GST Tax Cuts Could Spark Market Rally: The hottest topic in India’s economic and financial circles right now? GST tax cuts. And according to market veteran Ajay Bagga, these cuts could be the catalyst that pushes India’s economy into a fresh cycle of growth, boosts consumer spending, and sets the stock markets on fire. If you’re an investor, consumer, policymaker, or business owner, these changes could affect your money, investments, and lifestyle. This article breaks down exactly what’s happening, why GST cuts matter, and how you can prepare for the upcoming shifts. Bagga predicts that the Goods and Services Tax (GST) restructuring won’t just reduce prices — it could also trigger a massive market rally and revive consumer demand across multiple sectors, creating a ripple effect on jobs, investments, and growth.

GST Tax Cuts Could Spark Market Rally

Ajay Bagga’s forecast highlights one clear message: GST tax cuts could reshape India’s economic landscape. From cheaper prices to stronger consumption, higher corporate earnings, and booming stock markets, this reform has the potential to unlock the next phase of India’s growth story. While short-term revenue challenges exist, the long-term upside for consumers, investors, and businesses makes GST cuts a potential game-changer for India’s economy.

| Factor | Details |

|---|---|

| Main Topic | GST tax cuts could boost stock markets and demand |

| Expert Opinion | Ajay Bagga predicts GST cuts could spark a market rally and revive consumption |

| Market Impact | Auto, FMCG, and consumer durable stocks already showing strong momentum |

| Economic Benefit | Estimated demand boost of ₹2.4 lakh crore and ~0.5–0.7% GDP uplift |

| Reforms Expected | Simplified GST slabs — 5% for essentials, 18% for aspirational goods |

| Investor Outlook | Bullish for auto, FMCG, retail, and cement sectors |

| Risk Factors | Revenue shortfall for states, uncertain price pass-through |

| Reference | GST Council Announcement & Government Policy Updates |

Why GST Tax Cuts Matter Right Now?

Let’s simplify it. GST is the tax added to nearly everything you buy — from groceries and clothing to smartphones and cars.

When the government reduces GST rates, three big things happen:

- Prices fall → Consumers pay less, saving more money.

- Demand rises → Cheaper products lead to higher sales.

- Profits grow → Businesses sell more, boosting earnings and stock prices.

Ajay Bagga believes that at a time when global demand is slowing and inflation is squeezing household budgets, GST cuts could revive consumption and provide India’s economy with the energy it needs.

Ajay Bagga’s Perspective on GST Tax Cuts Could Spark Market Rally

Ajay Bagga, a widely respected market analyst, believes the timing of these cuts is critical for three reasons:

- Corporate earnings are recovering: Q1 of this financial year recorded the lowest earnings downgrades in eight quarters.

- Stock market stability is returning: After months of volatility, Indian markets are showing early signs of strength.

- GST cuts would amplify the recovery: Bagga expects cheaper goods to increase demand, fueling profits and lifting investor confidence.

According to him, “GST tax cuts can reignite consumer confidence, unlock growth opportunities, and drive the next leg of India’s market rally.”

Understanding the Global Context

India isn’t making these decisions in isolation. Across the globe, governments are using tax cuts to stimulate demand:

- China has lowered consumption taxes on electronics and vehicles to drive household spending.

- The U.S. has implemented tax rebates and credits to push sectors like renewable energy and EV adoption.

- Europe temporarily reduced VAT rates in several countries to support consumer-driven recoveries.

India’s GST reforms would align with global strategies, making the country more competitive in exports and attracting foreign investments.

