GST Council Considers Amnesty That Could Save Small Businesses: If you’re a small business owner in India and recently received a surprise notice from the GST department, don’t panic just yet. Relief might be on the way. The GST Council is actively considering a wide-ranging amnesty for small vendors who may have unknowingly crossed GST registration limits, particularly those flagged based on UPI transaction data. This potential move could save small businesses lakhs of rupees in penalties and interest, paving the way for a more inclusive, fair, and digitally supportive tax ecosystem. Let’s unpack what this amnesty is, who qualifies, why it matters, and what you should be doing now.

GST Council Considers Amnesty That Could Save Small Businesses

The proposed GST amnesty scheme is a golden opportunity for small businesses, especially those who got caught in the digital payment surge without fully understanding the tax implications. By separating unintentional oversights from fraud, the government is offering a balanced approach—encouraging compliance without crushing penalties. Whether you’re a street vendor, service provider, or small trader, now is the time to act. Register, comply, and clean the slate. This scheme might not come around again anytime soon.

| Key Points | Details |

|---|---|

| What’s Happening? | GST Council is reviewing a one-time amnesty for small vendors issued tax notices based on UPI-based turnover records |

| Who’s Affected? | Small businesses crossing ₹40 lakh/year (goods) or ₹20 lakh/year (services) without GST registration |

| Why the Panic? | AI-flagged UPI data triggered thousands of tax notices; some vendors received demands up to ₹29 lakh |

| How Does Amnesty Help? | Could waive interest and penalties; vendors may only need to pay core tax amount |

| Government Clarification | No GST applicable on personal UPI transfers; only business receipts count |

| Potential Impact | Boost in GST compliance, improved vendor confidence, and larger formal economy |

| Learn More | Visit GST Portal for official updates |

Why Are Small Businesses Receiving GST Notices?

In recent months, both state and central GST departments have begun using artificial intelligence and fintech integrations to analyze UPI transaction data from payment apps like Google Pay, PhonePe, and Paytm.

When digital transaction records indicated that some unregistered businesses had crossed GST thresholds—₹40 lakh annually for goods and ₹20 lakh for services—they were flagged for non-compliance. This triggered a wave of show-cause notices and tax demands, many of which included steep penalties and interest.

A notable case involved a small vegetable vendor in Karnataka who received a ₹29 lakh tax demand simply for exceeding the GST threshold via UPI receipts—without even knowing he had breached the limit.

Most of these vendors had no intent to evade taxes. They embraced digital payments out of convenience or necessity but were unaware of the legal thresholds and obligations.

Understanding the GST Amnesty Scheme

The proposed amnesty, modeled on past initiatives like the 2024 Section 128A scheme, aims to distinguish between fraudulent evasion and unintentional non-compliance.

What It Offers:

- Waiver of interest and penalties for eligible vendors

- Requirement to pay only the core GST amount

- Applicability likely to be limited to cases under Section 73 (no fraud or suppression of facts)

- Conditions such as GST registration, tax payment, and possibly appeal withdrawal

This is not a blanket forgiveness but rather a structured relief. Those involved in deliberate tax evasion, especially under Section 74 of the CGST Act, are unlikely to benefit.

The last similar scheme (Budget 2024) saw significant uptake and brought thousands of businesses back into the compliance fold. The 2025 version is expected to mirror those successes.

How Do You Know If You’re Eligible for GST Council Considers Amnesty That Could Save Small Businesses?

If your annual receipts (from FY 2018-19 onwards) through UPI or bank transactions exceed:

- ₹40 lakh for goods-related businesses

- ₹20 lakh for service providers

…and you are not registered under GST, you could be at risk.

Also, if you’ve recently received a GST DRC-01 notice or similar communication citing digital transaction discrepancies, you are likely in the target group for this amnesty.

Even if you haven’t received a notice yet, proactive compliance can help you avoid hefty penalties down the road.

Step-by-Step Guide: What to Do Now

Step 1: Determine Your Turnover

Use your UPI payment history, bank statements, and sales logs to estimate your annual turnover for the past financial years.

