GST Removed From Life And Health Insurance: If you’ve been paying for life or health insurance in India, you know that GST (Goods and Services Tax) has been biting into your wallet for years. Until now, a fat 18% GST was slapped onto your premium payments. But here’s the big news: the GST Council has decided to remove GST entirely from individual life and health insurance policies starting September 22, 2025. That’s not just a minor tweak—it’s a game-changer for millions of households, professionals, and retirees who budget carefully for insurance. But the real question buzzing around is: How much will you actually save? And are there any “gotchas” hidden in the fine print? Let’s break it down in plain English, with examples, stats, and practical tips.

GST Removed From Life And Health Insurance

The removal of GST from life and health insurance is a bold and welcome move. For individuals, it could mean savings of thousands every year. But the actual benefit depends on how insurers adjust premiums in response to losing input tax credits. If you’ve been on the fence about getting insured or upgrading your coverage, now’s the time to act smart. Circle September 22, 2025 on your calendar, keep an eye on revised premiums, and make the most of this tax break.

| Point | Details |

|---|---|

| Policy Change | GST reduced from 18% to 0% on individual life and health insurance. |

| Effective Date | September 22, 2025 |

| Applies To | Individual life insurance (term, ULIP, endowment) and health insurance (family floater, senior citizen plans). |

| Excludes | Group insurance policies (employer, banks) – they still attract 18% GST. |

| Savings Example | On a ₹15,000 annual premium, you save ₹2,700 per year. Over 10 years, that’s ₹27,000. |

| Official Source | GST Council – Ministry of Finance |

A Quick Throwback: GST on Insurance Before

When GST was rolled out in July 2017, insurance premiums got costlier overnight. Previously, service tax on insurance was around 14–15%. With GST, it jumped to 18%, making insurance one of the most heavily taxed financial products.

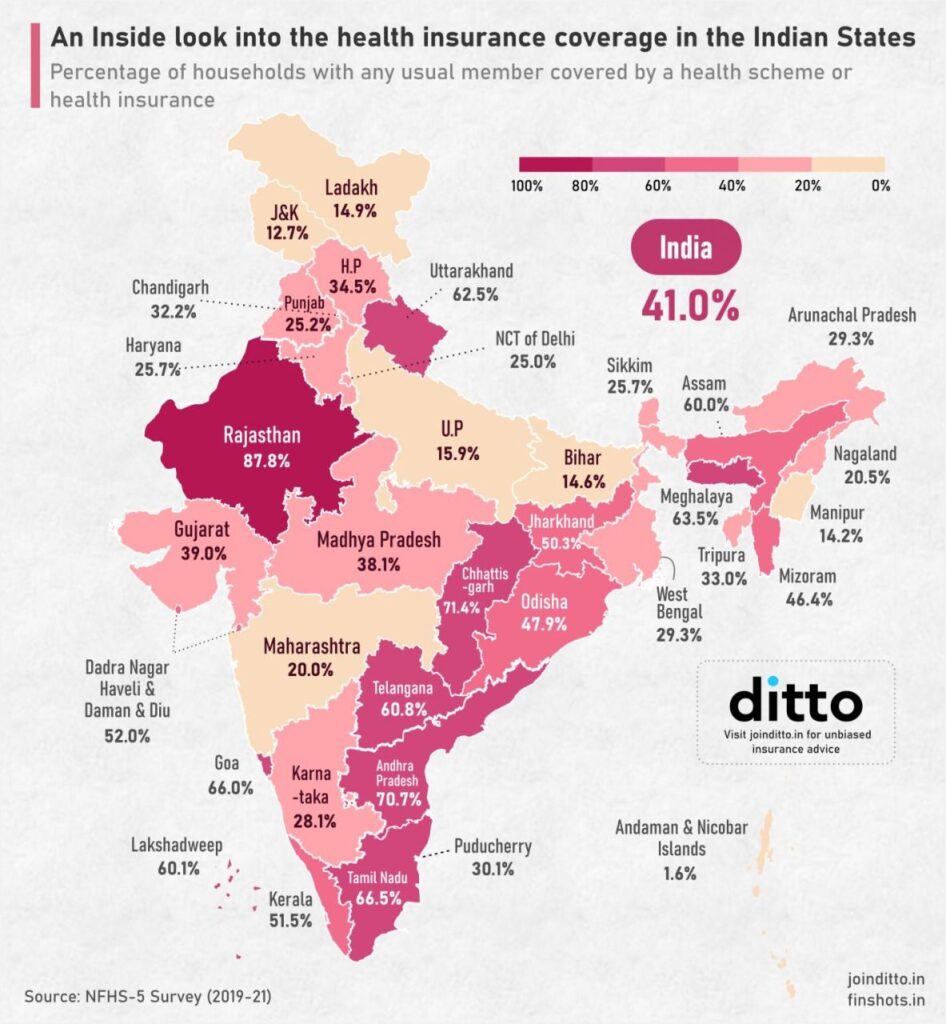

This was heavily criticized because insurance is considered a social necessity, not a luxury. Middle-class families saw premiums climb, and many either reduced coverage or avoided buying policies altogether.

