GST Revenue Hits ₹1.96 Lakh Crore in July: In July 2025, India’s Goods and Services Tax (GST) revenue reached ₹1.96 lakh crore, continuing a solid upward trend in collections. However, there’s a growing concern among economists and business leaders: the growth rate of these collections is slowing down. While this figure reflects a 7.5% year-over-year increase, net revenue (after refunds) grew by only 1.7%, a sharp contrast to previous months. This raises a critical question: Is India’s economic engine losing some steam? Let’s break this down so that everyone — from a student to a seasoned professional — can understand the implications, data, and how businesses can respond.

GST Revenue Hits ₹1.96 Lakh Crore in July

India’s ₹1.96 lakh crore GST collection in July 2025 is a tale of two halves. On the surface, it looks like the economy is rolling strong. But a closer look reveals a slowdown in net revenue, rising refunds, and softening domestic demand. These trends suggest that the government must take bold reform steps to keep the tax ecosystem efficient, business-friendly, and aligned with long-term economic goals. As we approach the festive season and year-end business cycles, all eyes will be on whether India can maintain its GST momentum — or whether more bumps lie ahead.

| Metric | Value | Year-over-Year Growth | Official Source |

|---|---|---|---|

| Gross GST Collection | ₹1.96 lakh crore | +7.5% | Ministry of Finance |

| Net GST Collection | ₹1.69 lakh crore | +1.7% | GST Portal |

| Refunds Issued | ₹27,147 crore | +66.8% | New Indian Express |

| IGST from Imports | ₹1.03 lakh crore | ~+10% | Times of India |

| April 2025 GST Record | ₹2.37 lakh crore | +12.6% | Economic Times |

What Is GST and Why It Matters?

Goods and Services Tax (GST) is a comprehensive, destination-based indirect tax that replaced multiple cascading taxes in India. Think of it like America’s federal sales tax, except GST is uniformly applied across all states, ensuring seamless inter-state trade and removing tax-on-tax effects. When you eat out, shop online, pay school fees, or get a haircut — a portion of that payment goes as GST. This money fuels India’s economy, funding everything from roads to hospitals.

Breaking Down the GST Revenue Hits ₹1.96 Lakh Crore in July

1. Gross vs Net Revenue

India collected ₹1.96 lakh crore in gross GST, an increase of 7.5% from July 2024. However, the net revenue after issuing refunds was only ₹1.69 lakh crore, growing at just 1.7%. This gap points to one big factor: refunds are rising significantly.

2. Refund Explosion

Refunds in July 2025 were ₹27,147 crore, a 66.8% jump from the same period last year. Much of this is due to improved efficiency in processing refunds and an uptick in export-related returns. While this benefits businesses, it does dampen net revenue growth for the government.

3. Domestic vs Import Receipts

Collections from domestic transactions declined by 0.2%, indicating weak internal demand. On the other hand, IGST collected from imports rose by about 9–10%, suggesting that imports are sustaining overall tax momentum. But relying too heavily on imports can skew the tax base and weaken domestic supply chains.

