GST Collection Hits ₹1.96 Trillion in July: India’s Goods and Services Tax (GST) collection touched an impressive ₹1.96 trillion in July 2025. That’s no small feat. In fact, it’s one of the highest gross GST collections since the tax was launched in 2017. But there’s a twist—while gross collections are soaring, the net revenue isn’t rising in sync. In this in-depth guide, we’ll break down the numbers, explain the reasons behind the revenue mismatch, and help you understand what this means for India’s economy, businesses, and policy landscape. Whether you’re a student, a small business owner, a tax consultant, or a policymaker, this article will give you valuable insights in a friendly, easy-to-follow format.

GST Collection Hits ₹1.96 Trillion in July

India’s GST collection in July 2025 reaching ₹1.96 trillion is a sign of strong economic momentum. However, the modest 1.7% growth in net revenue—due to a significant jump in refunds—shows that the tax system needs fine-tuning. Rather than being a red flag, this scenario highlights the strengths and maturing nature of India’s GST framework. That said, rate simplification, refund rationalization, and smarter fiscal planning are essential to ensure that tax collections translate into real, usable revenue for public development.

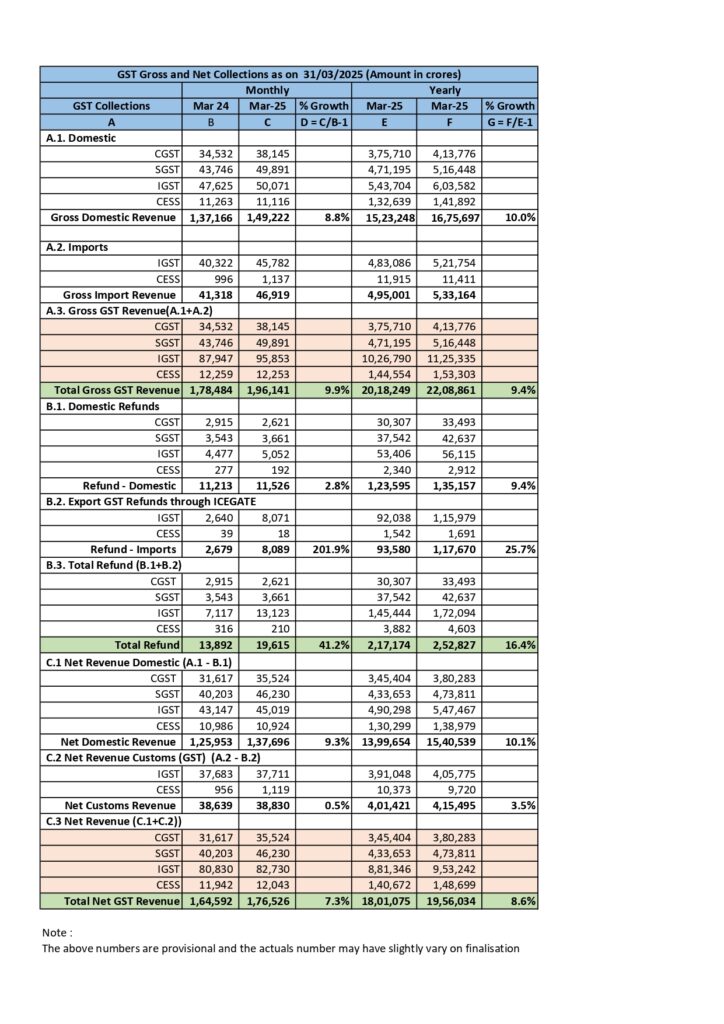

| Topic | Key Insights |

|---|---|

| Gross GST Collection (July 2025) | ₹1.96 trillion (₹1.96 lakh crore), up 7.5% YoY |

| Net Revenue (Post Refunds) | ₹1.69 trillion, growth of just 1.7% |

| Refunds Issued | ₹27,147 crore, a 66.8% YoY increase |

| Cess Revenue | ₹12,670 crore (–2% YoY) |

| Why the Gap? | Surge in refunds, IGST settlements, slower cess growth |

| Impact on Policy | Greater fiscal strain, need for rate rationalization |

| Official Source | PIB India |

What Is GST and Why Should You Care?

GST, or Goods and Services Tax, is a unified indirect tax that replaced various central and state-level taxes in India starting July 1, 2017. It’s collected at every stage of value addition and aims to make the tax system more transparent and business-friendly.

