GST Refund Process Simplified: The GST refund process simplified – what changed on the portal is the latest announcement from India’s Goods and Services Tax Network (GSTN). Effective August 28, 2025, this update finally fixes a technical roadblock that had been frustrating taxpayers for years.

For businesses, especially exporters and firms under inverted duty structures, refunds are critical. Locked-up refunds mean locked-up working capital, which affects day-to-day operations, growth, and global competitiveness. According to the Central Board of Indirect Taxes and Customs (CBIC), pending refunds once touched nearly ₹20,000 crore ($2.4 billion) in 2023. Many businesses faced cash crunches simply because their rightful refunds were blocked by system glitches. Now, with the new portal update, businesses will be able to access refunds faster, more smoothly, and with fewer errors.

GST Refund Process Simplified

The GST refund process simplified – what changed on the portal update is more than a minor tweak. It resolves a long-standing flaw, reduces refund delays, and puts money back into businesses’ hands faster. For Indian exporters, it means stronger competitiveness. For global partners, especially in the U.S., it means fewer supply chain disruptions. As India continues refining GST, the focus will shift to automatic refunds and stricter timelines. If implemented, GST may finally fulfill its promise of making compliance easier, faster, and more transparent.

| Feature | Old System (Before Aug 28, 2025) | New System (After Aug 28, 2025) |

|---|---|---|

| Refund Eligibility | Blocked if any minor head (tax, interest, penalty, fee) showed a negative balance, even with positive overall balance | Allowed if overall balance is zero or positive, even if one head is negative |

| Form Auto-fill | Manual entry required, often error-prone | Auto-populates only the negative balance heads |

| Order Number Guidance | No automated suggestions | Portal suggests the latest order number (original, rectification, appellate) |

| Taxpayer Assistance | Confusing interface with no help | Tooltips guide fields like Order No. and Demand ID |

| Impact | Refunds often delayed 3–6 months, blocking working capital | Faster processing, improved liquidity, easier compliance |

A Quick History of GST Refunds in India

India introduced GST in July 2017 with the promise of creating a “One Nation, One Tax” system. While GST successfully unified indirect taxes, refunds became a sticking point.

- 2017–2019: Businesses faced long refund delays, especially exporters. Refund camps had to be set up by CBIC in several states.

- 2020: With COVID-19 hitting supply chains, refund pendency increased sharply. Liquidity stress on small firms grew.

- 2021–2023: Technical mismatches and negative head issues worsened. According to Economic Times, over 40% of refund applications were delayed during this period.

- 2025: The latest update finally addresses one of the biggest issues: refunds being blocked due to a single negative minor head.

This journey shows how GST, while revolutionary, still needed fine-tuning to serve businesses better.

What Changed on the Portal?

1. Negative Head Issue Resolved

Earlier, refunds were denied if any “minor head” (tax, interest, penalty, fee) showed a negative balance—even if the overall balance was positive. This meant even a ₹1,000 negative entry could block a refund worth crores.

Now, refunds will be processed if the cumulative balance is zero or positive, ensuring businesses aren’t punished for small technicalities.

2. Auto-Population of Refund Forms

Refund application forms (RFD-01) now automatically fill in only the negative balance components. This minimizes manual errors and prevents businesses from mistakenly entering ineligible claims.

3. Smart Order Number Suggestions

The portal now suggests the most recent order relevant to the case—be it an order-in-original, rectification, or appellate order. This eliminates guesswork for taxpayers.

4. Tooltip Assistance

The interface now includes tooltips that explain what “Order No.” or “Demand ID” means, making the process easier for non-experts.

