GST 2.0 Promises Consumption Boost: When you hear about GST 2.0 (Goods and Services Tax reform), it might sound like another technical update buried in financial jargon. But here’s the truth: this reform could directly affect your grocery bill, your next phone purchase, and even the cost of your family car. In simple words, GST 2.0 promises to make essentials cheaper, boost consumer spending, and even help tame inflation. This isn’t just about policy—it’s about people’s everyday lives. Economists believe GST 2.0 can simultaneously strengthen household budgets and fuel economic growth without causing runaway prices. That’s a rare win-win, and it deserves a closer look.

GST 2.0 Promises Consumption Boost

GST 2.0 is not just another tax tweak—it’s a reform that touches every household and business. By simplifying slabs, lowering taxes on essentials, and keeping inflation in check, it promises to make daily living more affordable while boosting economic growth. Households could save thousands each year, businesses enjoy easier compliance, and the economy gets a demand-driven push. For once, there doesn’t have to be a trade-off between growth and inflation. GST 2.0 shows that both can move in the right direction together.

| Point | Details |

|---|---|

| GST 2.0 Reform | Simplifies 4-tier system into 2 slabs: 5% (essentials), 18% (standard goods), plus 40% for luxury/sin goods. |

| Consumer Impact | Food, clothing, electronics, small cars expected to get cheaper. |

| Inflation Effect | CPI inflation could drop by 20–40 basis points (SBI, Morgan Stanley). |

| Consumption Boost | Extra ₹1.98 lakh crore spending; GDP growth up by 0.6%. |

| Business Impact | Lower compliance costs, better cash flows, higher demand. |

| Fiscal Impact | Estimated ₹85,000 crore revenue dip offset by cess funds and higher tax buoyancy. |

| Official Resource | Government of India GST Portal |

Looking Back: Why GST 1.0 Needed an Upgrade

Back in 2017, GST 1.0 was introduced with the slogan “One Nation, One Tax.” It replaced a messy web of taxes like excise duty, service tax, and VAT. The idea was revolutionary: simplify taxation, unify the market, and reduce cascading taxes.

But reality wasn’t so simple. The system had multiple tax slabs—5%, 12%, 18%, 28%—plus exceptions and cesses. Businesses found it confusing to classify products, while consumers often paid higher prices due to complex tax structures.

For example: a packet of biscuits could be taxed at a different rate than a chocolate bar, even though both are snacks. This created uncertainty and extra compliance headaches. GST 2.0 aims to fix those problems.

How GST 2.0 Promises Consumption Boost?

GST 2.0 proposes just two main slabs instead of four, along with one premium slab for luxury goods.

- 5% slab – Covers essential items like food grains, medicine, clothing, and basic consumer goods.

- 18% slab – Applies to most consumer durables, services, and standard products like phones, appliances, and hotel stays.

- 40% slab – Reserved for luxury cars, premium liquor, and other sin goods.

By streamlining the system, GST 2.0 reduces confusion for both consumers and businesses. For households, this directly translates to cheaper groceries, lower clothing costs, and more affordable electronics.

The Inflation Question – Can Lower Taxes Actually Cool Prices?

Normally, governments worry that tax cuts will fuel demand and push up inflation. But in the case of GST 2.0, the effect could be the opposite.

