GST Collections Unveil Shocking Cultural Shifts: If you thought taxes were just boring numbers hidden in government reports, think again. GST collections—that’s Goods and Services Tax—are doing more than keeping India’s economy afloat. They are shining a spotlight on cultural shifts, lifestyle changes, and spending habits across districts in ways we’ve never seen before. From salons in Varanasi to multiplexes in Lucknow, the way people spend their money is now documented in GST numbers. And when you look closely, those numbers tell a fascinating story about how India is transforming—not just economically, but socially and culturally too.

GST Collections Unveil Shocking Cultural Shifts

GST collections are no longer just about government revenue—they’re a cultural compass. From beauty salons in Noida to theaters in Lucknow, these numbers reveal how Indians are living, spending, and aspiring. For entrepreneurs, policymakers, and analysts, GST data offers not only a financial roadmap but also a cultural story of transformation. If you want to understand where India is headed—economically and socially—just follow the GST trail. It’s the heartbeat of a nation on the move.

| Aspect | Data / Trend | Details |

|---|---|---|

| Beauty Consciousness | Gautam Budh Nagar: ₹11.21 crore (+38.45%) | GST from salons & parlors |

| Entertainment Boom | Lucknow: ₹24.5 crore (+69.93%) | Rising movie & leisure spending |

| National GST Surge | ₹22.08 lakh crore in FY25 | Doubled from ₹11.37 lakh crore in FY21 |

| State Standouts | Nagaland +104% (June ’25), Punjab +44% (June ’25) | Driven by enforcement & reforms |

| Official Resources | Government GST Portal | Latest updates, filings, rules |

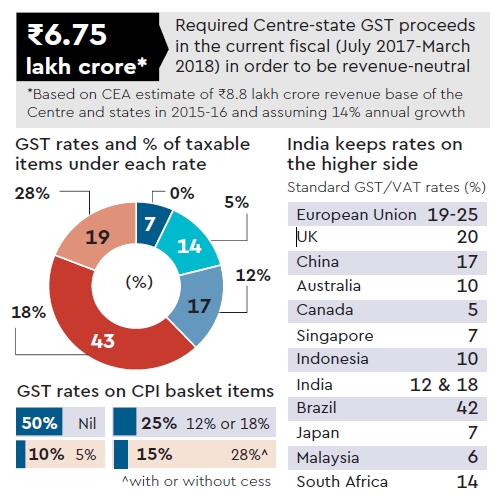

Why Was GST Introduced?

India rolled out GST in July 2017 to simplify its complicated tax system. Before GST, consumers paid multiple taxes: excise duty, service tax, VAT, octroi, and more. Imagine going shopping in New York and paying separate federal, state, and city taxes all stacked together—it was confusing and inefficient.

The idea behind GST was to create “one nation, one tax”, making it easier for businesses to operate and for governments to track revenues. What nobody predicted was how GST data would later reveal cultural shifts and consumption patterns at the district level.

District-Level Insights: Lifestyle Reflected in Taxes

Beauty and Grooming: The New Normal

India’s beauty industry is booming, and GST data proves it.

- Gautam Budh Nagar (Noida) registered ₹11.21 crore from salons, up 38.45%.

- Ghaziabad followed with ₹7.24 crore, up 34%.

- Lucknow collected ₹4.7 crore, up nearly 34%.

- Varanasi showed the steepest growth of 68%.

This isn’t just about vanity. It shows a cultural shift: people across cities and small towns are spending more on self-care and grooming. Weddings, office culture, and even social media presence are fueling this boom.

Entertainment and Leisure: A Big Comeback

For decades, leisure spending was limited for India’s middle class. But now, GST reveals a different story:

- Lucknow brought in ₹24.5 crore from theaters and entertainment, a 70% jump.

- Noida’s GST doubled, hitting ₹16.14 crore.

- Moradabad followed with ₹4.46 crore.

This trend mirrors what we see in the U.S.—even with Netflix and streaming services, people crave shared experiences like theaters, concerts, and festivals. It shows disposable income is no longer limited to essentials.