Now, by removing GST, the government is undoing almost a decade of burden and trying to boost insurance penetration.

Why GST Removed From Life And Health Insurance Matters?

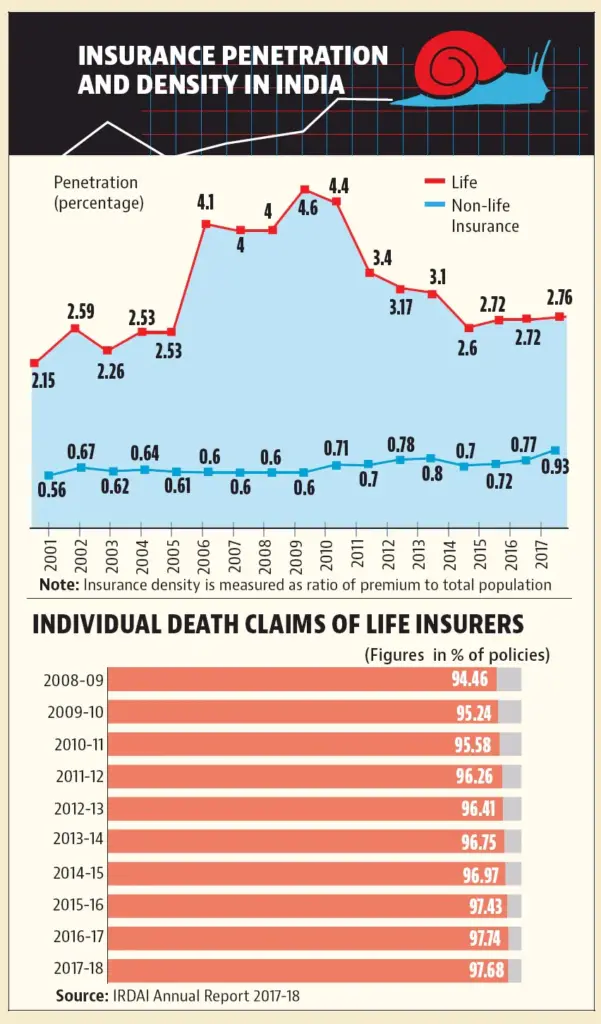

This is part of India’s larger economic reform package to boost domestic demand. By making insurance more affordable, the government is hoping more families will get covered—especially in a country where insurance penetration is still relatively low.

For context, according to the Insurance Regulatory and Development Authority of India (IRDAI), India’s insurance penetration in 2023 was around 4.2%, which is way below the global average of 7%.

More affordable insurance = more families protected = stronger financial resilience.

How Much Will You Actually Save?

Let’s run through some real-world scenarios:

Example 1: Young Professional with a Term Plan

- Annual Premium: ₹15,000

- Old System: ₹15,000 + ₹2,700 GST = ₹17,700

- New System: ₹15,000 flat

- You save ₹2,700 a year. Over a 20-year policy, that’s ₹54,000.

Example 2: Family Floater Health Plan

- Annual Premium: ₹40,000

- Old System: ₹40,000 + ₹7,200 GST = ₹47,200

- New System: ₹40,000 flat

- Savings = ₹7,200 a year. Over 10 years, that’s ₹72,000.

Example 3: Senior Citizen Health Policy

- Annual Premium: ₹70,000

- Old System: ₹70,000 + ₹12,600 GST = ₹82,600

- New System: ₹70,000 flat

- Savings = ₹12,600 per year. Over 10 years, that’s ₹1.26 lakh.

For retirees already squeezed by medical costs, this is massive relief.

But Wait—There’s a Catch

It’s not all sunshine and rainbows. Here’s the deal:

- Insurance companies used to claim Input Tax Credit (ITC) on their expenses like agent commissions, office rent, or advertising. With GST at 0%, they lose this credit.

- To balance the books, insurers might tweak their base premiums upward.

