GST Cess Set to Expire: The GST compensation cess—that extra charge on goods like luxury cars, coal, and tobacco—is finally set to expire by October 31, 2025. On the surface, this might sound like good news for consumers and businesses. But here’s the catch: states aren’t too happy about losing this revenue stream. And when governments lose revenue, history tells us they almost always find a new way to replace it. So the real question isn’t whether the cess will vanish—it’s whether states will push for a new tax to fill the gap. Let’s walk through the history, the stakes, and what it could mean for you.

GST Cess Set to Expire

The GST compensation cess set to expire by October 2025 may sound like the end of an extra burden on taxpayers, but states are already pushing for replacements. Whether it comes as a Health Cess, Clean Energy Cess, or simply higher GST rates, one thing is clear—luxury and harmful goods will continue to attract heavy taxation. For consumers, prices may not drop. For businesses, compliance could get simpler if slabs are streamlined. And for states, the real battle will be ensuring their budgets remain intact. The upcoming GST Council meeting in September 2025 will decide how India writes the next chapter in its tax story.

| Topic | Details |

|---|---|

| GST Cess End Date | Expected to end on October 31, 2025 (Official GST Portal) |

| Revenue Surplus | Around ₹2,000–3,000 crore to be shared between Centre and states |

| Replacement Options | Health Cess, Clean Energy Cess, or higher GST rates |

| Proposed GST Slabs | Simplify from 4 slabs (5%, 12%, 18%, 28%) → 2 slabs (5% and 18%) |

| GST Ceiling Change | Proposal to increase cap from 40% → 60% for luxury/sin goods |

| States’ Concerns | Revenue gap after cess ends; demands for a safety net |

| Upcoming Decision | To be finalized at GST Council meeting on September 3–4, 2025 |

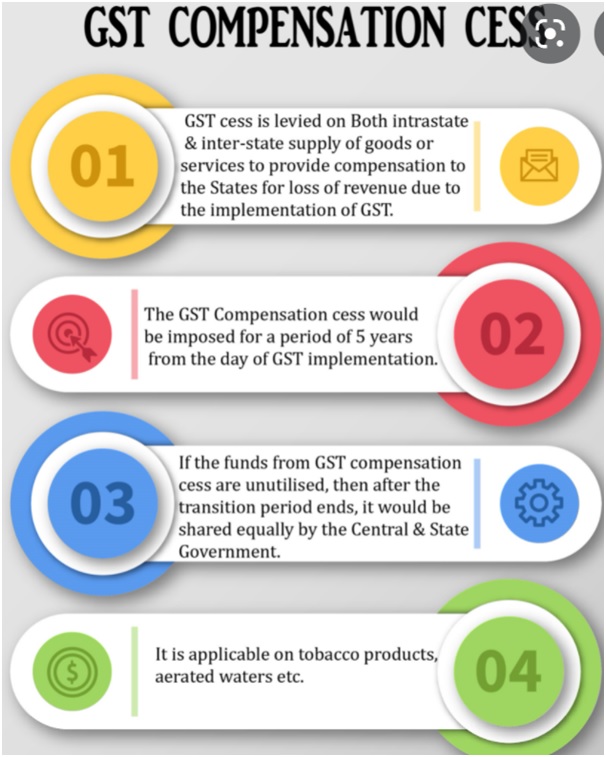

Why Was the GST Cess Introduced in the First Place?

When India introduced the Goods and Services Tax (GST) in 2017, it replaced a patchwork of central and state taxes. While GST simplified the system, states worried about losing their share of revenue.

To ease these fears, the Centre promised to compensate states for any shortfall in tax revenue for five years. That’s where the compensation cess came in—an add-on levy applied to goods considered either luxurious or harmful to health, such as:

- Cigarettes and tobacco products

- Luxury cars and SUVs

- Coal and fossil fuels

- Aerated drinks

The revenue collected from this cess was distributed to states to cover their losses.

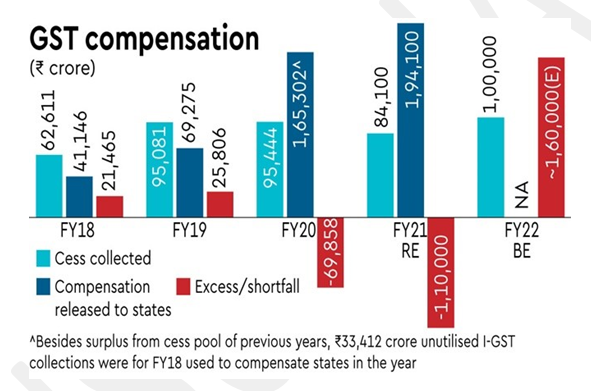

However, when the COVID-19 pandemic hit, government spending skyrocketed and state finances were under pressure. The cess was extended beyond the original deadline of 2022 to help repay loans raised during that time.

