GST Diwali Bonanza: The GST Diwali Bonanza is making headlines across India and sparking celebrations in industries like real estate and hospitality. During his Independence Day 2025 speech, Prime Minister Narendra Modi announced a sweeping overhaul of India’s Goods and Services Tax (GST). The reform, dubbed GST 2.0, will be rolled out by Diwali 2025 (October). This is not just another small adjustment—it’s being described as one of the most transformational tax changes since 2017, when GST was first launched. The goal: simplify the tax system, reduce rates, and stimulate demand across sectors. Businesses are calling it a game-changer, while consumers are hopeful that everyday goods and services will finally feel lighter on the wallet.

GST Diwali Bonanza

The GST Diwali Bonanza 2025 is more than just a festive announcement—it’s a structural shift in India’s tax system. By reducing rates and simplifying slabs, the reform offers relief to consumers, fresh demand for businesses, and new opportunities for professionals. While challenges remain in the short term, the long-term outlook is bright: affordable homes, cheaper travel, and a stronger domestic economy. As Diwali lights up the skies this year, India’s economic landscape may be shining just as bright.

| Aspect | Details |

|---|---|

| Reform Name | GST 2.0 – Diwali Bonanza |

| Announced By | Prime Minister Narendra Modi on August 15, 2025 |

| Implementation | Scheduled for Diwali 2025 (October) |

| Major Change | Simplified GST slabs (from 4 slabs → 2 slabs + special rates) |

| Key Impact | 99% of items in 12% slab → 5%, 90% of items in 28% slab → 18% |

| Beneficiaries | Realty firms, hospitality sector, MSMEs, and consumers |

| Official Source | GST Council |

A Brief History of GST in India

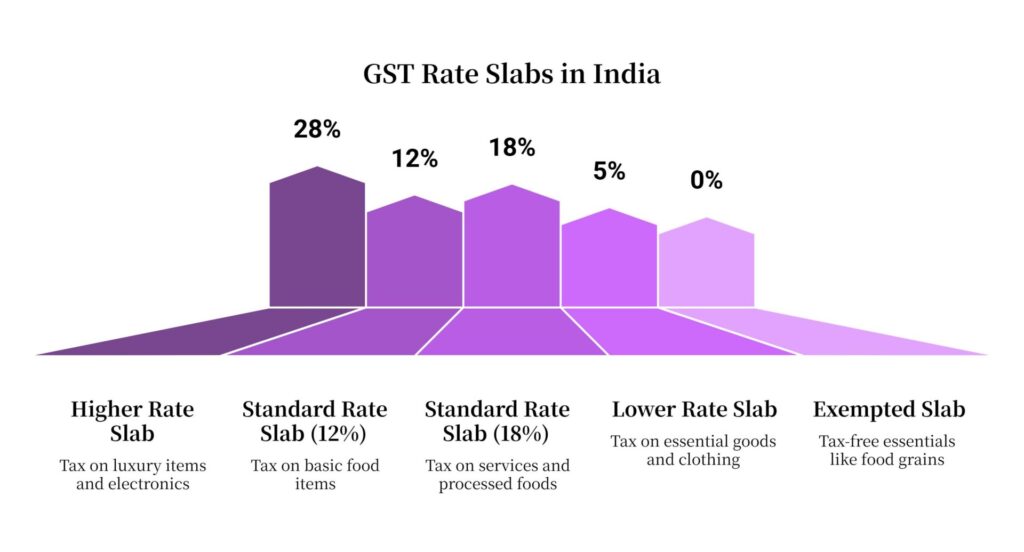

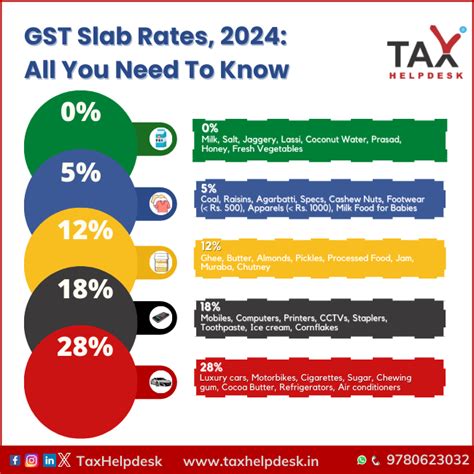

When GST was first introduced in July 2017, it was hailed as India’s biggest tax reform since independence. The system aimed to replace a confusing web of central and state taxes with a unified framework. However, instead of one or two simple rates, GST rolled out with multiple slabs—5%, 12%, 18%, and 28%, plus exemptions and cesses.

