GST 2.0 Announced: India’s Goods and Services Tax (GST) system has undergone a massive overhaul, and Finance Minister Nirmala Sitharaman has called the new reform “GST 2.0.” This is being touted as the final major tax reform for the country. Aimed at simplifying the tax system and boosting economic growth, this update has the potential to bring significant changes for businesses, consumers, and tax authorities alike. If you’re unfamiliar with GST or the changes it’s undergoing, don’t worry—this article will break everything down in easy-to-understand language, whether you’re a business owner, a tax professional, or someone who just wants to understand how this will affect your wallet. Let’s dive into what GST 2.0 means and how it will impact you.

GST 2.0 Announced

GST 2.0 is poised to be a game-changer for India’s tax system. With a simplified structure and lower tax rates on essential goods, the government aims to make life easier for businesses and consumers alike. By reducing the complexity of tax filings, GST 2.0 offers an opportunity for businesses to save time and money while promoting consumption and economic growth. As the launch date of September 22, 2025, draws near, businesses and consumers should start preparing for the new changes to reap the benefits of this tax overhaul.

| Feature | Details |

|---|---|

| Simplified Tax Slabs | GST will now have just two main tax slabs: 5% for essentials and 18% for most goods. |

| Luxury & Sin Goods | A new 40% tax will apply to luxury goods like high-end vehicles and tobacco. |

| Healthcare & Insurance Exemption | Life and health insurance premiums will now be exempt from GST. |

| Smaller Tax Burden for Consumers | The government expects reduced costs on everyday goods and services. |

| Scheduled Implementation Date | GST 2.0 will roll out on September 22, 2025. |

| Estimated Revenue Loss | Initial estimates suggest a ₹48,000 crore revenue loss, offset by increased consumption. |

| Official Reference | GST Official Website |

What is GST 2.0?

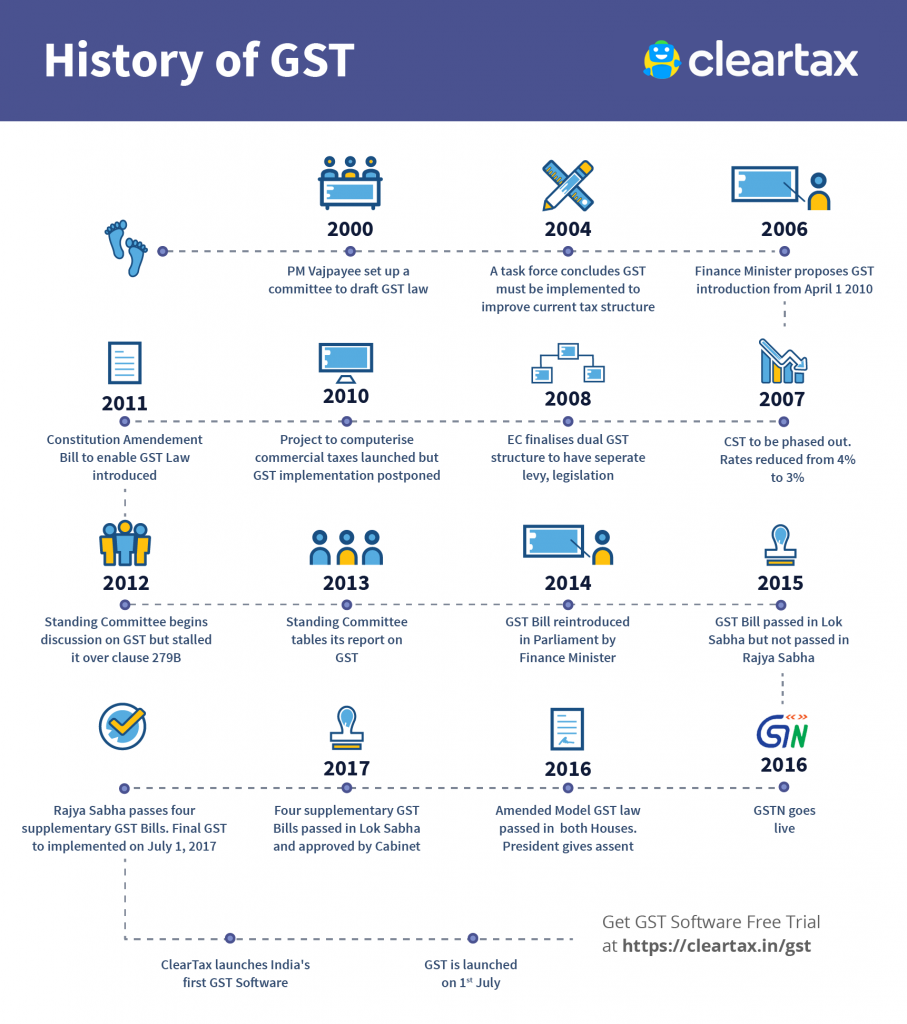

In the simplest terms, GST (Goods and Services Tax) is a value-added tax applied to most goods and services in India. The government introduced this system in 2017 to replace multiple indirect taxes and make things simpler for businesses and consumers. However, over the years, there were still complexities and issues around how GST was implemented, with multiple tax slabs, compliance burdens, and some industries feeling the pinch.

