GST Bonanza Alert: If you’ve been waiting for the right moment to upgrade your air conditioner, stock up on your favorite snacks, or finally begin that long-delayed home renovation, this might be your sign. GST Bonanza Alert is trending in India, and it’s more than just a catchy headline—it’s about to make a real difference in household budgets, shopping trends, and even big-ticket industries. The Indian government is gearing up for one of the biggest Goods and Services Tax (GST) reforms since the system was rolled out in 2017. The plan is to simplify tax rates, reduce costs for consumers, and boost demand across multiple sectors. For families, that means essentials like toothpaste, soaps, and packaged food could get cheaper. For businesses, construction materials like cement and consumer durables like ACs and TVs may see meaningful price cuts. For the economy, this move could spark higher spending, just in time for the festive season.

GST Bonanza Alert

The GST Bonanza Alert isn’t just a temporary headline—it’s a potential game-changer for India’s economy and households. With essentials moving from 12% to 5% and big-ticket items like ACs and cement shifting from 28% to 18%, consumers and businesses stand to gain significantly. For shoppers, it means more savings. For businesses, it means higher demand. For the economy, it’s a push toward simplification and growth. And with Diwali 2025 as the rollout date, this could turn into a festive season to remember.

| Category | Current GST Rate | Proposed GST Rate | Impact | Reference |

|---|---|---|---|---|

| Household Items (toothpaste, soaps, snacks) | 12% | 5% | Cheaper essentials | GST Council |

| Electronics (ACs, TVs, washing machines) | 28% | 18% | Prices may fall 8–10% | Economic Times |

| Cement & Construction Materials | 28% | 18% | Boost to housing & infra projects | Business Standard |

| Healthcare (vaccines, diagnostic kits) | 12% | 5% | Lower medical costs | Financial Express |

| Rollout Timeline | September–October 2025 | This Diwali | Festive shopping boost | A2Z Taxcorp |

What Exactly Is GST? A Quick Refresher

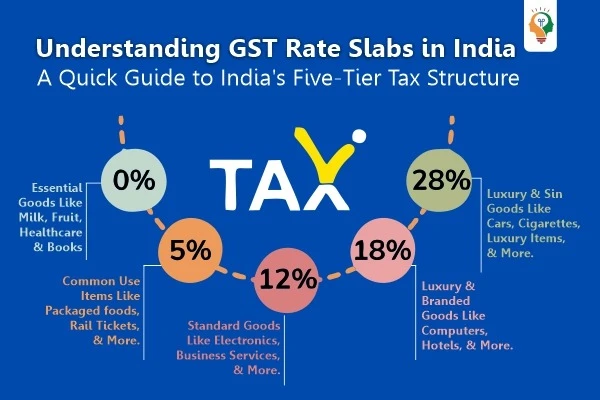

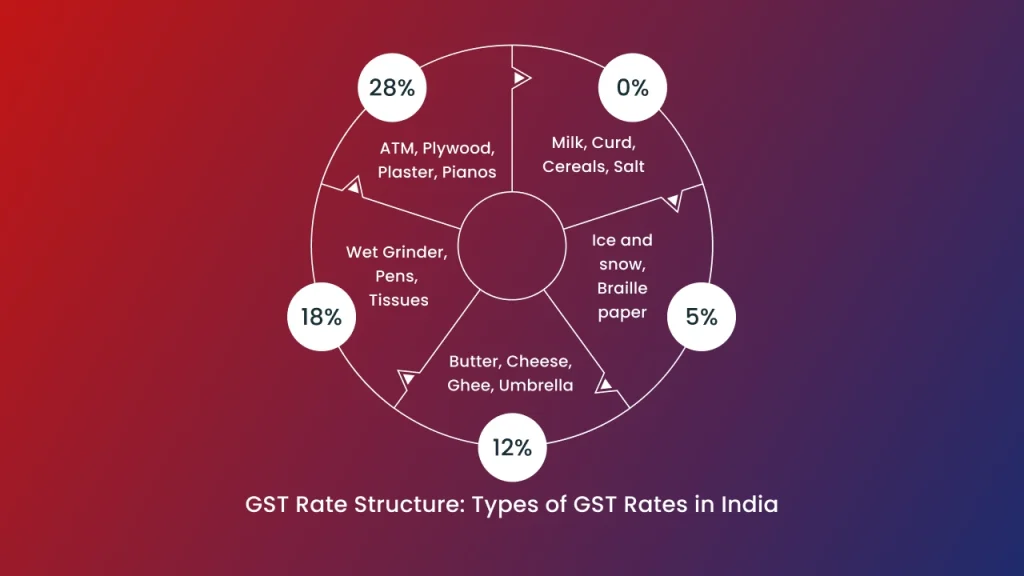

The Goods and Services Tax is India’s all-in-one tax system designed to simplify indirect taxation. Before GST, India had a patchwork of taxes—excise duty, service tax, VAT, and more—making compliance difficult and prices inconsistent. GST replaced this system in 2017 with a unified structure.

