GST Rate Cuts On Cars: If you’ve been holding off on buying a car, here’s the deal you’ve been waiting for: GST rate cuts on cars are officially here, and automakers like Hyundai and Tata Motors are slashing prices big time. Starting September 22, 2025, Indian customers can save lakhs of rupees thanks to the government’s landmark tax reform move. This update isn’t just about cheaper wheels—it’s about a major shift in the auto industry that’s set to benefit both middle-class families and business owners alike. Think of it as the Black Friday of cars, except it’s government-backed, and the discounts are permanent.

GST Rate Cuts On Cars

The GST rate cuts on cars are a win-win for both buyers and automakers. With Hyundai and Tata Motors slashing prices across their lineups, this is one of the best times in recent history to upgrade your ride or expand your business fleet. The savings are significant and permanent, giving Indian buyers more choices and better value. GST 2.0 is not just a tax reform—it’s a step toward making mobility more affordable and sustainable in India.

| Feature / Data Point | Details | Source / Reference |

|---|---|---|

| Policy Change | GST rate cuts effective Sept 22, 2025 | GST Council, Govt of India |

| Hyundai Savings | ₹60,640 – ₹2.4 lakh (Creta, Verna, Tucson) | Autocar India |

| Tata Motors Savings (Passenger) | ₹65,000 – ₹1.55 lakh (Tiago, Nexon, Safari) | Times of India |

| Tata Motors Savings (Commercial) | ₹30,000 – ₹4.65 lakh (HCV, ILMCV, Buses) | Tata Motors |

| New GST Rate (Small Cars) | 18% (down from 28%) | Economic Times |

| New GST Rate (SUVs & Large Cars) | Flat 40% (no cess) | Reuters |

What Exactly Changed With GST 2.0?

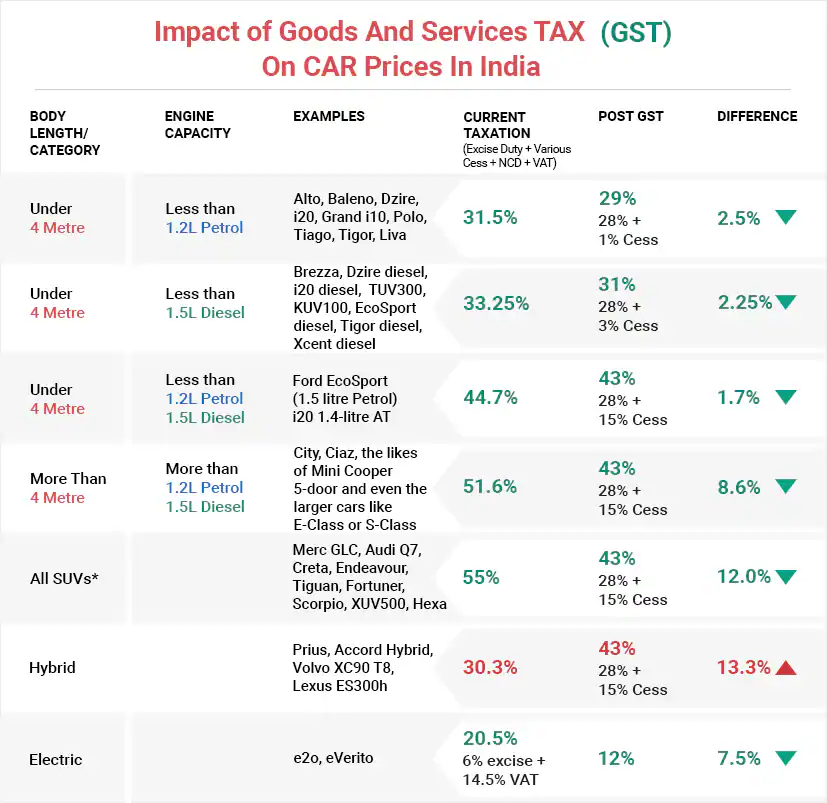

The GST Council rolled out GST 2.0, the biggest overhaul since GST’s introduction in 2017. Before this reform, cars in India had a complicated tax structure—small cars were taxed at 28%, while bigger cars and SUVs had varying cess rates stacked on top.