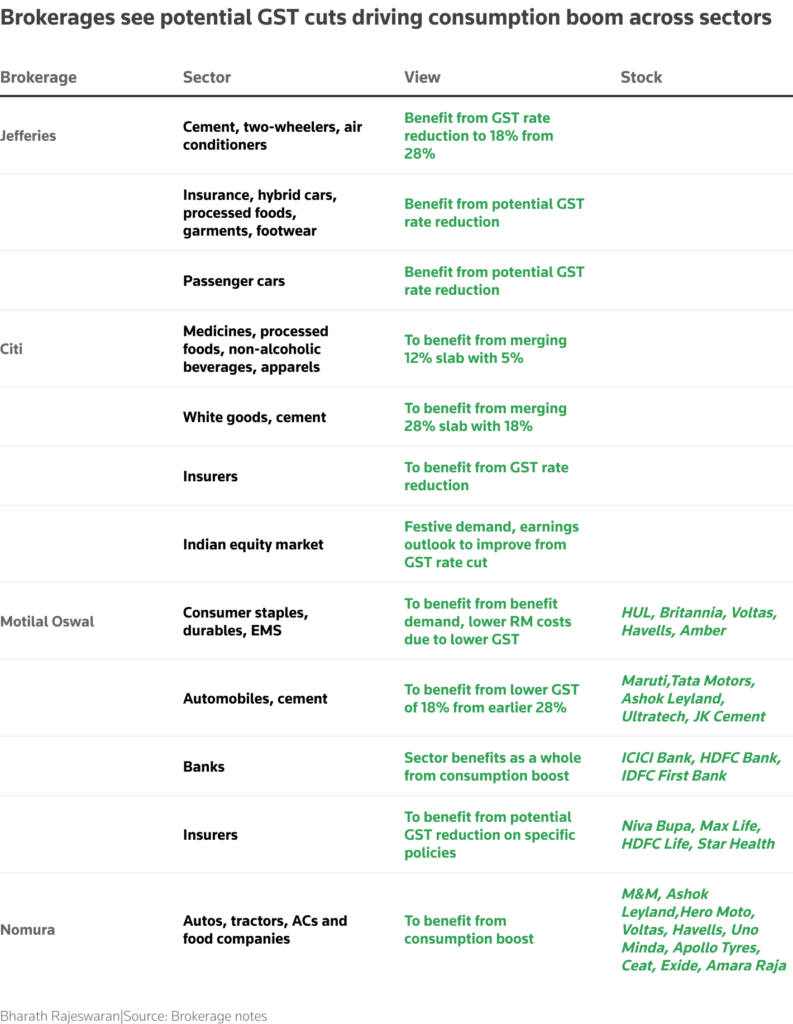

How GST Cuts Impact Stock Markets?

Markets don’t wait for policies — they react to expectations. Investors are betting on GST cuts, and we’re already seeing positive momentum in key sectors:

- Automobiles: Companies like Maruti Suzuki, Hyundai, and Tata Motors have seen stock gains of 8–9% in recent weeks.

- FMCG giants: Hindustan Unilever, Nestlé, and Dabur reported 4–7% price jumps.

- Consumer durables: Brands like Voltas, Havells, and Whirlpool are trending at multi-month highs.

This rally shows investors are confident that lower taxes = higher sales volumes = better profits.

