GST Rate Cuts From September 22: The news is out: GST rate cuts from September 22, 2025 are officially in effect, and they are already being called one of the most consumer-friendly moves since the original GST rollout back in 2017. For the everyday shopper, this means groceries, toiletries, and insurance just got cheaper. For businesses, this could mean higher demand, smoother operations, and more predictability. Think of it this way: in the U.S., if sales taxes suddenly dropped on essentials, appliances, and cars, it would feel like every day was a holiday sale. That’s what millions of Indians are waking up to this fall.

GST Rate Cuts From September 22

The GST rate cuts from September 22, 2025 are more than a tax reform; they’re a signal of India’s intent to simplify, grow, and compete globally. By making essentials tax-free, lowering rates on cars and appliances, and streamlining slabs, the government has handed families relief and businesses opportunity. While some sectors face challenges, the big picture is clear: India is ready for a new era of growth, consumer spending, and global competitiveness.

| Key Point | Details | Source |

|---|---|---|

| GST reform date | Effective September 22, 2025 | GST Council |

| Tax structure | Two slabs (5% and 18%) plus 40% for luxury/sin goods | Reuters |

| Essentials | Daily staples like milk, roti, paneer = 0% GST | Times of India |

| Insurance | Life, health, general insurance = 0% GST | Jagran Josh |

| Vehicles | Cars & scooters dropped from 28% to 18% | LiveMint |

| Price drops | Tata, Hyundai, Honda, Jeep cut prices up to ₹2.4 lakh | Economic Times |

| FMCG | Firms allowed to revise MRPs until Dec 31 | Mint |

| Jobs impact | 2 million new jobs projected by FY26 | Confederation of Indian Industry |

| GDP growth | India’s GDP forecasted at 6.9% in FY26 | World Bank |

From GST 2017 to GST 2.0: The Road to Reform

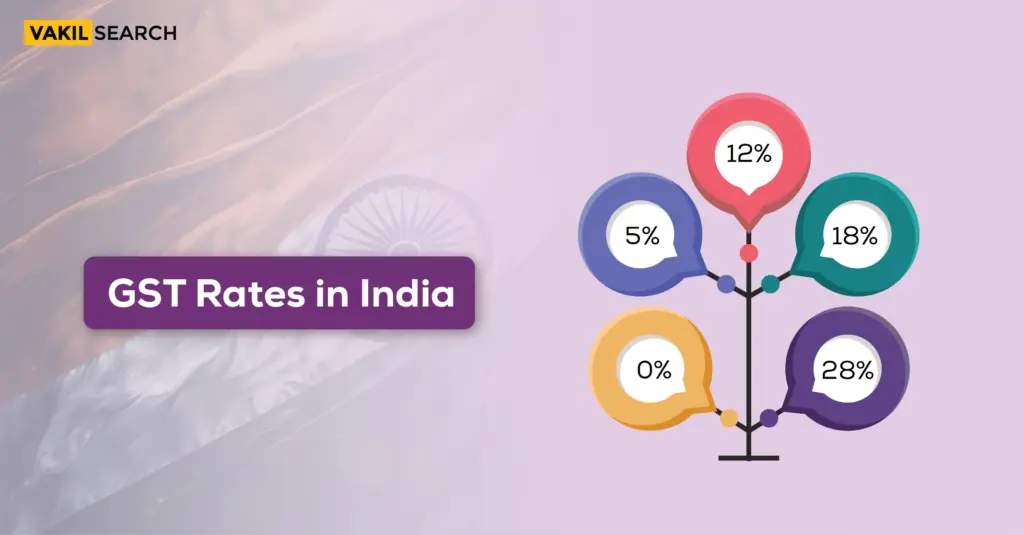

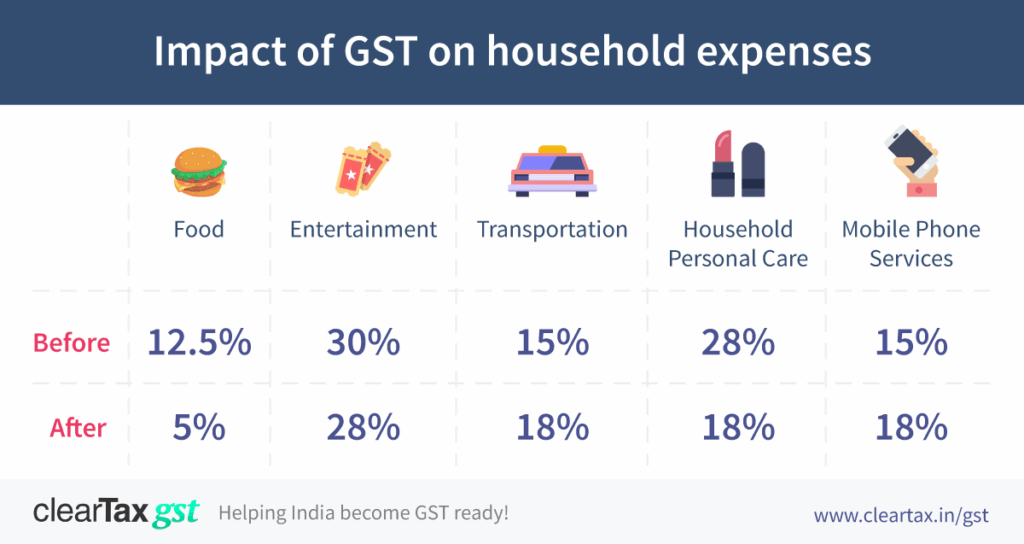

When India introduced the Goods and Services Tax in 2017, it was touted as “One Nation, One Tax.” The idea was to replace a messy network of state and federal taxes with a streamlined system. But there was a catch: four different tax slabs (5%, 12%, 18%, 28%) led to complexity and disputes. Businesses struggled with compliance, consumers often complained about unfair prices, and industries lobbied for special treatment.

