GST 2.0 to Replace All Slabs With One Tax Rate: If you’ve ever stood at the checkout counter wondering why two similar products were billed at different tax rates, you’re not alone. India’s indirect tax system has been complicated, confusing, and sometimes downright frustrating. That’s about to change with the arrival of GST 2.0, the government’s latest reform move. GST 2.0 aims to replace multiple tax slabs with a simpler two-rate system, eventually leading to a single tax rate for the whole country. The plan is ambitious, but if executed right, it could reshape the way India does business and make everyday life a little less expensive for millions of households. Think of it like upgrading your smartphone software—only this time, the update applies to the nation’s economy. Unlike buggy updates that cause more issues, GST 2.0 is designed to fix old problems, simplify the system, and fuel growth.

GST 2.0 to Replace All Slabs With One Tax Rate

GST 2.0 is the boldest tax reform since 2017. By collapsing four slabs into two (5% and 18%) and introducing a 40% slab for luxury goods, the system becomes simpler, fairer, and more transparent. For consumers, it means cheaper essentials. For businesses, less compliance stress. For the economy, a potential growth push. The road to a single GST rate by 2047 is long, but GST 2.0 is a strong step forward. India might finally achieve the promise of “One Nation, One Tax.”

| Aspect | Details |

|---|---|

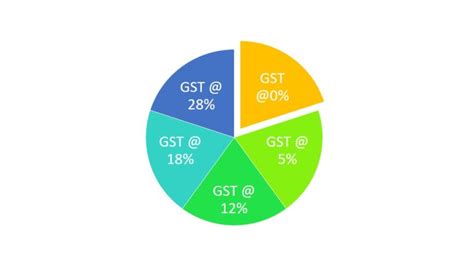

| Current GST System | 4 slabs (5%, 12%, 18%, 28%) |

| GST 2.0 Proposed Slabs | Two slabs – 5% (essentials), 18% (standard goods & services) |

| Special Tax | 40% for luxury & “sin” goods (tobacco, luxury cars, pan masala) |

| Long-Term Goal | One single rate system by 2047 |

| Consumer Impact | Cheaper essentials, reduced bill stress |

| Business Impact | Simplified compliance, lower costs for MSMEs |

| Implementation Timeline | Expected rollout by Diwali 2025 |

| Official Reference | GST Council Official Website |

A Quick Look Back: How We Got Here

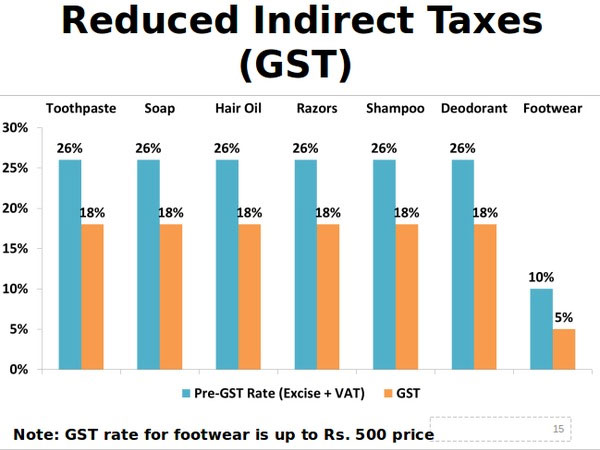

The Goods and Services Tax (GST) was introduced in July 2017 as India’s biggest tax reform since independence. It aimed to replace the messy web of excise duty, service tax, VAT, and other levies with one unified system. The promise was “One Nation, One Tax.”

But in practice, GST became a four-tier system with multiple exceptions, special cesses, and frequent changes. The intention was good, but businesses and consumers found themselves dealing with new headaches:

- Classification disputes: Chocolate bars vs. chocolate biscuits were taxed differently.

- Dual rates: Shoes under ₹1,000 attracted 5%, while anything pricier was taxed at 18%.

- Frequent updates: GST Council meetings often changed rates, leaving people confused.

The result? Instead of simplifying, GST became complicated to follow and harder to comply with.

That’s why GST 2.0 is being pitched as the real reboot—the version that finally delivers on the promise of simplicity.

How GST 2.0 to Replace All Slabs With One Tax Rate?

Two Main Slabs: 5% and 18%

The reform reduces the four slabs (5%, 12%, 18%, 28%) into just two:

- 5% slab: Essentials such as food grains, medicines, footwear, and clothing.

- 18% slab: Standard goods and services, including electronics, packaged foods, restaurants, and entertainment.

