GST Shake-Up May Drive Luxury EV Prices Higher: Electric vehicles (EVs) are the buzz of the decade, promising cleaner air, lower emissions, and a futuristic drive. From city commuters to luxury SUVs, EVs are speeding into Indian garages. But there’s a speed bump ahead. A GST shake-up may drive luxury EV prices higher, potentially reshaping the trajectory of India’s EV market. The Indian government is reportedly planning a change in Goods and Services Tax (GST) rates, specifically targeting premium electric vehicles priced between ₹20 lakh and ₹40 lakh. If implemented, this could mean significantly higher prices for high-end EVs, impacting both consumers and automakers. Let’s take a deep dive into what’s really happening, how it affects you, and what lies ahead.

GST Shake-Up May Drive Luxury EV Prices Higher

The potential GST shake-up on luxury EVs represents a strategic pivot in India’s electric mobility roadmap. By realigning tax incentives, the government aims to push affordability, scale, and equitable access to green transportation. However, the trade-off may be slower adoption among premium buyers and cautious expansion by global automakers. For now, if you’re in the market for a luxury EV, it might be time to act fast before the new rates kick in. For the rest, the EV dream continues — just on a different lane.

| Key Point | Data/Stat | Insight |

|---|---|---|

| Proposed GST Hike | From 5% to 18%, maybe 28% | Applies to EVs priced ₹20L–₹40L |

| Budget EVs | Remain at 5% GST | No change for mass-market EVs |

| ICE Cars | Small ICE cars may drop from 28% to 18% | Could narrow EV cost advantage |

