GST Slashed To Just Two Rates: India has rolled out one of its boldest tax reforms yet: GST slashed to just two rates, with 99 percent of items set to get cheaper by Diwali 2025. This reform is being dubbed “GST 2.0”, a move designed to make life simpler for businesses and lighten the load on consumer wallets just in time for the festive season. Whether you’re a small business owner, a consumer shopping for Diwali deals, or a professional tracking the economy, this change has wide-reaching implications. In this article, we’ll unpack what the reform means, why it matters, and how it could reshape India’s economic landscape.

GST Slashed To Just Two Rates

India’s GST 2.0 reform—cutting slabs from four to two—is one of the boldest fiscal moves since GST’s original launch in 2017. With 5% and 18% as the new primary rates, and a 40% slab reserved for luxury and harmful goods, the reform balances affordability, simplicity, and fairness. For households, this Diwali brings not just lights and celebrations but real savings. For businesses, it signals easier compliance and potential growth. And for India’s economy, it represents a step closer to global tax standards, with the promise of higher long-term growth.

| Point | Details | Source |

|---|---|---|

| New GST Structure | Only two main slabs: 5% and 18% | Gov.in Official Site |

| Special Rate | 40% GST on “sin” goods (like tobacco, pan masala, betting) | Indian Express |

| 99% of Items Cheaper | Most goods in 12% slab moved to 5% | Financial Express |

| Biggest Impact | Food, daily essentials, consumer goods, MSMEs | Reuters |

| Timeline | To roll out by Diwali 2025 after GST Council approval | Business Standard |

What Is GST and Why Does It Matter?

Goods and Services Tax (GST) is a unified tax system introduced in 2017 to replace a patchwork of state and central taxes. Before GST, businesses had to deal with sales tax, VAT, excise duty, and service tax separately, leading to confusion and inefficiency.

GST simplified this into a single nationwide system, but with multiple slabs (5%, 12%, 18%, 28%), businesses still struggled with compliance and classification disputes. By reducing slabs to just two, the government aims to make the system leaner, easier, and consumer-friendly.

The Big Change: GST Slashed To Just Two Rates Instead of Four

Previously, India’s GST had four slabs: 5%, 12%, 18%, and 28%, plus cess charges on luxury and sin goods.

Under GST 2.0:

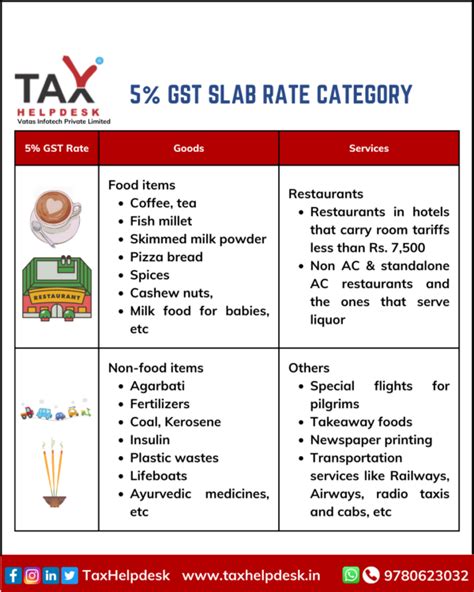

- 5% slab: For essentials and widely used consumer items.

- 18% slab: For most goods and services.

- 40% slab: For luxury or harmful items (sin goods).

This shift means fewer disputes, smoother compliance, and more predictable pricing.

What’s Getting Cheaper This Diwali?

The most significant savings will be felt in everyday purchases:

- Food and Household Products: Packaged foods, biscuits, and cleaning items moving from 12% ➝ 5%.

- Clothing and Footwear: Affordable apparel, shoes, and accessories see tax relief.

- Electronics and Appliances: Many products once under 28% are dropping to 18%, making big-ticket buys cheaper.

- Consumer Goods: Shampoo, toothpaste, soaps, and packaged snacks will get more affordable.

For a family shopping for Diwali, these savings can add up substantially, putting more money back into pockets.

What Stays Expensive?

The government is keeping luxury and harmful goods under heavy taxation. These include:

- Tobacco and Pan Masala – 40% GST.

