GST Rate Reset Sparks Panic: The GST rate reset has triggered one of the most heated fiscal debates India has seen since the launch of the Goods and Services Tax in 2017. While the central government has pitched the move as a bold reform to simplify taxation and fuel consumption, state governments are sounding the alarm over massive revenue losses. For the average citizen, this means mixed feelings: cheaper goods in some categories but a potential slowdown in state-funded welfare programs, roads, and public services. For states, however, the reset feels less like a “reform” and more like being handed a pay cut without warning.

GST Rate Reset Sparks Panic

The GST rate reset is India’s boldest tax experiment in years. It promises simpler compliance, cheaper goods, and a short-term boost to growth. But it also shifts a heavy burden onto states, threatening their ability to fund essential services. Unless the Centre crafts a permanent compensation framework, the reset risks turning from reform into fiscal chaos. For citizens, it means enjoying some cheaper goods today but bracing for higher local taxes tomorrow.

| Key Point | Details |

|---|---|

| What Happened | GST reset simplified four slabs (5%, 12%, 18%, 28%) into three: 5%, 18%, and 40% (luxury/sin goods). |

| Revenue Losses | Central govt loss ~ ₹1.8 lakh crore ($20B); states face ₹7,000–9,000 crore per year each. |

| State Impact | Kerala expects ₹8,000 crore hit; Punjab seeks ₹60,000 crore compensation. |

| Economic Impact | GDP may rise 0.6%, inflation dip 20–25 basis points. |

| Global Context | Canada, Australia, and EU use simplified GST/VAT with permanent revenue-sharing systems. |

| Next Steps | GST Council meets Sept 3–4, 2025, to decide on compensation frameworks. |

| Official Source | GST Council – Govt. of India |

GST: From Dream Reform to Today’s Reset

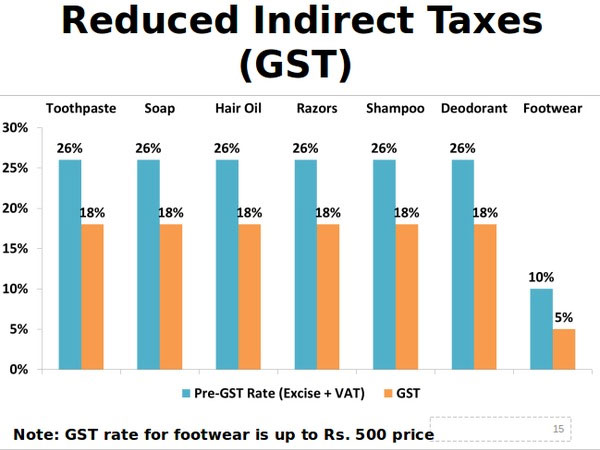

When India introduced GST in July 2017, it was hailed as a historic tax revolution. The idea was simple: replace the confusing patchwork of central and state taxes with a single, unified system. Before GST, businesses faced excise duties, service tax, VAT, entry tax, octroi, and more—often paying double or triple taxation as goods moved across states.

GST promised “One Nation, One Tax”, making India’s market more seamless and business-friendly. But there was a catch. Instead of one flat rate, India opted for multiple slabs—5%, 12%, 18%, 28%—plus cess on luxury goods. This compromise was made to balance state interests and protect revenue.

Fast forward to 2025, and complaints had piled up. Businesses were frustrated by disputes over classification (is a chocolate-covered biscuit a biscuit or a luxury snack?). Economists said the complexity slowed compliance. The new reset attempts to fix that by collapsing rates into 5% (essentials), 18% (standard goods/services), and 40% (luxury/sin goods).

Why the Reset Now?

The government has positioned the reset as a growth-oriented reform. By lowering rates on essentials and simplifying slabs, it hopes to:

- Boost consumer demand, especially in urban and semi-urban markets.

- Reduce litigation and compliance disputes.

- Make India more attractive for investment.

- Deliver political goodwill before key elections.

But this comes at a steep price: states’ finances are being squeezed dry.

GST Rate Reset Sparks Panic: The States’ Side of the Story

Here’s why state governments are panicking:

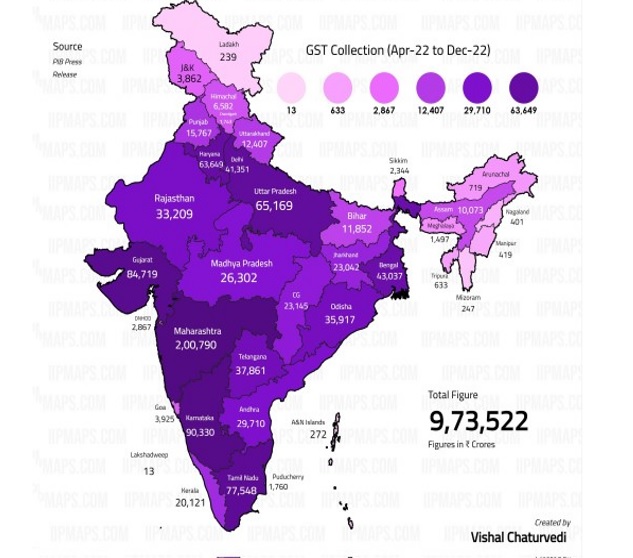

- Revenue Shock: The cut in slabs directly reduces GST collections.

- Kerala expects losses of ₹8,000 crore.

- Punjab is demanding ₹60,000 crore, citing cumulative GST-era losses of ₹1.11 lakh crore.

- Other major states estimate ₹7,000–9,000 crore losses annually.

