GST Reforms vs 50% Tariffs: When folks in the U.S. talk about the real estate market, the conversation usually circles around interest rates, mortgage costs, and whether it’s a good time to buy or rent. But halfway across the globe in India, the conversation in 2025 is heating up around two massive forces colliding: GST reforms and U.S. tariffs. The big question—will India’s housing market boom, or is it staring down a bust? If you’ve ever wondered how government taxes and international trade disputes can trickle down to the price of a humble apartment or condo, buckle up. This is the year India’s housing market could either ride a wave of affordability or get caught in a storm of economic slowdown.

GST Reforms vs 50% Tariffs

So, GST reforms vs 50% tariffs—who wins? On paper, GST cuts should boost affordability and spark fresh demand. But the U.S. tariffs are like a pothole on the highway—slowing the ride and making the journey uncertain. The truth is, India’s housing market in 2025 will likely balance between modest growth and cautious optimism. If trade tensions ease, expect a boom. If not, buyers and developers will need to navigate carefully. Either way, the story of 2025 proves one thing: in today’s globalized economy, even your future home’s price tag might depend on what happens in Washington, D.C.

| Topic | Key Details | Sources |

|---|---|---|

| GST Reforms (India) | India’s government is simplifying GST into 2 or 3 slabs, likely cutting cement GST from 28% to 18%; could lower affordable housing costs by 2–4% | Hindustan Times |

| U.S. 50% Tariffs | U.S. imposed 50% tariffs on Indian exports worth ~$40B; could shave 1% off India’s GDP growth | Reuters |

| Impact on Housing | GST cuts = cheaper inputs, more demand; Tariffs = weaker economy, job losses, affordability hit | Economic Times |

| Professional Takeaway | Developers, investors, and policy pros must balance optimism (GST cuts) with caution (trade war risks) | GST Council |

What Exactly Is GST and Why Should You Care?

Think of GST (Goods and Services Tax) like America’s sales tax—but on steroids. Instead of every state or city making its own messy rules, India has one unified tax system. Launched in 2017, it was meant to make life easier for businesses, but over time it’s gotten a bit complicated.

Here’s the kicker: construction inputs like cement and steel—the backbone of housing—fall under high GST rates. That means when you buy a home, part of what you’re paying is essentially a tax on the building blocks. No wonder buyers feel the pinch.

The Big 2025 Reform: Cutting GST Rates

India is set to simplify GST into just two or three slabs, down from four. Why does that matter? Because cement, currently taxed at a painful 28%, could get cut to 18%.

- What this means for buyers: A typical 2-bedroom home could get 2–4% cheaper, depending on the city and segment. For someone in Mumbai or Bangalore, that might mean savings of $3,000–$5,000.

- For developers: Lower costs = better margins, more projects, and a boost in demand.

Real estate consultants like Anarock project that affordable housing prices could dip by 2–4% while mid-segment homes might see a 2–3% cut. It may sound small, but in a market where millions of first-time buyers are priced out, this is like opening the gates at a Taylor Swift concert—expect a surge of interest.

The U.S. Tariffs Curveball

Just when things were looking rosy, along comes Uncle Sam with a hammer. On August 27, 2025, the U.S. slapped 50% tariffs on a huge chunk of Indian exports—from garments to gems to furniture. Why? Geopolitics. India’s oil deals with Russia ticked off Washington, and now India’s facing the fallout.

- Exports at risk: Around $40 billion worth, or two-thirds of what India ships to the U.S.

- GDP hit: Analysts warn of a potential 1% drag on growth.

When the economy slows, jobs tighten, and credit shrinks, people start thinking twice about big-ticket purchases like homes. It’s like how Americans hold off buying SUVs when gas prices skyrocket—same psychology, different market.

Historical Lessons: What We Can Learn

- 2017 GST launch: Initially caused confusion and slowed sales, but housing picked up once the dust settled.

- COVID-19 pandemic (2020–21): Housing saw a boom in recovery years when interest rates were cut and government incentives were high.

- Global comparison: China, facing trade wars in 2018–2019, saw housing slowdowns in export-heavy regions. The U.S. housing market, however, often benefits when tariffs redirect capital domestically.

Lesson? Housing doesn’t exist in a vacuum. Global shocks plus tax reforms = unpredictable results.

