GST Amnesty Scheme Alert: The GST Amnesty Scheme under Section 128A of the CGST Act is a rare opportunity for registered taxpayers to wipe the slate clean. If you’re a business owner, consultant, accountant, or just someone who’s been delaying past GST dues, now’s the time to act. By paying only the tax amount (and skipping interest and penalty) for Financial Years 2017–18, 2018–19, and 2019–20, eligible taxpayers can avoid significant financial liability. But this opportunity comes with strict deadlines and conditions. In this detailed guide, we’ll explain exactly how this scheme works, who qualifies, how to apply, what forms you need, and the common pitfalls you must avoid. Whether you’re a small trader or a tax professional managing dozens of clients, this guide is built to help you make smart, timely decisions.

GST Amnesty Scheme Alert

The GST Amnesty Scheme is your chance to wipe out the burden of old penalties and interest without litigation. But you need to act now. Pay your tax by March 31, 2025. Submit your waiver form by June 30, 2025.

Follow the steps, avoid mistakes, and use this opportunity to resolve past issues and start fresh. Once this window is closed, it may not return. Don’t miss your chance.

| Key Information | Details |

|---|---|

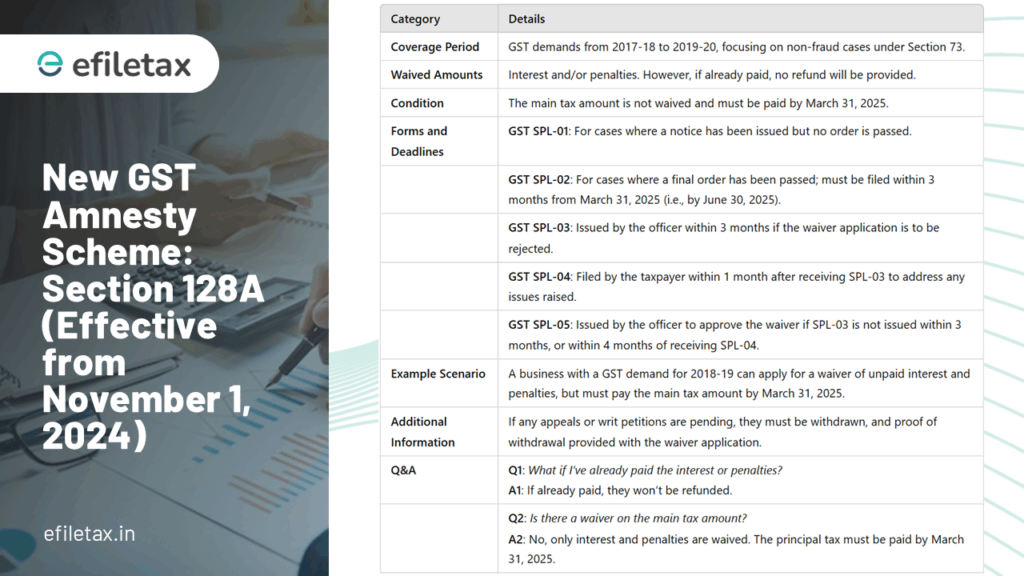

| Scheme Name | GST Amnesty Scheme – Section 128A |

| Applicable Years | FY 2017-18, 2018-19, 2019-20 |

| Effective Date | November 1, 2024 |

| Final Tax Payment Deadline | March 31, 2025 |

| Waiver Application Deadline | June 30, 2025 (or within 6 months if reclassified from Section 74 to 73) |

| Applicable GST Sections | Section 73 (non-fraud cases) |

| Forms Required | DRC-03, SPL-01, SPL-02, SPL-03 to SPL-07 |

| Appeal Reinstatement Allowed? | Yes, via APL-01 for rejected SPL-07 |

| Official Resource | CBIC Circular No. 238/32/2024-GST |

What Is the GST Amnesty Scheme?

The GST Amnesty Scheme is a one-time opportunity offered under Section 128A of the Central Goods and Services Tax (CGST) Act. It provides full relief from interest and penalty to registered taxpayers who have pending GST demands issued under Section 73—the section that deals with tax shortfall cases not involving fraud.