| Luxury ICE Cars | From ~50% to 40% GST | Slight relief, still premium-priced |

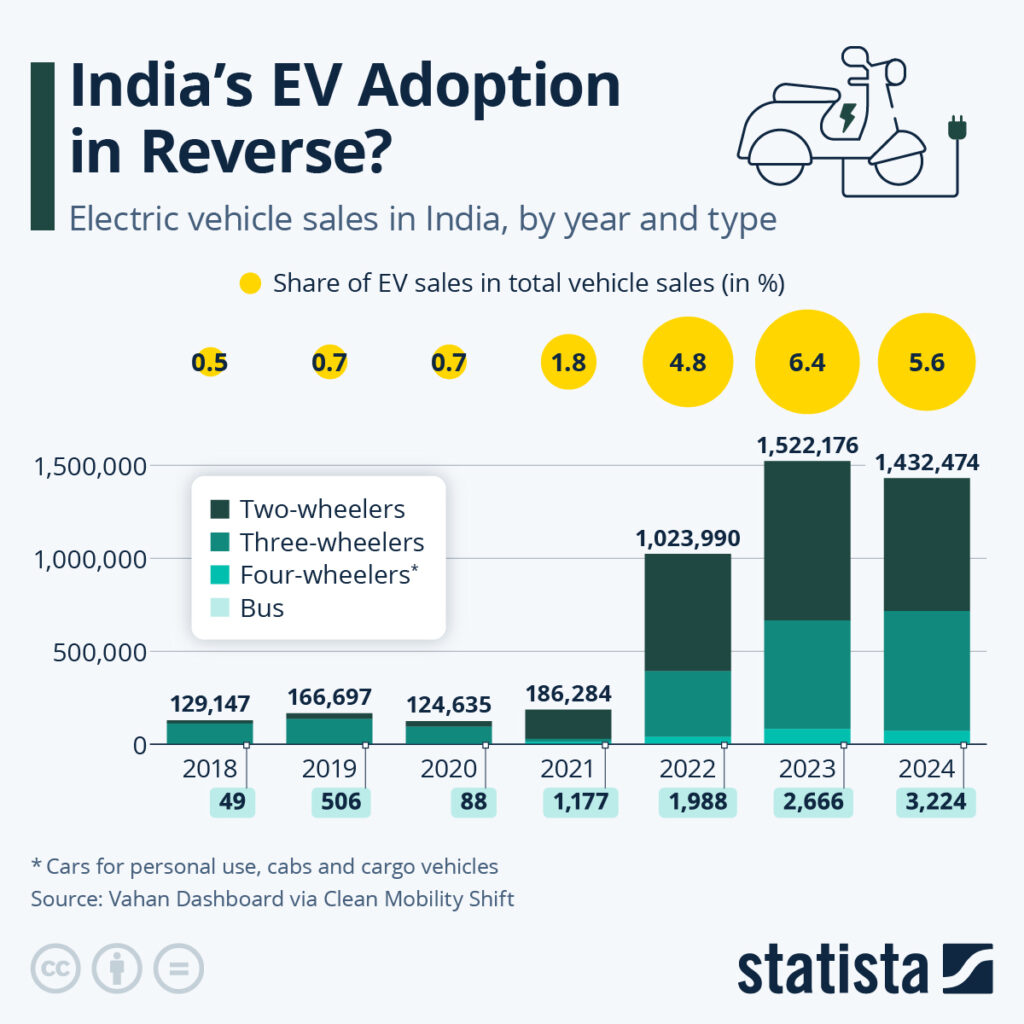

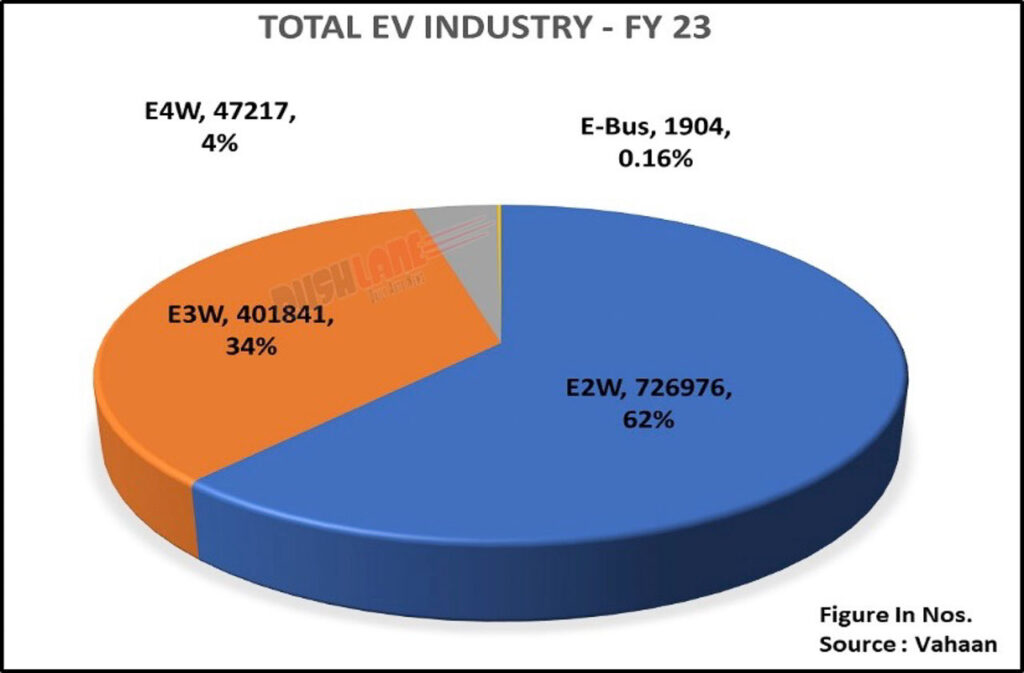

| EV Market FY24 | 1.7M+ units sold | Only 6% were luxury EVs |

| Policy Source | GST Council Website | Official announcements pending |

What Is the GST Shake-Up?

At present, India levies a flat 5% GST on all electric vehicles, regardless of price segment. This has helped create an even playing field, supporting both budget and luxury EV buyers. However, policymakers now believe that this blanket approach disproportionately benefits luxury EV buyers—who arguably don’t need taxpayer support.

The GST Council, India’s apex tax decision-making body, is considering:

- Increasing GST on EVs priced ₹20–₹40 lakh from 5% to 18%

- Possibly imposing a 28% GST slab for ultra-luxury EVs (above ₹40 lakh)