This restructuring is expected to bring clarity for both consumers and businesses. For example, nearly 99% of goods in the 12% category will now move to 5%, and 90% of items in the 28% slab will slide into the 18% category.

A Special 40% Slab for Luxury and Sin Goods

While most goods will become cheaper, luxury and “sin” goods will face a steep 40% tax rate. This includes tobacco products, high-end automobiles, and items like pan masala. The logic here is two-fold: discourage unhealthy consumption while ensuring the government doesn’t lose crucial revenue.

Long-Term Goal: One Rate by 2047

GST 2.0 isn’t the end—it’s the middle step. By 2047, the government envisions a single GST rate across India. That would mean no slabs, no classification disputes, and no confusion—just one simple rate for everything.

How India Compares With the World?

India’s indirect tax system is often compared to global peers. Here’s how GST 2.0 fits into the larger picture:

- Australia: A flat 10% GST rate applies to nearly all goods and services.

- Singapore: 9% GST, one of the lowest and simplest structures worldwide.

- Canada: Combines a 5% federal GST with provincial sales taxes.

- European Union: Uses Value Added Tax (VAT) with a standard rate (17–27%) plus reduced rates for essentials.

Compared to these, India’s two-slab model is a compromise—more straightforward than the current four slabs, but still flexible enough to balance revenue needs.

What This Means for Consumers?

This is where things get real.

- Essentials will be cheaper: Rice, pulses, medicines, and basic clothing will stay in the 5% category, reducing household spending.

- Electronics and mid-range goods will cost less: Items like TVs, refrigerators, and smartphones will drop from 28% to 18%.

- Luxury remains expensive: If you’re planning to buy a luxury car or imported whiskey, prepare to pay more with the 40% rate.

According to India Today, these changes could cut household expenses by 5–7%, especially for middle-income families.

What This Means for Businesses and MSMEs?

For over 63 million micro, small, and medium enterprises (MSMEs) in India, GST 2.0 could be a lifeline.

- Simplified compliance: With fewer slabs, filing returns and claiming input credits becomes easier.

- Cost savings: Lower rates reduce expenses on raw materials and services.

- Boosted demand: Lower consumer prices are expected to increase demand, helping small businesses grow.

Industry groups like CII and FICCI have welcomed the reform, calling it a “structural push that makes India more business-friendly.”

Economic Impact

GST 2.0 isn’t just about cheaper groceries—it’s about the bigger economic picture.

- GDP Growth: Analysts at CitiBank estimate the reform could add 0.6–0.7% to GDP in FY 2025–26.

- Job Creation: As demand rises in retail, textiles, and services, more jobs will be created.

- Global Investment: A streamlined tax system signals stability, encouraging foreign investors to bet on India.

Challenges and Concerns

While the reform is bold, it isn’t free of challenges.

- Revenue loss for states: With lower slabs, states could lose revenue in the short term. Compensation mechanisms will be key.

- Implementation hurdles: Updating IT systems, training officials, and educating businesses will be a mammoth task.

- Dependence on compliance: For GST 2.0 to succeed, compliance levels must remain high. Any dip could reduce tax collections.

Some state governments have already raised questions about revenue-sharing and autonomy, issues that could become flashpoints in the rollout.

Real-Life Examples

To make this practical, let’s look at numbers:

- A ₹900 pair of shoes: Currently taxed at 12% (₹1008 total). Under GST 2.0, taxed at 5% (₹945). Savings: ₹63.

- A 42-inch LED TV: Earlier in 28% slab. For a ₹30,000 TV, you paid ₹38,400. Under 18%, it will cost ₹35,400. Savings: ₹3,000.

- A pack of biscuits: No more confusion—whether plain or coated, all will fall under the same slab.

Step-by-Step Guide to Prepare

For Consumers:

- Stay updated on GST Council announcements.

- Plan major purchases around the rollout in October 2025.

- Compare costs before and after reform to understand savings.

For Businesses:

- Train employees on classification under GST 2.0.

- Update accounting and billing systems with new slabs.

- Reassess pricing strategies to stay competitive.

- Regularly check the official GST Portal.

Expert Insights

Economist Arvind Subramanian, one of the key architects of GST, recently remarked that GST 2.0 could be “the reform that unleashes the true potential of GST, by making it simple, fair, and future-ready.”

Meanwhile, trade associations such as the Confederation of All India Traders (CAIT) have welcomed the move but warned that clarity on exemptions and compliance rules will be critical.

Caught Profiteering! Subway Franchise Penalized ₹5.45 Lakh for Withholding GST Rate Cut Benefits

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling