GST Cuts Could Boost Consumption by ₹2 Lakh Cr: If you’ve been following the news lately, you’ve probably seen headlines screaming: “GST Cuts Could Boost Consumption by ₹2 Lakh Crore!” Sounds like a win, right? But then comes the kicker—the government might lose big bucks in tax revenue. So the real question on everyone’s mind is: Can faster economic growth balance out the hit to government coffers? Let’s break this down in plain English, with a bit of real talk and some numbers that’ll help us make sense of the big picture.

GST Cuts Could Boost Consumption by ₹2 Lakh Cr

So, can economic growth offset the losses from GST cuts? The answer is: most likely, yes—but only if governments manage it smartly. In the short run, expect a nice bump in spending and GDP growth. But for the long run, states will need fair compensation, and the Centre must protect capital spending. Otherwise, today’s consumption boom could create tomorrow’s budget crunch. If implemented with balance, the GST cuts could become a powerful economic stimulus, giving both consumers and businesses the breathing room they need.

| Aspect | Details |

|---|---|

| Consumption Boost | Around ₹1.98–2.4 lakh crore (~1.6% of GDP) [Source: SBI Research] |

| Revenue Loss | Estimated at ₹85,000 crore annually, ~₹45,000 crore in FY26 |

| Offset Potential | Growth-driven tax revenue, compliance improvements, and cess fund surplus |

| Risks | State fiscal strain, reduced capital spending, uneven benefits |

| Professional Insight | Could stimulate 0.7–0.8% of GDP; balance depends on states and capex |

What’s the Buzz About GST Cuts?

The Goods and Services Tax (GST) is India’s version of a nationwide sales tax. Think of it as the price tag attached to everything you buy—from your sneakers to your Netflix subscription. Lowering GST rates means you and I pay less tax at checkout.

The idea behind the cuts is simple: if stuff gets cheaper, people buy more. And when folks spend more, businesses boom, jobs get created, and the economy gets a much-needed caffeine boost.

But here’s the catch: when the government collects less tax, it has less money to spend on highways, schools, defense, and healthcare. That’s why economists are debating whether the extra shopping spree will truly make up for the hole in tax collections.

Why GST Cuts Matter for You and the Economy?

Imagine you’ve got an extra $50 (or ₹4,000) in your wallet because the government cut taxes. Are you going to:

- Pay off your student loans faster?

- Buy a new pair of Jordans?

- Take your family out for a fancy dinner?

Most people are going to spend it, and that’s exactly what boosts consumption demand.

According to SBI Research, GST and income tax tweaks together could pump ₹1.98 lakh crore back into people’s pockets—roughly 1.6% of India’s GDP.

Wall Street-style analysts like Jefferies and Morgan Stanley go even bigger, projecting a ₹2.4 lakh crore boost, which might add 0.5–0.7 percentage points to GDP growth.

That’s no small deal. For a $4-trillion economy, adding nearly 1% to growth is a significant stimulus.

The Flip Side: Government Revenue Loss

Of course, this isn’t Monopoly money. The government’s gotta balance its books. By cutting GST, they risk losing about ₹85,000 crore a year in revenue. That’s no pocket change—it’s what funds infrastructure projects, welfare programs, and state budgets.

- In FY26, the hit could be ₹45,000 crore (lighter because of compensation funds).

- Over time, states might feel the pinch harder, since they rely heavily on GST revenues.

As IDFC First Bank notes, the total loss could reach ₹1.8 lakh crore, with states carrying most of the burden.

This matters because if states face shortfalls, they may cut back on social programs, delay infrastructure projects, or increase borrowing—all of which carry long-term economic consequences.

Can Growth Save the Day?

