GST Rate Rejig to Benefit Farmers and Middle Class: The GST rate rejig to benefit farmers and the middle class, announced by Finance Minister Nirmala Sitharaman, is one of the most significant tax reforms India has seen since the introduction of the Goods and Services Tax (GST) back in 2017. For years, business owners, farmers, and middle-class households have complained that GST is too complicated, too uneven, and too burdensome on the average person. This new proposal looks to fix that. The idea is simple: reduce the number of tax slabs, lower rates for essentials, and increase taxes on luxury and harmful products. If the changes pass through the GST Council later this year, millions of Indians could see savings on daily goods and services. On the other hand, luxury consumption may become costlier—but that’s the point.

GST Rate Rejig to Benefit Farmers and Middle Class

The GST rate rejig to benefit farmers and the middle class is one of the boldest moves in India’s tax history. By simplifying slabs, reducing burdens on essentials, and raising taxes on luxuries, the government hopes to strike a balance between fairness and growth. Critics point to revenue risks, but if consumption rises and compliance improves, the reform could succeed in making GST what it was always meant to be: a Good and Simple Tax.

| Feature | Details |

|---|---|

| New GST Slabs | 5% (essentials), 18% (standard goods/services), 40% (luxury/sin goods) |

| Removed Slabs | 12% and 28% |

| Who Benefits | Farmers, middle-class households, MSMEs, and the “common man” |

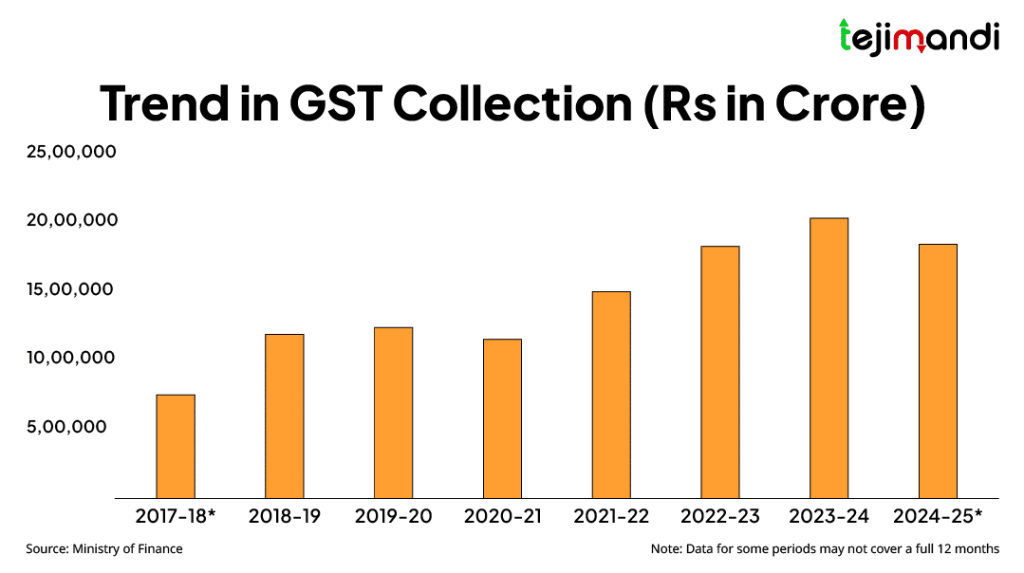

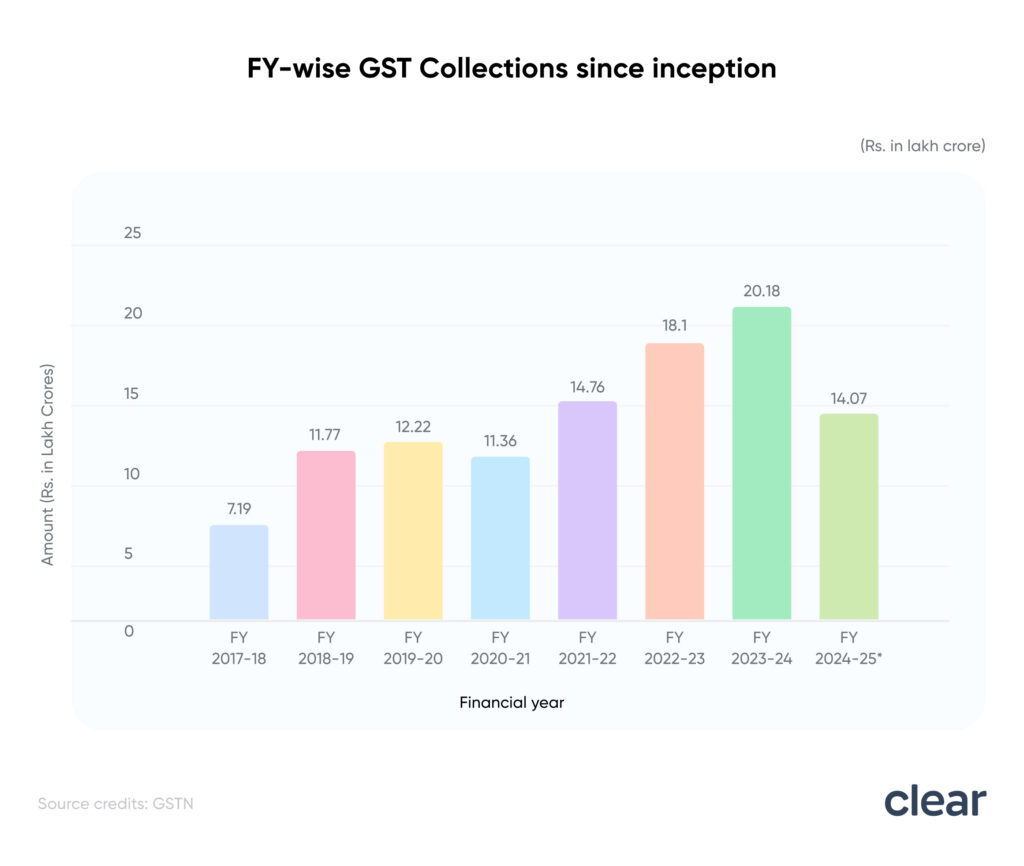

| Revenue Impact | ₹85,000 crore annual loss; ₹45,000 crore in FY 2025 if implemented mid-year (SBI Research) |

