GST Reform May Cost Billions in Revenue: When we talk about big economic shakeups, few things hit as close to home as a Goods and Services Tax (GST) reform. Right now, India is at the center of the debate, with proposed GST cuts that could cost billions in government revenue. But here’s the twist: while Uncle Sam would call that a “budget hole,” the move might actually lower consumer costs and fuel more spending, sparking growth. Now, if you’re scratching your head and thinking, “Wait, why would governments lose money on purpose?” — you’re not alone. Imagine you run a lemonade stand. If you cut the price of your lemonade, you might make less per cup. But if a whole lot more people come to your stand, you could still come out ahead. That’s basically what this GST reform is all about.

GST Reform May Cost Billions in Revenue

So, will GST reform be a budget buster or an economic booster? The answer: probably both. Governments lose money upfront, but consumers and businesses win with lower prices. If those savings turn into spending, the economy gets a shot in the arm. Like any tax shakeup, the real story will unfold in the years to come. For now, it’s a bold gamble: short-term pain, long-term gain. And whether it pays off depends on how states, consumers, and businesses respond.

| Point | Details |

|---|---|

| What is happening? | India is overhauling GST, slashing rates from high brackets (28%) to lower ones (5% and 18%). |

| Revenue hit | UBS projects ₹1.1 trillion loss annually (~0.3% of GDP). SBI estimates ₹85,000 crore loss per year. |

| GDP Impact | IDFC First Bank estimates 0.6 percentage point boost in GDP over a year. |

| Consumer Effect | Cheaper goods (like cars and insurance premiums) → potential $13 billion consumption surge. |

| State Finances | States could lose 0.36% of GDP, sparking fiscal tensions. |

| Long-term upside | Lower costs, more spending, better market sentiment. |

| Source | Government of India GST Portal |

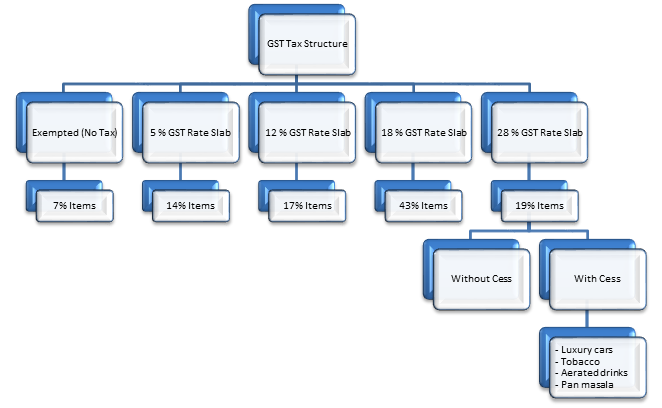

A Quick Refresher: What Is GST?

Think of GST as a one-stop shop tax. Instead of paying different taxes (sales tax, service tax, excise, VAT), India introduced GST in 2017 to simplify everything.

At launch, GST was celebrated as India’s “second freedom,” freeing businesses from the jungle of overlapping taxes. But critics say it was messy: too many slabs, tech glitches, compliance headaches, and frequent rate changes.

The new reform trims down slabs to mainly two: 5% and 18%, with a “sin rate” of 40% for luxury and harmful goods. It’s like Netflix saying: forget five plans — just choose Basic or Premium. Simple.