Education and Coaching: A Parallel Economy

Coaching centers are a unique cultural phenomenon in India. Families see them as an investment in the future. While district-level data isn’t as detailed, state collections suggest this is one of the fastest-growing sectors. For perspective, the Indian coaching industry is already worth over $8 billion, and GST captures its steady expansion.

State and National GST Trends

The National Picture

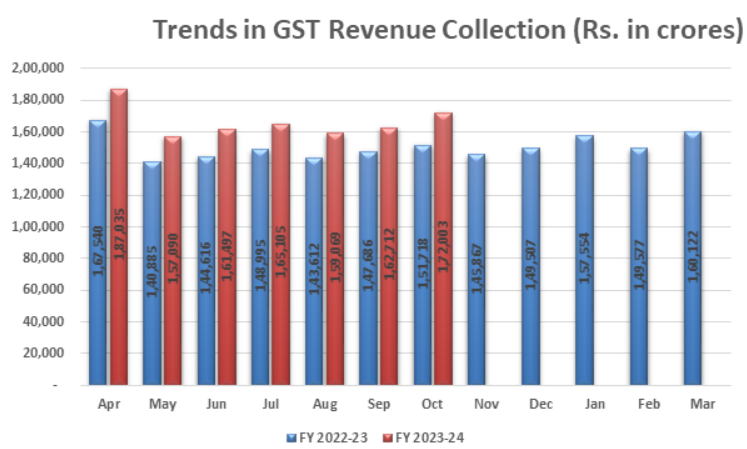

India’s GST collections nearly doubled in five years:

- FY2020–21: ₹11.37 lakh crore.

- FY2024–25: ₹22.08 lakh crore.

- Monthly average: ₹1.84 lakh crore.

This growth reflects rising compliance, expanding consumption, and stronger enforcement.