| Timeline | Proposed August 2025; rollout targeted before Diwali 2025 |

| Official Source | GST Council – Government of India |

How Did We Get Here? A Brief History of GST

GST was launched in July 2017, replacing a confusing web of central and state taxes. Before GST, goods and services were taxed multiple times across the supply chain—excise, service tax, VAT, entry tax, octroi—you name it. GST was supposed to fix that by creating a “One Nation, One Tax” system.

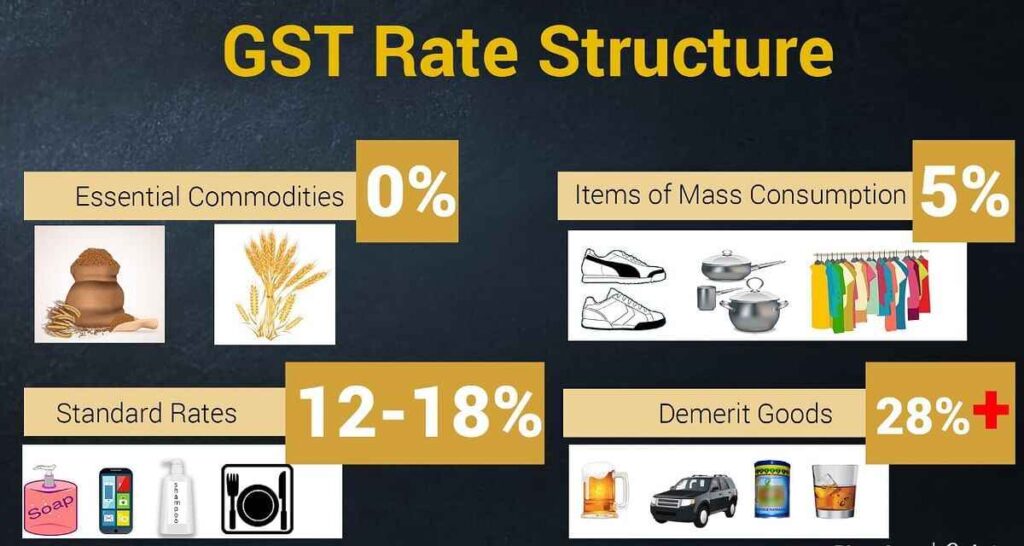

But in reality, India ended up with five different slabs: 0%, 5%, 12%, 18%, and 28%. On top of that, certain “luxury and sin” goods had additional cess. This made GST more complex than intended. Businesses struggled with compliance, accountants had to explain endless slab differences, and consumers often scratched their heads at why some biscuits were taxed at one rate and others at another.

The new rejig aims to undo that complexity by moving to a simpler two-slab system plus a sin tax.

The Big Shift: What Changes Are Coming

- 5% slab → Essentials like food grains, packaged staples, basic healthcare, and farm equipment

- 18% slab → Standard goods and services such as electronics, furniture, appliances, restaurant bills, and telecom

- 40% slab → Luxury and sin goods including tobacco, pan masala, luxury cars, betting, casinos, and online gaming

The 12% and 28% slabs will be removed. Items in those categories will be absorbed into either 5% or 18%, with certain luxury items redirected into the 40% sin category.

This streamlining makes it easier for businesses to price their products and reduces confusion for consumers.