If your tax demand falls within the three financial years:

- 2017–18

- 2018–19

- 2019–20

And it is not related to fraud, suppression, or wilful misstatement—you may qualify for this relief.

This scheme also covers certain Section 74 cases that were reclassified to Section 73 via appellate orders under Section 75(2).

Not Eligible?

You are not eligible if:

- The case involves fraud (Section 74 not revised)

- The liability is solely for interest or late fees

- The issue is linked to erroneous refunds

- The tax payment was made after the deadline

Comparison: With vs. Without Amnesty

| Scenario | With Amnesty | Without Amnesty |

|---|---|---|

| Tax Due | ₹1,00,000 | ₹1,00,000 |

| Interest | ₹0 | ₹20,000 |

| Penalty | ₹0 | ₹10,000 |

| Total Payable | ₹1,00,000 | ₹1,30,000 |

| Savings | ₹30,000 | ₹0 |

Who Can Benefit?

You’re Eligible If:

- Your tax demand falls under Section 73

- You’ve received a notice or final order for FY 2017–20

- You pay the full tax amount by March 31, 2025

- You withdraw all pending appeals or writ petitions

- You submit the correct waiver form (SPL-01 or SPL-02)

You’re Not Eligible If:

- Your demand involves fraud or suppression of facts

- You pay after March 31, 2025

- You submit partial payments

- You only owe interest, penalty, or late fees (no tax)