Enter GST 2.0—a streamlined version of the current tax structure. This new version promises to simplify the system even more, reduce compliance costs, and help businesses thrive, while still maintaining a fair tax structure for essential goods and services.

What Are the Key Changes in GST 2.0 Announced?

The key changes in GST 2.0 include:

- Fewer Tax Slabs

The old GST structure had four main tax slabs (5%, 12%, 18%, and 28%). With GST 2.0, the government is reducing these to just two main slabs: 5% for essentials and 18% for most other goods and services. This will make things much easier for businesses when calculating tax rates, and for consumers when purchasing goods. - Higher Taxes on Luxury and Sin Goods

To compensate for the reduced revenue from essential goods, luxury items—such as expensive cars, tobacco products, and aerated drinks—will now face a 40% GST. This is an increase from the previous tax rates on these items. - Exemptions for Healthcare and Insurance

One of the most welcome changes is that premiums for life and health insurance will now be exempt from GST. This change makes healthcare and insurance more affordable for the average Indian consumer. - Changes in Tax Rates on Food and Consumer Goods

Packaged food items like butter, cheese, and chocolates will now fall under the 5% tax rate. So, you can expect to pay a little less for these items. On the other hand, luxury consumer goods such as high-end televisions, air conditioners, and certain vehicles will still be taxed at the 18% or 40% rates, depending on their class.

Why Did India Introduce GST 2.0?

The main goal behind introducing GST 2.0 is to simplify the tax system and reduce the burden on businesses and consumers. By narrowing down the number of tax slabs, the government hopes to:

- Make tax compliance easier: Businesses, especially small and medium-sized ones, can now focus on growing their operations instead of getting bogged down by complex tax filings.

- Encourage consumption: Lower taxes on essential goods are expected to make life more affordable, leading to a boost in consumption, which in turn will drive economic growth.

- Enhance tax collections: With a simpler tax system, the government hopes to close the gap between the taxes owed and taxes paid, ensuring better revenue generation.

When Will GST 2.0 Be Implemented?

The government has set September 22, 2025, as the official launch date for GST 2.0. This date is strategically placed just before the start of the festive season in India, so consumers can start benefiting from lower taxes and businesses can get ready for the changes.

How Will GST 2.0 Impact Your Daily Life?

Consumers:

For consumers, the impact will mostly be positive. The reduction in tax on essential goods like food and toiletries will result in lower prices. Furthermore, with the simplification of tax rates, businesses will likely pass on the savings to you. You’ll also benefit from exemptions on healthcare and insurance premiums, which will make these services more affordable.

Businesses:

Businesses will benefit from the simpler tax system and lower compliance costs. Companies that deal with goods in the 18% and 5% tax brackets will have a much easier time managing taxes. Additionally, the higher tax on luxury goods means that businesses selling such products will face higher costs, which could lead to a shift in pricing strategies. Automobile manufacturers selling high-end cars, for example, may raise prices in response to the increased tax burden.

Government:

For the government, GST 2.0 is a calculated risk. There may be a temporary revenue loss of ₹48,000 crore due to the reduced tax burden on essentials, but it is expected that the increase in consumption will offset the loss in the long run. The government is optimistic about the reforms driving economic growth and improving overall tax compliance.

Industry-Specific Impact of GST 2.0

The impact of GST 2.0 will be felt differently across various sectors:

1. Retail Sector

The retail sector, which includes food, clothing, electronics, and household goods, will experience lower prices on many everyday products. For instance, the reduction in taxes on packaged foods will make grocery bills more affordable, leading to increased consumer demand. The simplified tax structure will also reduce administrative costs for retailers, particularly smaller businesses.

2. Automotive Industry

With luxury vehicles facing a 40% GST, manufacturers like Mercedes-Benz, BMW, and Audi may need to adjust their pricing models to account for this tax hike. However, electric vehicles (EVs), which fall under the 5% GST slab, will see greater demand, leading to more investments and a push for the growth of the EV market in India.

3. Healthcare and Insurance

As mentioned, the exemption of GST on life and health insurance premiums will make these services more affordable and accessible. This change is expected to drive greater participation in health insurance, which could significantly improve the financial protection of the Indian population.

4. Luxury Goods

Manufacturers and retailers of luxury items such as high-end watches, perfumes, and electronics will face a substantial tax increase under the 40% GST slab. These companies may need to reconsider their pricing and marketing strategies to maintain demand for their products.

Practical Steps to Prepare for GST 2.0

If you’re a business owner or tax professional, you need to start preparing for GST 2.0. Here are a few steps to get ready:

- Understand the New Tax Slabs: Review the products and services you sell and ensure they fall under the correct tax slab. You may need to adjust your pricing models accordingly.

- Train Your Staff: Ensure that your accounting team or tax professionals are familiar with the changes. Consider training them to handle the new GST filings.

- Update Your Software: Ensure that your accounting or ERP software is ready for the new tax codes and can handle the simplified tax system.

- Communicate with Your Customers: If your business will see a change in prices due to GST 2.0, be transparent with your customers about the adjustments.

GST 2.0 Promises Consumption Boost – Can Lower Taxes Also Tame Inflation?

Congress Warns GST 2.0 Could Crush Growth Unless One Big Change Is Made

PM Modi’s GST 2.0 Reform Explained — 5 Big Reasons It Matters for Everyone