High-End Electric Vehicles May Soon Attract 18% GST: and that headline has stirred quite a buzz. If you’re planning to buy a luxury EV in India, this isn’t just a small footnote in the news—it could change the way you think about your purchase. India’s Goods and Services Tax (GST) Council is reviewing a proposal that would raise GST on four-wheeled electric vehicles priced between ₹20 lakh and ₹40 lakh from 5% to 18%. That’s a steep jump and could make premium EVs more expensive by several lakhs overnight. The Council is expected to make a decision in its upcoming meeting on September 3–4, 2025 in New Delhi.

High-End Electric Vehicles May Soon Attract 18% GST

If approved, High-End Electric Vehicles may soon attract 18% GST—a major shift that could reshape India’s EV market. For buyers, this means acting fast if you’re considering a premium EV. For automakers, it’s a test of flexibility and pricing strategy. For policymakers, it’s a balancing act between fairness and sustainability. The big question is whether India can maintain EV momentum while making taxes more equitable. The answer will unfold in September 2025.

| Key Highlights | Details |

|---|---|

| Current GST on High-End EVs | 5% (no cess) |

| Proposed GST | 18% for EVs priced between ₹20 lakh – ₹40 lakh |

| Reason for Change | Fairness – avoid over-subsidizing wealthy buyers of luxury EVs |