Now, it’s much simpler:

- Small cars: 18% GST

- SUVs & bigger vehicles: Flat 40% GST, no cess

This simplification means manufacturers can price cars more competitively, and customers get to keep more money in their pockets. It also reduces the burden of compliance for manufacturers, who no longer need to navigate multiple tax slabs and additional cess categories.

Hyundai Price Cuts: How Much Will You Save?

Hyundai has gone all in, announcing price reductions across its lineup. Whether you’re looking for a family sedan or a premium SUV, here’s what’s new:

- Hyundai Verna – Save about ₹60,640

- Hyundai i20 – Save nearly ₹98,000

- Hyundai Venue – Price drop of over ₹1 lakh

- Hyundai Creta – Around ₹72,145 cheaper

- Hyundai Tucson – Massive savings up to ₹2.4 lakh

For a middle-class family, these reductions mean moving from an entry-level hatchback to a compact SUV could now fit within the same budget. For professionals looking at premium cars, the price cuts are almost equal to the cost of extended warranties, insurance premiums, and accessories combined.

Tata Motors Price Cuts: Double Benefits

Tata Motors has sweetened the deal for both individual buyers and business owners by slashing prices across passenger and commercial vehicles.

Passenger Cars

- Tiago – Save up to ₹75,000

- Tigor – Save up to ₹80,000

- Altroz – Up to ₹1.1 lakh cheaper

- Punch – Discounts of ₹85,000

- Nexon – A whopping ₹1.55 lakh price cut

- Harrier – ₹1.4 lakh savings

- Safari – ₹1.45 lakh slashed off

- Curvv – ₹65,000 lower

Commercial Vehicles

For business owners, the savings are even juicier:

- Heavy Commercial Vehicles (HCVs) – ₹2.8 to ₹4.65 lakh

- ILMCV – ₹1 to ₹3 lakh

- Buses & Vans – ₹1.2 to ₹4.35 lakh

- Small Commercial Vehicles (SCV) – ₹30,000 to ₹1.1 lakh

If you’re running a logistics business, these cuts are a game-changer. Lower acquisition costs translate into faster return on investment and more competitive pricing in the freight and passenger transport sectors.

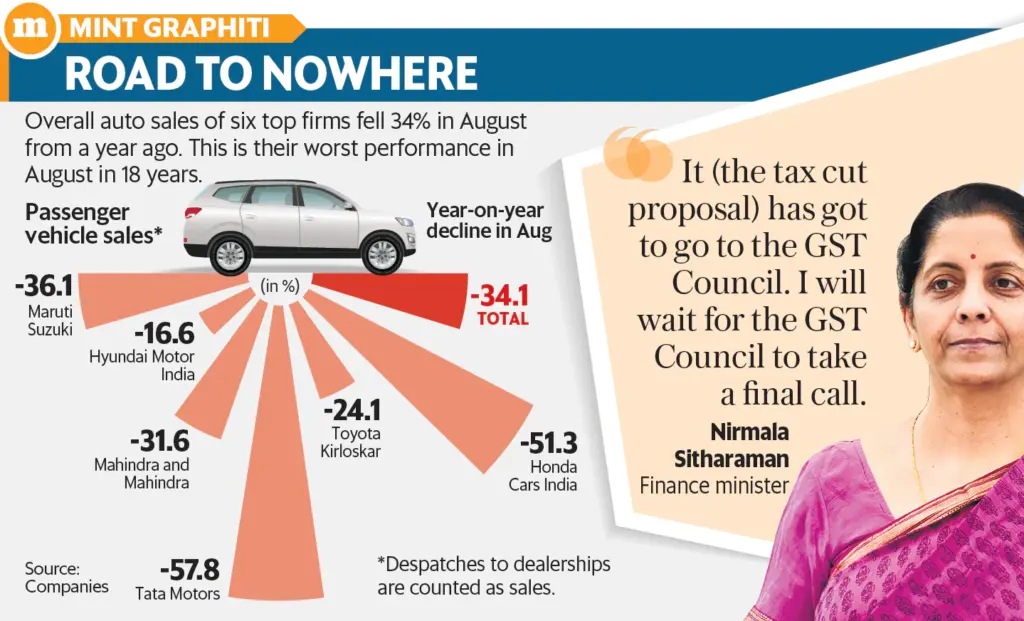

Historical Context: Why GST Matters

The Goods and Services Tax (GST) was introduced in 2017 to replace India’s patchwork of indirect taxes like excise duty, VAT, road tax, and luxury cess. While GST streamlined the system, automobiles remained among the highest-taxed goods.