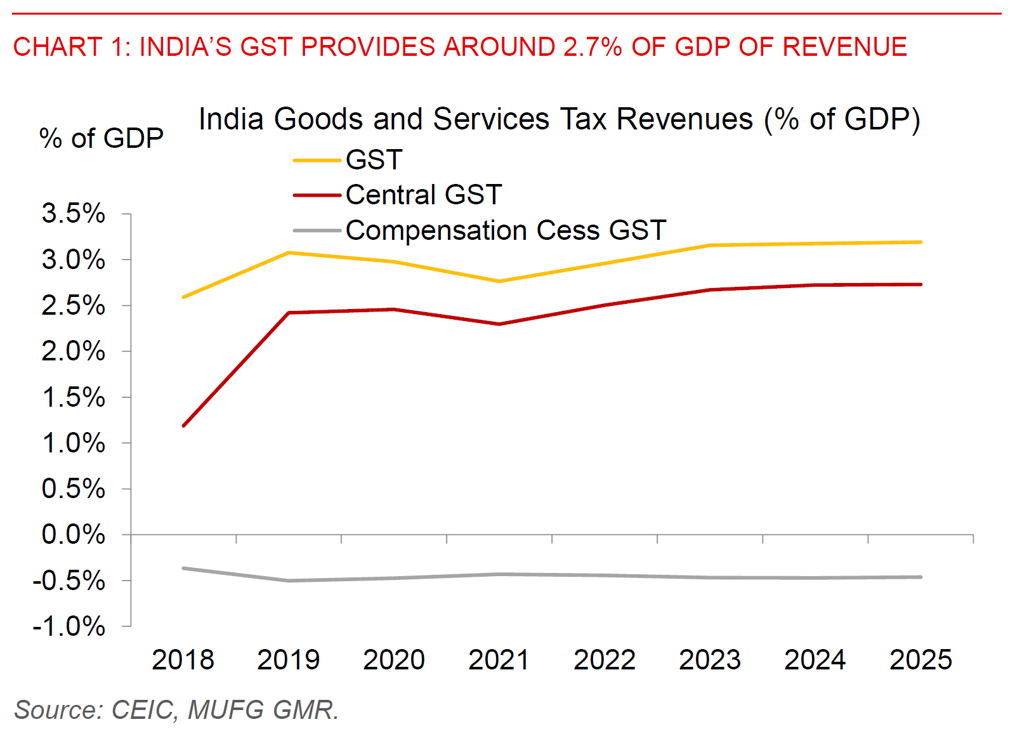

The Revenue Hit: Why Governments Are Nervous

Lowering tax rates means less money flowing into government treasuries. Here’s what the experts are saying:

- UBS: Annual loss of ₹1.1 trillion (~$13 billion, or 0.3% of GDP).

- SBI Research: Recurring loss of about ₹85,000 crore per year.

- States hit harder: Their losses could equal 0.36% of GDP, while the Centre loses ~0.15%.

For states that rely heavily on GST for funding schools, hospitals, and infrastructure, this is no small matter. Many are already demanding compensation packages to cover the gap.

Why Consumers and Businesses Are Excited About GST Reform May Cost Billions in Revenue?

On the other hand, for everyday folks and businesses, this reform feels like a much-needed tax break.

- Cars could get cheaper → Families who delayed purchases may finally upgrade.

- Insurance premiums may drop → Making health, life, and auto insurance more affordable.

- FMCG (fast-moving consumer goods) → Think shampoo, biscuits, and electronics — all set to see price cuts.

Economists at IDFC First Bank believe this could boost GDP by 0.6 percentage points in the first year. UBS even projects a $13 billion consumption surge, especially in auto and insurance sectors.

Global Lessons: How Others Do It

India isn’t the first to wrestle with GST-like taxes.

- Australia: GST is a flat 10%. It’s simple but raises debates about fairness. Economists agree it’s more efficient than messy state taxes like stamp duty.

- Canada: Uses both federal and provincial GST/HST, but with better integration. Compliance is smoother than India’s patchwork.

- New Zealand: Often called the gold standard — one single rate (15%) with almost no exemptions. Simplicity keeps costs low and compliance easy.

The takeaway? Simplicity = efficiency. India’s move to fewer slabs puts it closer to the “gold standard.”

Real-World Example: The Car Buyer’s Story

Let’s say Rahul, a middle-class professional, wants to buy a compact car priced at ₹6 lakh (~$7,200).

- Before reform: GST at 28% = Extra ₹1.68 lakh in tax.

- After reform: GST at 18% = Extra ₹1.08 lakh.