Now that those loans are close to being cleared, the government says the cess can end by October 2025.

Why Are States Worried About Losing the Cess?

For many states, the GST cess became a steady stream of money they came to rely on. Losing it feels like a salary cut with no replacement.

Take Punjab for example. The state claims it is already struggling with high debt and pending dues from the Centre. Without cess revenue, Punjab argues it will have to either borrow more or cut spending. Similarly, southern states like Tamil Nadu and Karnataka say the cess is essential to fund welfare schemes, infrastructure, and healthcare.

States are therefore pushing for:

- Extension of cess in a new form

- Introduction of new targeted levies (such as Health Cess or Clean Energy Cess)

- Raising GST ceilings so higher taxes can be levied on sin and luxury goods

In short, states don’t want to lose this lifeline.

What Could Replace the GST Cess Set to Expire?

The Centre and states are weighing different options.

1. Merge Cess Into GST Slabs

Instead of a separate cess, the tax burden could be folded directly into GST. For example, instead of paying 28% GST plus cess on a car, the rate might simply be 40% GST.

2. Raise the GST Ceiling

The law currently allows GST rates up to 40%. Proposals suggest raising it to 60%, giving the government flexibility to maintain revenue without a separate cess.

3. Introduce Targeted New Taxes

This is the “rebranding” approach:

- Health Cess on tobacco and alcohol

- Clean Energy Cess on coal and big cars

The name changes, but the burden on the consumer stays.

What Does This Mean for You?

Here’s how these changes could affect everyday people:

- Smokers and drinkers: Tobacco and alcohol could still remain expensive if new health-related taxes are introduced.

- Car buyers: Don’t expect luxury cars or SUVs to suddenly get cheaper. States want to keep taxing these products.

- Middle-class families: Essentials like food, clothing, and medicines are already at the lower 5% GST slab and won’t be hit. But restaurant bills, gadgets, and household appliances could move into different slabs if restructuring happens.

The bottom line: while the “cess” may disappear, your bills are unlikely to shrink.

Global Comparisons: Sin Taxes Aren’t Unique to India

India isn’t alone in using these kinds of taxes. Governments worldwide rely on “sin taxes” to discourage harmful consumption and raise revenue.

- United States: Many states impose steep taxes on cigarettes. In New York, a single pack costs around $12.85, partly due to high excise taxes.

- United Kingdom: Alcohol duty and sugar taxes generate billions in revenue each year.

- Australia: Cigarette packs cost over AUD $40, thanks to extremely high taxes.

So, while the names and structures may differ, the idea of taxing “luxuries” or “sins” is common across the globe.

Who Are the Winners and Losers?

Consumers

Everyday essentials won’t see major changes. But those who consume tobacco, alcohol, or luxury goods will continue to face high prices.

Businesses

Companies in auto, alcohol, and tobacco sectors need to prepare for price restructuring. Compliance systems will need to adapt quickly if slabs are simplified.

States

Without a replacement, states stand to lose more than ₹1.2 lakh crore annually. This is why they are lobbying hard for alternatives.

Investors

If the Centre manages to end cess smoothly without causing fiscal chaos, it strengthens India’s credibility with global investors and credit rating agencies.

The Push for Simplified GST Slabs

The government wants to move from four GST slabs (5%, 12%, 18%, 28%) to just two main slabs (5% and 18%). A higher rate (40% or more) would apply only to luxury and harmful goods.

Benefits of this move:

- Easier compliance for businesses

- Reduced tax disputes and court cases

- Greater transparency for consumers

But shifting products between slabs will spark intense lobbying from industries. For example, restaurant owners may resist being bumped from 5% to 18%.

Practical Advice

For Businesses

- Keep compliance systems flexible. New slabs may require updates to accounting software and billing systems.

- Stay alert for GST Council announcements—pricing strategies may need adjustment.

- Factor in higher GST ceilings if you operate in luxury or sin goods sectors.

For Consumers

- Don’t expect significant price drops on luxury cars, alcohol, or tobacco.

- Watch out for new taxes under fresh names like Health or Clean Energy Cess.

- Essentials will remain affordable under the 5% slab.

For Investors

- Monitor India’s fiscal deficit targets.

- A smooth transition without a messy fight between Centre and states will be a positive signal for India’s economic stability.

- Track reports from the IMF and World Bank on India’s tax reforms.

GST Structure Simplified – Key Changes Explained

12% & 28% GST Slabs Axe Approved – Will Consumers and Businesses Finally Benefit?

Centre Plans Major GST Overhaul — Four Slabs May Shrink to Just Two