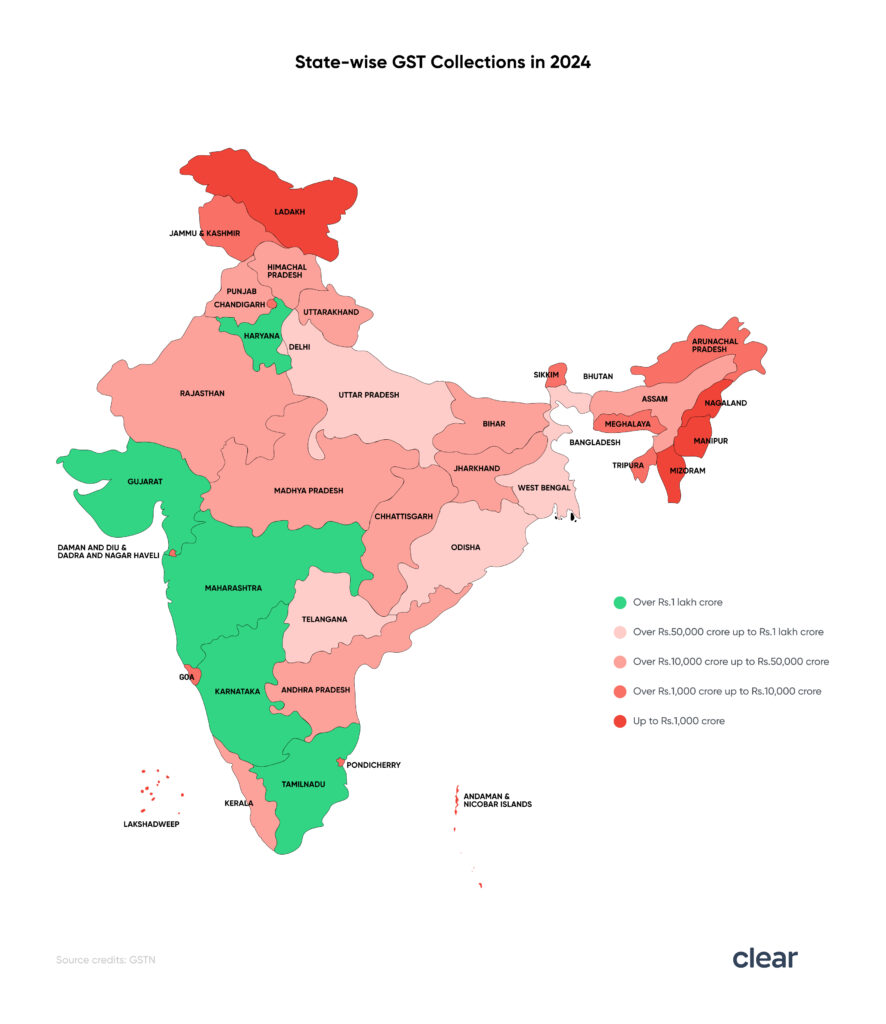

State Leaders and Laggards

- Nagaland: June 2025 collections jumped 104%, driven by reforms and stricter checks.

- Punjab: Recorded a 44% spike in June 2025 and 27% growth in the first quarter.

- West Bengal: Achieved 12% year-on-year growth in July 2025.

- Uttar Pradesh: Despite lifestyle surges, overall state GST slipped 4% in June 2025.

The contrast highlights how local consumption may rise, but state revenues also depend on enforcement and industrial contributions.

How GST Collections Unveil Shocking Cultural Shifts?

GST isn’t just an economic number—it’s a cultural diary.

- Higher GST from salons indicates rising beauty consciousness.

- More entertainment GST shows a population hungry for leisure and community experiences.

- Education-linked GST highlights a generational priority: upward mobility through learning.

District data reveals that even semi-urban and rural areas are embracing lifestyle spending, breaking the old stereotype that consumption growth is only an urban trend.

Real-Life Example: A Small Business Owner’s Journey

Consider Ramesh, who runs a salon in Ghaziabad. Ten years ago, he managed cash transactions, barely earning enough to cover rent. Today, with UPI and GST registration, he reports his income, contributes to GST, and qualifies for small business loans. His shop has expanded from two chairs to a full-service salon with five employees. His GST payments now contribute to the very statistics shaping district planning.

This example shows how GST not only funds the government but also helps small businesses formalize and grow.

Professional Insights: Why This Matters

For entrepreneurs, GST data highlights where consumer demand is rising. A beauty chain or multiplex investment in Lucknow or Noida could thrive.

For policymakers, GST serves as a compass for targeted development. If education-related GST is growing, that district may need better infrastructure, libraries, or scholarships.

For global investors, India’s GST data acts as a reliable proxy for growth sectors, signaling where opportunities lie.

How Does This Compare Globally?

In the U.S., policymakers track sales tax collections and credit card spending to assess consumer behavior. For instance, spikes in Florida’s sales tax often reflect tourism booms. India’s GST is even more comprehensive because it’s a nationwide system covering almost all goods and services.

Canada and Australia also run GST systems, but India’s scale—over 1.4 billion people—makes it a massive cultural mirror.

Future Outlook: What Lies Ahead?

- Digital Dominance: With electronic invoicing and UPI integration, GST data will become sharper and more detailed.

- Sectoral Deep Dives: Expect future GST reports to break down health, tech, and education in greater detail.

- Cultural Mapping: Within a decade, GST may guide cultural policies—funding festivals, promoting tourism, and planning urban lifestyles.

- Predictive Analytics: Governments could even use GST trends to forecast employment shifts and design skill-development programs.

Step-by-Step Guide to Reading GST Trends

- Start Local: Look at district GST collections for insights into everyday spending.

- Track Growth: Compare year-over-year changes to see rising or declining sectors.

- Ask Questions: Link growth to cultural or economic reasons—migration, rising incomes, or social change.

- Cross-Verify: Check official data on the GSTN Portal.

- Act: Use insights for business decisions, policy design, or academic research.

High GST on Waste Is Bleeding ₹1.8 Lakh Crore From India’s Circular Economy

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

12% GST Dodge? Bengaluru PG’s ‘Cash-Only’ Rent Rule Triggers Massive Tax Evasion Uproar