GST Reshuffle on the Horizon: is not just a headline—it’s a turning point for India’s economy. If you’ve ever been confused about why some items were taxed at 5%, others at 12%, and still others at 28%, you’re about to see that complexity shrink. The Indian government is now looking to simplify the Goods and Services Tax (GST) regime into just two slabs: 5% and 18%, with an additional 40% rate for luxury and “sin goods” such as tobacco, alcohol, and online betting. This proposal, highlighted by Prime Minister Narendra Modi in his Independence Day 2025 address, is aimed at making India’s tax system more consumer-friendly and business-friendly. It’s expected to roll out by Diwali 2025, turning the festival of lights into a festival of economic clarity.

GST Reshuffle on the Horizon

The GST Reshuffle on the Horizon as Government Considers Retaining Only 5% and 18% Rates is one of India’s boldest tax reforms since GST’s launch in 2017. For consumers, it means lower prices on essentials and easier household budgeting. For businesses, it promises simpler compliance and fewer disputes. For the economy, it’s a calculated bet: trade some short-term revenue for long-term growth. Whether you’re a household shopper, a small business owner, or an industry leader, this reform will shape your daily life.

| Point | Details |

|---|---|

| Main Proposal | Two GST slabs: 5% for essentials, 18% for most goods/services |

| Special Rate | 40% for luxury/sin goods like tobacco and online gaming |

| Impact on Consumers | Cheaper daily essentials; lower burden for households |

| Impact on Businesses | Easier compliance, fewer disputes, better transparency |

| Industries Benefiting | Textiles, health, insurance, agriculture, auto, MSMEs |

| Implementation Timeline | Announced on Aug 15, 2025, expected by Diwali 2025 |

| Official Reference | GST Council Official Portal |

Why India Had Multiple GST Slabs in the First Place?

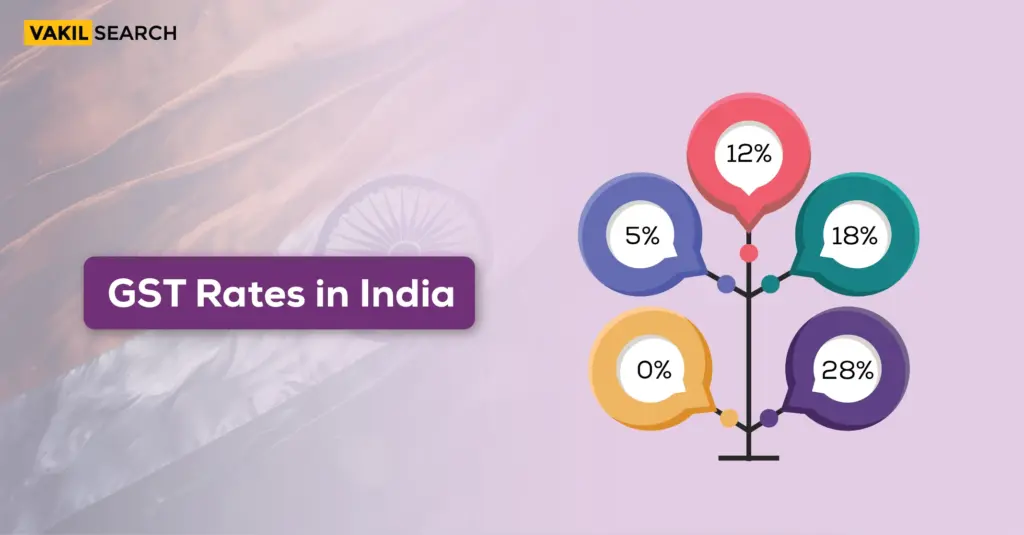

When GST was introduced in 2017, it replaced a jumble of state and central taxes with the idea of “One Nation, One Tax.” But policymakers worried about how a single rate would hit poor households. So, they introduced multiple slabs (5%, 12%, 18%, 28%) to spread the load:

- 5% for essentials like food and medicine.

- 12% and 18% for middle-tier goods.

- 28% for luxury items like cars, air conditioners, and premium electronics.

This looked fair on paper, but in practice, it created confusion and disputes. A classic case: should a paratha (stuffed bread) be taxed like regular bread at 5% or as a processed food at 18%? The courts had to decide. Over time, this complexity made India’s GST compliance one of the most time-consuming in the world.

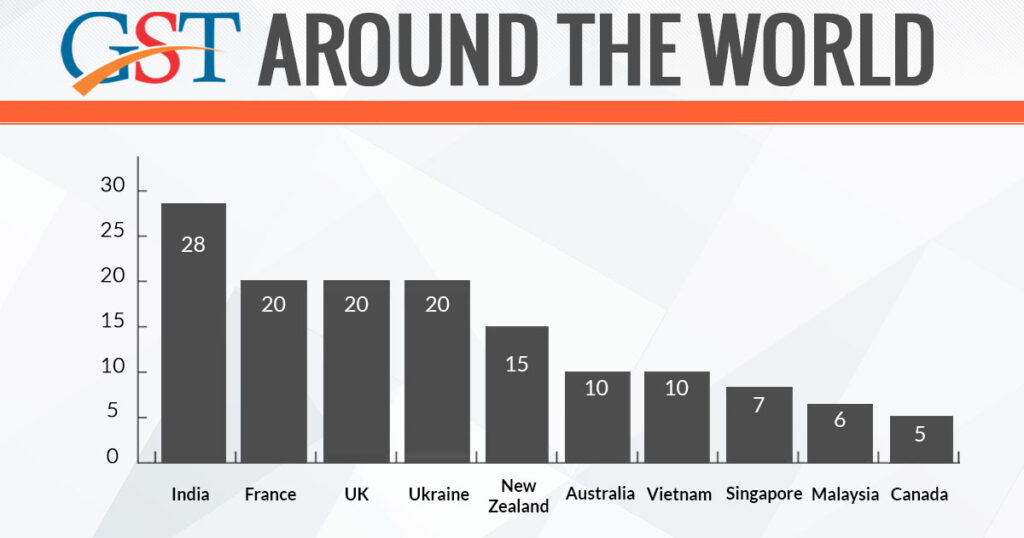

Global Comparisons: What Other Countries Do

India isn’t the first to wrestle with tax simplification.

