GST Collections Surge 6.5% In August: India’s Goods and Services Tax (GST) collections surged 6.5% in August 2025, reaching ₹1.86 lakh crore, compared to August 2024. This growth, though modest compared to some earlier months, is an important signal of the resilience of India’s domestic economy, even as global trade slows and imports weaken. Think of GST collections as the government’s monthly paycheck. A bigger paycheck compared to last year means stronger earnings. In the same way, higher GST collections show that businesses are selling, consumers are spending, and tax compliance is improving.

GST Collections Surge 6.5% In August

India’s 6.5% GST growth in August 2025 is more than just a statistic—it’s a reflection of resilient domestic demand, improving compliance, and a maturing tax system. Despite weak imports and global headwinds, India’s economic engine continues to run steadily, powered by local consumption. For policymakers, businesses, and citizens, the message is clear: focus on domestic strength, adapt to changing global dynamics, and keep compliance sharp. The stability of GST collections is a reassuring sign of India’s economic health and its ability to weather global storms.

| Metric | Value (August 2025) | YoY Change | Reference |

|---|---|---|---|

| Gross GST Collection | ₹1.86 lakh crore | +6.5% | GST Official Data |

| Net GST Revenue | ₹1.67 lakh crore | +10.7% | Economic Times |

| Refunds Issued | ~₹19,359 crore | –20% | LiveMint |

| Domestic GST Revenue | Up ~9.6% | Strong Growth | Times of India |

| Import-Linked GST | Down ~1.2% | Weakness | Reuters |

Understanding GST in Simple Terms

For those new to the concept, Goods and Services Tax is a single, nationwide tax that India introduced in 2017 to replace multiple indirect taxes like VAT, excise duty, and service tax. Instead of paying several smaller taxes, businesses and consumers now pay one consolidated tax on goods and services.

It’s like subscribing to one streaming service instead of paying separately for each channel. GST makes taxation simpler, more transparent, and easier to track.

Why does it matter? Because GST revenue reflects the pulse of the economy. If collections are rising, it means people are spending more, businesses are selling more, and tax systems are working efficiently.

Breaking Down the GST Collections Surge 6.5% In August

Gross vs Net Revenue

Gross GST collections hit ₹1.86 lakh crore, but after deducting refunds, net revenue stood at ₹1.67 lakh crore. Interestingly, refunds were 20% lower than last year, which boosted the net revenue growth to 10.7%, even though gross revenue rose only 6.5%.

Domestic vs Import Trends

- Domestic GST revenue rose nearly 9.6%.

- Import-linked GST dipped by about 1.2%.

This indicates that local consumption and production are driving the economy, while international trade pressures and tariffs have slowed imports.

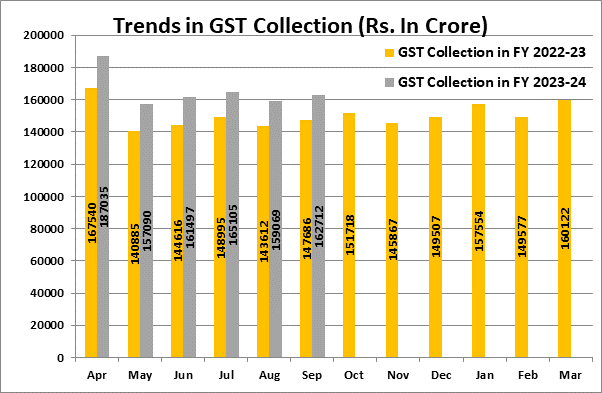

Month-on-Month Comparison

July 2025 recorded ₹1.96 lakh crore, slightly higher than August. However, the year-on-year comparison shows steady growth, which is more important for long-term economic health.

Historical Context: Looking Back to Move Forward

Let’s put this year’s numbers in perspective.

- August 2023: ₹1.59 lakh crore

- August 2024: ₹1.75 lakh crore

- August 2025: ₹1.86 lakh crore

Over two years, GST collections in August have grown nearly ₹27,000 crore—that’s around 17% growth. This steady rise demonstrates that GST has matured as a reliable revenue stream for the government.

Sector-Wise Analysis

GST collections are not uniform across industries. Here’s how different sectors have performed:

- FMCG (Fast-Moving Consumer Goods): Strong growth driven by rising consumer demand, especially in rural markets. Everyday essentials like packaged food, personal care, and beverages are major contributors.

- Services Sector: IT, telecom, and financial services remain key pillars, contributing significantly to GST revenue due to consistent demand.

- Automobiles: A mixed bag. Passenger vehicles are doing well, but two-wheelers and commercial vehicles face challenges from financing costs and high fuel prices.

- Manufacturing: Moderate growth as domestic demand picks up, though rising raw material costs weigh on margins.

- Imports: Weak, reflecting both global trade slowdowns and a shift toward domestic sourcing.

