GST Collections for July 2025: GST (Goods and Services Tax) collections are a key indicator of economic health, and July 2025 is no exception. As we dive deeper into this subject, we’ll explore which states are contributing the most to the national GST kitty and why these collections matter. This article will not only break down the most recent trends in GST collections but also offer practical advice on how states can enhance their contributions. Let’s get into it!

GST Collections for July 2025

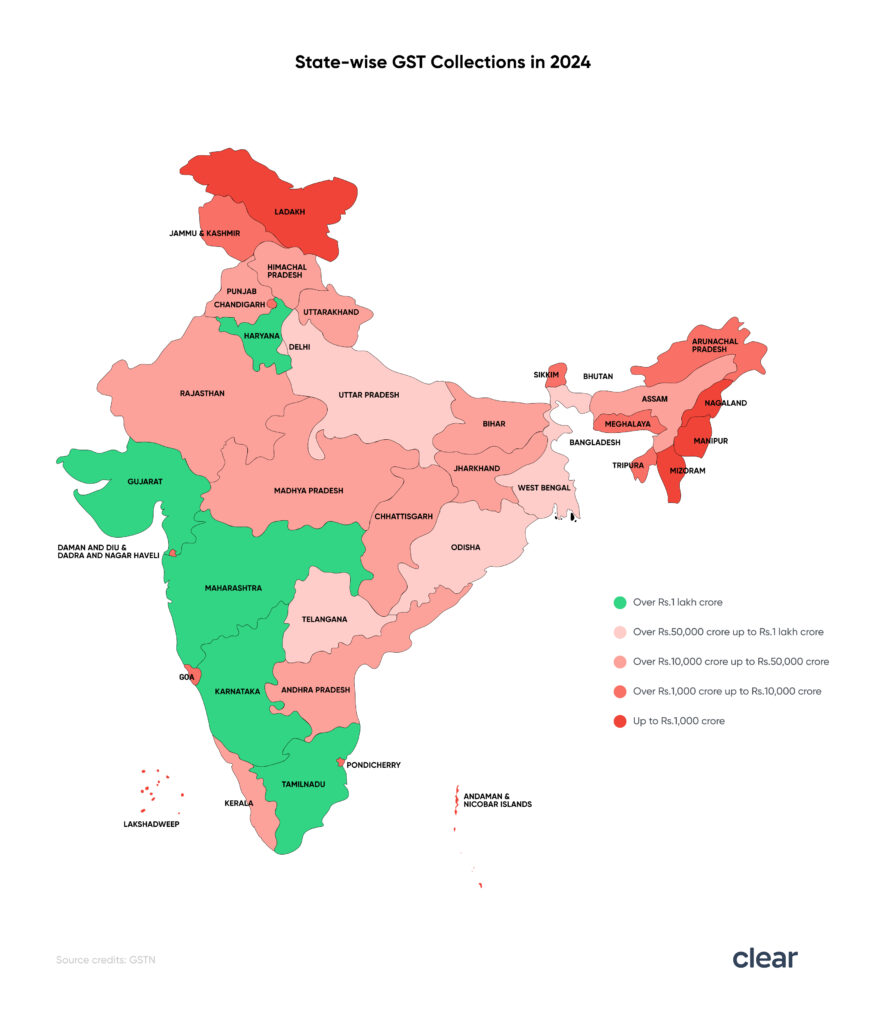

As we look at GST collections for July 2025, it’s clear that Maharashtra, Karnataka, Tamil Nadu, and Gujarat are the top contributors to India’s national revenue pool. With steady growth across these states, we can expect further improvements in India’s economic outlook. The government’s focus on taxpayer compliance, fostering business growth, and streamlining the process will continue to drive GST collections higher in the months ahead.

| Key Data & Stats | Details |

|---|---|

| Top State for GST Collections | Maharashtra |

| Total GST Collected (July 2025) | Estimated ₹1.70 Lakh Crore (Based on Previous Trends) |

| Growth Rate in GST Collections (2025) | 6-8% growth in major states like Maharashtra, Karnataka |

| Key Contributors | Maharashtra, Karnataka, Tamil Nadu, Gujarat |

| Key Resource Link | GST Collections Official Data |

What’s Going on With GST Collections for July 2025?

GST collections in July 2025 are expected to hit ₹1.70 Lakh Crore, showing continued signs of economic strength. This is a significant rise, following the trend of consistent growth over the last few months. Maharashtra remains the undisputed leader in GST revenue, a testament to its dominant position in India’s economy. However, other states like Karnataka, Tamil Nadu, and Gujarat have also posted strong performances.

For context, GST collections are critical because they reflect the country’s overall economic activity. When businesses do well, more goods and services are taxed, and as a result, GST collections go up. This means that the economic pulse of the nation is strong—people are spending, businesses are growing, and the economy is moving forward.

Why Does GST Matter?

