GST Sleuths Bust Electronics Firm: When headlines announce “GST sleuths bust electronics firm in ₹5 crore tax fraud,” it may sound like one more story in the endless stream of business scandals. But this case isn’t just about corporate mischief. It highlights the loopholes that fraudsters exploit, the vigilance of enforcement agencies, and why tax compliance matters for businesses, governments, and everyday citizens alike. In India, the Goods and Services Tax (GST)—introduced in 2017—was hailed as the biggest tax reform since independence. It merged a tangled web of state and central taxes into one streamlined system, designed to make business easier and tax collection smoother. But, as with any system, some players have tried to game the rules. The recent ₹5 crore GST fraud involving an electronics firm shows exactly how.

GST Sleuths Bust Electronics Firm

The case of GST sleuths busting Epack Durable Ltd for ₹5 crore in fraud is more than just a scandal. It’s a reminder that compliance is non-negotiable, enforcement is getting smarter, and fraud has consequences far beyond balance sheets. For businesses, it’s a wake-up call: transparency and proper documentation aren’t optional. For consumers, it shows that vigilance matters—because tax fraud robs everyone of resources. In the end, building a fair economy depends on shared responsibility, accountability, and trust.

| Aspect | Details |

|---|---|

| Case | GST sleuths bust Epack Durable Ltd for ₹5 crore tax fraud |

| Scheme | Forged transport records, fake input tax credit (ITC) claims |

| Period | Last 3 financial years |

| Amount Paid Back | ₹1.85 crore during investigation |

| Enforcement | 8 GST teams, led by Joint Commissioner SIB Ajay Kumar |

| Industry Impact | First major electronics GST enforcement this fiscal year |

| Reference | Goods & Services Tax India – Official Portal |

The Company at the Center

The business under scrutiny is Epack Durable Ltd, part of the well-known EPACK Group. Headquartered in Noida, the group has sprawling plants in Uttarakhand, Rajasthan, and Andhra Pradesh. They’re not an obscure player: their factories manufacture goods for some of the world’s top consumer brands like Daikin, Haier, and Panasonic.

This isn’t a struggling start-up trying to cut corners. This is a seasoned manufacturer that supplies to multinational corporations, proving that tax fraud isn’t just a small-business problem—it happens at the top too.

The Alleged Scheme

According to investigators, Epack engaged in forging transportation records to make it appear that goods were being shipped across state lines. These fake records created the illusion of legitimate business transactions, allowing the company to claim Input Tax Credit (ITC).

Here’s how it worked:

- Paper Movement, Not Actual Movement – The company allegedly declared that trucks loaded with goods were passing through toll plazas. But when authorities checked toll data, the trucks never appeared.

- Claiming Fake ITC – Based on these false records, Epack claimed GST input credits, which reduced their tax liability by crores.

- Prolonged Duration – This wasn’t a one-time slip. Officials say the fraud went on for at least three years.

By the time sleuths swooped in, the damage was pegged at ₹5 crore. During the raids, the company admitted irregularities and paid ₹1.85 crore immediately.

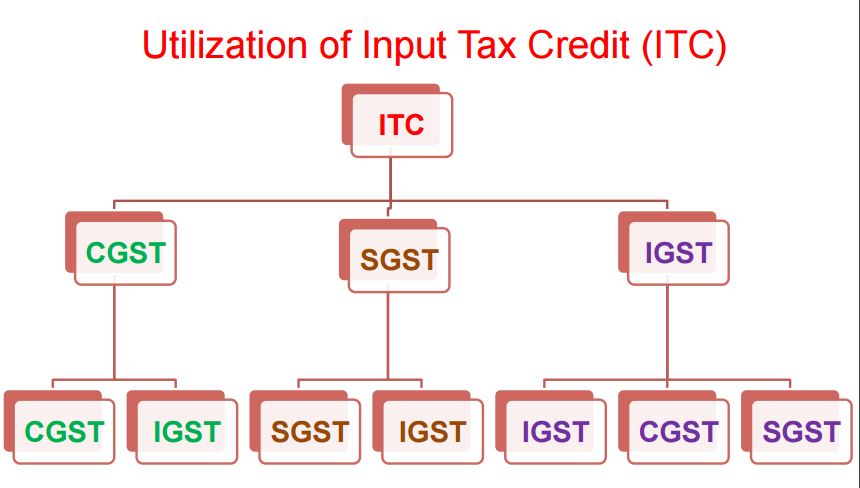

Understanding Input Tax Credit (ITC)

If you’re scratching your head at this point, let’s break it down simply.

- Suppose you own a small shop selling washing machines.

- You buy machines from a wholesaler, paying GST upfront.

- Later, you sell those machines to customers, charging them GST.

- Instead of paying GST twice, the system lets you deduct the tax you already paid from the tax you collected. That deduction is called Input Tax Credit.

The system is fair—when used correctly. But if someone claims ITC without actually buying or transporting goods, it becomes free money stolen from the government.

Why GST Sleuths Bust Electronics Firm Matters?

Fraud of this kind hurts more than just government revenue. It undermines the entire system:

- Erodes public trust: Citizens expect businesses to play fair.

- Unfair competition: Honest businesses shoulder their tax burden while fraudsters slash costs by cheating.

- Loss of development funds: Every rupee lost in tax fraud is one less for highways, schools, and hospitals.

- Signals stricter enforcement: Authorities are now using advanced analytics, toll data, and e-way bill reconciliation to catch offenders.

