GST Overhaul Could Make Big Bikes Pricier While Smaller Ones Get Cheaper: When it comes to buying motorcycles, taxes can make or break your budget. Now, India’s Goods and Services Tax (GST) overhaul has sent shockwaves through the auto industry. In simple terms: big bikes might soon get more expensive, while smaller ones could actually get cheaper. This reform could transform not only the motorcycle market but also how millions of Indians plan their purchases. Here’s a complete breakdown.

GST Overhaul Could Make Big Bikes Pricier While Smaller Ones Get Cheaper

The proposed GST overhaul in India is a game-changer for the motorcycle market. Smaller, commuter-friendly bikes will become more affordable, while premium motorcycles could see steep price hikes. For buyers, timing is everything. Hold off if you’re buying a commuter bike, but if you dream of owning a premium machine, it might be wise to buy before the 40% slab hits. For the industry, this reform is both a challenge and an opportunity: domestic commuter-bike makers will thrive, while premium brands may need to rethink strategy. In the long run, India’s focus is clear—mobility for the masses first, luxury later.

| Topic | Details |

|---|---|

| New GST Rates | Small bikes (≤ 350 cc): 18% GST; Big bikes (> 350 cc): 40% GST |

| Current Rates | Small bikes: 28%; Big bikes: 31% (28% + 3% cess) |

| Impact on Buyers | Small bikes get more affordable, big premium motorcycles will see price hikes |

| Impact on Industry | Brands like Hero, Honda, Royal Enfield benefit; Harley-Davidson, Triumph, KTM take a hit |

| Decision Timeline | Final discussion by GST Council in September 2025 |

| Official Reference | Government GST Portal |

A Quick History of GST on Bikes

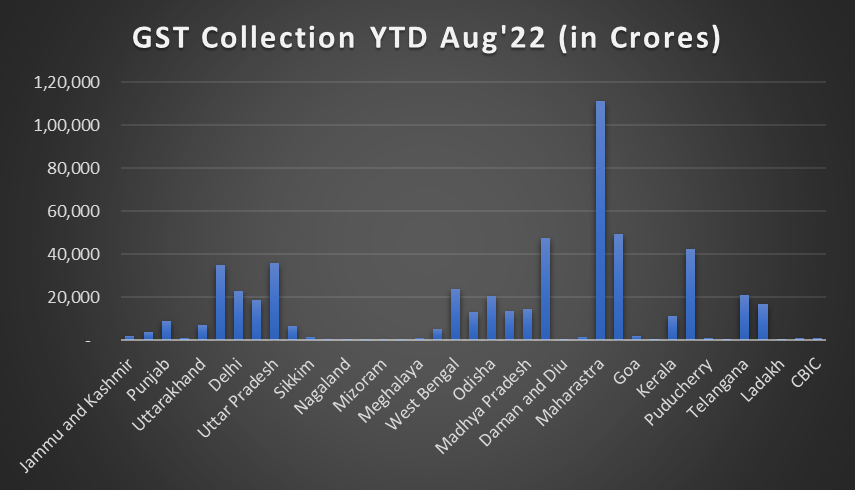

Since GST was rolled out in 2017, motorcycles have fallen under the highest 28% slab, making them one of the most heavily taxed consumer products. To add to this, bikes above 350 cc attracted a 3% compensation cess, bringing the effective tax rate to 31%.

This was a contentious move because in India, motorcycles are not just lifestyle purchases—they are the backbone of daily commuting for millions. Critics argued that taxing a Royal Enfield Bullet 350 the same way as a luxury SUV was unfair.

The proposed overhaul attempts to fix these distortions. Instead of multiple slabs, the government wants just two main GST rates (5% and 18%) with a new 40% luxury category for premium products, including large motorcycles.

Why GST Overhaul Could Make Big Bikes Pricier While Smaller Ones Get Cheaper?