Before we dive deeper into state-wise performance, it’s essential to understand why GST matters. GST is a nationwide indirect tax that replaced multiple state and central taxes. For businesses and governments, it has streamlined the taxation process, making it easier to track and manage. The revenue generated from GST is used for infrastructure projects, healthcare, education, and welfare programs across the country.

From a professional perspective, tracking GST collections is an effective way to gauge the health of the economy. It helps policymakers and businesses assess market conditions, consumer confidence, and business growth.

State-wise Breakdown: Who’s Leading the Pack?

Maharashtra: The Front Runner

Maharashtra has always been a frontrunner when it comes to GST collections, and July 2025 is no different. This state accounts for a significant portion of India’s overall GDP, thanks to its strong industrial and financial sectors. With Mumbai being the financial capital of India, it’s no surprise that Maharashtra continues to dominate the GST landscape.

In June 2025, Maharashtra’s GST collection stood at a massive ₹30,000 crore, and it’s expected that this number will be even higher in July 2025. Maharashtra’s growth rate has been consistent, with a 6% year-on-year increase in collections. The industries driving this growth include manufacturing, IT, and services, with Mumbai’s status as an international business hub playing a central role.

Key Insights:

- Financial Capital: Maharashtra houses Mumbai, the country’s financial capital.

- Growth Rate: Consistent growth in GST collections, driven by major sectors like IT, manufacturing, and services.

- Future Projections: Likely to remain a strong contributor to national GST collections in the coming months.

Karnataka: The Tech Powerhouse

Karnataka takes the second spot, thanks to its booming IT and start-up sectors. The state’s capital, Bangalore, is known as India’s “Silicon Valley,” home to a multitude of national and international tech firms. Karnataka’s GST revenue for June 2025 was ₹13,409 crore, reflecting an 8% increase over the previous year.

With digital services and technology exports surging, Karnataka’s GST collections are only expected to rise further. The state’s proactive business policies and a strong industrial ecosystem contribute significantly to its position as one of the highest revenue-generating states in India.

Key Insights:

- Tech Hub: Karnataka’s IT industry is a major contributor to GST revenue.

- Start-up Ecosystem: Strong policies that support emerging tech companies and start-ups.

- Expected Growth: As e-commerce and digital services expand, Karnataka will continue to boost GST collections.

Tamil Nadu: A Strong Economic Player

Tamil Nadu remains one of India’s most industrialized states, contributing significantly to the GST pool. With major sectors like automobile manufacturing, textiles, and tourism, Tamil Nadu’s economy is diverse and robust. The state’s GST collection for June 2025 was ₹10,676 crore, showing a 4% growth from last year.

Tamil Nadu is expected to see sustained growth in the upcoming months due to the strength of its manufacturing base. With a focus on export-oriented industries, the state is positioned to contribute even more to the national GST collections in the future.

Key Insights:

- Industrial Base: A strong manufacturing and export-oriented economy.

- Key Sectors: Automotive, textiles, and tourism.

- Future Outlook: Continued growth expected due to strong industrial performance.

Gujarat: The Growth Giant

Gujarat is another state that has shown impressive performance in GST collections. Despite a small dip of 1% in collections for June 2025, Gujarat continues to rank among the top contributors. The state has seen a 145% increase in the number of GST taxpayers since the system was introduced in 2017.

Gujarat’s economy is largely driven by textiles, chemicals, and petrochemicals. With a favorable business environment and a booming export sector, Gujarat is well-positioned to contribute significantly to the GST kitty in the months to come.

Key Insights:

- Industrial Growth: Known for its booming industrial economy.

- Increased Taxpayers: Significant growth in the number of GST taxpayers over the years.

- Sectors Driving Growth: Textiles, chemicals, and petrochemicals.

Practical Guide: How Can States Boost GST Collections?

States looking to increase their GST collections should consider a few practical steps to boost economic activity and improve tax compliance.

1. Encouraging Compliance Through Technology

Implementing technology-driven solutions can streamline the GST compliance process. By simplifying the filing system and offering digital tools for businesses, states can increase both accuracy and compliance rates.

2. Attracting New Businesses

States can foster growth by attracting new industries, especially those in emerging sectors like e-commerce, biotechnology, and renewable energy. Offering tax incentives and creating a business-friendly environment can encourage businesses to set up shop and start contributing to GST collections.

3. Fostering Export Growth

For states like Gujarat, which have a strong export base, removing bottlenecks in the export process can significantly increase GST revenue. Streamlining trade and improving infrastructure can help states leverage their export potential.

4. Promoting Start-ups and SMEs

States can incentivize the growth of start-ups and small and medium-sized enterprises (SMEs), which are often the backbone of regional economies. Offering financial assistance, tax exemptions, and mentorship programs can help these businesses thrive, ultimately contributing more to GST collections.

7,000 Vendors Without Registration Now Targeted in Karnataka—Here’s How to Avoid Penalties

Say Goodbye to In-Person GST Hearings: ‘Faceless Adjudication’ System to Be Tested from Friday