But even with this reform, India stuck with four different slabs (5%, 12%, 18%, and 28%) plus a few special “sin” taxes. Over time, critics pointed out that too many slabs confused consumers and businesses alike.

The new proposal aims to streamline GST into:

- Two primary slabs: 5% and 18%

- One special slab: 40% for luxury and harmful goods like alcohol, tobacco, and online betting

By simplifying the structure, the government hopes to make compliance easier, encourage spending, and bring India closer to global norms.

Why GST Bonanza Alert Matters?

Let’s break it down in everyday language. Lower tax = lower cost. If manufacturers and retailers pass on the benefits, consumers will pay less at checkout.

- For households: Essentials like toothpaste, soaps, and processed foods shifting from 12% to 5% will help families save every month.

- For big purchases: Appliances like refrigerators, TVs, and ACs moving from 28% to 18% could see price cuts of 8–10%.

- For industries: Cement and tiles becoming cheaper may reduce construction costs, easing housing prices and infrastructure budgets.

- For the economy: Higher disposable income means stronger demand, which in turn stimulates business growth and job creation.

This is a demand-side push—similar to how U.S. governments sometimes offer tax relief or rebates to spark consumer spending.

What’s Getting Cheaper?

Everyday Essentials (12% → 5%)

- Personal care: Toothpaste, soaps, hair oil

- Food: Packaged snacks, processed foods, frozen vegetables

- Education & stationery: Exercise books, geometry boxes

- Health: Vaccines, HIV/TB diagnostic kits, Ayurvedic medicines

- Clothing & footwear: Ready-made garments, footwear in the ₹500–1,000 range

- Energy & lifestyle: Solar water heaters, bicycles

Electronics and Big Appliances (28% → 18%)

- Air conditioners

- Refrigerators

- Washing machines

- Dishwashers

- Large-screen televisions

- Cement and ready-mix concrete

- Tiles, aluminum foil, tempered glass

Staying in the High Tax Bracket (40%)