This created complexity for businesses, especially small and medium enterprises (SMEs). Different items often attracted different rates, making compliance tricky. Critics also argued that the 28% “luxury” slab was too broad, penalizing goods like cars and appliances that were aspirational purchases for the middle class.

Over the years, successive GST Council meetings trimmed some rough edges, but a major simplification never happened—until now. GST 2.0 aims to finally streamline the system to just two main slabs and a few special rates.

What the GST Diwali Bonanza Means?

At the core of the reform is rate reduction and slab simplification.

- Items in the 12% slab (like packaged food, appliances, household goods) are expected to shift to 5%.

- Around 90% of items in the 28% slab (cars, electronics, consumer durables) will be brought down to 18%.

- Essential goods will continue to remain in the 0% exemption or 5% slab, ensuring affordability for households.

- Luxury goods and sin items like tobacco, alcohol substitutes, and luxury cars may still attract higher taxes.

This is like moving from a confusing menu of options to a simple two-choice meal deal. Easier for everyone to understand, cheaper for many, and more efficient for businesses.

Why Realty Firms Are Celebrating?

More Affordable Homes

Buying a house in India is already one of the largest financial commitments for families. On top of down payments and EMIs, buyers also pay GST on under-construction properties. A ₹50 lakh ($60,000) home today attracts around ₹2.5 lakh ($3,000) in GST. With slab simplification and lower input taxes on materials like cement, steel, and tiles, costs are expected to drop significantly.

This makes homes more accessible to first-time buyers and boosts confidence among middle-class families.

Developers See Reduced Burden

Builders often struggled with multiple slab rates for different inputs, leading to disputes over input tax credit (ITC). By simplifying slabs, compliance becomes smoother, and developers can focus more on building and less on paperwork.

Case Study: Urban vs. Semi-Urban Demand

- In metro cities, lower costs may revive demand in premium housing projects.

- In Tier-2 and Tier-3 cities, the middle class may now find under-construction properties more affordable, expanding homeownership.

Why Hospitality Firms Are Cheering?

Hotels Become More Competitive

Currently, hotel rooms priced above ₹7,500 ($90) are taxed at 18% GST, making Indian hotels pricey compared to competitors in Southeast Asia. By reducing this slab to 12% or even 5%, India can attract more domestic and foreign tourists.

Restaurants See a Boost

Restaurant bills often confuse customers with different GST rules for dine-in vs. takeaway. Simplification means consistent, lower rates, encouraging more eating out and higher spending in the food services sector.

Tourism Ripple Effect

According to the World Travel & Tourism Council (WTTC), India’s travel sector contributed $200+ billion to GDP in 2024. Lower GST could add billions more by boosting domestic tourism and reducing “tax tourism” abroad, where travelers pick cheaper destinations due to high Indian hotel rates.

Global Comparisons: How India Stacks Up

- United States: No GST, only state-level sales taxes (0%–9%).

- European Union: VAT rates average 20%, with reduced rates for essentials.

- Singapore: A single flat 9% GST (from 2024).

- India (GST 2.0): Moving from four slabs to two makes India more aligned with global practices and reduces the “tax maze.”

Economic Impact of the Reform

Boost to Consumption

Lower GST puts more money in the pockets of consumers. Economists expect a 3–4% rise in discretionary spending during the first year of implementation.

Potential Inflation Impact

While some items will get cheaper, the government may raise rates slightly on exempt categories to balance revenue. Experts believe inflation will stay stable, with more positive effects on affordability.

Revenue Concerns

States may initially worry about lower collections, especially from high-value goods. The GST Council has promised a compensation mechanism to balance state finances during the transition.