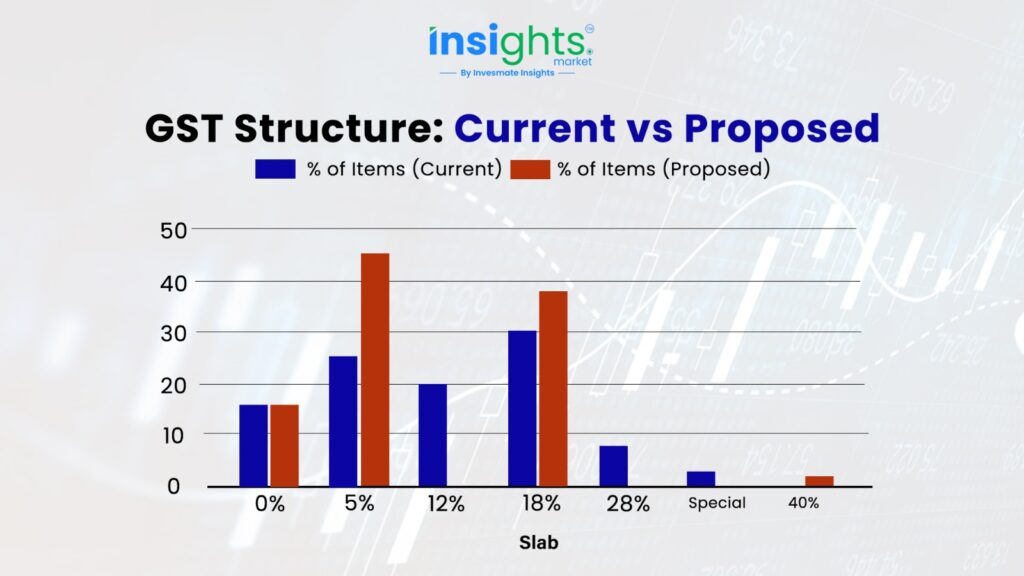

Proposed GST Restructuring

The government plans not only to cut rates but also to simplify slabs. Here’s what’s expected:

| Category | Current GST | Proposed GST |

|---|---|---|

| Essentials (food, medicines) | 5% | 5% (unchanged) |

| Aspirational Goods (clothing, appliances, electronics) | 12% / 18% | 18% flat |

| Luxury & Demerit Goods (cars, alcohol, tobacco) | 28%+ | Up to 40% |

This change aims to make taxation simpler, predictable, and business-friendly, while boosting consumer confidence.

How Different Income Groups Benefit?

GST cuts affect everyone but in different ways.

| Income Group | Benefit | Example |

|---|---|---|

| Middle Class | Cheaper essentials and electronics | Smartphones, home appliances, clothing |

| Upper Middle Class | Better affordability on aspirational items | Laptops, premium furniture, branded apparel |

| Luxury Buyers | Savings on high-value purchases | Cars, jewelry, premium gadgets |

This across-the-board affordability boost can supercharge demand and increase market liquidity.

The ₹2.4 Lakh Crore Demand Boost Explained

Analysts estimate that the GST reforms could unleash a ₹2.4 lakh crore wave of consumer spending. Here’s the breakdown:

- GDP Growth: India’s GDP could rise by 50–70 basis points (~0.5–0.7%).

- Sectoral Demand: Automobiles, retail, FMCG, and electronics will see a major spike in sales volumes.

- Corporate Profits: Increased revenues will reflect in quarterly earnings, attracting fresh investor capital.

This could make India one of the fastest-growing consumption markets globally.

Real-Life Example: The Smartphone Effect

Let’s put this into perspective with a simple example:

If you buy a smartphone worth ₹20,000 today at 18% GST, you’re paying ₹3,600 in tax.

If the GST is reduced to 12%, your tax drops to ₹2,400 — saving you ₹1,200 instantly. Multiply that across millions of consumers, and you see how GST cuts create massive market-wide demand surges.

Investor Strategies for the Coming Rally

Ajay Bagga suggests that investors should position themselves early to benefit from the upcoming demand boom. Focus areas include:

- Automobiles: Vehicle prices may drop, pushing sales higher.

- FMCG & Retail: Essential goods will get cheaper, driving household consumption.

- Electronics & E-commerce: Expect a jump in online sales volumes.

- Cement & Infrastructure: Affordable housing demand will push construction activity.

For beginners, mutual funds or sectoral ETFs focused on these industries could be safer than buying individual stocks.

Potential Risks and Challenges

While optimism is high, GST cuts come with certain challenges:

- State Revenue Shortfalls: Lower taxes may initially hurt state finances.

- Uneven Pass-Through: Some companies may keep part of the benefit, limiting price drops for consumers.

- Inflationary Pressure: A sudden demand surge could lead to short-term price spikes.

- Implementation Delays: Businesses may need time to adapt to revised tax structures.

Despite these hurdles, experts believe the long-term growth impact will outweigh short-term concerns.

GST Reforms Update — Will Insurance Finally Get Tax Exemption?

India May Remove 12 Percent GST Slab And Cut Taxes On Essentials

Multiplexes Demand Tax Cut — Tickets Under Rs 300 May Soon Be in 5% Slab

What’s Next: GST Council’s Expected Timeline

The GST Council is expected to finalize the reforms soon, likely before the Diwali shopping season. Here’s what’s coming:

- Announcement of new GST slabs within the next quarter.

- Implementation plan for simplified compliance procedures.

- Sector-wise incentives to accelerate manufacturing and exports.

Investors, businesses, and consumers should prepare for a transformational policy shift.