Fast-forward to 2025. The government has finally taken bold action by collapsing those slabs into a simpler, more global-standard model. GST 2.0 is here, and it’s all about clarity:

- 0% for essentials

- 5% for everyday items

- 18% for manufactured goods, appliances, and cars

- 40% for luxury and sin products

This restructuring isn’t just cosmetic. It’s designed to reduce confusion, ease compliance, and spark consumer spending.

Everyday Life: Cheaper Bills, Bigger Savings

Essentials Go Tax-Free

Imagine shopping for bread, milk, or health insurance and not paying a dime in taxes. That’s what Indians now experience. Staples such as roti, paneer, khakhra, and UHT milk have been moved to the 0% slab. Personal care basics like toothpaste and soaps now fall into the 5% slab, down from higher rates.

Healthcare gets the biggest relief: life, health, and general insurance are now tax-free. For families, this means annual premiums are lower and coverage is more affordable.

Household Gadgets and Appliances

Electronics like TVs, washing machines, ACs, and dishwashers are now taxed at 18% instead of 28%. For the middle class, that’s like getting a permanent discount before the holiday shopping season. Families upgrading appliances this year can expect meaningful savings.

Cars and Two-Wheelers

The auto market is buzzing. Small cars, scooters, and motorcycles now fall under the 18% slab, slashed from 28%. Automakers quickly announced price cuts:

- Hyundai Tucson dropped by ₹2.4 lakh

- Tata Safari and Harrier fell by ₹1.4–1.5 lakh

- Honda City became cheaper by nearly ₹95,000

- Jeep Compass and Meridian cut by ₹1.26–4.8 lakh

- Two-wheelers from Yamaha and Bajaj reduced by ₹20,000–₹24,000

Luxury bikes and SUVs, however, now face a hefty 40% slab, signaling the government’s intent to tax indulgence while easing affordability for the masses.

Business and Industry Impact of GST Rate Cuts From September 22

Automotive Industry

Industry experts are calling this the best festive season in a decade. With price cuts across brands, dealerships are already reporting a spike in foot traffic. Analysts expect auto sales to grow 15–20% in FY26.

FMCG and Retail

For consumer goods companies, the lower GST means better affordability for products like packaged food, shampoos, and detergents. The government also gave firms until December 31, 2025, to update their maximum retail prices with stickers, reducing packaging waste estimated at ₹2,000 crore.

Small Businesses and Handicrafts

Artisans in Bhadohi and Srinagar, known for handwoven carpets, celebrated as their tax rate dropped from 12% to 5%. This makes Indian handicrafts more competitive globally, potentially boosting exports and supporting thousands of small-scale jobs.

Insurance and Finance

With insurance policies now GST-exempt, financial planners are predicting higher enrollment in health and life coverage. More affordable policies could also reduce out-of-pocket healthcare spending.

Expert Opinions

Finance Minister Nirmala Sitharaman hailed the move as a “Diwali gift to the people”, highlighting how it balances consumer relief with fiscal discipline.

International observers are also weighing in. Analysts at Goldman Sachs described the reform as “India’s most significant tax rationalization since 2017,” pointing out that predictability will attract more foreign investment.

Challenges and Concerns

No reform is without challenges.

- The paper industry is worried about dual taxation: 0% GST for exercise book paper but 18% for printing paper. Traders fear this may lead to disputes and misclassification.

- Luxury brands and high-end automobile makers are concerned that the 40% slab could shrink their market share. Some experts also worry it may push buyers toward the gray market.

Despite these issues, the majority of industries support the reform, noting that the positives far outweigh the negatives.

How Consumers Can Benefit?

- Plan big purchases wisely: Hold off until after September 22 to maximize savings.

- Check insurance bills: Premiums should automatically reflect lower costs.

- Use the festive season: Companies are likely to pass on GST cuts with bigger discounts during Navratri and Diwali sales.

How Businesses Should Prepare

- Update billing systems to reflect the new slabs.

- Revise contracts with distributors and suppliers to ensure smooth compliance.

- Educate employees on the revised GST structure.

- Watch demand trends carefully, as consumer behavior may shift quickly.

Investor Takeaways

For investors, this is a classic opportunity.

- Auto and FMCG stocks are likely to outperform.

- Insurance companies may see higher enrollments, boosting revenue.

- Paper industry stocks could remain volatile until the dual-rate issue is resolved.

The reforms also make India a more attractive market for foreign investors, who value tax clarity.

Global Comparisons

- U.S.: Sales tax is simpler but varies widely by state (0% in Oregon, over 9% in Tennessee).

- U.K.: VAT is 20%, with exemptions for essentials.

- India (post-September 22): 0%, 5%, 18%, and 40%.

India now stands closer to global norms, making it easier for multinational companies to operate without excessive compliance headaches.

Future Outlook

Economists believe this reform sets the stage for India’s next growth chapter. The World Bank estimates GDP growth could hit 6.9% in FY26, driven by higher consumption and easier compliance. The Confederation of Indian Industry projects the creation of 2 million new jobs, particularly in retail, auto, and manufacturing.

If successful, GST 2.0 could become a case study in how developing nations can modernize tax systems to fuel growth.

India Plans GST Cuts On Hybrid Cars And Electronics

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?