Consumer Psychology: Why Tax Cuts Matter

Taxes shape buying behavior. In the U.S., for example, “holiday sales tax breaks” drive higher shopping during certain weeks. Similarly, India’s Diwali Bonanza is designed to spark consumer confidence.

When people know their purchases—whether homes, hotel stays, or appliances—will attract lower taxes, they are more likely to spend. This “feel-good factor” can stimulate the economy beyond just numbers.

Step-by-Step Guide: What Businesses Should Do Now

- Review product pricing to anticipate slab shifts.

- Upgrade billing and accounting software for GST 2.0 compliance.

- Communicate with customers about upcoming savings.

- Train employees in sales, finance, and operations on new GST rules.

- Work with tax advisors to restructure contracts and invoices.

Challenges and Criticisms

No reform is perfect. Some economists caution:

- Short-Term Disruptions: Businesses will need to adjust invoices, billing, and IT systems.

- Revenue Loss for States: Lower GST on cars and electronics could hurt state tax collections temporarily.

- Transition Confusion: Consumers may face billing errors during the first few months of rollout.

However, long-term benefits are expected to outweigh short-term hiccups.

Career and Professional Opportunities

- Tax Consultants and Auditors: High demand for advisory services during the transition.

- Hospitality Managers: Opportunity to market competitive packages for domestic travelers.

- Real Estate Brokers: Increased homebuyer inquiries.

- IT & Software Providers: Strong demand for GST-compliant ERP and billing software.

Case Studies

- Ravi, a Homebuyer in Delhi: Plans to purchase a flat in 2026. With lower GST, his savings may cover interior costs.

- Meera, a Hotel Owner in Goa: Lower room tariffs under GST 2.0 help her attract domestic tourists who earlier chose Thailand.

- Arun, a Small Business Owner: Less paperwork and fewer slab confusions allow him to expand his packaged food business faster.

Future Outlook: Beyond Diwali 2025

Experts believe GST 2.0 could be the foundation for a true single-rate GST in the future, like Singapore’s system. Over time, India may move toward a uniform 12%–15% slab, balancing revenue needs with consumer ease.

For now, the Diwali Bonanza acts as both an economic stimulus and a political statement—strengthening the government’s image ahead of upcoming state elections and reassuring industries that India is open for business.

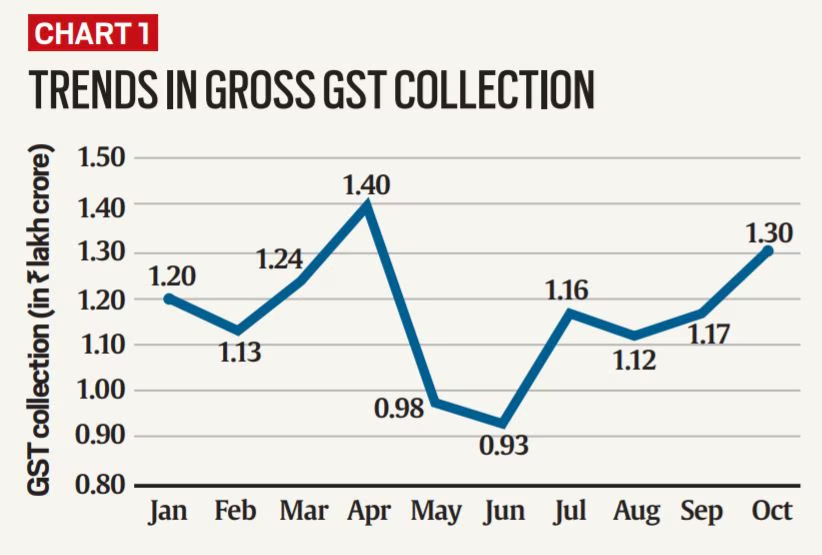

Stats That Speak

- GST collection in July 2025: ₹1.85 lakh crore ($22 billion), highest ever (Finance Ministry).

- Real estate employs 52 million Indians, second only to agriculture (NAREDCO).

- Hospitality projected to contribute 10% of GDP post-reform, up from 8% in 2024 (WTTC).

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

India’s Aggressive Investment Reforms: GST Relief, PLI Tweaks, and a Simpler Future