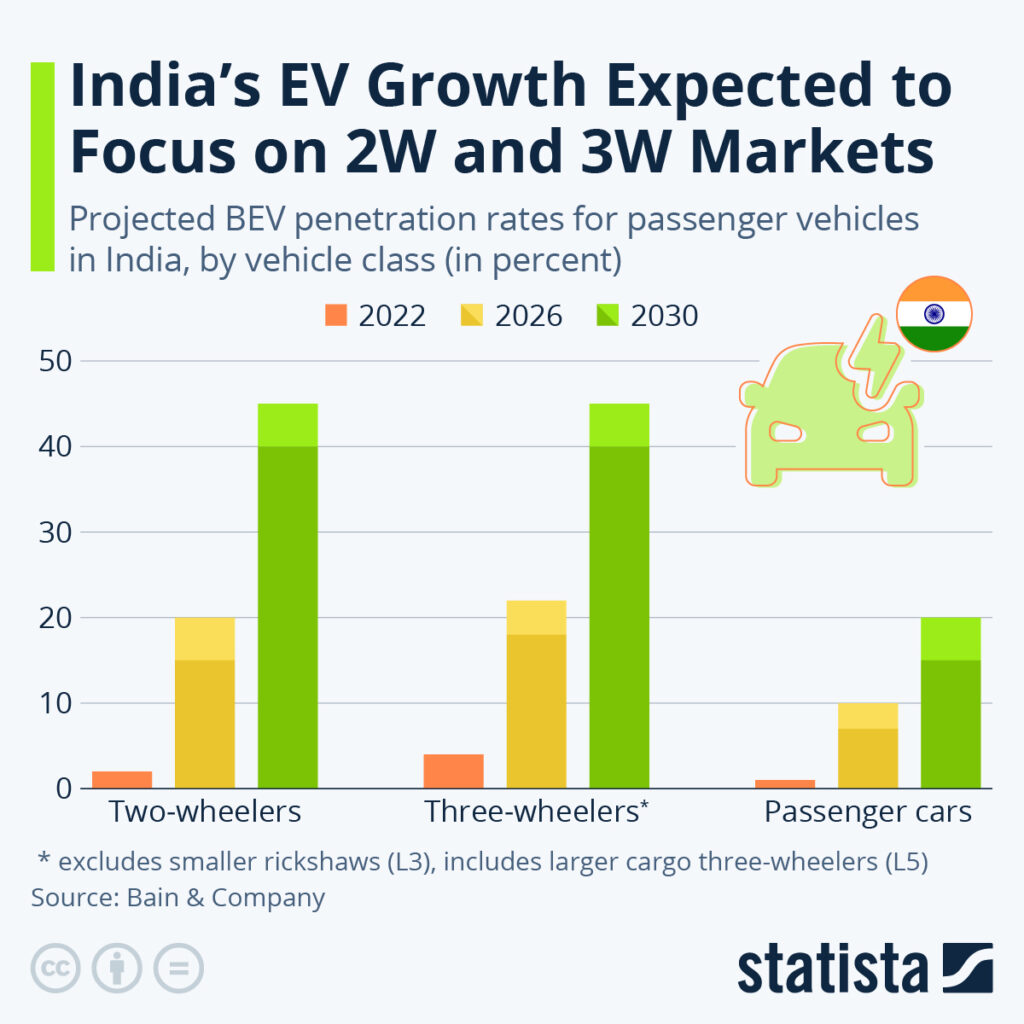

- Retaining 5% GST for two-wheelers, three-wheelers, buses, and budget EVs

The goal? Create a tiered taxation system that encourages adoption among the masses while withdrawing blanket benefits for high-income buyers.

Why the Change? Government’s Rationale

This isn’t just a tax story—it’s about policy priorities.

India’s EV policy ecosystem—rooted in the National Electric Mobility Mission Plan (NEMMP) and executed through the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) schemes—has aimed to accelerate green mobility, reduce dependence on imported fuels, and cut down on air pollution.

But there’s growing concern within the Finance Ministry and NITI Aayog that:

- A 5% GST on all EVs creates an equity problem

- Limited fiscal resources should be used where they make the biggest difference

- Luxury EV buyers—think Audi e-tron or BMW iX—aren’t the intended beneficiaries

In short, the government wants to focus incentives on middle-income consumers, where adoption still lags but potential is high.

Real-World Example: Price Implications

Let’s say you want to buy a Hyundai Ioniq 5, which currently costs around ₹46 lakh.

- With 5% GST: The tax component is ₹2.3 lakh

- With 18% GST: That rises to ₹8.28 lakh

- With 28% GST: You’re looking at ₹12.88 lakh in GST alone

That’s a difference of ₹6–₹10 lakh, which could significantly alter consumer interest and push potential buyers back to ICE alternatives.

Impact of GST Shake-Up May Drive Luxury EV Prices Higher on Brands and Launch Plans

This potential GST overhaul doesn’t just rattle wallets—it affects strategy too. Here’s how various automakers are impacted:

Tesla

Tesla’s India entry has long been delayed by import duties. With new tax uncertainty around luxury EVs, Tesla’s Model Y and Model 3—already expected to be priced in the ₹40–₹70 lakh range—may face further hesitation from the brand to launch at scale.

Kia and Hyundai

Kia’s EV6 and Hyundai’s Ioniq 5, both imported under the CBU (completely built unit) route, would become more expensive. This could affect sales momentum just as these models gain visibility.

Mercedes-Benz, Volvo, BMW

These brands sell premium EVs—like the EQB, XC40 Recharge, and i4—mostly in the ₹50–₹90 lakh range. The increase in GST could delay portfolio expansion or force pricing realignment.

Tata and Mahindra

Ironically, these homegrown players could benefit. Their EV lineups, such as Tata Nexon EV and Mahindra XUV400, are priced under ₹20 lakh and retain the 5% GST, giving them a clear price advantage.

The Small ICE Car Factor

Adding fuel to the fire, the same GST Council meeting may also cut GST on small petrol and diesel cars (under 4 meters, under 1.2L engine) from 28% to 18%. This is meant to boost consumption in India’s slowing auto sector.

This means models like:

- Maruti Swift

- Hyundai i10 Nios

- Tata Punch

…might suddenly become more price-competitive with entry-level EVs, potentially shifting buyers back to ICE vehicles.

How Will This Affect India’s EV Adoption Targets?

India has committed to achieving 30% EV penetration by 2030 for private vehicles. While the luxury segment contributes to innovation, volumes remain low—just 5–6% of all EV sales.

But luxury EVs have been:

- Image drivers of the EV movement

- Technology leaders introducing advanced features like Level 2 ADAS, fast charging, and range optimization

- Influencers of upper-middle-class adoption in urban centers

A GST hike could slow that momentum, at least temporarily.

The Bigger Risk?

A confusing or abrupt tax change can create uncertainty in the market, slowing investment and discouraging long-term commitments from global brands.

International Examples: What Other Countries Are Doing

To put things in perspective, let’s compare India’s evolving approach with global policies.

| Country | EV Tax Policy | Key Insight |

|---|---|---|

| Norway | 0% VAT + perks | EVs outsell ICE; massive success |

| US | Up to $7,500 federal tax credit | State subsidies enhance appeal |

| Germany | EV subsidy of up to €6,750 | Clear focus on transition |

| China | EVs exempt from purchase tax | Largest EV market globally |

| India | 5% GST on all EVs (possibly changing) | Focused shift toward affordability |

India’s move may seem regressive, but it’s aligned with a global trend toward targeted incentives rather than blanket subsidies.

Consumer Psychology: The Real Impact

Car buying in India is driven by a mix of:

- Price sensitivity

- Status aspirations

- Fuel cost calculations

Raising GST on luxury EVs could:

- Dampen impulse purchases

- Reinforce the idea that EVs are only for the wealthy

- Shift upper-middle-class buyers back toward hybrid or ICE alternatives

It also raises a messaging problem—is India still committed to promoting EVs across the board?

Practical Advice for Consumers

Here’s what to keep in mind if you’re in the EV market:

1. Buy Before September 2025

The 56th GST Council meeting is expected to happen in early September. If you’re eyeing a luxury EV, complete your purchase soon to avoid price increases.

2. Compare Total Cost of Ownership (TCO)

Remember, EVs still save you money in the long run. Factor in:

- Fuel savings (₹3–5 per km vs ₹8–12/km for petrol)

- Lower maintenance costs (no oil, fewer moving parts)

- State and central subsidies

3. Stay Updated via Official Channels

Bookmark the GST Council website and follow auto news platforms for timely updates.

Expert Opinions: What the Industry Is Saying

Anjali Mehra, Auto Journalist:

“The EV dream is alive, but this move shows India is rethinking who gets to ride first.”

Dr. Arvind Menon, Policy Analyst:

“We need equitable electrification. Subsidizing a ₹70 lakh car makes no sense when rural adoption is near zero.”

Rahul Bhasin, Tata Motors Executive:

“Tiered GST helps us reach the real market—mass users, fleet buyers, and urban two-wheeler users.”

Coimbatore Trade Bodies Petition CM Against State GST Harassment

₹500 Crore GST Scam Busted in Guwahati, Four Held

Thane Man Arrested in Massive ₹47 Crore GST Credit Fraud Scheme