- Australia: Runs on a flat 10% GST—simple, effective, predictable.

- Canada: Has a federal GST of 5%, plus additional provincial sales taxes.

- European Union: Countries usually run one main VAT rate (15–25%) and one reduced rate for essentials.

By comparison, India’s proposed 5% and 18% structure keeps essentials affordable while still ensuring government revenue. It’s not as lean as Australia’s flat rate, but it’s far less messy than the four slabs we have today.

How the GST Reshuffle on the Horizon Would Work?

Essentials at 5%

This category covers groceries, medicines, farm inputs, and daily-use household items. By reducing or retaining a low tax rate, the government ensures basic affordability for families.

Standard Goods at 18%

Most goods and services will fall here, from electronics to restaurant meals. Businesses will finally have a clear rate to apply, reducing disputes with tax authorities.

Sin Goods at 40%

This special slab is designed to target tobacco, liquor, luxury cars, and online betting. The idea is twofold: discourage harmful consumption while raising revenue without burdening the middle class.

What Shifts Where?

According to government estimates:

- 99% of items under 12% will shift to 5%.

- 90% of items under 28% will shift to 18%.

- Only a handful (around seven products) will move to the 40% category.

That means many consumer goods—shoes, clothing, insurance products, and auto components—will likely get cheaper.

Impact on Consumers

For consumers, the benefit is twofold:

- Lower Costs for Essentials – groceries, medicines, and farm goods will be more affordable.

- Clarity at Checkout – no more confusion between 12% and 18% slabs on similar items.

For example, footwear that previously attracted 12% under ₹1,000 and 18% above that will now be flat 5%. That makes shopping simpler and household budgeting easier.

Impact on Businesses

For businesses—especially MSMEs (micro, small, and medium enterprises)—this reform is a game-changer:

- Reduced compliance costs – fewer disputes about classification.

- Smoother refunds – exporters in particular will benefit.

- Higher transparency – one rate for most goods means fewer loopholes.

Take the restaurant industry. After GST came in, restaurants struggled with changing rates (12%, 18%, 5% with or without input tax credit). A flat 18% rate brings back clarity, ensuring stable pricing for customers.

Industry-Wise Impact

- Textiles & Handicrafts: Moving from 12% to 5% makes Indian goods more competitive globally.

- Healthcare & Insurance: Lower taxes on medicines and premiums expand access.

- Agriculture: Cheaper farm inputs directly support farmers.

- Automobiles & Manufacturing: Dropping from 28% to 18% on components can cut vehicle costs, boosting sales.

- E-commerce: Simplified slabs reduce billing disputes between platforms and sellers.

The Economic Angle

Economists predict the reform may cause a short-term revenue dip for states. But the Centre expects to offset this through:

- Higher compliance – fewer loopholes for tax evasion.

- Increased spending – cheaper essentials mean more money left for discretionary purchases.

- Boosted GDP growth – some experts forecast a 0.5–1% jump in GDP after implementation.

This is essentially a stimulus package before Diwali, designed to encourage households to spend more during India’s biggest shopping season.

State Governments: Concerns and Pushback

Not all states are thrilled. Many depend heavily on GST revenue and worry that lowering rates could cut into their finances. The GST Council, which includes both central and state representatives, will negotiate:

- Revenue compensation: Will the Centre reimburse states for losses?

- Sin goods taxation: Will states get a bigger share of the 40% slab?

These debates could shape how quickly the reform is rolled out.

Consumer Psychology: Why Simpler Taxes Matter

When consumers understand tax rates, they feel more confident spending. Complex slabs create perceptions of unfairness (“Why is a biscuit 18% but bread 5%?”). A simple 5% or 18% choice reduces this friction, encouraging smoother transactions. In behavioral economics, this is known as reducing decision fatigue—making people more likely to spend.

Challenges and Risks

- Short-Term Inflation: Some services may shift upward from 12% to 18%.

- System Overhaul: Businesses will need to update billing, ERP, and invoicing software.

- State Resistance: Without guarantees of revenue compensation, some states may resist implementation.

Practical Checklist: Preparing for GST 2025

For Consumers:

- Track price drops after October.

- Plan big purchases (cars, appliances) around the rollout.

- Use extra savings to diversify spending.

For Businesses:

- Update accounting and billing systems.

- Educate staff on the new structure.

- Reassess pricing—decide whether to pass savings to customers.

For Investors:

- Watch textiles, FMCG, auto, healthcare. These industries are likely winners.

Future Roadmap: What’s Next?

Some experts believe this is just Phase 1 of simplification. Eventually, India could move toward a single GST rate, similar to Australia. That would be the ultimate “One Nation, One Tax” dream. But for now, the two-slab system is a significant leap toward clarity and efficiency.

Apollo Tyres Hit With ₹61.52 Lakh GST Demand Over Ineligible Input Tax Credit

Borrowed Money From a Friend? You Might Be Hit With a Tax Penalty

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know