Tip: Some digital wallets allow you to download yearly transaction summaries for easy calculation.

Step 2: Register for GST

Go to gst.gov.in and file Form REG-01 to obtain a GSTIN. Ensure that all details, including business address and nature of operations, are accurately provided.

Step 3: Collect and Organize Documents

Gather:

- PAN, Aadhaar

- Transaction records

- Sales invoices

- Existing notices or show-cause letters (if applicable)

Documentation is essential both for registration and for defending your case if needed.

Step 4: Calculate Tax Dues

If your turnover crossed the threshold, calculate the applicable GST based on product/service type. Most items fall in the 5%, 12%, or 18% slab.

Tip: Consult a CA or GST practitioner to avoid errors that could affect your eligibility.

Step 5: File Past Returns (If Required)

You may need to file backdated returns if you operated for past periods without registration. This is critical for aligning your compliance status.

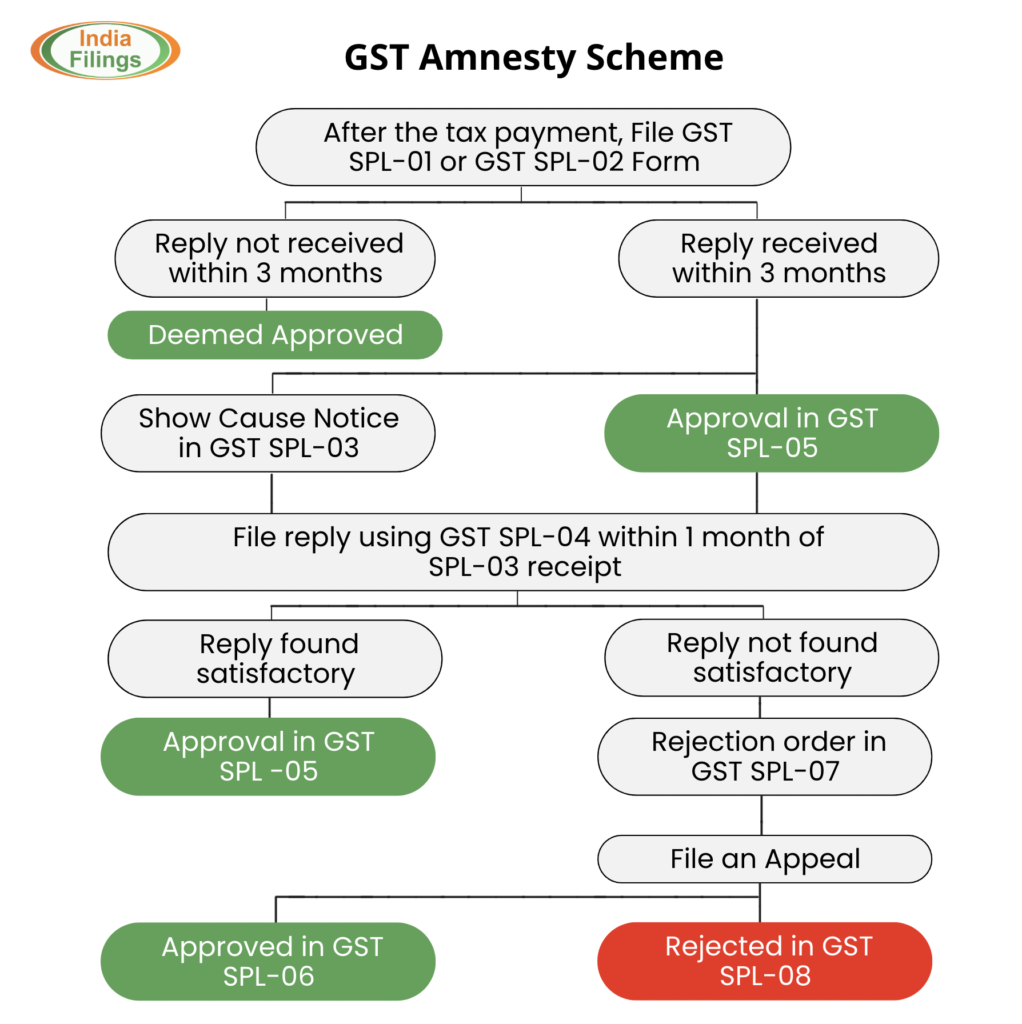

Step 6: Apply for Amnesty (Once Notified)

