GST Countdown: When we talk about the GST Countdown: States Fear Revenue Loss, Centre Shows Confidence, it feels like a tug-of-war playing out on India’s fiscal stage. On one side, states are sounding the alarm, worried about losing billions in tax revenue. On the other, the Centre is cool as a cucumber, saying, “Relax, we’ve got this under control.” So, who’s right? Let’s break it down in plain language. Whether you’re a policymaker, a business owner, or a curious reader, this article will give you the full picture — with real data, examples, and even a few American-style analogies to keep things light.

GST Countdown

The GST Countdown is more than a tax debate — it’s a stress test of India’s federal system. States say they’re staring at huge losses and need help now. The Centre says the long game will balance out, so chill. Both are right in their own way. But here’s the truth: without a short-term bridge plan, states won’t survive the wait for long-term growth. And when the foundation of a system like GST is trust, leaving states hanging isn’t just risky — it’s dangerous.

| Point | Details |

|---|---|

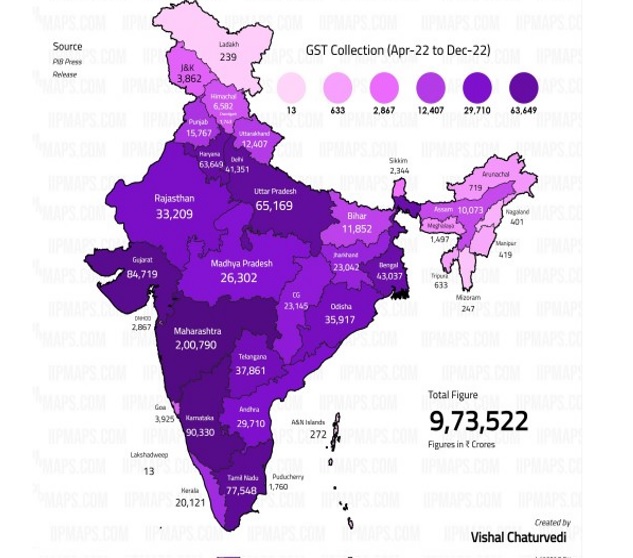

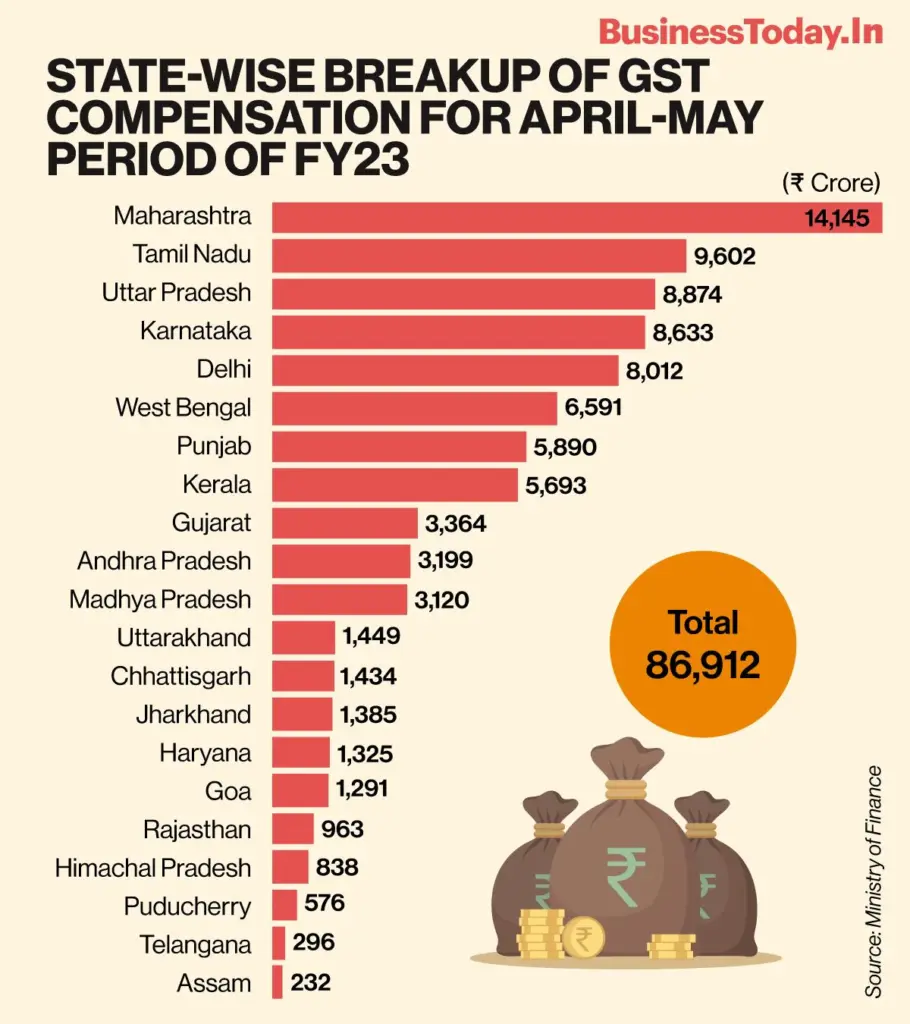

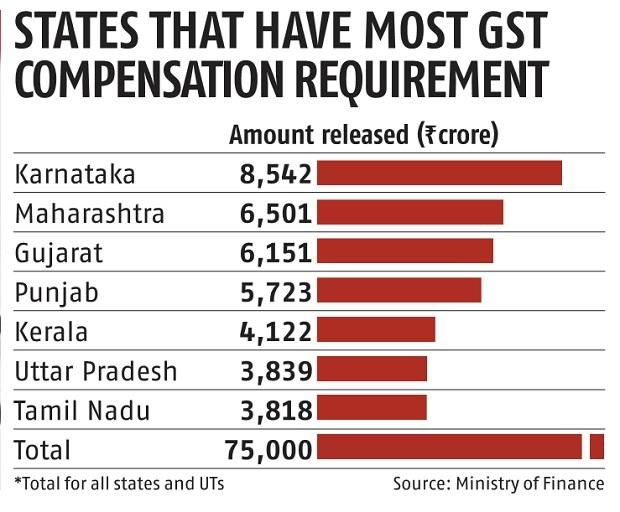

| Projected State Revenue Loss | Between ₹85,000 crore to ₹2 lakh crore annually (15–20% of GST income) |

| Examples | Telangana: ~₹7,000 crore loss; Kerala: ₹8,000–10,000 crore loss; Punjab: demands ₹50,000 crore in dues |

