GST Rejig: When we talk about money, shopping, and taxes, one phrase that’s been making big waves lately is “GST Rejig – Household Items Likely To Get Cheaper Soon.” If you live in India, get ready: the way the government taxes everyday goods is about to change in a big way. And yes, that means your toothpaste, ghee, soap, clothes, and even your TV or air conditioner could all cost less in the coming months. Now, you might be thinking, “Wait, what’s the big deal? It’s just taxes, right?” Well, not exactly. This shift isn’t just about a few extra bucks saved at the grocery store. It’s about how India is reworking its Goods and Services Tax (GST) — a system that touches nearly every part of the economy. And if you’re a business owner, investor, or just a budget-conscious family, this change could be a game-changer.

GST Rejig

The GST Rejig – Household Items Likely To Get Cheaper Soon is more than just a tax reform. It’s about making life easier for millions of Indian households, boosting consumer confidence, and giving the economy a timely push before the festive season. From toothpaste to TVs, the impact will be felt everywhere. While challenges remain for government revenue and state compensation, the potential for growth is undeniable.

| Key Point | Details |

|---|---|

| What’s happening? | India is cutting down GST slabs from 4 to 2, making goods cheaper. |

| Old Slabs | 5%, 12%, 18%, 28% |

| New Slabs | 5% (essentials), 18% (standard goods), 40% (luxury/sin goods) |

| Items getting cheaper | Ghee, butter, toothpaste, footwear, utensils, ACs, TVs, dishwashers, cement, small cars, two-wheelers |

| Impact on Economy | ₹1.98 lakh crore boost in consumption, possible 0.6–0.8% GDP growth |

| Revenue Loss for Govt. | Around ₹85,000 crore annually |

| Timeline | Likely roll-out by October 2025, before Diwali |

| Official Reference | GST Council India |

A Quick Refresher: What is GST?

The Goods and Services Tax (GST) was introduced in India in July 2017, replacing a messy system of state-level VAT (Value Added Tax), excise duties, service tax, and a dozen other indirect levies. Before GST, every state had its own tax rates on goods, making trade complicated. Imagine a truck carrying goods from Delhi to Kerala having to pay multiple state entry taxes — that’s how bad it was.

GST was designed to unify India under a single, nationwide tax system. The promise was “One Nation, One Tax.” Initially, it had four slabs — 5%, 12%, 18%, and 28%, which simplified things somewhat but still left room for confusion. Over the years, consumers and businesses pushed for a simpler structure, which is why this two-slab rejig is such a big deal.

GST Rejig: Breaking Down the Changes

Items Moving from 12% → 5%

Nearly 99% of goods in the 12% bracket will now fall into the 5% slab. This is where middle-class households will feel the most relief. Examples include:

- Food & Kitchen: ghee, butter, cheese, packaged juices, ketchup, noodles, pasta

- Daily Essentials: toothpaste, soaps, hair oil

- Household Items: pressure cookers, utensils, water heaters, sewing machines

- Clothing & Shoes: garments under ₹1,000 and footwear under ₹500–₹1,000

- Healthcare: vaccines, diagnostic kits

- Stationery & Bicycles: cheaper education and travel

If your family spends ₹5,000 a month on groceries and household items, the GST cut could save you ₹250–₹400 monthly. That’s like an extra utility bill covered.

Items Moving from 28% → 18%

This category is where consumers will notice serious savings on big-ticket items. With 90% of goods in the 28% slab dropping to 18%, the relief is significant:

- Electronics: air conditioners, TVs larger than 32 inches, dishwashers

- Vehicles: small cars, two-wheelers under 250cc, auto components

- Construction Materials: cement, tiles, sanitaryware

- Insurance Premiums: health and life insurance could drop from 18% to 5% or 0% (under review)

For example, an AC costing ₹40,000 earlier attracted ₹11,200 GST at 28%. Under the new slab, the GST would be ₹7,200 at 18%. That’s a straight ₹4,000 saved.

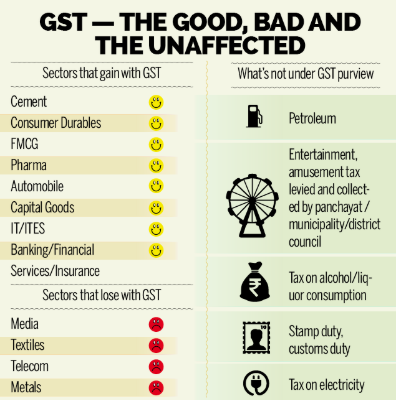

Impact on Businesses & Industries

FMCG (Fast-Moving Consumer Goods)

Companies like Hindustan Unilever, Nestle, and ITC are expected to see a sharp jump in demand. Lower GST means more affordable soaps, biscuits, and packaged foods.