Keep an eye on GST portal announcements. If the scheme is launched:

- File Form SPL-01 (for tax demand notices)

- Or SPL-02 (for adjudication orders)

- Attach proof of tax payment and possibly withdrawal of any appeal under APL-01

Make sure to complete all steps before the deadline to avoid disqualification.

Real-Life Case Study: Ramesh the Tea Seller

Ramesh, a tea stall owner in Bengaluru, made ₹41 lakh via UPI in FY 2023-24. He never registered for GST, assuming he was below the threshold.

In June 2025, he received a notice demanding ₹4.5 lakh in GST, plus ₹1.5 lakh in interest and ₹2 lakh in penalties—totaling ₹8 lakh.

With the amnesty scheme, Ramesh can now:

- Register for GST

- Pay only the ₹4.5 lakh core tax

- Avoid the ₹3.5 lakh in extra charges

For small traders like Ramesh, that’s a huge relief and a second chance.

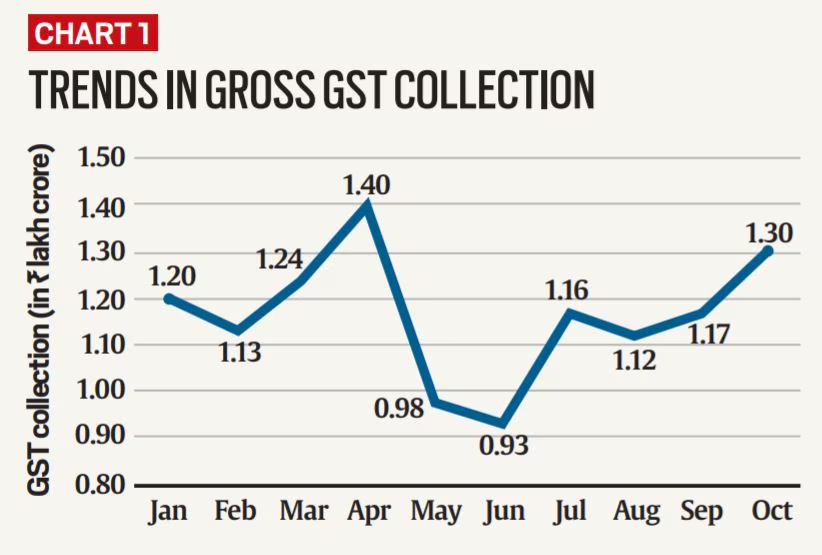

Impact on the Indian Economy

While the scheme targets individual businesses, its ripple effects can benefit the broader economy.

1. Strengthened Compliance

Encouraging small businesses to register improves tax collection efficiency and brings more participants into the formal economy.

2. Promotes Digital Transactions

If vendors feel safe accepting digital payments without risk of being blindsided by penalties, it fuels India’s transition to a cashless economy.

3. Better Data for Policy Making

Formalization helps the government gather accurate data to shape future MSME support schemes, tax policies, and credit frameworks.

Expert Commentary and Industry Response

According to CA Ritesh Tiwari, a GST specialist in Mumbai:

“This scheme is timely and needed. Small vendors adopted digital payments in good faith. Penalizing them harshly discourages that behavior. Amnesty gives them a fair path to regularization.”

The Federation of Indian Chambers of Commerce and Industry (FICCI) and Confederation of All India Traders (CAIT) have also endorsed the plan, urging the government to make the process user-friendly and minimize paperwork.

West Bengal’s GST Revenue Soars 12% in July

Businessman Arrested in ₹34 Crore GST Scam — Shocking Details Emerge

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling