GST Rate Cut Incoming: If you’ve been following the buzz, you know something big is brewing: a GST rate cut incoming for cement, auto, FMCG, insurance, and air conditioners (ACs). On the surface, this might sound like just another tax update out of India. But if you’re an investor, a consumer, or even just curious about how global markets move, this is a big deal. And yes, while this is happening in India, don’t forget that India is the world’s fifth-largest economy and one of the fastest-growing. Moves like this ripple into everything from emerging market ETFs in New York to global consumer demand trends.

GST Rate Cut Incoming

The GST rate cut incoming in India could be a turning point for its economy. Automobiles, insurance, FMCG, and ACs stand to benefit the most, while cement remains untouched. For investors, this is a strong opportunity to position in growth-oriented sectors. For consumers, it could mean cheaper cars, affordable insurance, and lower grocery bills. Taxes aren’t just a government tool to raise money — they shape industries, markets, and livelihoods. And this reform shows how tax policy can double as economic stimulus.

| Category | Current GST Rate | Proposed GST Rate | Impact | Reference |

|---|---|---|---|---|

| Small Cars (Auto) | 28% | 18% | Boost demand for hatchbacks, good news for automakers like Maruti & Tata | Reuters |

| Health & Life Insurance | 18% | 5% or even 0% | Insurance becomes more affordable, demand likely to skyrocket | Economic Times |

| FMCG Products (12% slab) | 12% | Likely 5% | Staples & snacks cheaper, FMCG companies like Nestlé & HUL benefit | LiveMint |

| Air Conditioners & Tractors | 28% / 12% | 5%–18% | ACs, tractors may see lower prices, lifting sales | Financial Express |

| Cement | 28% | No change | Remains high, government cautious due to revenue impact | Economic Times |

What is GST Anyway?

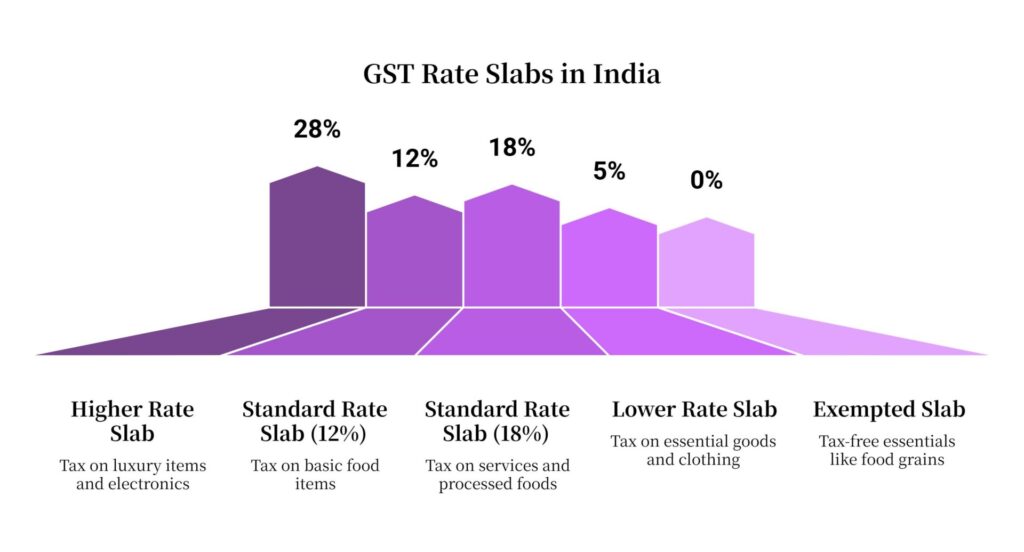

Goods and Services Tax (GST) is India’s version of a unified sales tax, rolled out in 2017. Instead of juggling dozens of state and federal taxes (like how we have state sales tax, excise, and service taxes here in the U.S.), India bundled them under one umbrella. But unlike the U.S., where sales tax rates hover between 4–10%, India’s GST goes up to 28%, making big-ticket items like cars, ACs, and cement pretty expensive. The Indian GST system currently has four major slabs: 5%, 12%, 18%, and 28%. A reform now under discussion is about simplifying these slabs, potentially merging 12% and 18% into a more consumer-friendly band, while retaining 28% only for sin goods and luxury items.

Why This GST Rate Cut Incoming Matters?

- Boosts Middle-Class Spending: Cheaper cars, insurance, and household products mean more disposable income for families.

- Industry Lifeline: The auto industry in India is a $100 billion sector, while FMCG contributes over $220 billion annually. Both have struggled with slower demand and high inflation. A tax cut could revive growth.

- Stock Market Rally: Insurance, FMCG, and auto stocks are already moving up as traders anticipate the reforms.

- Festive Season Timing: India’s Diwali shopping season accounts for nearly 30% of annual consumer spending in some categories. Cutting rates right before it is like dropping fuel on a fire.

Breaking Down the Sectors

Automobiles

- Current GST: 28%

- Proposed: 18%

The automobile industry is one of India’s biggest employers and exporters. Small hatchbacks, once dominant, have seen slower demand as SUVs captured the spotlight. A GST cut could revive the segment by making cars significantly cheaper.

Example: A hatchback priced at $10,000 with 28% GST costs $12,800. With GST reduced to 18%, it would cost $11,800. That $1,000 saving could make the difference for first-time buyers.

Winners: Maruti Suzuki, Tata Motors, Hyundai India.

Insurance

- Current GST: 18%

- Proposed: 5% or 0%

India’s insurance penetration is about 4% of GDP, compared to the global average of 7–8%. With rising healthcare costs, making insurance premiums cheaper could dramatically expand coverage.

For example, a $500 annual premium becomes $590 under 18% GST. If cut to 5%, the same policy would cost $525 — much more affordable.

Winners: HDFC Life, ICICI Prudential, SBI Life.

FMCG (Daily Essentials)

- Current GST: 12%

- Proposed: 5%

The FMCG sector, which includes everyday items like snacks, butter, packaged foods, and toiletries, accounts for half of all consumer spending in India. Lowering GST from 12% to 5% could translate into lower grocery bills for households while boosting sales volumes for companies.

Winners: Nestlé, Hindustan Unilever, Dabur, ITC.

Air Conditioners & Tractors

- Current GST: ACs at 28%, Tractors at 12%

- Proposed: 5–18%

Air conditioners, treated almost like luxury goods in India, may become more accessible to the middle class. With summers in many Indian cities crossing 110°F, demand for cooling is rising rapidly.

Meanwhile, tractors are crucial for rural India. Lower taxes could reduce farming costs and lift rural demand — a big political win for the government.

Winners: Voltas, Havells, Mahindra & Mahindra.

Cement (The Odd One Out)

- Current GST: 28%

- Proposed: No change

Despite heavy lobbying, cement remains at 28%. It’s one of the biggest revenue contributors for GST, generating over $15 billion annually. The government is wary of lowering it due to fiscal risks and cartelization concerns.

Losers: Ultratech Cement, Ambuja Cement, ACC.

Historical Context

When GST was introduced in 2017, it was hailed as India’s biggest tax reform in decades. Rate cuts have happened before:

- In 2018, taxes on consumer durables were slashed, boosting sales.

- In 2019, FMCG saw a reduction, which lifted demand across packaged food.

The lesson? Rate cuts often lead to short-term revenue dips but long-term consumption growth.

Risks & Challenges

- Revenue Impact: India’s GST collections for FY 2024 stood at about ₹18 lakh crore (~$215 billion). Lowering slabs means a potential shortfall.

- Profiteering Risks: Companies may not pass savings to consumers. To prevent this, India’s National Anti-Profiteering Authority has stepped up monitoring.

- Timing Delays: Final approval lies with the GST Council, where states and the central government must agree. Politics may slow things down.

Global Comparison

- U.S. sales tax averages 7%, varying state by state.

- EU VAT ranges between 17% and 27%.

- China has VAT at around 13%.

India’s highest slab of 28% makes many consumer goods unusually expensive, which hurts affordability. These cuts aim to bring India closer to global tax competitiveness.

Expert Opinions

- Nomura suggests that scrapping the 12% slab could simplify the tax system and lift sales of ACs and tractors.

- Goldman Sachs estimates that auto demand could rise by 10–15% if GST cuts are implemented.

- Finance Ministry sources emphasize that reforms will balance “consumer affordability with sustainable revenue.”

Step-by-Step Guide for Investors

- Track GST Council announcements directly on the official website.

- Focus on auto and insurance stocks first — these are the clearest beneficiaries.

- Watch FMCG for margin expansion and higher sales.

- Keep an eye on festive-season earnings reports for real demand signals.

- Stay cautious on cement until reforms include the sector.

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

GST Diwali Bonanza – Why Realty And Hospitality Firms Are Celebrating

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling