GST Shake-Up May Cushion Trump’s Tariff Blow: When headlines scream “GST Shake-Up May Cushion Trump’s Tariff Blow,” it feels like déjà vu from the global trade wars of 2018. This time, Donald Trump’s return to tariffs threatens India’s exports. But India isn’t just sitting back—it’s gearing up with a massive GST reform that could keep its economy steady. This story isn’t just about India’s economy. It’s about how U.S. trade decisions ripple across the world, hitting exporters, consumers, and markets. And yes, it matters to everyday Americans too—because tariffs can quietly raise prices on clothes, jewelry, and even your favorite spices at the grocery store.

GST Shake-Up May Cushion Trump’s Tariff Blow

The claim that “GST Shake-Up May Cushion Trump’s Tariff Blow” is more than a catchy headline. It’s a deliberate strategy: offset export pain with stronger domestic demand. By simplifying taxes and cutting rates, India hopes to keep growth near 6% even as U.S. tariffs bite. For Americans, it’s a reminder that global trade is interconnected. Tariffs don’t just hurt exporters abroad—they raise prices at home. For India, GST 2.0 is both an economic shield and a political move, showing resilience in a world where trade wars are far from over.

| Point | Details |

|---|---|

| Main Topic | GST reforms in India (GST 2.0) as a buffer against Trump’s tariffs |

| Growth Impact | GDP may still grow 5.8% in FY25-26, despite tariffs |

| Consumption Boost | Extra ₹5.31 lakh crore (~$64B) demand = 1.6% of GDP |

| Reform Timeline | Expected rollout: October 2025, before Diwali |

| Winners | Automobiles, cement, FMCG (consumer goods) |

| Losers | Export-heavy sectors: textiles, jewelry, leather |

| Official Info | Learn more at Government of India GST Portal |

A Quick History Lesson: GST 1.0 vs GST 2.0

Back in 2017, India launched GST (Goods and Services Tax)—its biggest tax reform in 70 years. Before GST, every state had its own taxes. A truck carrying goods from Delhi to Bangalore had to stop multiple times to pay state-level duties. It slowed trade and raised costs.

GST 1.0 simplified things by replacing dozens of taxes with one nationwide tax. But it wasn’t perfect. There were five different tax slabs (5%, 12%, 18%, 28%, plus exemptions). Businesses complained about paperwork, refunds, and compliance headaches.

Now comes GST 2.0, a leaner version:

- Two main slabs (5% and 18%) for most goods and services.

- 40% “luxury slab” for imported liquor, high-end cars, and luxury watches.

- Simplified compliance and faster refunds for small businesses.

Think of GST 2.0 as a software upgrade: same system, but less lag and fewer bugs.

How Does This Compare to U.S. Taxes?

In the U.S., we don’t have a nationwide sales tax. Instead, we pay state sales tax—anywhere from 0% in Oregon to over 7% in California. That means buying a burger in Texas costs a different tax than in New York.

India’s GST is like a federal sales tax that applies across the country. Whether you buy shoes in Mumbai or Delhi, you pay the same rate. That makes business simpler and supply chains smoother.

For U.S. readers, imagine if sales tax in all 50 states was replaced by one nationwide rate—that’s how big this reform is.

Why GST Reform Now?