Automobile Industry

Two-wheeler and small car makers could see a revival. Many buyers had been delaying purchases, waiting for tax relief.

Real Estate & Construction

Cement and tiles becoming cheaper could reduce housing costs, especially for affordable housing projects. That’s a boost for both homebuyers and builders.

Textile & Apparel

Clothing under ₹1,000 becoming cheaper will especially benefit the lower- and middle-income groups. This could help revive demand in India’s massive textile industry.

Healthcare

With lower GST on vaccines and medical kits, healthcare affordability improves, particularly in rural areas.

Tourism & Hospitality

Hotels and travel services are still under discussion, but experts believe GST simplification may bring relief here too, spurring tourism growth.

Challenges & Criticisms

While the reform is widely celebrated, it comes with challenges:

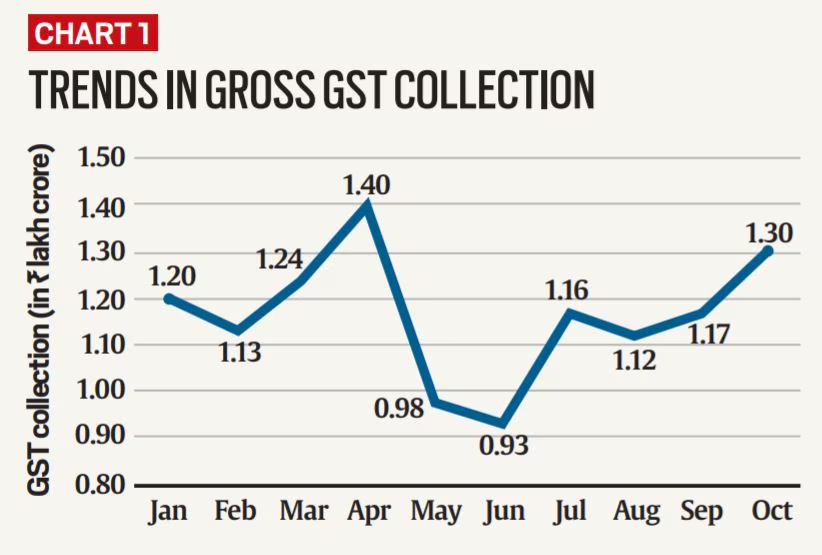

- Revenue Loss: The government could lose around ₹85,000 crore annually in GST collections.

- State Compensation: States fear losing revenue share, and negotiations are expected in the GST Council.

- Inflation Risks: Higher consumer demand might push prices up in the medium term.

- Adjustment Costs: Businesses will need to update billing systems, accounting practices, and IT systems to align with the new rates.

Expert Opinions

- Nomura Research: Expects the rejig to add 0.6%–0.8% to GDP while moderating inflation.

- Deloitte India: Says the reform will “boost consumer sentiment and drive festive season demand.”

- Former Finance Secretary Subhash Garg: Warns of fiscal stress on states if compensation isn’t managed well.

Practical Advice for Consumers

- Delay Big Purchases

Planning to buy a TV, AC, or scooter? Waiting until October 2025 could save thousands. - Plan Bulk Purchases

Household items like soap, toothpaste, and ghee will be cheaper after the rejig. Stock up then. - Rework Household Budgets

With essentials becoming cheaper, consider reallocating savings toward investments, education, or emergency funds. - Builders & Renovators

If you’re building a house or renovating, delaying purchases of cement, tiles, and sanitaryware until after the reforms could lower project costs significantly.

Global Comparison: How Does India Stack Up?

- United States: The U.S. has no GST, but state-level sales taxes range from 0% to over 7%. Prices vary widely depending on location.

- United Kingdom: Uses VAT (Value Added Tax) at a flat 20%, with reduced rates of 5% on some essentials.

- European Union: Most EU nations use VAT between 15–27%.

- India (Post-Rejig): With just two slabs (5% and 18%), India’s system will become much simpler than before, though still more layered than a single-rate VAT like in the UK.

Future Outlook

If implemented smoothly, this GST rejig could:

- Strengthen consumer confidence.

- Increase India’s global competitiveness.

- Spur demand-led growth.

- Attract foreign investment into manufacturing and retail.

However, long-term success depends on whether the government can balance lost revenue with higher consumption and manage state-level concerns.

Supreme Court Denies Plea Challenging GST ECL Blocking Relief

Bengaluru Professional Saves ₹70,000 by Switching to New Tax Regime

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials