GST Shake-Up Sparks Tensions Between Centre and States: When we talk about India’s Goods and Services Tax (GST), most people’s eyes glaze over like it’s just another boring tax policy. But trust me, the latest GST shake-up is a big deal—and it’s stirring up a family feud between the Centre (that’s the federal government) and the states. The question everyone’s asking: Can the massive revenue gaps be bridged, or are we heading into deeper financial drama? At its heart, this battle isn’t just about numbers on a spreadsheet. It’s about everyday folks—shopkeepers, truck drivers, factory workers—and whether states will have enough money to fund schools, hospitals, and infrastructure. So let’s break it down step by step, in plain English, with the facts, the politics, and what it means for you and me.

GST Shake-Up Sparks Tensions Between Centre and States

The GST shake-up is like rearranging the furniture in a crowded living room—yes, it looks cleaner, but somebody’s toes are getting stepped on. The Centre is betting on long-term gains from higher consumption, while the states are stuck worrying about short-term survival. Bridging the gap will require more than political sweet talk. It’ll take transparent sharing of new levies, temporary compensation, and a genuine spirit of cooperative federalism. If both sides don’t compromise, India’s biggest tax reform risks becoming a family feud that nobody wins.

| Topic | Details |

|---|---|

| GST Change | 12% and 28% tax slabs scrapped, now just 5%, 18%, and 40% for luxury/sin goods |

| Revenue Loss | Estimated $20 billion (₹1.8 lakh crore) annual shortfall |

| State Impact | States could lose up to 0.36% of GDP; some shortfalls ₹7,000–9,000 crore yearly |

| Centre’s Claim | Higher consumption will offset losses; fiscal deficit target still 4.4% |

| Possible Fixes | Extra excise on tobacco/luxury goods, extension of compensation cess, special grants |

| Official Source | GST Council – Ministry of Finance, Govt. of India |

A Quick Throwback: Why GST Was Born

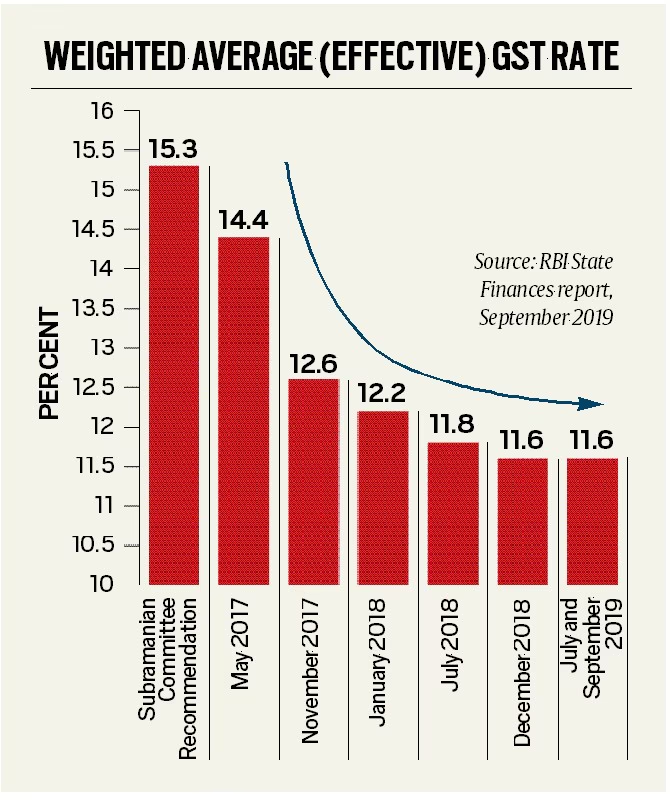

Before GST came into play in 2017, India’s tax landscape looked like a messy buffet—excise duty, service tax, VAT, entry tax, luxury tax… the list went on. Businesses complained of double taxation, complicated paperwork, and states fought with the Centre over who taxed what.

GST was sold as the “One Nation, One Tax” dream—cutting red tape, reducing corruption, and making interstate trade smoother. And for a while, it worked. Tax compliance improved, and India’s rank in “ease of doing business” got a bump.

But like any reform, GST came with growing pains, especially for states dependent on high-tax items like liquor and fuel (which, by the way, are still outside GST).

Why the GST Shake-Up Sparks Tensions Between Centre and States Matters Today?

Earlier, India had multiple GST “slabs”—5%, 12%, 18%, and 28%. Now the Centre wants to simplify things by cutting out the 12% and 28% rates, leaving only:

- 5% for essentials (food staples, medicines, etc.)

- 18% for most goods and services (like electronics, clothing, restaurants)

- 40% “super tax” for luxury and sin items (tobacco, high-end cars, etc.)

The upside? Easier compliance and possibly cheaper goods for consumers. The downside? States are staring at a gaping hole in their budgets.