Why This Matters for Farmers?

Farmers have long argued that input costs are too high. Fertilizers, irrigation equipment, seeds, and machinery often carried higher GST rates of 12% or 18%. Under the new structure, many of these will remain at or move into the 5% slab, directly lowering farming expenses.

Practical examples:

- A tractor priced at ₹8 lakh could become cheaper by ₹30,000–₹40,000.

- Fertilizers taxed at 12% may now move closer to 5%, saving farmers large sums during crop cycles.

Lower costs for farmers also mean lower food prices in the long run. When production becomes cheaper, those savings often pass down to consumers. So, the reform indirectly benefits everyone’s kitchen budget.

How the Middle Class Gains?

Middle-class families often face the squeeze of rising costs—rent, education, healthcare, and groceries. The GST rejig is aimed squarely at reducing everyday burdens.

What could change:

- Home appliances: Fridges, washing machines, and TVs taxed at 28% will likely shift to 18%, reducing prices significantly.

- Restaurant dining: Bills will remain at 18%, but the removal of confusion around 12% vs. 18% slabs helps standardize costs.

- Clothing: Everyday apparel under ₹1,000 will continue at lower slabs, keeping fashion affordable.

This gives households more disposable income, potentially boosting spending in other areas.

MSMEs and Startups: Relief in Compliance

Micro, small, and medium enterprises (MSMEs) have been some of the loudest critics of GST complexity. Different slabs forced businesses to split invoices, adjust product classifications, and manage endless reconciliations.

The simplified slab structure brings:

- Lower compliance costs

- Pre-filled returns and faster refunds through technology

- Simplified registration processes for new businesses

For startups, especially in e-commerce and services, this could be a game-changer—allowing them to focus on growth instead of tax compliance headaches.

Sector-Specific Impacts

Real Estate and Cement

Cement, currently in the 28% slab, will move to 18%. This is huge for the housing sector. Cheaper cement means lower construction costs, which could make homes more affordable. The real estate industry, long demanding this change, is expected to see a boost.

Insurance and Healthcare

Insurance premiums have been a pain point for families. The Group of Ministers is considering exemptions for life and health insurance, which would make policies more affordable. Combined with cheaper medical services at 5% GST, this could increase coverage in a country where insurance penetration is still low.

Digital Economy and E-Commerce

While online shopping platforms like Amazon and Flipkart continue under 18%, the online gaming industry faces a heavy blow. With a proposed 40% sin tax, platforms offering betting or real-money gaming will face significantly higher costs.

Global Context: How Does India Compare?

- United States: Uses state-level sales tax (0–10%), no unified GST. Simple at the state level but fragmented nationwide.

- Canada: A 5% federal GST plus provincial taxes. Less complex than India’s current system.

- Australia: Flat 10% GST across most goods and services—clean, predictable, and business-friendly.

With the rejig, India moves closer to the global standard of fewer, flatter rates, making it easier to trade and attract investment.

The Revenue Question

One major concern: government revenue loss.

- Annual loss: ₹85,000 crore (SBI Research)

- Current year loss: ₹45,000 crore (if implemented October 2025)

Critics argue that at a time when government spending on infrastructure and welfare is rising, such losses could hurt. However, supporters believe higher consumption will eventually offset the gap. When people spend more, overall tax collections rise—even if rates are lower.

Political and Economic Challenges

- State Governments: Many states rely on GST compensation from the center. A revenue drop could cause pushback.

- Industry Lobbies: Luxury and tobacco industries argue that higher sin taxes will hurt business.

- Opposition Politics: Opposition parties are calling the move “populist,” accusing the government of eyeing the 2026 elections.

Despite this, the reform’s popularity among farmers and the middle class may give it strong political backing.

Practical Advice for Different Groups

For Businesses

- Update accounting systems quickly to reflect new slabs.

- Revisit pricing for products moving from 28% → 18%.

- Train staff to handle new invoicing.

For Farmers

- Postpone large machinery purchases until new rates apply.

- Join farmer cooperatives to push for fertilizer and seed exemptions.

For Families

- Time purchases of electronics or cement-heavy home projects for post-rollout savings.

- Consider buying luxury items sooner rather than later, before the 40% slab hits.

Step-by-Step Guide to Understanding the GST Rate Rejig to Benefit Farmers and Middle Class

- Identify your product/service category: essential, standard, or luxury/sin.

- Check the new slab: 5%, 18%, or 40%.

- Review compliance rules: new formats, pre-filled returns, and refund systems.

- Monitor rollout: GST Council expected to finalize before Diwali 2025.

- Adjust decisions: time purchases, investments, and business strategies accordingly.

GST Rate Cut Incoming — Cement, Auto, FMCG, Insurance & AC Shares Set to Soar!

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

GST Reshuffle on the Horizon as Government Considers Retaining Only 5% and 18% Rates