High GST on Waste Is Bleeding ₹1.8 Lakh Crore: and while that sounds like a figure you’d expect in a Wall Street deep-dive, it’s not just a finance story. It’s about how India handles trash, recycling, and the livelihoods of millions. It’s about cleaner air, greener cities, and whether a whole industry can stand on its own two feet. The Goods and Services Tax (GST), India’s version of a national sales tax, was designed to simplify the country’s messy tax system. But in the waste and recycling sector, it’s turned into a roadblock. Charging the same 18% tax rate on recycled goods as on brand-new, “virgin” materials is a move experts say is costing India billions in lost revenue, jobs, and environmental progress.

High GST on Waste Is Bleeding ₹1.8 Lakh Crore

Right now, India’s GST policy on waste is like charging tax on hand-me-down clothes as if they were designer outfits — it makes no sense and punishes the more sustainable choice. High GST on recycled materials is holding back the country’s circular economy, costing revenue, and keeping millions in unregulated, unsafe jobs. With lower GST rates, better integration of informal workers, and strong environmental incentives, India could flip an annual loss into a ₹1.8 lakh crore gain by 2035. The blueprint is clear — now it’s about the political will to make it happen.

| Topic | Details |

|---|---|

| Current Annual GST Loss | ₹65,000 crore |

| Projected Loss by 2035 (No Reform) | ₹86,700 crore |

| Potential GST Gain by 2035 (With Reform) | ₹1.8 lakh crore |

| Main Issue | GST rate on recycled waste materials is the same (18%) as on virgin materials |

| Impact | Encourages informal, untaxed waste trade; discourages recycling |

| Source | CSE India Official Report |

| Key Reform | Lower GST rates (5–12%), integrate informal sector into formal economy |

Understanding GST and Why It’s a Problem for Waste Management

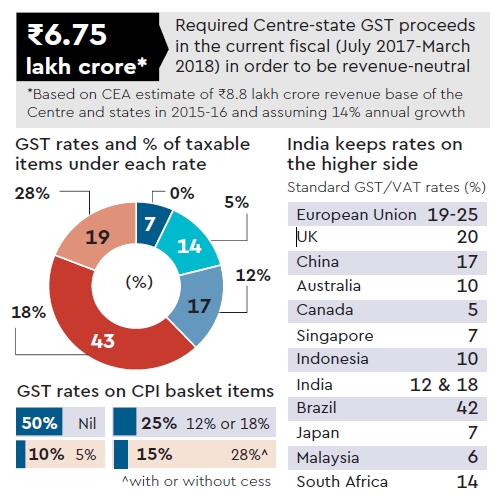

The Goods and Services Tax (GST), introduced in 2017, merged multiple state and central taxes into one unified system. It works fine for most industries, but when applied to waste recycling, the flat 18% rate on both virgin and recycled goods wipes out any competitive edge that recycled materials might have.

In practical terms, it means a kilo of virgin aluminum and a kilo of recycled aluminum both carry the same tax burden, even though recycled material saves energy, reduces mining, and helps the planet. Businesses often go for virgin materials for their consistent quality, and with no tax advantage for recycled goods, the greener choice loses out.

The Scale of the Loss

The numbers are clear, and they’re not pretty:

- ₹65,000 crore in GST revenue lost annually today because most recycling happens in the informal, untaxed sector.

- If nothing changes, that number will climb to ₹86,700 crore by 2035.

- With smart reforms — lowering GST rates, formalizing workers, and closing tax loopholes — India could gain ₹1.8 lakh crore in GST revenue by 2035.

This isn’t just about government coffers. That kind of money could fund healthcare, build renewable energy projects, or upgrade waste infrastructure across the country.

Why the Current High GST on Waste Is Bleeding ₹1.8 Lakh Crore?

The circular economy is all about keeping products and materials in use for as long as possible — reusing, recycling, repairing — instead of tossing things into landfills. But the way GST is applied today actually pushes waste out of the formal system.

Equal Tax Rates for Virgin and Recycled Goods

With both taxed at 18%, recycled goods can’t compete on price. Virgin materials often have big manufacturers and established supply chains behind them, while recyclers operate with smaller margins and higher uncertainty.

The Informal Sector Trap

Because paying GST would make recycled goods more expensive, many recyclers operate without registering for GST. That keeps their prices low but also means:

- The government gets no tax revenue.

- Workers stay in unsafe, unregulated jobs.

- There’s no official record of how much waste is being recycled.

Waste Categories Most Affected

Not all waste is created equal — and some streams are feeling the GST pinch more than others.