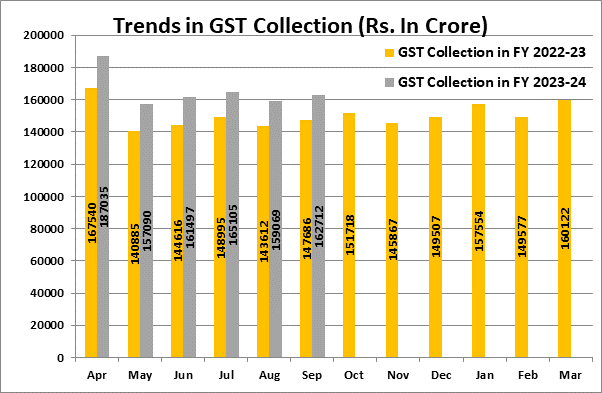

Monthly Trends Comparison

| Month | Gross GST Collection | Net Collection | YoY Growth | Refunds Issued |

|---|---|---|---|---|

| April 2025 | ₹2.37 lakh crore | ₹2.00 lakh crore | +12.6% | ₹22,000 crore |

| May 2025 | ₹1.93 lakh crore | ₹1.72 lakh crore | +10.1% | ₹24,000 crore |

| June 2025 | ₹1.84 lakh crore | ₹1.68 lakh crore | +8.0% | ₹26,000 crore |

| July 2025 | ₹1.96 lakh crore | ₹1.69 lakh crore | +1.7% | ₹27,147 crore |

Structural Issues Under the Surface

Complex Tax Slabs

India’s GST structure is complicated, with four primary slabs: 5%, 12%, 18%, and 28%, plus additional cesses on items like tobacco and luxury cars. This complexity leads to frequent disputes over rate classifications and legal ambiguity.

Input Tax Credit Bottlenecks

Even though businesses can claim Input Tax Credit (ITC) for taxes paid on raw materials, delays, mismatches, and compliance issues often lead to blocked funds. This hampers working capital, especially for small and medium enterprises (SMEs).

Technological Gaps

While GSTN (Goods and Services Tax Network) has improved, it still faces system outages during filing deadlines, glitches in return matching, and difficulties with automated reconciliations. More investment in GST tech infra is needed.

Real-World Example: Textile Exporter in Tamil Nadu

Rajesh Kumar, who runs a medium-sized textile export business in Tirupur, submitted a refund claim of ₹1.3 crore in July 2025. The amount was credited within 30 days — a big improvement from last year. However, his domestic sales dropped 20% due to weak festival-season orders. Rising cotton prices and slower payment cycles are pushing him to rely more on export orders, making GST refunds a lifeline.

What Experts Are Saying

“While the headline numbers seem strong, the net revenue growth is too low for comfort. The government needs to be cautious as domestic consumption softens,” says Dr. Anjali Mehra, an economist with NCAER.

“The focus should now be on simplifying GST rates and ensuring that refund processes continue to improve without compromising fraud detection,” notes Amit Chopra, tax partner at EY India.

Practical Advice for Indian Business Owners

1. Stay On Top of Refund Claims

Late or inaccurate filings can lead to refund delays. Double-check your documentation, reconcile GSTR-2B and 3B, and maintain clean vendor records.

2. Watch for Policy Changes

The GST Council is likely to announce rate slab changes soon. Be prepared to revisit your product pricing and compliance processes.

3. Maintain Liquidity

With rising input costs and delayed payments, keep cash flow planning tight. Don’t depend solely on refunds for working capital.

4. Use GST Software

Modern accounting tools like TallyPrime, Zoho Books, or ClearTax can automate return filing, ITC matching, and flag errors early.

How This Affects the Common Man?

You might think this is just about big business — but here’s how it trickles down:

- Higher GST refunds mean the government has less cash for infrastructure spending.

- Slower domestic demand can lead to job losses or stagnant wages.

- Changes in GST rates could make your essentials costlier or cheaper depending on policy direction.

For example, there’s talk of reducing the 12% slab and merging it with 18%, which could make some appliances, footwear, and services more expensive.

Why Global Investors Are Watching?

For investors from the U.S., UK, and EU, India’s GST trend is a reliable barometer of economic activity. Higher GST collection = more business transactions = healthy growth.

But a slowing net revenue, driven by weakening domestic demand, may signal headwinds in sectors like retail, auto, electronics, and construction. These signals often influence investment inflows, currency movements, and stock market sentiment.

FM Sitharaman Clears the Air on GST Issue for Apartment Associations—What You Need to Know

Manufacturing Activity Soars to 16-Month High, Driving GST Inflow Up by 7.7%

The Road Ahead: Policy Watch

The next GST Council meeting is expected to take place after the monsoon session. Major reforms on the table include:

- Tax slab merger (likely 12% and 18%)

- Simplification of rate structure

- Improved refund verification systems

- E-invoicing expansion to smaller businesses

- Changes in taxation for gig economy and digital platforms

If implemented wisely, these changes could reinvigorate GST growth, reduce compliance burdens, and create a fairer system for everyone.