| Decision Date | September 3–4, 2025 |

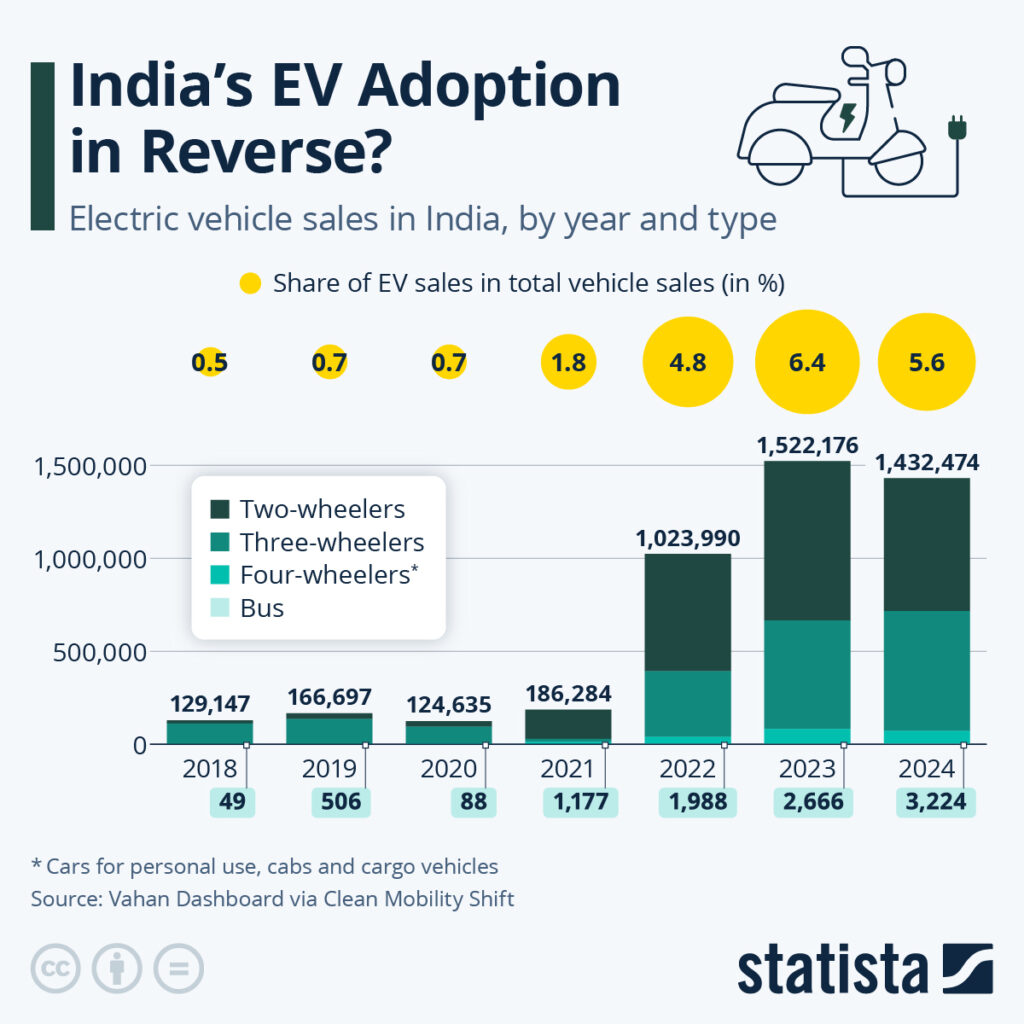

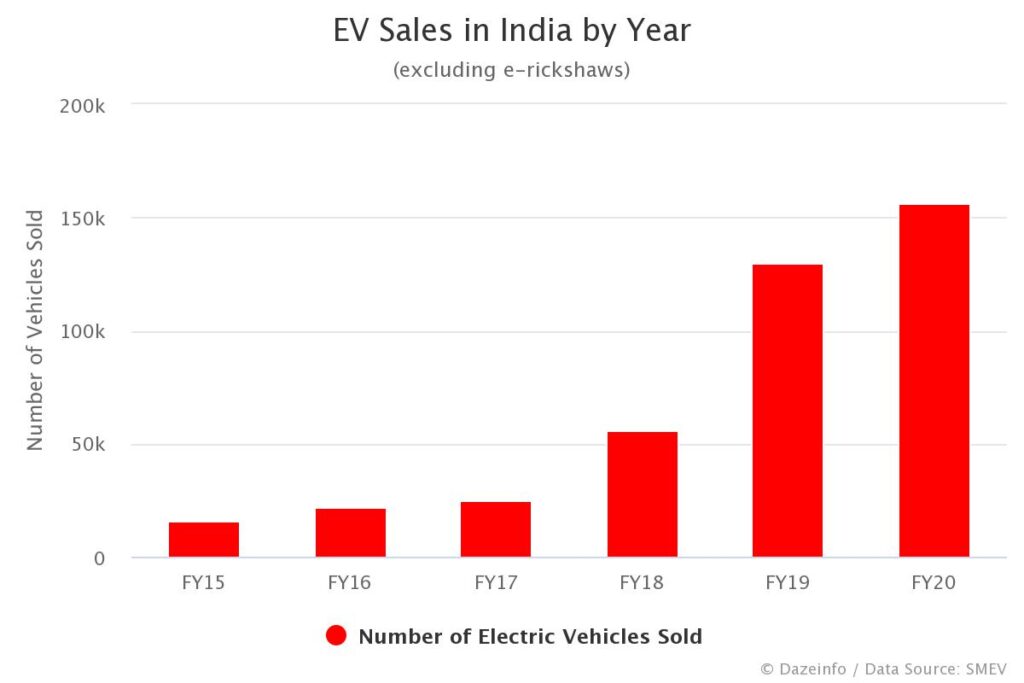

| EV Market Growth | 110,000+ units sold in 2024; 93% YoY jump in July 2025 |

| ICE Cars Proposal | Small ICE cars may see tax cut from ~29% to around 18% |

| Official Resource | GST Council Portal |

Why High-End Electric Vehicles May Soon Attract 18% GST Matters?

Current Tax Setup

At present, electric vehicles enjoy a 5% GST rate—the lowest across categories—without any compensation cess. In contrast, petrol and diesel cars attract a base 28% GST plus additional cess (ranging from 1% to 22% depending on type), meaning effective tax rates of 29–50%. This tax break has been one of the biggest drivers of EV adoption in India.

The Proposed Change

The new proposal targets the ₹20–40 lakh price segment, where many premium EVs sit. Under this system, affordable EVs and electric buses would retain their tax breaks, but luxury EVs would see costs rise sharply.

The Rationale

The GoM believes that keeping GST low for high-end cars unfairly subsidizes affluent buyers while burdening public revenue. The intention is to make taxation more progressive—supporting mass-market EVs while ensuring luxury buyers pay their fair share.

The Practical Impact on Buyers

Let’s take a closer look with some examples:

- Tata Nexon EV (₹15–18 lakh)

Currently under 5% GST, it’s not in the danger zone. This model will likely remain attractive and affordable. - Hyundai Kona EV (₹24 lakh)

- At 5% GST: adds about ₹1.2 lakh.

- At 18% GST: adds ₹4.3 lakh.

- Extra burden: nearly ₹3.1 lakh.

- Tesla Model 3 (expected ₹35 lakh if launched)

- At 5% GST: about ₹1.75 lakh.