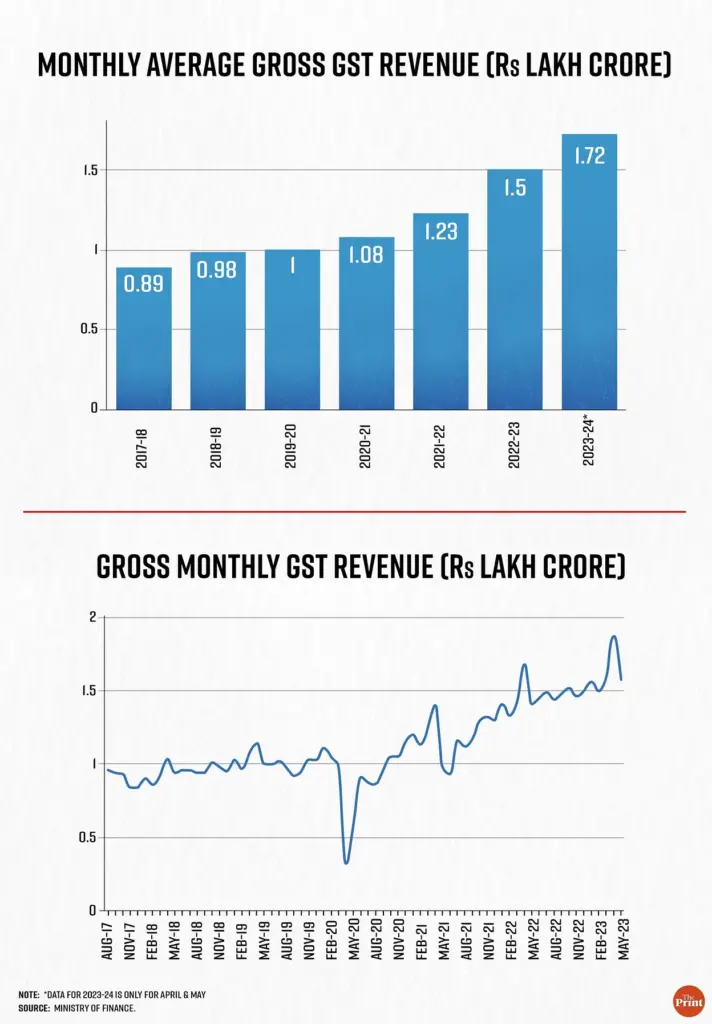

Here’s where the optimism kicks in. Economists argue that higher consumption could actually generate extra GST revenue—about ₹52,000 crore, thanks to more transactions.

Plus, the government has a ₹45,000 crore surplus in the compensation cess fund, which is like having an emergency savings account to cover shortfalls.

On top of that:

- Faster GDP growth boosts income tax collections.

- Cheaper goods mean lower inflation, encouraging more spending.

- Higher demand helps businesses scale, creating jobs (and more taxpayers).

So in theory, the short-term loss could be balanced—or even outweighed—by medium-term growth.

Global Context: How Other Countries Handle Tax Cuts

This isn’t just an India story. Around the world, governments have used tax cuts as economic stimulus:

- In the United States, stimulus checks and payroll tax cuts during COVID boosted consumption dramatically. Research by the U.S. Treasury shows that nearly 70% of stimulus money was spent directly into the economy.

- In the UK, temporary VAT cuts in 2009 were used to pull the economy out of recession, though critics say the long-term benefits were muted.

- In Japan, frequent adjustments to its consumption tax have often led to short-term booms followed by slumps when taxes went back up.

The lesson? Tax cuts can jumpstart spending, but long-term growth depends on sustained investment and productivity.