Here’s what you need to understand:

- Gross GST is the total amount collected by the government before making any deductions.

- Net GST is what’s left after refunds are issued—this is the money the government can actually spend.

Understanding the difference between these two figures is crucial to grasp the story behind India’s tax revenues.

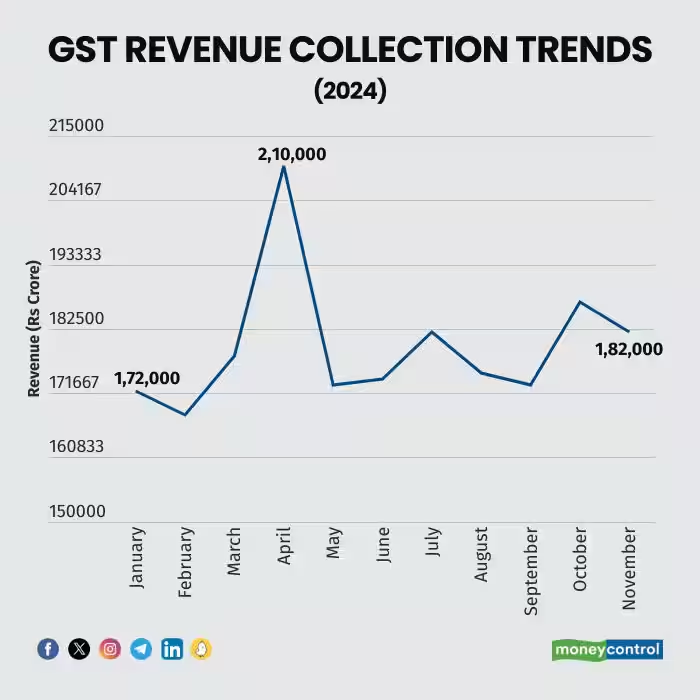

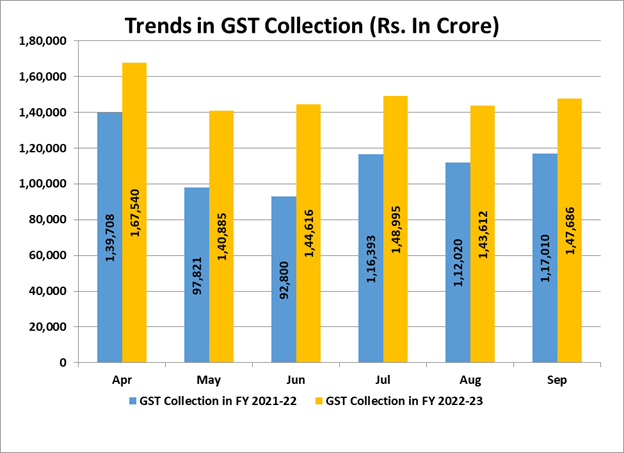

Historical GST Performance (2017–2025)

Let’s take a quick look at how GST collections have evolved over the years:

| Fiscal Year | Gross GST (₹ Cr) | Net GST (₹ Cr) | Notes |

|---|---|---|---|

| 2017–18 | 7.4 lakh crore | 6.5 lakh crore | Initial implementation year |

| 2018–19 | 11.8 lakh crore | 10.3 lakh crore | Full year implementation |

| 2019–20 | 12.2 lakh crore | 10.9 lakh crore | Pre-pandemic growth |

| 2020–21 | 11.4 lakh crore | 9.7 lakh crore | COVID-19 impact |

| 2021–22 | 14.8 lakh crore | 13.2 lakh crore | Recovery phase |

| 2022–23 | 16.6 lakh crore | 14.5 lakh crore | High compliance |

| 2023–24 | 18.3 lakh crore | 16.1 lakh crore | Strong demand |

| 2025–26 (Apr–Jul) | ₹7.11 lakh crore (net) | +8.4% YoY | Higher refunds limiting growth |

This table shows that while gross GST has steadily increased, net revenue often lags, especially during high-refund periods.

Why Net GST Revenue Isn’t Keeping Up After GST Collection Hits ₹1.96 Trillion in July?

1. High Refund Volumes

In July 2025, the government issued refunds worth ₹27,147 crore—a 66.8% jump compared to July 2024. Refunds are paid to businesses that have paid more input tax than output tax, which is common in export-heavy or inverted duty industries.