The GST Council has several reasons for this restructuring:

- Simplification of Tax Structure

Fewer slabs mean easier compliance for businesses and fewer disputes. - Promoting Affordable Mobility

India’s economy depends heavily on two-wheelers, especially in rural areas. Cheaper small-capacity motorcycles encourage mobility, which directly improves productivity. - Boosting Domestic Manufacturing

Lower taxes on commuter bikes will benefit domestic players like Hero, Bajaj, and TVS, who dominate this segment. - Revenue from Luxury Segment

The luxury motorcycle market may be small, but the government views it as a revenue opportunity without hurting the masses.

In short, it is both an economic and political move: relief for the majority, higher contribution from the premium minority.

What This Means for Riders?

Smaller Bikes (≤ 350 cc)

- Current tax: 28%

- New tax: 18%

- Impact: Substantial price relief. For middle-class buyers, this could mean savings of ₹20,000–₹30,000 on a purchase.

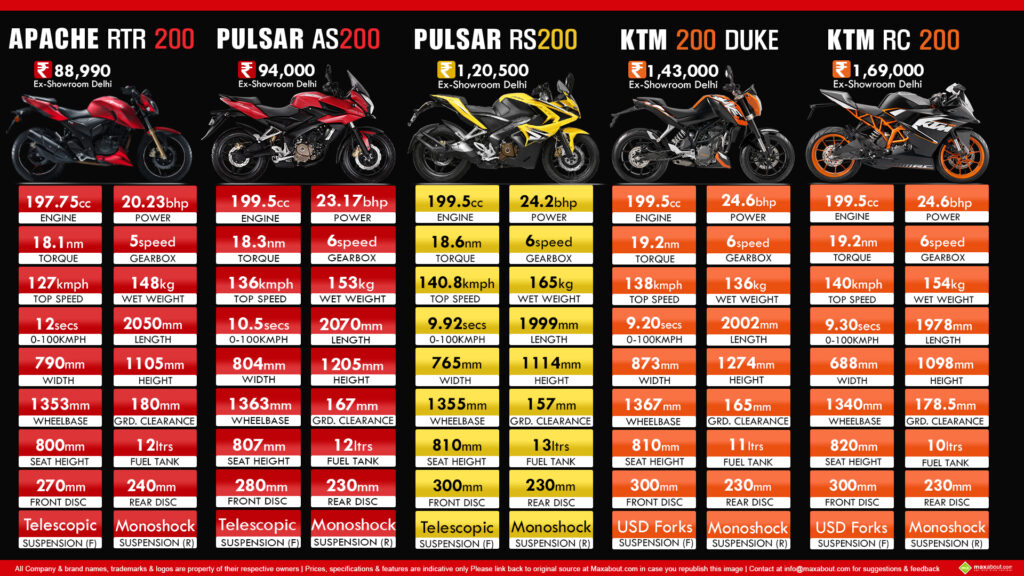

Popular examples: Hero Splendor, Honda Shine, Bajaj Pulsar 150, Royal Enfield Classic 350.

Bigger Bikes (> 350 cc)

- Current tax: 31%

- New tax: 40%

- Impact: Sharp price increases. Premium bikes could become out of reach for many enthusiasts.

Popular examples: KTM Duke 390, Harley-Davidson X440, Triumph Speed 400, BMW G 310 GS.

Rural vs. Urban Buyers

The split in impact is stark:

- Rural India: More than 60% of bike sales come from rural and semi-urban areas, dominated by commuter bikes. Lower GST here directly benefits farmers, small shopkeepers, and workers who rely on affordable bikes for livelihood.

- Urban India: Metropolitan buyers with higher disposable income often go for mid-capacity or premium bikes. For them, higher GST could mean either postponing purchases or settling for lower-displacement models.

This policy therefore redistributes purchasing power, favoring rural and budget-conscious buyers.

Global Comparison: India vs. USA & Europe

Globally, India’s proposed structure looks very different.

- USA: Import duty on motorcycles ranges from 2.4% to 6%. State sales tax adds 4–10%. A Harley-Davidson Street 750 in the U.S. costs nearly half of what it does in India.

- Europe: VAT on bikes is around 19–21%, with environmental levies in some countries.

- India (proposed): Up to 40% GST makes it one of the most expensive markets for premium motorcycles.