Historical Perspective: India’s Own Playbook

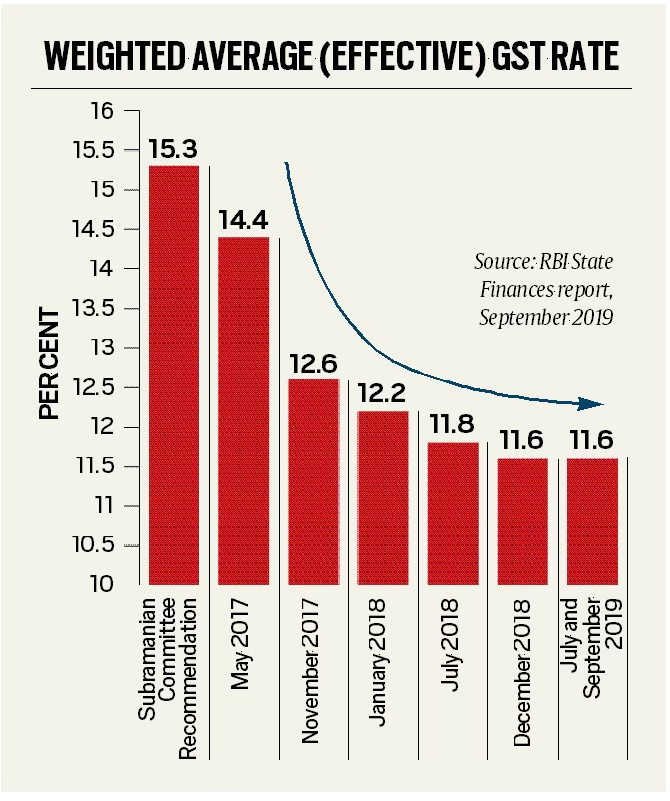

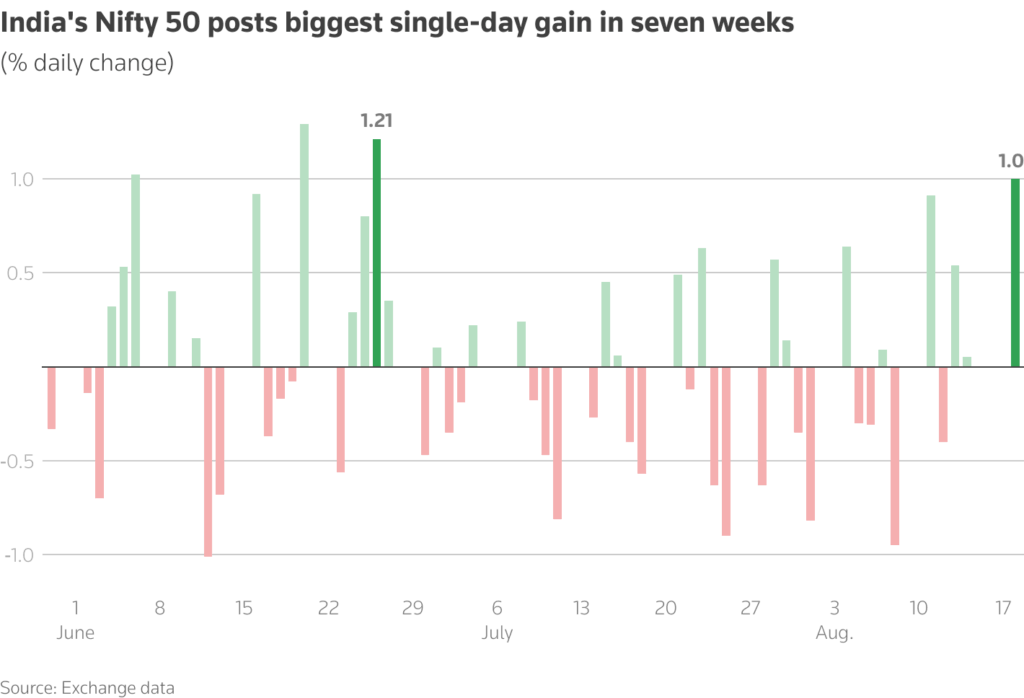

This isn’t India’s first rodeo either. In 2019, the government slashed corporate taxes from 30% to 22%. That move boosted corporate sentiment and stock markets but took years to show real effects on jobs and investment.

Similarly, GST tweaks in 2017–18 (cutting rates on consumer goods like appliances and food items) gave shoppers some relief. But the central and state governments argued over shrinking revenues for years afterward.

So history tells us that while tax cuts are popular, their impact on long-term growth is often mixed.

Sectoral Winners and Losers

Winners:

- Retail & FMCG: Everyday products get cheaper, meaning more sales volume.

- Automobiles: Lower GST makes cars and bikes more affordable, sparking higher sales.

- Hospitality & Travel: Families spend more on vacations, eating out, flights, and hotels.

- Real Estate: Lower costs for cement, steel, and appliances could make housing more affordable.

Potential Losers:

- State Budgets: States rely on GST for up to 45% of their tax revenue. A dip here means tighter budgets.

- Capex Projects: If states cut spending on infrastructure, construction and related sectors may take a hit.

- Luxury Imports: More disposable income might go to iPhones or foreign cars—benefiting other countries more than India.

Expert Opinions on GST Cuts Could Boost Consumption by ₹2 Lakh Cr

- SBI Research: “The surge in consumption will generate nearly ₹52,000 crore in incremental GST revenues.”

- Morgan Stanley: “The cuts may lift GDP growth by 50–70 basis points.”

- Venugopal Garre (equity strategist): “GST cuts are great for consumption, but may come at the cost of lower capital expenditure.”

- State Finance Ministers: Many have voiced concerns that they’ll have to “tighten belts” if compensation is inadequate.

Practical Advice: What Professionals & Families Should Do

- Consumers: Plan big-ticket purchases like cars, electronics, or home appliances, as prices are expected to drop.

- Investors: Keep an eye on stocks in FMCG, auto, retail, and hospitality, which could see strong earnings growth.

- Businesses: Improve supply chains and prepare for higher demand, especially in consumer-facing sectors.

- State Governments: Push for stronger federal support to cover losses, instead of cutting long-term investments.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

Cement Stocks Could Boom as Analysts Eye a Possible GST Slash

A Step-by-Step Guide: How GST Cuts Could Play Out

- Tax Cuts Announced → Prices drop across goods and services.

- Consumers React → Spending rises, from groceries to gadgets.

- Businesses Gain → Higher demand, better margins, and more jobs.

- Government Balances → Short-term revenue dip, but growth adds new tax collections.

- States Negotiate → Likely demand more compensation from the Centre to avoid fiscal stress.