So, while you should definitely see a benefit, it may not be the full 18% reduction. The Times of India has already warned that policy prices “may not drop as much as 18%.”

Global Comparisons

To put this in perspective:

- United States: Life and health insurance premiums are generally exempt from sales taxes.

- UK: Insurance Premium Tax (IPT) exists, but it’s 12–20%, depending on policy type.

- Singapore: No GST on life insurance; limited application on general insurance.

India’s move aligns it closer with the U.S. system, treating insurance as a necessity, not a luxury.

Who Benefits Most?

Winners:

- Middle-class families paying for health covers.

- Young professionals locking in long-term term insurance.

- Senior citizens who face higher premiums.

- First-time buyers who may have avoided policies due to affordability.

Not So Lucky:

- Folks under group insurance plans—these still attract GST. If you’re covered by your employer, your premiums aren’t going down.

Expert Opinions

Industry experts have been cautiously optimistic:

- Kotak Life noted that the reform will “encourage long-term financial planning.”

- Financial Express highlighted that “savings could be significant, but insurers may adjust premiums to account for ITC loss.”

- Independent analysts believe this will boost first-time insurance buyers significantly in smaller cities.

Broader Economic Impact

This reform isn’t just about personal savings—it’s also about:

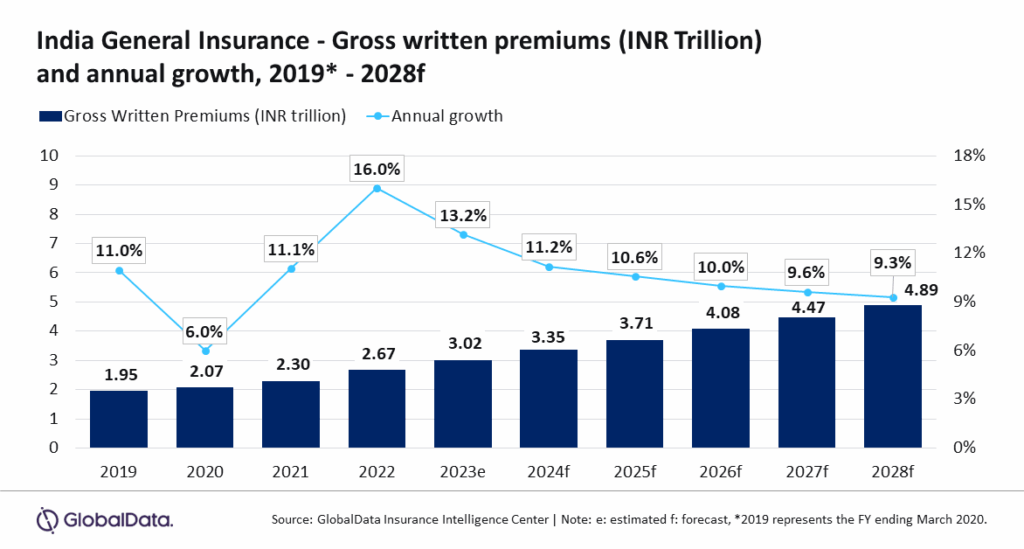

- Boosting insurance penetration: Lower costs make policies accessible to lower-income households.

- Encouraging preventive healthcare: With more people covered, healthcare spending becomes more predictable.

- Supporting financial inclusion: Rural and semi-urban India may finally see meaningful insurance adoption.

- Creating jobs: Insurance agents and advisors may see higher demand as more people consider policies.

Practical Advice: How to Maximize Your Savings

Here’s your step-by-step guide to making the most of this change:

Step 1: Time Your Renewals

If your renewal is close to September 22, 2025, consider aligning it so you fall under the new regime.

Step 2: Review Policy Type

Double-check if your policy is individual (eligible) or group (not eligible).

Step 3: Compare Premiums

Use online calculators from LIC India or HDFC Life to see post-GST rates.

Step 4: Negotiate with Agents

Ask directly: “Will my premium reflect the full GST benefit?”

Step 5: Upgrade Coverage

If you’ve been holding back on coverage size due to cost, now’s your chance.

Checklist: What You Should Do Right Now

- Note your renewal date.

- Confirm if your policy is individual or group.

- Bookmark September 22, 2025.

- Compare insurers’ revised rates.

- Plan upgrades if affordable.

Health & Life Insurers Eye Zero GST – Will You Finally Pay Less on Premiums?

GST Council Agrees On Life And Health Insurance Tax Exemptions

Proposed GST Removal on Term Life Insurance – What It Means for Young Families’ Finances