Case Study: Raj’s Apartment Dream

Let’s put this into perspective.

- Raj, a 32-year-old IT worker in Pune, has been saving for a $70,000 apartment.

- Before GST cuts: With cement at 28%, his apartment cost about $72,000.

- After GST cuts: The cost drops to ~$69,500—suddenly in his budget.

- But here’s the rub: if Raj’s company loses U.S. contracts due to tariffs and freezes hiring, he may decide to delay the purchase.

This case sums up India’s housing dilemma: affordability gains vs. economic headwinds.

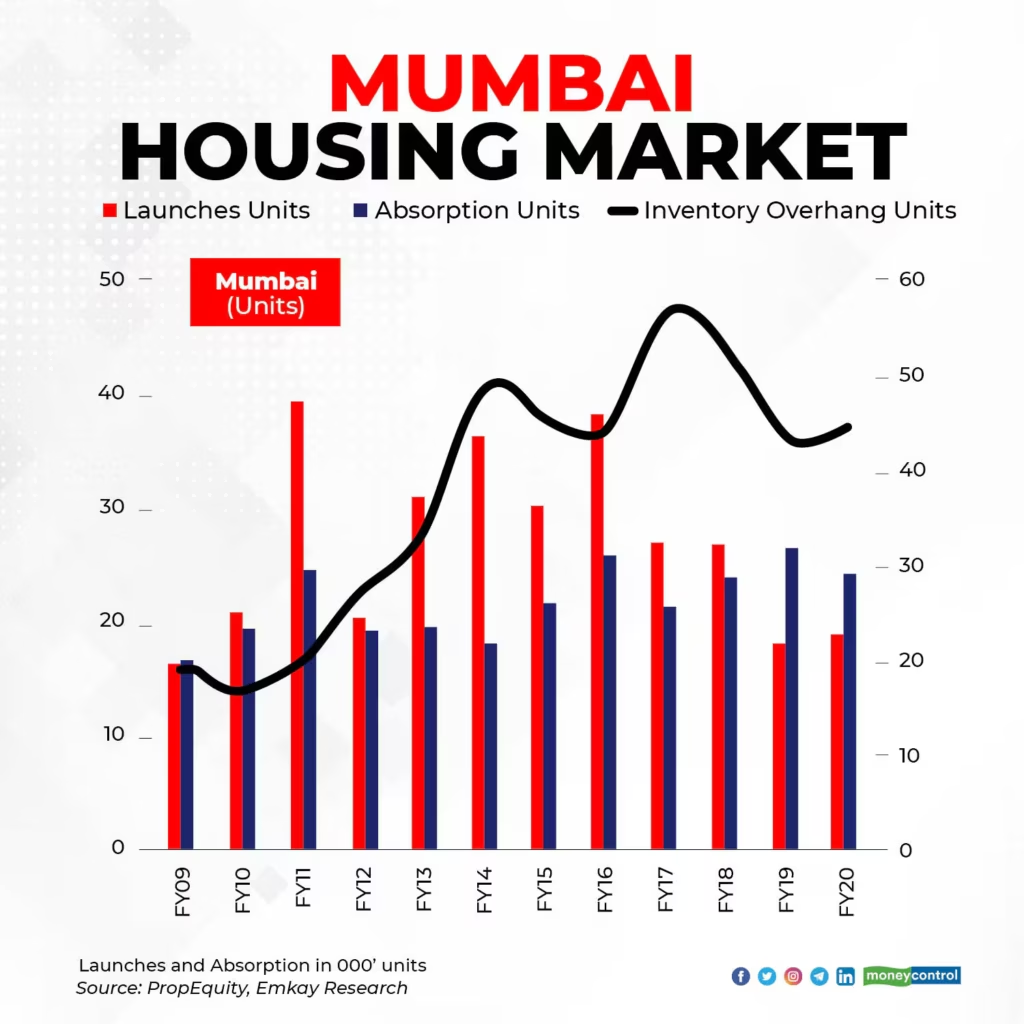

Housing Market Outlook: Boom or Bust?