This comparison highlights why many international brands struggle to gain traction in India.

Case Study: Royal Enfield vs. Harley-Davidson

To see the real impact, compare two iconic brands:

- Royal Enfield Classic 350

Price today: Around ₹2.8 lakh (on-road with GST).

Post-reform: Could drop by ₹20,000–₹25,000.

Effect: More middle-class riders will choose Enfield’s entry-level models. - Harley-Davidson X440

Price today: Around ₹3.5 lakh (on-road with GST).

Post-reform: Could rise by ₹25,000–₹30,000.

Effect: Harley loses price-sensitive buyers, potentially shrinking its niche even further.

This example shows how the reform strengthens domestic players while putting global brands on the back foot.

Impact on Motorcycle Brands

The overhaul creates winners and losers.

Winners:

- Hero MotoCorp, Honda, Bajaj, TVS (strong commuter lineup)

- Royal Enfield (Classic 350, Meteor)

Losers:

- KTM, Husqvarna, Triumph (mostly > 350 cc)

- Harley-Davidson, BMW, Ducati (premium imports)

Stock Market and Industry Reaction

News of potential GST cuts for smaller bikes already sent Hero MotoCorp and Bajaj Auto shares up 5–7% in August 2025, according to Reuters.

Meanwhile, companies focusing on premium bikes saw cautious investor sentiment, as higher taxes could dampen their India growth story. Analysts predict commuter bike makers could see double-digit sales growth in the next fiscal year if the reform is approved.

Future Outlook: Electric Motorcycles

Electric vehicles (EVs) already enjoy a flat 5% GST, making them the cheapest segment tax-wise. As fuel prices rise and premium bikes get more expensive, EVs could gain market share.

Brands like Ola Electric, Ather, and Revolt could benefit from buyers who can no longer justify paying 40% tax on petrol-powered motorcycles. The GST overhaul may unintentionally accelerate the shift to electric mobility.

Consumer Behavior: Waiting for Festive Discounts

Indians often align big purchases with festive seasons, especially Diwali. With the GST decision expected in September 2025, many buyers are delaying purchases, hoping to save thousands once the new rates kick in.

This could temporarily slow sales but trigger a major festive-season boom once the reform is implemented.

Pro Tips for Buyers

Here’s a checklist if you’re planning a bike purchase:

- Buying a commuter bike (≤ 350 cc)? Wait for GST cuts.

- Eyeing a premium motorcycle (> 350 cc)? Consider buying before September.

- Interested in electric? EVs already have the lowest GST at 5%.

- Always check official updates on the GST portal.

A Quick Example Breakdown

Royal Enfield Classic 350 (≤ 350 cc)

- Current ex-showroom price: ₹2,20,000

- Current GST @ 28%: ₹61,600

- Total: ₹2,81,600

- New GST @ 18%: ₹39,600

- New Price: ₹2,59,600

- Savings: ₹22,000

KTM Duke 390 (> 350 cc)

- Current ex-showroom price: ₹3,00,000

- Current GST + cess @ 31%: ₹93,000

- Total: ₹3,93,000

- New GST @ 40%: ₹1,20,000

- New Price: ₹4,20,000

- Extra Cost: ₹27,000

Industry Voices

Experts have weighed in:

- Rajiv Bajaj (MD, Bajaj Auto): “Reducing GST on commuter bikes is the right step to empower rural India. It boosts demand where it matters most.”

- Automobile Dealers Association of India: “Premium bikes will feel the pinch, but overall, the market will benefit from increased affordability of mass models.”

These statements reflect a consensus: commuter bikes are the lifeblood of the industry, and reforms must prioritize them.

Policy Outlook: What’s Next?

The GST Council is expected to finalize the decision in September 2025. While small and big bikes are the current focus, experts believe:

- Accessories and safety gear may also get revised tax rates in the future.

- EV incentives could expand as the government pushes for net-zero targets.

- The 40% slab may later extend to cars and SUVs, reshaping India’s auto industry even further.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

GST Cuts Could Boost Consumption by ₹2 Lakh Cr – Can Economic Growth Offset Losses?