- At 18% GST: about ₹6.3 lakh.

- Extra burden: over ₹4.5 lakh.

That’s not pocket change. For buyers, especially those stretching budgets to upgrade from an ICE car, this hike could be a deal-breaker.

Automaker Impact

Domestic Automakers

- Tata Motors and Mahindra dominate the sub-₹20 lakh EV market. With the hike targeting pricier models, their affordable EV lineups could look more attractive.

- These automakers might actually benefit as buyers shift down-market.

Global Players

- Tesla, BYD, and Hyundai stand to lose momentum. Their offerings largely fall in the ₹20–40 lakh bracket. Higher taxes could mean delays in launches, or price restructuring to maintain competitiveness.

Strategy Adjustments

- Automakers may absorb part of the tax through slimmer margins to keep demand alive.

- Some could pivot to local manufacturing or assembly to cut costs.

- Others may prioritize sub-₹20 lakh launches to stay within the “safe zone.”

The Global Context

India’s move would stand out globally.

- United States: Offers federal tax credits up to $7,500 depending on battery sourcing and assembly rules.

- European Union: Countries like Norway, Germany, and France provide heavy subsidies, VAT exemptions, or cash rebates for EV buyers.

- China: Exempts EVs from purchase tax and provides direct purchase subsidies, fueling the world’s largest EV adoption wave.

In comparison, India’s proposed hike could be seen as a step backward in incentivizing EV adoption, especially when global peers are still pushing hard with subsidies.

Environmental Angle

India has committed to achieving net-zero emissions by 2070. EV adoption is central to this goal.

- Positive Argument: Taxing luxury EVs harder while keeping mass-market EVs affordable could redirect resources toward widespread adoption instead of subsidizing high-income buyers.

- Negative Argument: Raising taxes risks slowing EV penetration at a time when it’s barely 3.7% of new car sales. With ICE cars possibly getting cheaper, adoption could stall right as momentum was building.

Balancing fiscal fairness and environmental urgency is the real challenge here.

Consumer Behavior Insights

- Middle-Class Families: If ICE small cars see tax cuts, they might prefer those over expensive EVs, especially when upfront price matters more than long-term fuel savings.

- Luxury Buyers: Wealthier consumers may still go for EVs, but demand could slow if prices jump too high. Some may delay purchases or switch to hybrids.

- Fleet & Corporate Buyers: For businesses, the economics of bulk buying matter. They may lean toward cheaper EVs or ICE options if tax hikes shrink margins.

The bottom line: the decision could split the EV market into two worlds—affordable city EVs vs luxury imports.

Infrastructure Factor

Taxes aren’t the only thing buyers consider. Charging infrastructure remains a pain point. India currently has about 12,000 public EV chargers, with most concentrated in big metros. For context: China has over 2 million public chargers.

If GST hikes make EVs costlier without simultaneously expanding infrastructure, adoption could face a double roadblock—higher costs and limited convenience.

What You Should Do (Actionable Advice)?

- Buyers:

- If you’re planning a luxury EV purchase, consider closing the deal before the September GST Council decision.

- Calculate total cost of ownership, not just upfront price. Include charging costs, fuel savings, and maintenance.

- Dealers:

- Provide transparent breakdowns of “before and after GST” pricing.

- Offer special financing options to offset the tax jump.

- Investors:

- Track auto stocks. Companies like Tata and Mahindra may gain, while Tesla or BYD could see challenges.

- Look for policy cues beyond GST—battery manufacturing and subsidy policies will also shape the market.

- Policy Professionals:

- Push for a balance—higher GST on luxury EVs should not derail climate commitments. Consider reinvesting revenue into EV infrastructure.

Future Outlook – Next 5 Years

- 2025–2026: If passed, luxury EV sales may slow. Affordable EVs could grow stronger.

- 2027–2028: Falling battery costs and expanding charging infra may offset tax disadvantages.

- 2029–2030: With stable policies, EVs could cross 10% market share in India, though progress may be slower than in the U.S. or China.

India’s EV story isn’t over—it’s just facing a speed bump.

Lower GST On ICE Vehicles Could Impact EV Growth – HSBC Report

GST 2.0 – Why It Still Isn’t A Truly Good And Simple Tax

GST Reform to Cut Rates on Vehicles – Will Two-Wheeler and Car Sales Finally Rebound?