Legal Consequences

The Central Goods and Services Tax Act, 2017 is tough on fraud:

- Section 122: Monetary penalty equal to the amount of tax evaded.

- Section 132: Willful tax evasion can lead to imprisonment of up to 5 years.

- Interest Liability: Offenders must pay 18% annual interest on delayed amounts.

So, fraud isn’t just an accounting error—it can put executives behind bars.

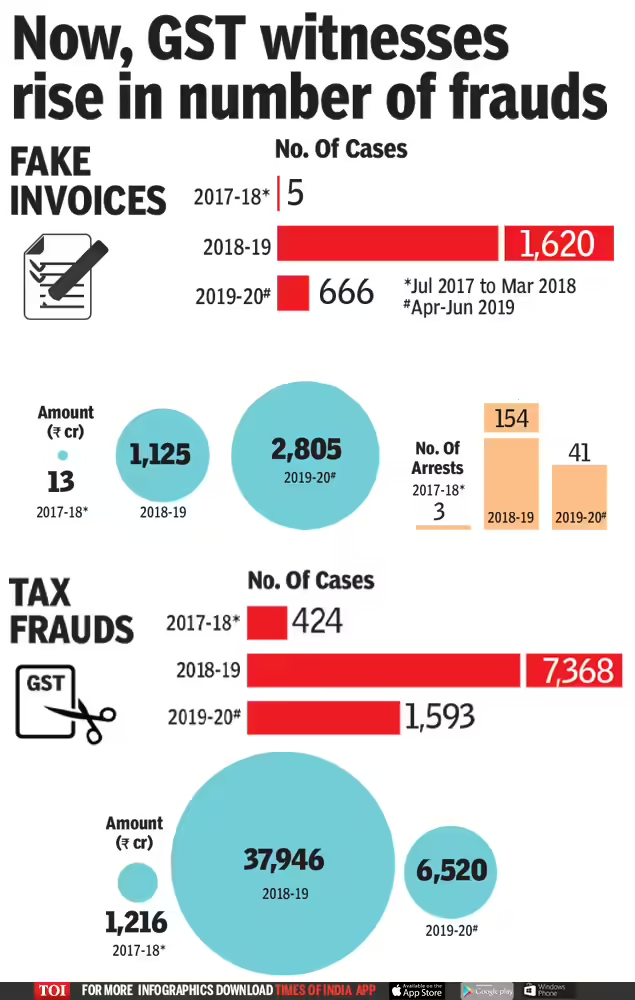

The Bigger Picture: India’s GST Fraud Problem

The scale of GST fraud in India is staggering. According to Business Standard, enforcement agencies detected ₹7.08 trillion in GST evasion between 2017 and 2022. Out of this, ₹1.79 trillion was linked to fake ITC claims.

To put that in perspective, this amount is larger than the annual education budget of India. That’s how serious the problem is.

Global Comparisons

India isn’t alone in battling such frauds.

- United States: The IRS regularly busts businesses for misusing tax credits. Penalties can include fines up to 75% of the unpaid tax and criminal charges.

- Europe: VAT fraud costs the European Union nearly €50 billion annually, prompting strict cross-border audits and real-time invoice reporting.

These examples show that tax fraud is a global challenge—and that technology-driven enforcement is the new norm.

Impact on Consumers

Even if you’re not a business owner, you’re not immune to the effects:

- Higher prices: Fraudulent companies may undercut rivals temporarily, but enforcement costs eventually get baked into the market.

- Reduced services: Less tax revenue means fewer government services.

- Trust deficit: When big companies cheat, consumer faith in brands takes a hit.

Practical Lessons for Businesses

This case offers important lessons for entrepreneurs and managers:

- Maintain Authentic Records – Keep genuine invoices, transport slips, and e-way bills.

- Use Reliable GST Software – Cloud-based solutions prevent errors and sync with official portals.

- Audit Regularly – External audits catch issues before enforcement agencies do.

- Train Staff – Mistakes by employees can escalate into fraud allegations.

- Avoid Shortcuts – Compliance might feel expensive, but fraud is costlier.

What Ordinary Consumers Can Do

Yes, even customers can play a role in reducing fraud:

- Always ask for a GST invoice when you buy goods.

- Check the seller’s GSTIN on the official portal.

- Report suspicious billing practices to GST helplines.

This ensures your money contributes to the system, not fraudsters’ pockets.

Thane Man Arrested in Massive ₹47 Crore GST Credit Fraud Scheme

₹50 Crore GST Fraud Busted In Mumbai – Two Directors Arrested In Mega Scam

₹50 Crore GST Scam Busted: Two Mumbai Businessmen Arrested in Massive Tax Fraud

A Real-World Analogy

Think of a local grocery store. You pay them for milk, and they’re supposed to pass the tax portion to the government. Now imagine the storeowner never actually buys the milk but still issues bills showing he did—claiming credit for tax he never paid. That’s what happened here, just on a much bigger corporate scale.

Expert Insights

Tax professionals and auditors emphasize that GST compliance isn’t optional anymore. According to a Deloitte report, automated GST analytics have improved detection rates by nearly 30% since 2020. Chartered Accountants warn that “fake ITC is the single biggest red flag in audits.”

This case also reflects the increasing use of data analytics by Indian tax authorities, a trend expected to grow with the adoption of AI tools for invoice tracking and fraud detection.