- Online Gaming and Betting – 40% GST.

- Luxury Cars, High-End Jewelry, and Premium Alcohol – continue to face steep taxation.

This approach ensures affordability for essentials, while encouraging responsible consumption of luxury or harmful goods.

Why Did the Government Do This?

The motivations behind this reform are both economic and political:

- Simplification – Reducing four slabs to two makes compliance easier for businesses, especially small and medium enterprises.

- Boosting Consumption – Lower prices encourage households to spend more, stimulating demand.

- Encouraging Compliance – Fewer slabs mean fewer loopholes and misclassifications.

- Festive Timing – Launching during Diwali, India’s biggest shopping season, maximizes impact and goodwill.

- Long-Term Growth – By making the system easier, India becomes more attractive to global investors.

A Quick History of GST Reforms

Since its rollout in 2017, GST has seen several revisions:

- 2018: Over 350 items moved from 28% ➝ 18%.

- 2019: Hotel tariffs rationalized to encourage tourism.

- 2020: COVID-era relief on masks and sanitizers.

- 2023: GST on online gaming and digital services introduced.

This new 2025 reform is the biggest overhaul since the original launch, making GST more practical for everyday use.

Global Comparison: How Does India Stack Up?

Understanding India’s GST in global context helps highlight its significance:

- USA: Relies on state-level sales tax, ranging from 4% to over 9%, leading to inconsistencies across states.

- European Union (EU): VAT rates between 17% and 27%.

- Canada: GST is 5% nationwide, with some provinces adding extra taxes.

- Australia: Uniform GST of 10%.

India’s new two-slab structure (5% and 18%) puts it closer to international best practices, while balancing affordability and revenue.

Impact on Key Sectors

Different industries will feel this reform differently:

FMCG (Fast-Moving Consumer Goods)

Companies like Nestlé, HUL, and ITC will benefit as essentials get cheaper, boosting demand.

Automobiles

Mid-range cars may get cheaper as the 28% slab shifts to 18%, potentially reviving the auto sector.

Textiles and Clothing

Affordable fashion becomes more accessible, which could strengthen India’s exports and retail markets.

Startups and MSMEs

Small businesses gain most from reduced complexity, boosting compliance and growth.

Digital Economy

Online gaming faces a 40% tax hit, signaling stricter regulation of the fast-growing sector.

Challenges and Criticisms

While widely welcomed, challenges remain:

- Revenue Losses – States worry about losing money in the short term due to lower tax rates.

- Implementation Hurdles – Updating billing software, invoices, and systems will take time.

- Not True “One Nation, One Tax” – Critics argue multiple slabs still create complexity.

- Consumer Expectation Management – Not all items will get cheaper, and luxury goods remain taxed heavily.

The government has promised to compensate states for revenue losses, but debates will continue.

Expert Opinions

- Prime Minister Narendra Modi: Called the reform “a Diwali gift for every Indian household.”

- Economists: Many predict a 10–12% rise in consumption in FMCG and retail.

- Industry Leaders: FMCG and auto giants see this as a growth catalyst.

- State Leaders: Some remain cautious about short-term revenue dips.

Practical Tips for Businesses

Businesses must prepare early for smooth adoption:

- Update Billing Software – Ensure accounting systems reflect new slabs.

- Reclassify Goods – Identify products that moved from 12% ➝ 5%.

- Train Staff – Educate employees about the new rates.

- Communicate with Customers – Highlight lower prices as a selling point.

- Monitor GST Portal – Stay updated with official notifications.

Step-by-Step Guide: How GST Reform Affects You

- Consumers – Expect cheaper groceries, clothing, and household goods.

- MSMEs – Reduced tax burdens and compliance stress.

- Professionals – More demand for accountants, consultants, and GST experts.

- Investors – Sectors like FMCG, retail, and auto likely to gain.

- States – Adjust budgets to account for temporary revenue dips.

Caught Profiteering! Subway Franchise Penalized ₹5.45 Lakh for Withholding GST Rate Cut Benefits

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Centre Plans Major GST Overhaul — Four Slabs May Shrink to Just Two