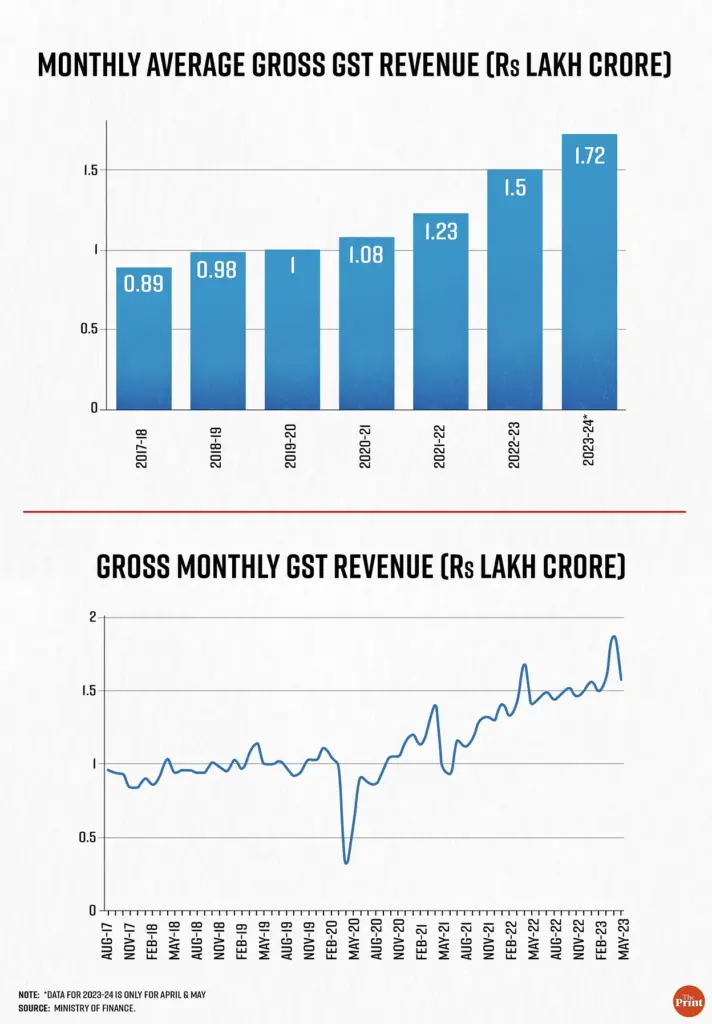

The Money Gap: How Big Is It?

This isn’t pocket change we’re talking about. According to Reuters, the total hit from this GST cut could be around $20 billion a year (about ₹1.8 lakh crore).

- Punjab says it’s owed about ₹60,000 crore in pending dues.

- Some states could see ₹7,000–9,000 crore vanish from their yearly budgets.

- Analysts at CRISIL predict overall state revenues could shrink by 0.36% of GDP.

That’s like taking away an entire year’s education budget for some states.

Real-World Examples

- A car dealership in Chennai selling SUVs that used to be taxed at 28% will now see only 18% GST. Good news for buyers, but Tamil Nadu loses a huge chunk of tax money.

- A cement factory in Rajasthan faces lower taxes, boosting construction, but the state loses revenue for its social welfare schemes.

- A shopkeeper in Punjab may cheer cheaper appliances, but his state government may cut back on local development funds.

These aren’t just numbers. They’re choices between building roads and paying pensions.

Centre vs. States: Who’s Got the Better Argument?

The Centre’s View

The federal government says, “Chill, we got this.” They argue:

- States already get 41% of the divisible tax pool.

- Simplified GST will boost consumption in the long run.

- Fiscal deficit target of 4.4% will be met.

They’re also floating ideas like a special excise duty on tobacco to cover the losses.

The States’ Counter

States aren’t buying it. Their worries:

- Immediate shortfall: Salaries and welfare can’t wait for long-term growth.

- Trust deficit: GST compensation ended in 2022, leaving states feeling cheated.

- Unequal burden: Wealthier states cope better; poorer states suffer.

International Comparison

- Australia rolled out GST in 2000 with heavy initial compensation packages for states, phased out later.

- Canada uses a mix of federal and provincial GST/HST rates, giving provinces flexibility.

- The European Union applies VAT with uniform minimum standards, but allows member states to tweak within ranges.

The big takeaway? Successful tax reforms always included transitional support to keep states on board.

Possible Ways to Bridge the Revenue Gap

- Targeted Excise or Special Levies – “sin taxes” on tobacco and luxury cars.

- Extension of the Compensation Cess – reviving it until consumption-driven revenue kicks in.

- Direct Grants or Budgetary Support – central government paying states during transition.

- Expanding GST Base – encouraging compliance from small businesses, digital firms, and gig platforms.

Impact on Businesses and Consumers

- Businesses/SMEs: Less paperwork, fewer disputes, better cash flow. But some sectors (like tobacco) may face higher costs.

- Consumers: White goods, cement, and cars could get cheaper; luxury items pricier.

- Corporate Sector: Will welcome simplified compliance, but worry about uncertainty in tax policy shifts.

Practical Advice

- For Businesses:

- Recalculate pricing strategies under new slabs.

- Track GST Council updates closely.

- Use professional accounting software to stay compliant.

- For Consumers:

- Expect some prices to dip (cars, cement).

- Budget extra for luxury goods.

- For Professionals (CA/Finance folks):

- Demand for advisory services will grow—opportunity alert!

- Stay updated on GST Council rulings.

Career & Professional Angle

If you’re in finance, accounting, or policy analysis, this shake-up is a goldmine for expertise. Businesses will need advisors to:

- Interpret GST Council notifications.

- Design compliance strategies.

- Forecast sector-specific impacts.

For professionals, brushing up on GST nuances can open consulting gigs, corporate jobs, and even policy research opportunities.

Income Tax Bill 2025 Brings No Rate Hike – But Here’s The Catch

Trump’s Tax Credit Shock Isn’t As Bad As Feared – Solar Stocks Surge Big

GST Collections Unveil Shocking Cultural Shifts Across Indian Districts

Looking Ahead: The Road to GST 2.0

The Centre calls this reform GST 2.0. It’s ambitious, but also risky. If handled well, it could boost compliance and fuel consumption. If botched, it could strain Centre-state relations and slow down welfare spending.

The GST Council will be the battleground for these negotiations. States will push for stronger compensation mechanisms, while the Centre will emphasize long-term gains. For India’s economy, the outcome will shape fiscal stability for years.