Under the earlier framework, a hatchback and an SUV could both be taxed at the same 28%, but the SUV often carried additional cess charges up to 22%, pushing total taxation above 50%. GST 2.0 corrects this imbalance, creating clearer categories and fairer pricing.

Global Comparison

- United States: Sales tax varies by state, usually between 4% and 8%, making cars significantly cheaper compared to India.

- European Union: VAT ranges from 19% to 25%, with additional registration and emissions-based taxes.

- Japan: Cars attract acquisition and weight taxes, but the effective burden is still lower than India’s pre-GST 2.0 rates.

By comparison, India’s 18% GST for small cars is still higher than the US, but the reforms have closed the gap significantly.

Ripple Effects on the Used Car Market

Lower new car prices almost always push down used car values. For current car owners, this might feel like bad news since resale values may fall by 5–10%. However, for buyers entering the market, this means better deals across both new and used segments.

For example, a three-year-old compact SUV might see its market value drop by ₹50,000 to ₹70,000, making it an attractive option for families seeking affordability without compromising on features.

Expert Opinions On GST Rate Cuts On Cars

Industry leaders and analysts are optimistic:

- RC Bhargava, Maruti Suzuki Chairman: “This reform is long overdue. It will help us compete globally and make cars more accessible for Indian families.”

- Tata Motors spokesperson: “We’re committed to passing on 100% of GST benefits to our customers—both retail and fleet buyers.”

- ICRA (Indian Credit Rating Agency): Predicts a 15% surge in passenger vehicle sales over the next two quarters.

Practical Advice: Should You Buy Now?

The short answer: yes. But here’s how to be smart about it.

Step 1: Compare Models Post-Cut

Research online and compare not just Hyundai and Tata but also Maruti, Kia, Toyota, and Mahindra.

Step 2: Recheck Financing Options

Lower prices mean smaller loans. Revisit your bank or NBFC for better EMI deals.

Step 3: Negotiate at Dealerships

Dealers may still hold older inventory purchased at pre-GST prices. Use this to your advantage to ask for freebies like free accessories or extended warranties.

Step 4: Think Long-Term

A bigger car might look tempting, but don’t overlook ownership costs like fuel, insurance, and servicing.

Buyer’s Checklist Post-GST Cut

- Confirm the exact on-road price after GST cuts

- Compare financing options across banks and NBFCs

- Recalculate insurance premiums based on reduced car values

- Push for additional dealer discounts on unsold stock

- Keep long-term costs like maintenance and resale value in mind

Impact on Industry and Economy

- Demand Boost: Lower prices will likely lead to higher car sales, giving a push to India’s auto industry, which contributes around 7% of GDP.

- Employment: Higher demand could create new jobs in manufacturing, dealerships, logistics, and after-sales services.

- EV Adoption: With better affordability, manufacturers might find more breathing room to push electric vehicles into the mainstream.

- Exports: Simplified GST rates can make India more attractive as an export hub, especially for compact and mid-size cars.

Future Outlook

Analysts expect the GST reforms to:

- Increase car ownership among middle-income households.

- Boost India’s standing as a global auto manufacturing destination.

- Encourage investment in cleaner technologies, including electric and hybrid cars.

- Provide a long-term stable tax framework that benefits both consumers and industry players.

India Plans GST Cuts On Hybrid Cars And Electronics

Jefferies Predicts Stronger Growth for Two-Wheelers and Cars on Expected GST Rate Cuts

Nirmala Sitharaman Urges Businesses to Pass On GST Cuts to Consumers Immediately