| Centre’s Claim | Confident of meeting 4.4% fiscal deficit target despite reforms |

| Compensation Debate | States demand 5-year package; Centre leans on long-term growth optimism |

| Who’s Right? | States have legit short-term worries; Centre banking on future revenue boost |

| Reference | Official GST Portal |

What Is GST and Why Does It Matter?

For my American readers, GST (Goods and Services Tax) is like a national sales tax. Introduced in 2017, it replaced a messy system of federal and state taxes. Instead of paying separate levies at every stage of production and sale, businesses and consumers deal with one unified tax.

The pitch was simple: One Nation, One Tax. Imagine replacing 50 different state sales taxes in the U.S. with one flat nationwide sales tax. That’s GST in a nutshell.

A Quick History of GST in India

When GST launched, states were worried about losing autonomy and revenue. To win them over, the Centre promised a five-year compensation package (2017–2022). Basically: “If you lose revenue because of GST, we’ll make you whole.”

That deal expired in June 2022. Since then, states have been pressing for an extension, especially as COVID-19 hammered collections. Fast forward to today, and with GST 2.0 reforms being discussed, states fear déjà vu all over again.

GST Countdown: Why Are States Freaking Out?

1. The Cold, Hard Numbers

- Opposition-ruled states like Tamil Nadu, Kerala, West Bengal, Karnataka, Telangana, Punjab, Jharkhand, Himachal Pradesh project massive shortfalls.