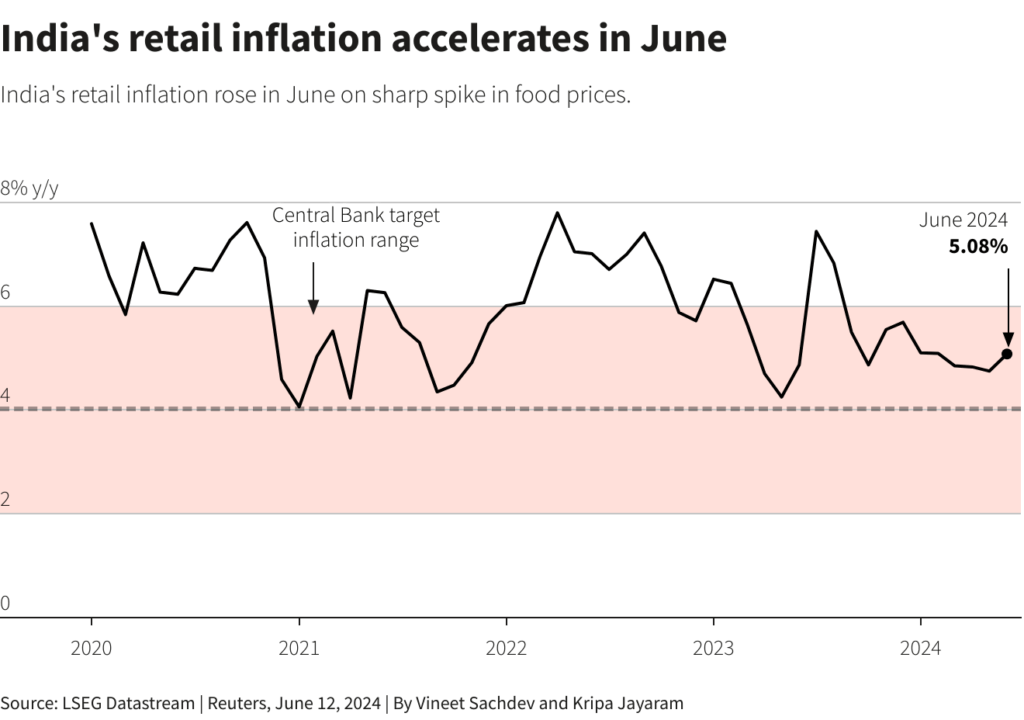

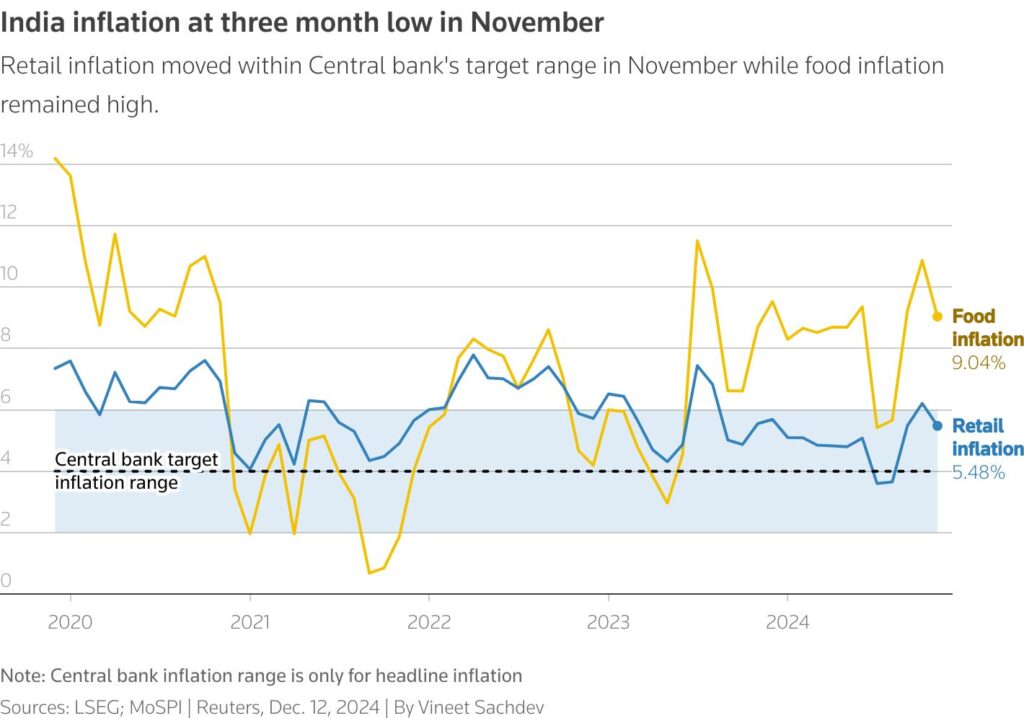

According to SBI Research, lowering GST could reduce Consumer Price Index (CPI) inflation by 20–25 basis points. Morgan Stanley estimates the effect could be as high as 40 basis points.