- You fail to file the waiver application before the deadline

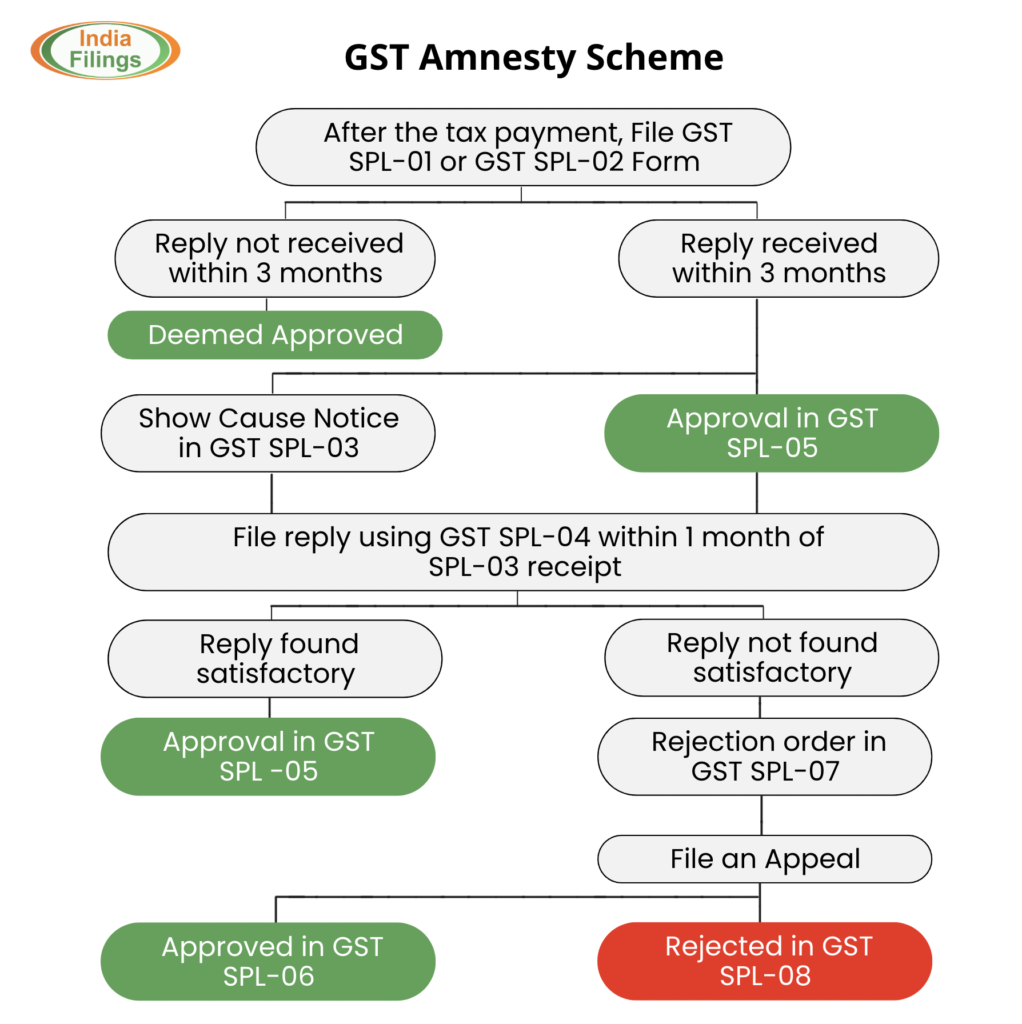

Step-by-Step Guide to Apply Under GST Amnesty Scheme Alert

Step 1: Check Your Eligibility

- Confirm your tax demand is under Section 73

- Review the financial year of the demand (should be FY 17–20)

- Make sure you’ve not already paid interest/penalty

Step 2: Make the Payment (Tax Only)

- Use Form DRC-03 for voluntary payment

- Use ELR Part-II if it’s a confirmed order

- Tax payment must be made on or before March 31, 2025

- Input Tax Credit (ITC) can be used if the nature of demand allows it

Important: If you paid before March 31 via DRC-03 but didn’t link it to the order immediately, you’re still eligible. The actual payment date counts—not the portal reflection.

Step 3: Withdraw Appeals/Writs (If Any)

- If you’ve filed an appeal (Form APL-01) or a court writ, withdraw it

- Upload either:

- The court/tribunal withdrawal order, or

- A screenshot of your GST portal showing “Appeal Withdrawn”

The GSTN has officially allowed screenshots as valid evidence.

Step 4: File the Waiver Form

- Use SPL-01 if your demand is only a notice

- Use SPL-02 if there’s a final order or appellate order

- Attach:

- Proof of tax payment

- Appeal/writ withdrawal document

- Copy of demand notice/order

- Submit on the GST portal before June 30, 2025

Step 5: Wait for Officer Response

- You may receive an SPL-03 (Show Cause Notice)

- Respond using SPL-04 within 30 days

- If no response from the officer within 3 months—waiver is deemed approved via SPL-05

What If Your Waiver Gets Rejected?

If your application is rejected, you’ll receive an SPL-07. The good news? You now have the right to file an APL-01 appeal against this rejection.

- You must appeal within 3 months

- If you don’t appeal, your original appeal (if any) gets automatically reinstated

- If the appeal is successful, you’ll receive an SPL-06, and the waiver is granted

No separate SPL-08 filing is needed anymore for appeal reinstatement—GSTN automated this part in July 2025.

Real-Life Case Studies

Case Study 1: Anjali, Boutique Owner – Jaipur

Anjali got a ₹70,000 GST demand for FY 2018–19. She had a pending tribunal appeal.

She paid the full ₹70,000 tax by March 15, 2025, and withdrew her appeal. She filed SPL-02 with all attachments.

Her waiver was approved automatically after 3 months—saving her ₹20,000 in penalty and ₹15,000 in interest.

Case Study 2: CA Arvind – Handles 80 Clients

Arvind segmented his clients into:

- Eligible under Section 73

- Eligible only if redetermination happened

- Non-eligible fraud/suppression cases

By March 2025, he helped 47 clients file DRC-03 and 41 SPL-01/SPL-02 forms. Estimated total savings across clients: ₹26 lakh.

Professional Tips for Tax Consultants

- Create batch processing lists for DRC-03 and SPL forms

- Ensure you track exact payment dates

- Keep a dashboard or spreadsheet to follow up on SPL-05 auto-approvals

- Alert clients not to rely on just portal alerts—cutoff dates are absolute

Common Mistakes to Avoid

- Paying tax after March 31, 2025—even by 1 day

- Filing SPL-01 when SPL-02 is required (and vice versa)

- Forgetting to withdraw an appeal before filing waiver

- Submitting waiver with incomplete attachments

- Assuming partial payments qualify—they don’t

West Bengal’s GST Revenue Soars 12% in July

Telangana High Court Delivers Major Relief for NRSC in GST Dispute

Manufacturing Activity Soars to 16-Month High, Driving GST Inflow Up by 7.7%