- End of Compensation Cess: When GST was launched, states were promised five years of guaranteed compensation. That ended in 2022, but a temporary cess extension runs only until December 2025. After that, states are on their own.

- Fiscal Federalism at Risk: States argue that the Centre is reaping political benefits of tax cuts, while they’re left with shrinking budgets for health, education, and infrastructure.

For many states, GST makes up nearly 45% of their tax revenues. Losing that cushion is like taking oxygen away from a runner mid-race.

Global Comparisons: Lessons from Abroad

India isn’t the first country to wrestle with GST/VAT reforms.

- Australia: Introduced a 10% GST in 2000. All revenues are pooled by the federal government and then redistributed to states via a formula that guarantees fairness.

- Canada: Uses a dual system—5% federal GST + provincial HST in some provinces. This lets states/provinces retain fiscal autonomy.

- European Union: Countries have standard VAT rates (15–25%) but allow reduced rates on essentials, while ensuring EU-wide rules prevent distortion.

The takeaway? Successful models hardwire compensation into the system. India’s temporary cess approach was always a ticking time bomb.

What It Means for Ordinary Citizens?

For everyday Indians, the GST reset will feel like a mixed bag.

- Winners:

- FMCG goods (packaged foods, soaps, cosmetics).

- Electronics like smartphones and home appliances.

- Restaurants in the mid-range service category.

- Losers:

- Luxury cars and SUVs taxed at 40%.

- Cigarettes, alcohol, and insurance premiums.

- State-funded public services like welfare and subsidies.

Think of it as paying less at the mall, but possibly more at the gas station if states raise fuel taxes to cover losses.

Sector-by-Sector Impact

- FMCG & Retail: Big win, as lower rates encourage demand in rural and semi-urban areas.

- Auto Industry: Particularly the SUV segment, likely to take a hit under 40%. Automakers are lobbying for relief.

- Insurance: Higher rates could make premiums costlier, slowing penetration in middle-class markets.

- Hospitality: Standardization at 18% may bring some clarity and boost domestic tourism.

- Liquor & Tobacco: Heavily taxed at 40%, but states may still pile on local excise duties.

Expert Opinions

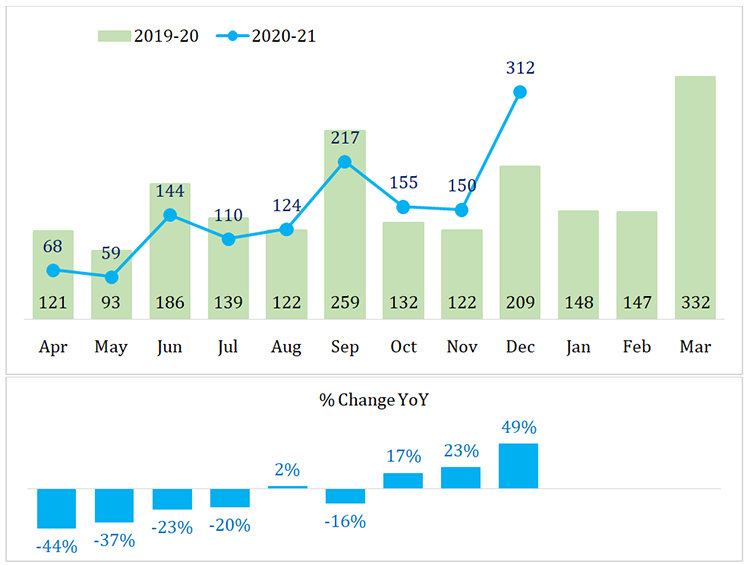

- UBS Research: Predicts a 0.6% boost to GDP and reduced inflation by 20–25 basis points.

- CRISIL: Warns that states’ revenue growth may drop from 11–14% (pre-GST) to around 8%.

- Subhash Chandra Garg (Former Finance Secretary): “Reform without permanent compensation is politically unsustainable. States cannot be perpetual losers.”

- Industry Chambers (CII, FICCI): Welcomed simplification but urged clarity on compensation to protect public spending.

Future Scenarios: Best vs Worst Case

Best Case:

- GST reset boosts consumer spending.

- GDP lifts by 0.6%.

- Centre devises a permanent compensation framework (like Australia).

- Inflation moderates, making life easier for households.

Worst Case:

- States slash spending on healthcare, infrastructure, and subsidies.

- Centre–state relations sour, triggering legal and political battles.

- Local taxes rise, offsetting benefits of cheaper goods.

- Reform gets politically toxic, forcing a rollback.

GST Slashed To Just Two Rates As 99 Percent Items Get Cheaper This Diwali

GST Reshuffle on the Horizon as Government Considers Retaining Only 5% and 18% Rates

GST Reform to Cut Rates on Vehicles – Will Two-Wheeler and Car Sales Finally Rebound?

Practical Guide: What Businesses & Citizens Should Do

For Businesses

- Reprice Goods/Services: Update GST slabs in billing systems quickly.

- Adjust Budgets: Prepare for short-term demand spikes in consumer goods.

- Watch Sectoral Trends: Luxury, auto, and insurance sectors may contract.

- Plan for Local Levies: Factor in possible state-level charges like fuel cess.

For Citizens

- Budget Smart: Essentials may cost less, but keep an eye on petrol/diesel prices.

- Insurance Planning: Premiums may rise; consider locking in long-term policies now.

- Luxury Splurges: Cars, alcohol, and cigarettes will be pricier—plan accordingly.

- Stay Updated: Follow the GST Council’s official updates.