High Taxes And Poor Facilities: If you’ve been keeping an eye on the headlines, you might have noticed a striking trend: wealthy Indians are leaving their home country in droves. And this isn’t just about chasing the American dream or enjoying a European summer—it’s largely because of high taxes and poor facilities back home. This so-called “millionaire migration” has become one of the hottest topics in India’s economic discussions. But it’s not just about the rich seeking luxury. It’s about people who feel like they’re paying a lot into the system but getting very little back in terms of infrastructure, safety, healthcare, and opportunity. When the top taxpayers and wealth creators leave, the ripple effects hit everyone—from small business owners to middle-class families.

High Taxes And Poor Facilities

The story of wealthy Indians moving abroad due to high taxes and poor facilities isn’t just about private jets or luxury lifestyles. It’s a reflection of systemic challenges that make people feel undervalued in their own country. With more than 2 lakh Indians giving up citizenship in 2024, and billions of dollars in wealth leaving every year, India risks a long-term brain drain unless it takes urgent steps. If India wants to retain its wealth creators, it needs to give them what other nations are offering: fairness, opportunity, and dignity in exchange for their contribution.

| Point | Details | Reference |

|---|---|---|

| Indians renouncing citizenship in 2024 | 2.06 lakh | Tribune India |

| Millionaires expected to leave India in 2025 | ~3,500 | Henley & Partners |

| Wealth moving abroad | $26.2 billion | Henley & Partners |

| Indian passport ranking | 80th (58 visa-free destinations) | Henley Passport Index |

| Top destinations | UAE, Singapore, USA, Portugal, Malta | Tribune India |

A Quick Look Back: How Did We Get Here?

India’s taxation system has long been complicated. In the 1970s, there was something infamously called the “License Raj”, where entrepreneurs needed endless government approvals to operate, and taxes were sky-high. Over the years, reforms came—especially after the 1991 economic liberalization—but the perception of India being a high-tax, high-bureaucracy country has stuck.

Meanwhile, other countries invested strategically in infrastructure, education, and public services. So when you compare the experience of a taxpayer in the U.S. or Europe with that of someone in India, the differences are glaring.

Why High Taxes And Poor Facilities Are Driving Wealthy Indians Abroad?

1. High Taxes Without High Returns

Wealthy Indians often pay 30–40% of their income in taxes, sometimes even more when you add surcharges and GST. But the problem isn’t just the tax rates—it’s the feeling of getting nothing in return.

- In countries like the U.S., high taxes fund Medicare, Social Security, and solid infrastructure.

- In Scandinavia, citizens enjoy free education, universal healthcare, and world-class public amenities.

- In India, despite paying steep taxes, many still have to rely on private hospitals, private schools, and private security.

This double burden feels unfair, and many ask themselves: why stay when other countries give you more value for your money?

2. Poor Public Infrastructure

Infrastructure is where the cracks really show. Daily life in India often includes battling traffic jams, pollution, water shortages, and unreliable power supply.

One Reddit user summed it up:

“They leave because even after giving almost half of their earnings in taxes … they hardly get anything in return.”

For someone who travels globally and sees what’s available elsewhere, the contrast becomes impossible to ignore.

3. Global Mobility and Passport Power

The Indian passport ranks 80th, offering visa-free access to only 58 countries. Compare that with Singapore’s passport (195 countries) or the U.S. passport (189 countries).

For entrepreneurs, investors, and professionals who need to travel often, mobility isn’t a luxury—it’s essential. Limited access makes it harder to build international businesses and networks.

4. Better Opportunities Abroad

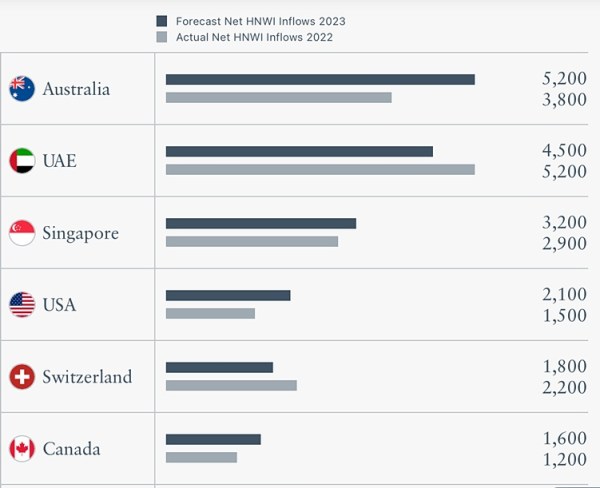

Countries like Dubai, Singapore, Portugal, and Malta are intentionally luring wealthy migrants.