Refunds are not bad. In fact, they’re a sign of business activity and government efficiency. But they lower the actual money retained by the government.

2. Inverted Duty Structure

Certain industries—textiles, footwear, pharmaceuticals—often pay a higher GST on inputs than on outputs. For example, if raw material is taxed at 18% and the final product at 5%, the business can claim a refund on the excess input tax credit.

This mismatch leads to regular and large refund claims. Unless the duty structure is corrected, refunds will remain a significant drain on net revenue.

3. Export Incentives

Exports are zero-rated under GST. That means businesses don’t pay tax on the goods or services exported, but they often pay GST on input costs. The government refunds this amount to maintain international competitiveness. With export activity on the rise, refund claims are growing accordingly.

4. Faster Digital Refund Processing

Thanks to improved digital systems, refund applications are now processed much faster. The new automated portal validates data using e-invoices, GSTR-1, and GSTR-3B. Businesses are receiving refunds quicker, and while that’s great for liquidity, it has a short-term impact on net revenues.

5. Falling Cess Collections

GST compensation cess, which helps states bridge revenue gaps, fell 2% in July 2025. As sales of cess-based goods like coal, tobacco, and luxury vehicles flatten, this revenue source is becoming less reliable.

Also, the 14% annual guaranteed revenue growth for states ended in 2022, putting more pressure on states to manage their own finances.

6. IGST Settlements

Inter-state GST (IGST) collections are first pooled and later apportioned between the Centre and states. Some of the IGST collected may later be refunded (for exports) or adjusted (for internal transfers), causing further mismatch between gross and net revenue.

How India Compares with Other Countries?

India isn’t alone in facing these challenges. Let’s compare GST (or VAT) systems globally:

| Country | GST/VAT Rate | Refund Timeline | Refund Ratio (Avg) |

|---|---|---|---|

| India | 5–28% | 15–45 days | 12–18% of gross |

| Australia | 10% | 14 days | 5–8% |

| UK | 20% | 21 days | 6–10% |

| Canada | 5–15% | 10–15 days | 5–7% |

| Singapore | 8% | 14 days | 4–6% |

India’s refund ratio is higher due to multiple slabs and industry-specific exemptions. This highlights the need for simplification.

Real-World Example: How Refunds Work

Imagine you run a textile company in Gujarat. You buy fabric, yarn, and accessories taxed at 18%. You manufacture shirts taxed at 5%. The difference—13%—accumulates as input tax credit.

Each month, you file for a refund. The government verifies your purchases, sales, and shipping documents. Once cleared, your refund is processed within a few weeks. Multiply this by thousands of such exporters across India, and you’ll understand the sheer volume of outgoing refunds.

Implications for Policymakers and Businesses

The growing gap between gross and net GST collections carries multiple implications:

For Policymakers:

- Need to rationalize GST slabs, especially to reduce inverted duty issues.

- Explore AI and predictive analytics to forecast refund surges.

- Monitor sector-specific refund behaviors for fraud detection and policy correction.

- Consider reintroducing limited compensation mechanisms for poorer states.

For Businesses:

- Maintain accurate, timely GST filings to ensure smooth refunds.

- Track industry changes that may affect refund eligibility.

- Consult tax experts on structuring input costs to minimize credit blockages.

- Use automated tax compliance tools to avoid errors and delays.

For Tax Professionals:

- Expect more refund-related consultancy.

- Help clients understand refund eligibility, timelines, and reconciliation.

- Advise on possible implications of changes in GST rates or slab structures.

What Can Be Done Going Forward?

Rate Rationalization

One of the long-standing proposals is to reduce the number of GST slabs—currently 0%, 5%, 12%, 18%, and 28%—and merge them into a simpler two- or three-rate system. This could significantly reduce the inverted duty structure problems.

Boost Compliance and Transparency

Enhanced use of e-invoicing, data matching between GSTR-1 and GSTR-3B, and AI-powered audit trails can minimize fraudulent refund claims and make GST more reliable.

Strengthen Fiscal Monitoring

Creating state-level fiscal planning tools that integrate GST trends with budget planning can help both the Centre and states make better revenue projections.

West Bengal’s GST Revenue Soars 12% in July

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

Manufacturing Activity Soars to 16-Month High, Driving GST Inflow Up by 7.7%