GST Not Applicable on Renting Property to Government for Girl’s Hostel: GST not applicable on renting property to government for girl’s hostel — that’s the message from a recent ruling by the Maharashtra Authority for Advance Ruling (AAR). If you’re a landlord, tax advisor, or property manager working with the government, this article unpacks everything you need to know: the law, the logic, the implications, and the smart way to stay compliant. Whether you’re curious about GST exemptions or deep into GST compliance, this article gives you a clear roadmap—with real-life examples, expert analysis, and step-by-step action items to help you navigate the situation like a pro.

GST Not Applicable on Renting Property to Government for Girl’s Hostel

The Maharashtra AAR’s 2025 ruling offers a clear GST exemption for landlords renting to the government for a girls’ hostel aimed at backward-class welfare. If you provide pure services to a government authority and your use matches constitutional welfare goals, you fall under Entry 3 of Notification 12/2017. This can save you from GST payments and compliance hassles—just make sure you’ve got the paperwork to prove it. When in doubt, consult a tax professional or get an AAR specific to your case. With the right strategy, doing good and staying compliant can go hand in hand.

| Key Element | Details |

|---|---|

| AAR Decision | Maharashtra AAR, In Re: Ravindra Navnath Satpute (Dewoo Engineers), April 2025 |

| Ruling Summary | Renting a residential property to the Social Justice Department for use as a girls’ hostel for backward-class beneficiaries is exempt from GST |

| Exemption Clause | Entry 3 of Notification No. 12/2017-Central Tax (Rate) |

| GST TDS Status | Not applicable under Section 51 of CGST Act |

| Use Case | Direct rental to government for constitutionally mandated welfare activity (Articles 243G, 243W) |

| Contrasting Cases | Telangana AAR (2024) denied exemption when the link to government use wasn’t direct |

| Official Source | GST Council Website |

The Legal and Practical Background

What the Maharashtra AAR Ruled

The applicant, Dewoo Engineers, leased a residential property in Ahmednagar to the Social Justice & Special Assistance Department of the Maharashtra Government. The purpose: to run a girls’ hostel for students belonging to backward-class communities. The property was a simple residential building, and the monthly rent charged was ₹2,14,283.

The Maharashtra AAR found that:

- The landlord was supplying a “pure service” — no goods were involved.

- The recipient of the service was a government entity (State Department).

- The use of the property was for a welfare activity covered under constitutional mandates (Articles 243G and 243W).

Because the service met these three conditions, it qualified for exemption under Entry 3 of Notification 12/2017-Central Tax (Rate).

As a result:

- No GST was payable.

- GST TDS under Section 51 was not applicable.

What is Entry 3 of Notification 12/2017?

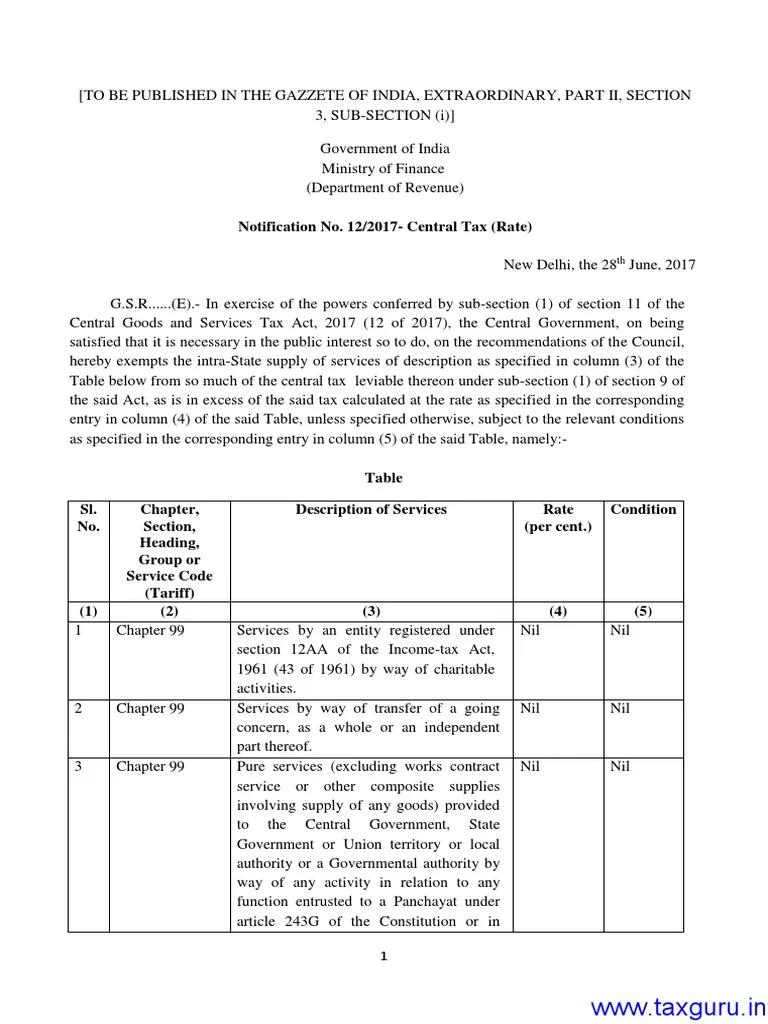

Entry 3 provides GST exemption for:

“Pure services (excluding works contract service or other composite supplies involving supply of any goods) provided to the Central Government, State Government or Union territory or local authority or a Governmental authority by way of any activity in relation to any function entrusted to a Panchayat under Article 243G or to a Municipality under Article 243W of the Constitution.”