Savings = ₹60,000. That’s not just pocket change — that’s enough to cover insurance or fuel for months. Multiply that across millions of buyers, and you see why the auto sector is thrilled.

Impact on Inflation

Here’s a hidden angle: lower GST rates could help tame inflation.

- Everyday goods like food items, appliances, and insurance becoming cheaper reduces headline inflation rates.

- But states might offset their revenue losses by raising fuel or property taxes, which could push prices back up.

So the inflation impact is a tug-of-war. Consumers may see relief in one basket of goods but pay more elsewhere.

The Trade-Off: Short-Term vs Long-Term

Here’s a quick breakdown:

| Short-Term | Long-Term |

|---|---|

| Governments lose billions in revenue. | More efficient tax system. |

| States may demand compensation or raise other taxes. | Consumers spend more, boosting demand. |

| Fiscal deficits may widen. | Higher GDP growth and investment attractiveness. |

It’s like taking a pay cut today in the hope of landing a better-paying job tomorrow. Risky, but potentially rewarding.

Practical Tips: What Should Businesses and Consumers Do?

For Businesses

- Review pricing strategy: Lower GST means adjust product pricing quickly. Early movers will win.

- Watch supply chain costs: Cheaper inputs mean potential to expand margins.

- Track state policies: States may offset revenue loss with new levies.

For Consumers

- Time purchases smartly: If you’ve been eyeing a car or big-ticket appliance, post-reform may be your moment.

- Look for bundled savings: Insurance plus add-ons could get cheaper.

- Stay alert: Retailers may take time to pass down benefits — don’t hesitate to compare or demand transparency.

The Politics: Who’s For and Against?

- Central Government: Says reforms will simplify taxes, improve compliance, and fuel growth.

- States: Worry about fiscal losses and demand guaranteed compensation.

- Businesses: Largely supportive — especially automakers and insurers.

- Opposition Parties: Criticize potential revenue holes, warning of inflationary side-effects if states raise other taxes.

This tug-of-war ensures GST reform will stay in headlines for months.

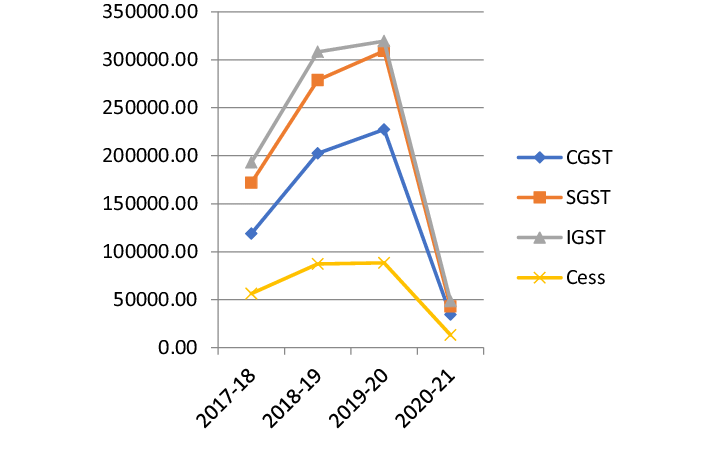

Historical Context: A Rocky Road Since 2017

GST was introduced in July 2017 as India’s biggest tax reform since independence. The promise: “One Nation, One Tax.”

But the rollout had hiccups:

- Compliance burden: Small businesses struggled with online filings.

- Frequent rate tweaks: Over 1,000 changes in the first three years left businesses confused.

- Revenue underperformance: GST collections often fell short of targets, leaving both states and the Centre dissatisfied.

This new reform is seen as an effort to finally simplify GST and make it resemble successful models abroad.

Small Cars May Get Cheaper Under New GST Reform – But Luxury Cars to Stay Costly

₹500 Crore GST Scam Busted in Guwahati, Four Held

GST Revamp Could Pull Thousands of Small Units Into Formal Economy