- Alcohol, tobacco, pan masala

- Online betting and gaming

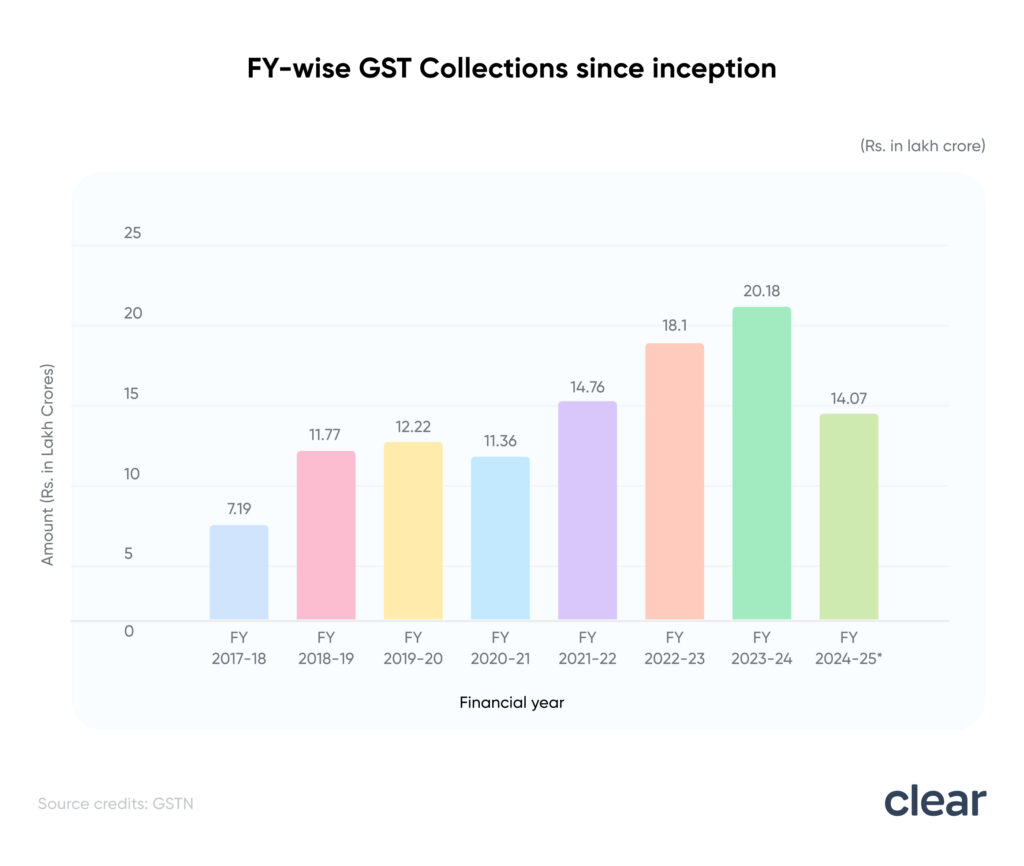

Historical Context: How GST Evolved

When GST first launched in 2017, it was hailed as India’s biggest tax reform since independence. But over the years, concerns mounted:

- Too many slabs: Unlike Singapore (9% flat GST) or Canada (5% federal GST + provincial tax), India’s four slabs created confusion.

- High 28% rate: Putting items like cement and electronics in the highest slab was seen as hurting industries and consumers alike.

- State revenues: States worried about losing money, prompting constant debates in GST Council meetings.

This new revamp shows the government’s intent to balance simplification with fairness.

Global Comparison

- United States: No GST; sales tax varies by state (0% in Oregon, over 9% in Tennessee).

- European Union: Value Added Tax (VAT) usually 15–25%.

- Singapore: One of the simplest models—just 9% flat GST.

India’s two-slab model would still be more complex than Singapore’s but much more streamlined than the current setup.

The Festive Angle: Why Timing Matters

The GST cuts are expected to roll out by Diwali 2025. Diwali, like Black Friday in the U.S., is peak shopping season in India. Families splurge on electronics, home appliances, clothing, and even cars.

By lowering GST just before this season, the government could trigger a shopping frenzy that boosts retail and e-commerce, while also stimulating demand in industries like construction and automobiles.

Expert Opinions

- Nomura: Highlights tractors, ACs, and consumer durables as big winners.

- CRISIL: Predicts a boost for housing affordability due to cheaper cement.

- FICCI and CII: Supportive of simplification but warn about possible revenue shortfalls for states.

- Economists: Some argue that while the move reduces tax complexity, it must be paired with strict compliance to avoid misuse.

Challenges Ahead

- Revenue Loss for States: Cutting GST from 28% to 18% on cement, for example, is a big drop. States may initially lose thousands of crores in collections.

- Implementation: Businesses will need to update billing, pricing, and accounting systems.

- Inflation Risks: Some industries could use this as an excuse to delay passing benefits to consumers.

- Balancing Act: Ensuring essential items get cheaper without derailing fiscal discipline is key.

How to Make the Most of This GST Bonanza?

For Consumers

- Delay big purchases until after the new rates kick in.

- Watch festive sales closely; combined with GST cuts, deals could be massive.

- Prioritize essentials—snacks, toiletries, medicines—that will see real price drops.

For Businesses

- Update GST compliance systems early to avoid confusion.

- Plan inventory—anticipate a spike in festive demand.

- Pass tax benefits to consumers transparently to build goodwill.

For Investors

- Track stocks in cement, FMCG, consumer durables, and retail.

- Consider real estate plays, as cheaper materials may spur housing demand.

- Watch insurance and healthcare sectors, which could benefit from GST cuts on services and products.

Consumer Psychology: Why Price Cuts Work

In economics, even small tax cuts can change behavior. For example:

- A family putting off buying a refrigerator might act when prices drop by 8–10%.

- Cheaper cement encourages contractors to speed up construction.

- Lower food costs free up money for discretionary spending.

Diwali is the perfect backdrop—people are already primed to spend. Lower GST could turn “window shoppers” into “buyers.”

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

Small Cars May Get Cheaper Under New GST Reform – But Luxury Cars to Stay Costly

GST 2.0 to Replace All Slabs With One Tax Rate – Here’s What It Means for You