In simple terms:

- The service must be to a government body.

- It must be purely service-based (no goods).

- It must relate to an official welfare function like education, social justice, or child welfare.

Why This Matters for Landlords and Tax Professionals?

This ruling opens the door for private property owners to rent their buildings to the government for public welfare purposes—without charging or paying GST. It also clarifies that hostels for underprivileged groups run by the government are clearly covered under GST exemptions, provided the arrangement meets the criteria under Entry 3.

Understanding the Alternatives: Entry 3 vs Entry 12 vs Entry 12A

| Criteria | Entry 3 | Entry 12 | Entry 12A (2024) |

|---|---|---|---|

| Use | Services to government for constitutional welfare functions | Renting residential dwelling for use as residence | Hostel/PG for 90+ days stay under ₹20,000/month |

| Recipient | Central/State Government or local authority | Private individual or family | Students, working professionals |

| Taxpayer | Landlord to government | Landlord to tenant | Hostel/PG operator |

| Example | Hostel for backward-class girls by govt | Apartment rented to family | Hostel charging ₹18K/month for student lodging |

| GST Status | Exempt | Exempt | Exempt (post July 2024) |

| Notification | 12/2017 – Entry 3 | 12/2017 – Entry 12 | 4/2024 – Entry 12A |

Step-by-Step Guide to Determine GST Not Applicable on Renting Property to Government for Girl’s Hostel

Step 1: Identify Your Tenant

Start by asking: Is your tenant a direct government authority? If yes, you’re on the right track for Entry 3 exemption. If it’s an NGO, society, or private entity—even if they do good work—you’re probably not covered under Entry 3.

Step 2: Clarify the Purpose

Is the property used for a welfare function like:

- Running a hostel for backward-class students?

- Providing shelter for marginalized groups?

- Supporting child welfare or education programs?

If yes, and it’s directly linked to a government initiative, you may qualify.

Step 3: Check the Documentation

Ensure that your rental agreement:

- Clearly states the tenant as a government department

- Mentions the use of property (e.g., welfare hostel)

- Is signed and acknowledged by the government authority

Also keep:

- Proof of rent payments from a government bank account

- Letters or notifications from the government confirming the use

Step 4: Match the Right Entry

- Use Entry 3 if all the above criteria are met.

- Consider Entry 12 if you’re renting to a private tenant for residential use.

- Apply Entry 12A if you’re a PG/hostel operator meeting the new July 2024 exemption conditions.

Step 5: Consult a Tax Advisor or File AAR

If your situation is complex or doesn’t exactly match a precedent, it’s best to:

- Get a written opinion from a GST consultant

- File your own AAR application for clarity

Real-World Scenarios

Scenario 1: You Qualify for Exemption

You own a 3-story residential building in Nagpur. The Maharashtra Government’s Social Welfare Department rents it from you to use as a girls’ hostel for SC/ST students. The rent is ₹1.8 lakhs/month, paid from the treasury department.

This qualifies under Entry 3: No GST. No GST TDS.

Scenario 2: You May Not Qualify

You rent the same property to a private trust that runs a hostel for orphan girls. Even if the trust is doing social good, it’s not a direct government department. This may not qualify under Entry 3 — but Entry 12 might apply depending on residential use.

Scenario 3: Entry 12A Applies

You run a PG in Pune and offer beds to working women for ₹12,000/month. Each person stays over 90 days. From July 15, 2024, you are exempt from GST under Entry 12A, even if your services are commercial.

Other Relevant Case Law

- Madras High Court – Thai Mookambikaa Ladies Hostel (2024)

- Women’s hostel charges ₹1,200 to ₹6,500/month

- Exempt under Entry 12 (residential dwelling)

- Telangana AAR – Navya Nuchu (2024)

- Property rented to govt college for boys’ hostel

- Denied Entry 3: insufficient direct link to government welfare function

- Karnataka High Court – Taghar Vasudeva Ambrish (2022)

- Hostel for students ruled as residential use

- GST exemption under Entry 12 upheld

Professional Insights for Landlords and Consultants

- Separate Service Elements: Don’t bundle services like food, laundry, or security into rent unless they’re optional. Bundled services might break the “pure service” requirement.

- Preserve Paper Trails: Keep clear invoices, rental agreements, and tenant declarations. During a tax audit, documentation can make or break your exemption.

- Use Correct HSN Code: Even when exempt, use proper HSN coding in your billing and GST returns.

West Bengal’s GST Revenue Soars 12% in July

GST Portal to Be Down August 2–3 — Check Exact Hours Before Filing

Manufacturing Activity Soars to 16-Month High, Driving GST Inflow Up by 7.7%

Final Checklist Before Claiming GST Exemption

- Is your tenant a government authority?

- Is the use strictly for a welfare function?

- Does the lease mention the intended purpose clearly?

- Have you separated rent from additional services?

- Do you have supporting letters, receipts, and payment proof?

If all answers are yes, your case for exemption is strong.