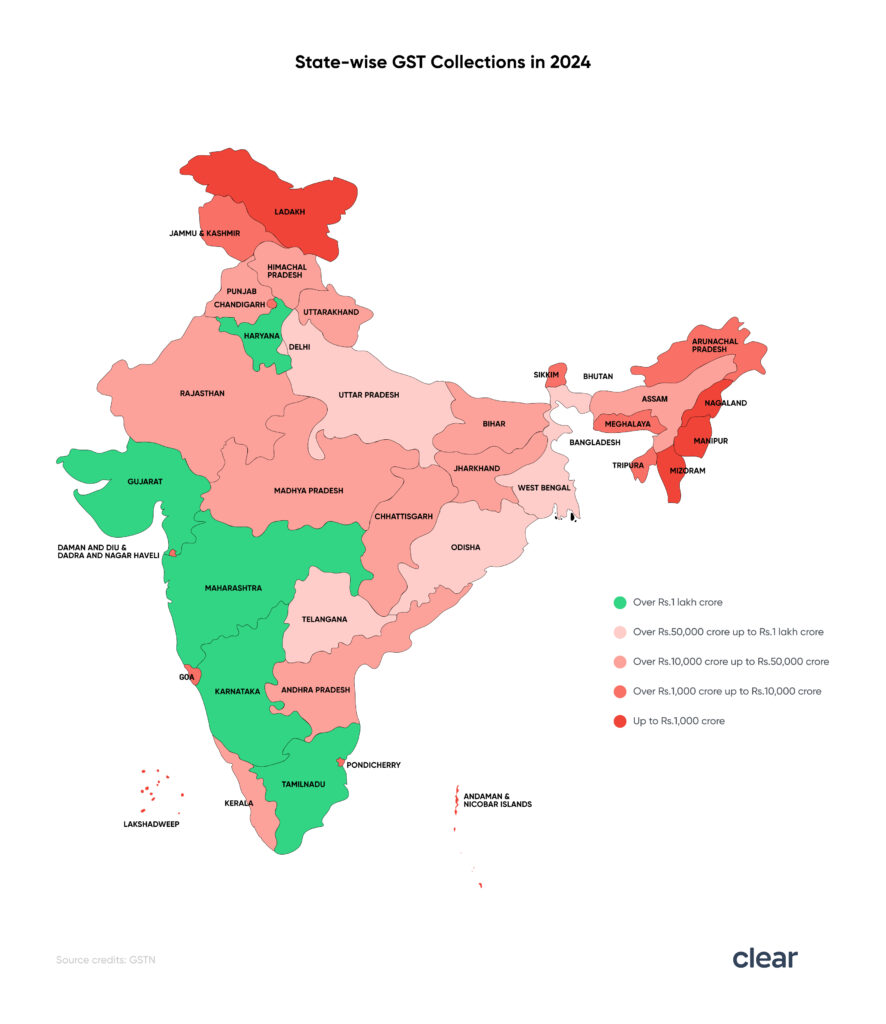

State-Wise Performance

Large states with industrial and commercial hubs dominate GST collections:

- Maharashtra and Karnataka: Strong performers thanks to IT services, banking, and manufacturing.

- Gujarat and Tamil Nadu: Significant contributions from automobile and industrial production.

- Uttar Pradesh and West Bengal: Rising collections due to improved compliance and strong retail demand.

Smaller states are catching up too, largely because of increased digitization of GST filings and government initiatives to improve compliance.

How India Compares Globally?

India’s GST performance is notable when compared with other countries:

- United States: Relies on state-level sales taxes, which vary and are less centralized. Revenue collection is often less stable.

- European Union: Value-Added Tax (VAT) systems are similar but often face compliance challenges.

- India: Despite being a relatively new system, GST has stabilized quickly and consistently shows growth, aided by strong compliance mechanisms and digital filing.

This consistency makes India’s GST system one of the most effective tax frameworks in large economies.

Why the 6.5% Growth is Important?

Some may say 6.5% is modest compared to double-digit growth in earlier months, but steady growth is more sustainable. Flashy jumps often indicate volatility, while consistent growth shows resilience.

- For the government: A reliable revenue stream for spending on infrastructure, social welfare, and development projects.

- For businesses: A sign that domestic demand is strong, supporting sales and expansion.

- For citizens: Higher collections mean the government has more fiscal room for subsidies and services.

Practical Takeaways

For Small Businesses

- Stay on top of GST filings and refund claims, as refunds are trending lower.

- Focus on domestic markets where demand is strongest.

For Corporates

- Expect tighter compliance audits with increasing use of digital tracking.

- Diversify supply chains to reduce dependence on imports.

For Investors

- Domestic-focused industries such as FMCG, retail, and services are poised for steady growth.

- Import-heavy sectors may face challenges if global trade remains weak.

Step-by-Step: How to Interpret GST Data

- Start with gross collections for the big picture.

- Look at refunds to understand net revenue.

- Compare domestic versus import collections to see demand trends.

- Check both year-on-year and month-to-month growth.

- Relate the numbers to your industry or investments.

Policy Outlook

Experts expect the government to:

- Tighten compliance further using artificial intelligence and big data audits.

- Possibly revise GST slabs to simplify rates and encourage consumption.

- Expand digital adoption for small and medium enterprises to improve compliance.

The upcoming GST Council meetings will likely focus on rate rationalization and measures to support sectors hit by global slowdown.

Expert Commentary

According to tax analysts, the dip in refunds suggests improved accuracy in filings, but businesses must remain vigilant. Economists also note that while domestic demand is healthy, India must watch global headwinds—particularly U.S. tariffs and slower Chinese growth—that could impact imports and exports.

Market strategists argue that GST data provides a reliable leading indicator of economic activity, and consistent growth is a positive sign for equity markets, especially in consumer-facing industries.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

New DDP Indicators and GST Collections Reveal Economic and Cultural Shifts in Districts

GST Restructuring Debate – Why Experts Say It Could Hurt Federalism