Here’s why:

- Direct Price Drop – Essentials moving from 12% tax to 5% immediately lowers shelf prices.

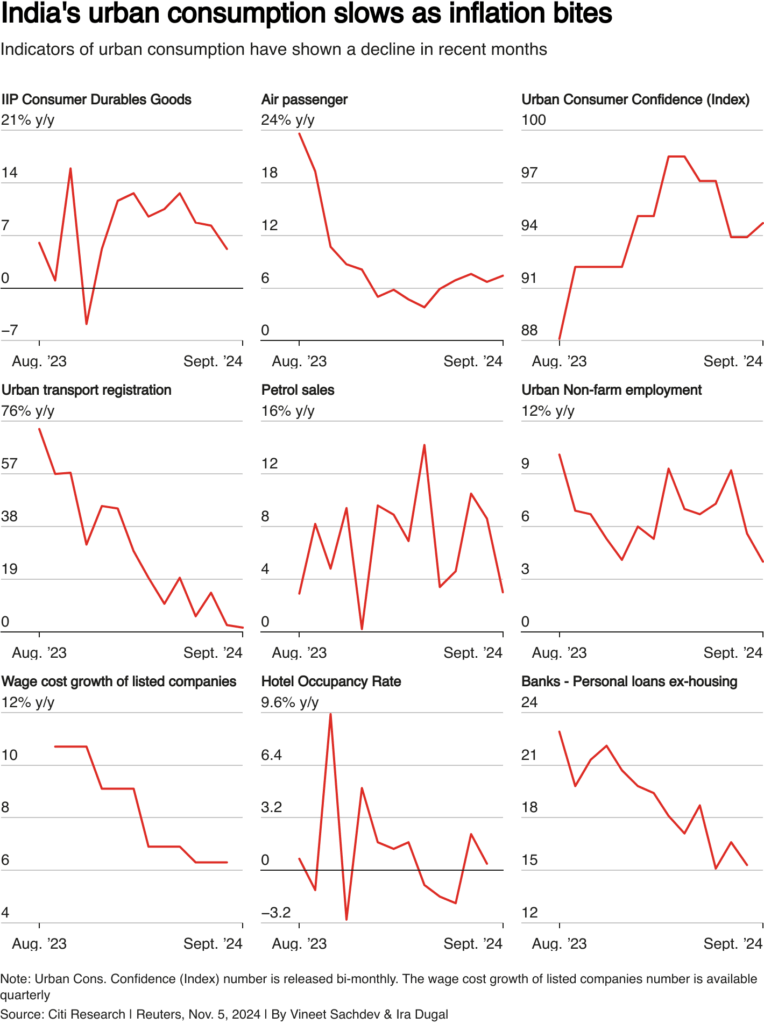

- Service Cost Reduction – Rationalized tax rates on services like transport and hospitality reduce input costs across industries.

- Pass-Through Impact – About 60% of tax savings are expected to reach the end consumer.

Think of it like this: if your family spends ₹10,000 a month on groceries, under the old 12% GST, that’s ₹1,200 in tax. Under the new 5% rate, the tax drops to ₹500. That’s ₹700 saved every month, or ₹8,400 a year—real relief for households.

Broader Economic Impact

Boosting Consumption

More savings mean more spending. Economists estimate GST 2.0 could lead to an additional ₹1.98 lakh crore in consumer spending, giving India’s GDP a 0.6 percentage point boost. That’s no small number in a $4 trillion economy.