Affordable Housing

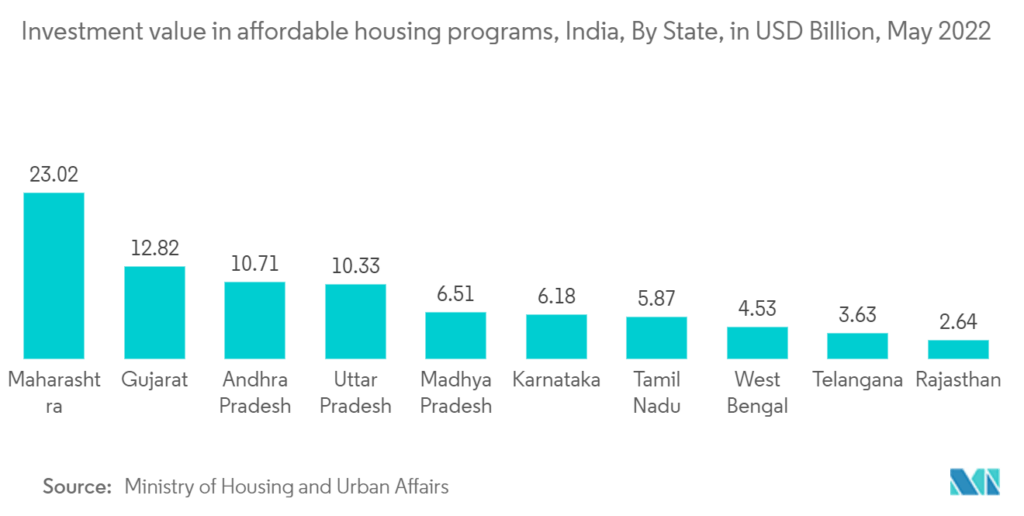

Affordable housing accounts for roughly 41% of sales in cities like Kolkata. GST cuts will make it cheaper, but job losses from export-led industries could choke demand. If the government steps in with subsidies or loan guarantees, the sector could still see growth.

Mid-Range and Luxury Housing

Mid-segment homes may get modest relief from GST cuts, but growth depends on consumer confidence. Luxury housing is less sensitive to GST and more tied to wealth creation. If stock markets wobble due to trade tensions, the luxury segment could slow.

Developer Side

Cheaper inputs make new projects attractive, but financing risk rises if GDP slows. Banks become cautious in lending, and developers with high debt may struggle.

Professional Insights

Industry leaders are weighing in.

- Adish Oswal, Oswal Group: “GST rationalisation is overdue. It could be the catalyst the sector needs, especially in smaller towns.”

- Umang Jindal, Homeland Group: “Buyers today are extremely price-conscious. Even a 2% dip matters, and it can change market sentiment quickly.”

- Anarock Analysts: “The affordability crisis won’t disappear overnight, but GST cuts offer meaningful relief.”

These insights highlight the balancing act: optimism from reforms, caution from global trade stress.

GST Reforms vs 50% Tariffs: What To Do in 2025

For Homebuyers

- If you’ve been waiting, this might be your year. GST cuts could save you thousands.

- Check job stability first. A cheaper home doesn’t matter if your paycheck is uncertain.

- Use festive season deals. Developers often pass savings during Diwali sales.

For Investors

- Look beyond metros. Tier-2 cities like Jaipur, Lucknow, and Coimbatore are hotbeds for affordable housing.

- Diversify. Balance Indian real estate with REITs or U.S. property holdings.

- Watch interest rates. Even small hikes in home loan rates can offset GST savings.

For Real Estate Professionals

- Sell the savings. Break down GST cuts into real-dollar figures for buyers.

- Stay agile. Watch trade negotiations—market sentiment can flip overnight.

- Embrace digital marketing. Buyers are researching online first; highlight GST benefits in campaigns.

Actionable Checklist

- Track official GST Council updates.

- Compare pre- and post-GST project costs.

- Assess job stability before buying.

- Focus on affordable housing for long-term growth.

- Hedge investments with international diversification.

- Follow U.S.-India trade talks to anticipate economic swings.

GST Structure Simplified – Key Changes Explained

GST Reform May Cost Billions in Revenue – But Could Lower Costs Fuel Spending?

Could a 15% GST Actually Help Young Australians? The Surprising Argument for Reform

Policy Outlook: What’s Next?

India may negotiate tariff relief by offering concessions in other sectors, but this could take months. GST reforms rollout is expected by mid-2025—execution speed will matter. The Reserve Bank of India will also play a role: if tariffs hurt growth, the central bank may cut rates to stimulate demand, giving housing another boost.