- Annual losses could hit ₹2 lakh crore — roughly $24 billion.

- Telangana: Estimates a ₹7,000 crore annual loss (~15% of its GST take).

- Kerala: Projects ₹8,000–10,000 crore in losses; last year alone, it had a ₹21,955 crore gap.

- Punjab: Claims a cumulative ₹1.11 lakh crore loss since GST began, and now demands ₹50,000 crore in dues.

That’s like California or Texas suddenly losing one-fifth of their state budget. Ouch.

2. Overdependence on GST

Many Indian states rely heavily on GST for their budgets. Kerala spends 95% of its revenue just on salaries and pensions. If GST dries up, basic services collapse.

3. What States Want

- A five-year compensation package.

- Special sin and luxury goods levies (alcohol, tobacco, luxury cars) with proceeds going directly to states.

- Immediate assurance of fiscal stability.

Without this, states warn they’ll have to slash welfare, education, and infrastructure spending.

Why Is the Centre So Chill?

1. Confident on Fiscal Deficit

The Centre insists it will hit its 4.4% fiscal deficit target, even with GST reforms. Translation: “We can manage our books just fine.”

2. Betting on Growth

The government believes lower GST rates = more spending. When consumers buy more, overall tax revenue rises. Think of it as Walmart’s “Everyday Low Prices” strategy: sell more at lower margins, and the profits roll in.

3. Centre’s Backstop

Officials remind states they share GST revenues equally. Plus, cess collections and central schemes are meant to cushion the impact until growth stabilizes.

Who’s Really Right?

Both sides have a point.

- States’ Side:

Their budgets are bleeding today. They can’t gamble on promises of future growth while salaries and pensions are due next month. - Centre’s Side:

Long-term gains are possible. Rate rationalization could boost compliance, reduce evasion, and expand the tax base.

Reality check: Without a credible short-term safety net, states won’t buy into the Centre’s optimism.

Lessons from Other Countries

- United States: States have their own sales taxes, while federal government uses income and corporate taxes. Washington doesn’t collect state sales tax, so states keep control.

- Canada: Some provinces harmonized their sales tax with the federal GST (HST system), but provinces were compensated when they joined.

- Australia: Its GST, introduced in 2000, was accompanied by a guarantee that states would receive a share of the revenue, preventing the kind of standoff India is seeing.

India’s challenge is unique: It pooled state revenue streams into a shared bucket but hasn’t found a long-term fix for balancing losses.

Expert Opinions

- Economists argue that fiscal uncertainty could derail state-level infrastructure, housing, and healthcare programs.

- Rating agencies like Moody’s warn that disputes may affect India’s fiscal credibility if states cut capital spending.

- Policy think tanks suggest adopting a hybrid model where temporary compensation is tied to state performance in digital tax compliance.

Deeper Look: Why Compensation Matters

This isn’t just about numbers on a spreadsheet. It’s about federal trust. When GST was introduced, states gave up their independent tax powers in exchange for the promise of compensation. If that trust breaks, future reforms will face even more resistance.

It’s like a business deal: one partner promised, “Don’t worry, I’ll cover any losses for five years.” If that promise gets broken, good luck convincing partners to sign the next contract.

Practical Guide: What This Means for You

For Businesses

- Expect pricing changes as states adjust budgets with levies or incentives.

- Industries like real estate, retail, and manufacturing may see compliance rules evolve.

- Watch for new opportunities in tax advisory, compliance software, and audit services.

For Citizens

- Everyday essentials could become cheaper if rates fall, but public services like schools, hospitals, and roads may suffer if states cut spending.

- Some states may hike local levies (like property tax or road tax) to make up shortfalls.

For Professionals

- Accountants, tax advisors, and policy analysts will be in demand.

- Job opportunities may shift toward tax technology and government advisory roles.

No GST on UPI Payments — Government Clears the Air in Rajya Sabha

Banks Propose New GST Slab of ₹1 Crore to Prevent Merchants from Avoiding Digital Payments

Thane Man Arrested in Massive ₹47 Crore GST Credit Fraud Scheme