax authorities.

- Easier compliance for businesses operating in multiple states.

Challenges:

- Filing GST returns remains complex.

- Refunds under input tax credits often get delayed, hurting cash flow.

- Digitization requirements could be tough for small traders in rural areas.

While bigger players cheer the reform, policymakers need to ensure that small and medium enterprises don’t get left behind.

Global Comparisons

It helps to zoom out and see how India stacks up globally.

- United States: Uses state-based sales tax systems, usually between 6–10%. Each state sets its own rules, which can confuse consumers traveling across borders.

- European Union: Runs on VAT (Value Added Tax), with a standard rate of around 20%, and lower rates on essentials.

- India: With GST 2.0, India moves closer to the EU model, with simplified slabs and lower rates on essentials.

The big difference? India’s GST covers more categories, making it one of the broadest consumption taxes in the world.

Expert Opinions and Criticism

Economists are divided.

Optimists argue:

- Demand will surge as products get cheaper.

- Investment will flow into India’s manufacturing sector.

- GDP growth could sustain above 7%.

Critics warn:

- States could lose tax revenue, straining federal relations.

- Companies might pocket tax savings instead of passing them to consumers.

- Implementation could take months, delaying benefits.

Former RBI Governor Raghuram Rajan has previously warned that tax reforms need careful execution to avoid inflation spikes. The same applies here.

Future Outlook: Could We See GST 3.0?

If GST 2.0 succeeds, the next decade could see:

- Digitization of compliance: Real-time tracking of invoices, refunds, and tax credits.

- AI-driven auditing: Reducing tax evasion while simplifying filings.

- Single slab GST (like EU VAT): Truly one rate for all products, except luxury items.

This could make India’s tax system not just simpler but a model for other developing countries.

Practical Takeaways

- Car Buyers: Waiting a few months could save you thousands on a new vehicle.

- Everyday Shoppers: Prices on essentials like soap, biscuits, and tea may soon drop.

- Home Buyers/Builders: Lower cement costs will make housing projects more affordable.

- Investors: Sectors like autos, FMCG, and cement are poised for growth.

GST 2.0 Promises Consumption Boost – Can Lower Taxes Also Tame Inflation?

Govt Plans 40% Sin Tax on Alcohol, Cigarettes and Gaming Under GST 2.0 Shock Plan

GST 2.0 to Replace All Slabs With One Tax Rate – Here’s What It Means for You