Metals

Recycling aluminum, steel, and copper saves massive amounts of energy compared to producing new metal. Yet the 18% GST rate makes scrap dealers reluctant to formalize, driving much of the trade underground.

E-Waste

Electronics are rich in recoverable materials, but dismantling and recycling them is labor-intensive. Informal handlers dominate this space, often working without protective gear and outside safety laws.

Plastics

Plastic recycling could help curb pollution, but small recyclers struggle to survive when taxed at the same rate as virgin plastic producers.

Paper

Recycled paper can save trees and water, but the GST rate wipes out any cost advantage over new paper.

Real-Life Examples From the Field

In Uttar Pradesh, a small scrap yard owner named Ramesh has been in the trade for over 20 years. If he registers for GST, he’d have to add 18% to his prices, making him more expensive than unregistered competitors. So he stays informal, earning just enough to keep going but with no access to loans or safety nets.

In Gujarat, a mid-sized paper recycler recently shut down because their main buyers opted for virgin paper suppliers who could offer bulk discounts, making recycled paper uncompetitive after GST.

How Other Countries Do It Better?

| Country | Tax Policy on Recycling | Impact |

|---|---|---|

| India | 18% GST on virgin and recycled | Discourages recycling, favors informal sector |

| USA | Reduced sales tax or tax credits for recycled goods in many states | Boosts recycling investments |

| EU | Lower VAT for eco-friendly products | High recycling rates, strong green industry |

| Japan | Tax breaks and subsidies for recycling | High material recovery, export surplus of recycled goods |

The takeaway? Where governments lower taxes for recycling, recycling thrives.

Steps to Unlock the ₹1.8 Lakh Crore Potential

- Reduce GST on Recycled Goods

Cut GST from 18% to 5–12% for major waste streams. This would instantly make recycled goods more competitive. - Formalize Informal Workers

Offer incentives like microloans, easier registration, and safety training to bring small recyclers into the formal sector. - Link GST Benefits to Environmental Performance

Give rebates to companies that meet Extended Producer Responsibility (EPR) targets. - Strengthen Waste Infrastructure

Invest in better sorting plants, logistics networks, and collection systems. - National “Buy Recycled” Campaign

Run public campaigns to make buying recycled materials a point of pride.

The Environmental and Job Market Benefits

Lowering GST and formalizing recycling wouldn’t just be a tax story — it’s an environmental and social win.

Environmental Gains

- Less waste in landfills.

- Lower carbon emissions from reduced mining and manufacturing.

- Conservation of water and energy resources.

Job Creation

- Formalizing waste work could create thousands of new, safer jobs.

- Workers would get access to social security, healthcare, and legal protections.

Expert Opinions

Sunita Narain, Director General of CSE India, says:

“Tax policy should encourage sustainability, not punish it. Lowering GST on recycled goods will create a win-win — higher government revenue, more jobs, and a cleaner environment.”

Environmental economist Dr. Rakesh Kumar adds:

“India has the talent and resources to be a recycling powerhouse. We just need the right fiscal signals to make it happen.”

Actionable Advice for Businesses

While waiting for reforms, recycling businesses can:

- Document supply chains to prepare for formalization.

- Join trade associations to lobby for tax reforms.

- Explore partnerships with large brands looking to meet EPR targets.

- Keep up with policy updates via the GST portal and environmental news.

Maruti Suzuki Subsidiary Slammed With ₹86 Crore GST Penalty in Appellate Ruling

Parliamentary Panel Demands Quicker Appointment of GST Appellate Tribunal Benches!

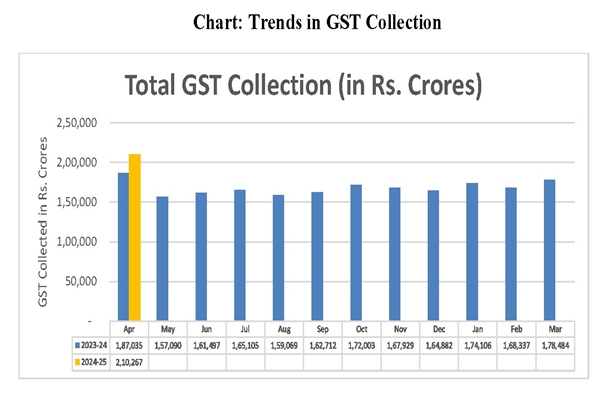

New DDP Indicators and GST Collections Reveal Economic and Cultural Shifts in Districts