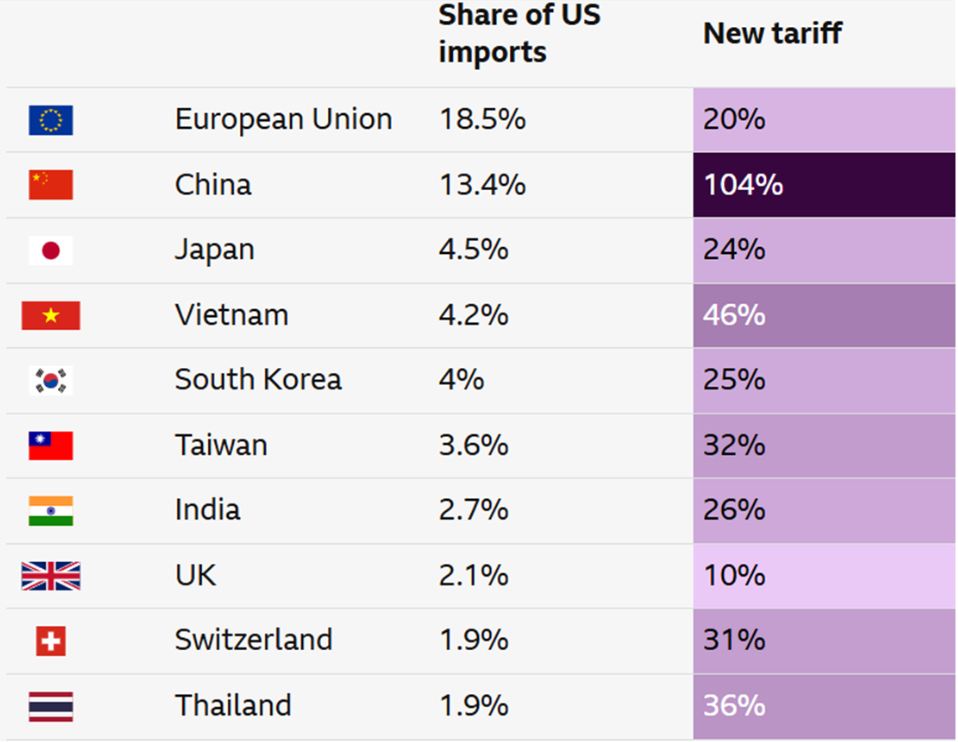

Because tariffs are back on the table. Donald Trump, during his new administration, has revived his tough stance on trade. U.S. tariffs on Indian goods—especially textiles, jewelry, and auto parts—make them more expensive in American stores.

India’s government knows it can’t control U.S. trade policy. So instead, it’s making sure domestic demand picks up the slack. By cutting GST, India hopes people buy more cars, houses, and goods at home, keeping the economy moving even if exports slow.

How GST Shake-Up May Cushion Trump’s Tariff Blow?

Here’s how the math works:

- Tariffs hurt exports. Indian products become costlier in the U.S., leading to fewer sales.

- GST cuts boost local spending. Cheaper goods encourage Indian households to spend more.

- Domestic demand offsets export losses. GDP growth doesn’t crash—it stays steady.

It’s like losing a part-time job but getting a tax break that lets you keep spending.

The Numbers That Matter

- $64 billion (₹5.31 lakh crore): Boost to household spending from GST and tax cuts.

- 5.8% GDP growth: India’s projected growth in FY25-26, even with tariffs.

- 20 basis points: Possible GDP boost from GST simplification alone.

- 67% of economists: Say GST reforms will cushion at least part of tariff damage.

Sectoral Deep Dive: Who Wins and Who Loses?

Winners

- Automobile industry: Maruti Suzuki and Tata Motors expect stronger sales of affordable cars thanks to lower GST.

- Cement and housing: Lower GST fuels construction, benefiting both urban housing and rural infrastructure.

- Consumer goods (FMCG): Cheaper packaged foods, toiletries, and beverages increase sales volume.

Losers

- Export-driven sectors: Textiles, jewelry, and leather exporters face reduced U.S. orders.

- Government finances: Lower GST rates mean lower tax collections. To balance, India must rely on higher consumption and better compliance.

Expert Voices

- HDFC Bank economists: “Tariffs may shave 40 basis points off GDP, but GST cuts could add 20 back.”

- Fitch BMI: Predicts growth of 5.8% in FY25-26, down slightly but resilient.

- Prime Minister Narendra Modi: Promises GST reform will “empower farmers, small businesses, and households,” framing it as both an economic and political move.

Real-Life Example

Take Arvind, a textile exporter from Surat. His U.S. orders dropped 25% after tariffs made his shirts more expensive for Walmart. But thanks to GST cuts, he’s seeing stronger demand at home. Retailers in India are ordering more casual wear, giving him a lifeline.

It’s not a perfect replacement for lost U.S. sales, but it shows how domestic demand can provide a cushion.

The Global Trade Angle

This isn’t just about the U.S. and India. Other countries—Vietnam, Mexico, and even Bangladesh—stand to benefit as American companies look for cheaper suppliers.

The World Trade Organization (WTO) has already warned that new tariffs could destabilize global trade. India’s reforms are a way of hedging bets: building a self-reliant economy that isn’t overly dependent on exports to one market.

Meanwhile, U.S. consumers could feel the pinch too. Higher tariffs mean higher prices at the checkout counter. From jewelry at Macy’s to leather goods on Amazon, Americans may pay more without even realizing tariffs are the reason.

Practical Advice

For Businesses

- Diversify export markets. Don’t rely on the U.S.—explore Europe, ASEAN, and Africa.

- Go digital. GST 2.0 will have stronger digital compliance tools. Invest in tech early.

For Consumers

- Plan big purchases. Buying a car or home appliance? Wait for GST 2.0 rollout around Diwali for better deals.

- Track essentials. Everyday goods like packaged food and toiletries should get cheaper.

For Investors

- Bullish sectors: Automobiles, cement, FMCG.

- Caution sectors: Textiles, jewelry, export-heavy industries.

- Long-term: India remains one of Asia’s fastest-growing economies, even under tariff pressure.

US Abruptly Cancels India Trade Talks Amid Tariff Tensions

Europe Blocks U.S.-Bound Parcels – Tax Rule Change Behind The Move

FHRAI Pushes GST Rationalisation To Boost Indian Tourism Globally