Fiscal Health

The government might lose around ₹85,000 crore annually in tax revenue. However:

- India has a compensation cess buffer that can absorb much of the shortfall.

- Higher consumer spending will eventually bring in more GST revenue.

- Historically, India’s tax collections have exceeded projections by ₹2 trillion annually.

No Growth-Inflation Trade-Off

Usually, policymakers face a dilemma: cut taxes to boost growth, or keep taxes to fight inflation. But GST 2.0 offers a rare case where growth and inflation both improve together.

Global Perspective – How India Stacks Up

Understanding GST 2.0 becomes easier when compared globally:

- United States: No nationwide GST. Each state has its own sales tax (0% in Delaware, over 7% in Tennessee). It’s fragmented, much like India before GST.

- European Union: Uses a Value Added Tax (VAT) system, averaging 20%. Essentials often get lower rates (5–10%), similar to India’s proposed 5% slab.

- Canada: Combines federal GST with provincial sales taxes. Some provinces harmonize them into a single HST (Harmonized Sales Tax).

India’s GST 2.0 is closer to the EU’s streamlined VAT system, aiming for simplicity and efficiency.

What This Means for Businesses

- Simplified Compliance: Fewer slabs mean less paperwork and confusion over product classification.

- Better Cash Flow: Lower upfront taxes free up working capital, especially for SMEs.

- Higher Demand: Cheaper products naturally drive up consumer demand.

- Digital Transition: The reform strengthens digital tax filing via GSTN Portal, reducing manual errors and fraud.

For example, a small retailer selling clothing will no longer struggle with 12% vs. 18% tax classification. With essentials at 5% and standard goods at 18%, compliance becomes easier, and customers benefit too.

Risks and Criticisms

No reform is perfect. Critics point out a few risks:

- Revenue Shortfall: A possible annual loss of ₹85,000 crore. But experts argue this can be offset with cess funds and tax buoyancy.

- Implementation Challenges: Businesses need to update billing systems, software, and contracts. There may be short-term confusion.

- Luxury Goods Impact: The 40% slab might discourage high-end consumption, affecting luxury car and liquor markets.

Still, the long-term benefits outweigh the short-term hiccups.

Real-Life Example – The Family Budget

Take the case of a middle-class family earning ₹60,000 a month. Here’s how GST 2.0 could change their spending:

- Groceries: Tax drops from 12% to 5%. Savings: ~₹700/month.

- Clothing: A ₹3,000 clothing bill taxed at 12% earlier (₹360) will now cost only 5% (₹150). Savings: ₹210.

- Electronics: A mid-range phone at ₹20,000 taxed at 18% remains the same, but other smaller electronics may shift downward.

In total, such a family could save ₹1,000–1,200 monthly, adding up to over ₹12,000 annually—a meaningful difference.

Step-by-Step Guide: How to Make the Most of GST 2.0

- Track Your Expenses: Identify where you spend most—groceries, clothes, utilities, gadgets.

- Check New Rates: See which items move to lower tax slabs.

- Use GST Calculators: Free online calculators help you see savings instantly.

- Plan Your Savings: Redirect extra money toward investments, debt repayment, or savings.

- Monitor Inflation: Keep an eye on official CPI reports from RBI or Economic Times.

Expert Opinions

- SBI Research: “GST 2.0 will unlock nearly ₹1.98 lakh crore in consumption and boost GDP growth by 0.6 percentage points.”

- Morgan Stanley: “Inflation could fall by as much as 40 basis points, reducing the pressure on the Reserve Bank of India.”

- IMF: Called GST reforms “pro-growth and critical for India’s long-term fiscal stability.”

These endorsements give the reform credibility and underline its importance.

₹2 Crore Fake GST Scam Busted in Chhatarpur — 3 Firms Raided, 2 Were Just on Paper

Congress Warns GST 2.0 Could Crush Growth Unless One Big Change Is Made

Govt Plans 40% Sin Tax on Alcohol, Cigarettes and Gaming Under GST 2.0 Shock Plan