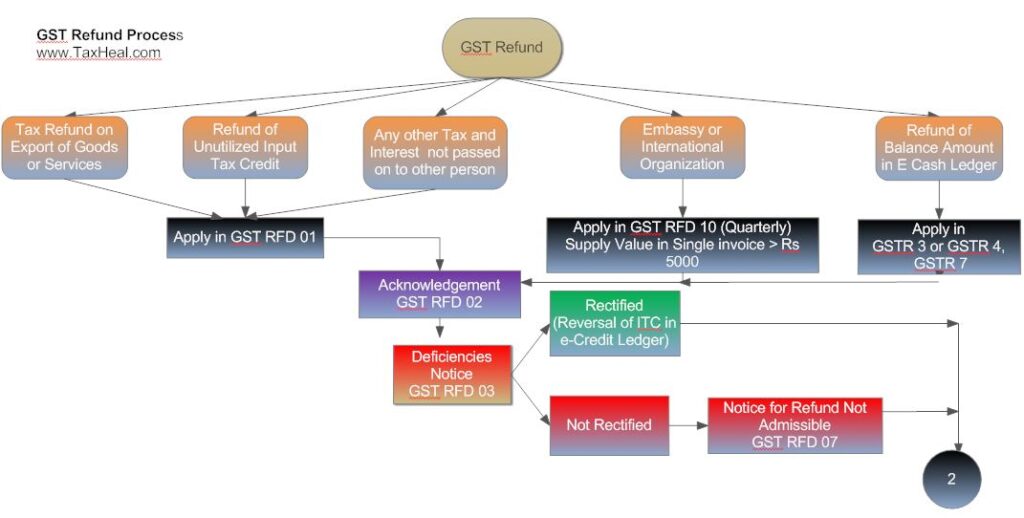

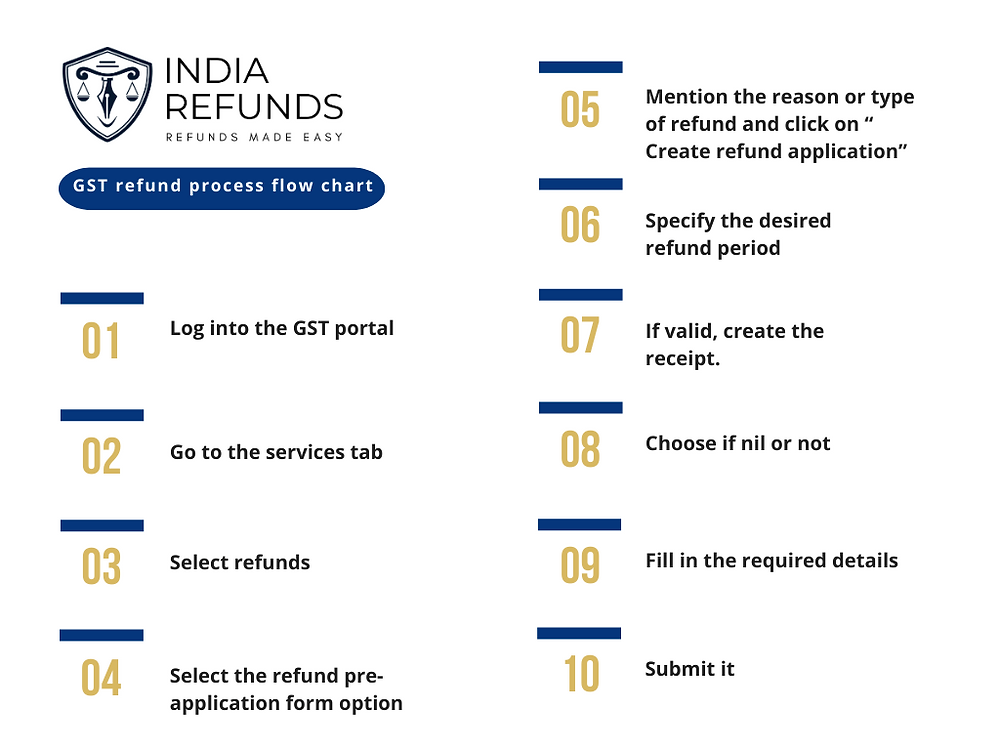

Step-by-Step: GST Refund Process Simplified

- Login to the GST portal using your credentials.

- Navigate to Services > Refunds > Application for Refund (Form RFD-01).

- The system automatically suggests the latest relevant order number.

- Review the auto-populated negative balance heads. Only those amounts will appear for refund eligibility.

- Upload necessary supporting documents: invoices, challans, shipping bills (for exporters), etc.

- Submit the application. The system generates an Application Reference Number (ARN).

- Track the status via Refunds > Track Application Status.

Unlike before, you don’t need to manually calculate or cross-check every order. The portal does much of the heavy lifting.

Case Study: How It Helps Businesses

Consider a small textile exporter in Surat with a refund claim of ₹1 crore ($120,000). Previously, a ₹2,000 penalty head negative would block the entire claim. The exporter had to wait months, leading to delayed payments to U.S. buyers. With the new update, the exporter’s refund gets processed minus the penalty head. That means over ₹99.98 lakh reaches the business account without delay. This immediate liquidity helps them fulfill new export orders and retain overseas clients. For IT firms, especially in Bengaluru that serve global clients, faster refunds mean better cash flow for scaling operations and paying employees on time.

Why U.S. Businesses Should Pay Attention?

You might ask: why does a GST update in India matter to American businesses? The answer is supply chains.

- India is a key supplier of textiles, pharmaceuticals, and IT services to the U.S.

- Refund delays in India reduce suppliers’ liquidity, slowing production and shipment schedules.

- Faster refunds mean Indian suppliers can fulfill contracts more efficiently, benefiting U.S. importers and buyers.

In global trade, delays in one country ripple through the entire chain. This update strengthens India’s position as a reliable partner.

Comparisons with the U.S. and EU

In the United States, sales tax refunds are generally straightforward and processed at the state level, often within weeks. In the European Union (EU), VAT refunds are electronically processed and standardized under EU directives, with clear time limits.

India’s GST refund system, by contrast, has been slower and more complex. This update is a step toward aligning India’s refund framework with global best practices.

Industry Reactions

- Federation of Indian Export Organisations (FIEO): Praised the move as “a timely correction that will unlock crores in working capital.”

- Confederation of Indian Industry (CII): Highlighted reduced compliance costs with auto-population and tooltips.

- Industry Associations: Pushed for the next big step—automatic Input Tax Credit (ITC) refunds across all sectors, not just exporters.

Currently, exporters enjoy automatic refunds, but other businesses under inverted duty structures face long delays. Automatic ITC refunds could save firms 2–3% of turnover in stuck capital.

Practical Tips for Businesses

- File Early: Don’t delay refund claims; submit as soon as eligible.

- Maintain Clean Records: Reconcile invoices monthly to avoid mismatches.

- Check Auto-Population: Review the auto-filled fields carefully.

- Track Refunds: Use the ARN to monitor progress on the portal.

- Hire Professionals if Needed: Especially if dealing with international transactions.

Future Outlook

This update is part of a larger trend toward making GST more business-friendly. On the horizon:

- Automatic ITC Refunds: A major demand from industries.

- Interest on Delayed Refunds: Likely to be enforced more strictly.

- AI-driven Compliance Checks: GSTN is piloting AI systems to detect fraudulent claims without delaying genuine ones.

If implemented, these reforms could make India’s GST system globally competitive.

GST Restructuring Debate – Why Experts Say It Could Hurt Federalism

GST Rejig – Household Items Likely To Get Cheaper Soon

FADA Issues Advisory On Excess Inventory Amid GST Uncertainty