- Dubai: Zero income tax, modern infrastructure, global business hub.

- Portugal: Golden Visa programs giving access to the EU.

- Singapore: Political stability, strong rule of law, and ease of doing business.

- U.S.: Access to the largest consumer market and top universities.

In comparison, India’s regulatory system is often seen as slow, unpredictable, and overly complex.

Real-Life Stories

- Startup Founder: After selling his company, one Indian founder moved to Dubai. In India, nearly 40% of his earnings went to capital gains taxes. In Dubai, he pays zero and gets access to investors in Europe and Asia.

- Medical Specialist: A top surgeon relocated to the U.S., frustrated by India’s crumbling public healthcare system. In America, she earns more, works in cutting-edge hospitals, and doesn’t worry about power outages mid-surgery.

These stories are not outliers—they reflect what many wealthy professionals experience.

The Bigger Picture: Brain Drain

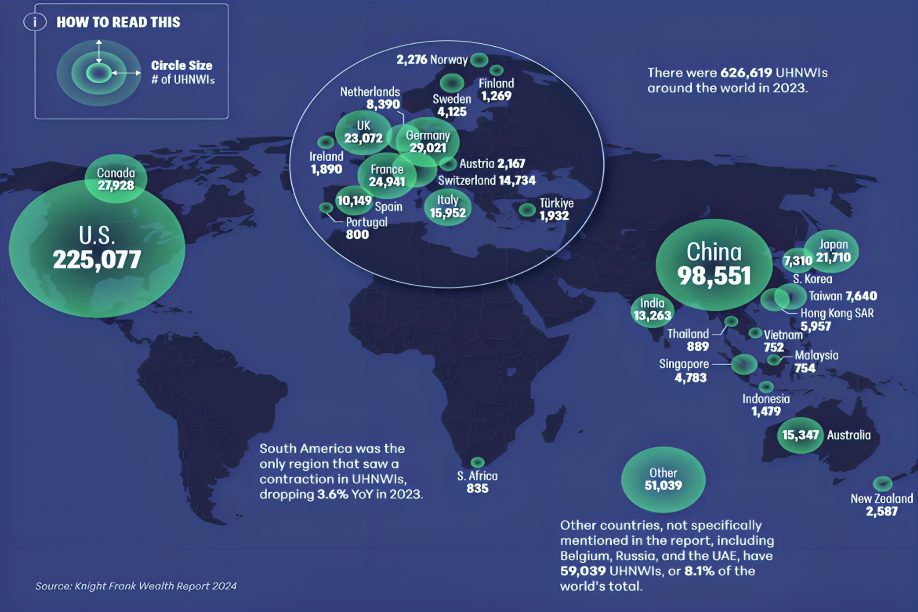

According to Henley & Partners, India will lose 3,500 millionaires in 2025, with $26.2 billion in wealth leaving the country. That’s money that could have built startups, funded schools, or created thousands of jobs.

But it’s not just about money. This exodus also drains talent, innovation, and leadership. Economists call this brain drain—when the smartest and most capable individuals leave, taking their knowledge and connections with them.

And who loses out? Not just the rich—the middle class and small businesses also miss out on opportunities that these wealthy individuals create.

How the U.S. and Other Nations Do It Better?

The U.S. is a perfect comparison. Taxes are high, but Americans know they’re getting something back: Medicare, Social Security, quality infrastructure, and passport power. Wealth creators are also celebrated and encouraged to innovate, rather than criticized.

Meanwhile, smaller countries like Singapore and UAE have made it their mission to attract talent with streamlined regulations and tax incentives. India, on the other hand, risks sending a message that success is punished rather than rewarded.

Government’s Response

India has rolled out several initiatives:

- Ease of Doing Business reforms aimed at reducing bureaucracy.

- Make in India campaign to promote domestic manufacturing.

- Startup India to support entrepreneurship.

These are steps in the right direction, but critics argue they don’t go far enough. Issues like complicated tax structures, weak infrastructure, and limited global mobility remain unresolved.

What India Needs to Do?

Here’s what could actually make a difference:

- Improve Return on Taxes – Ensure that tax money translates into better healthcare, clean water, safe roads, and reliable electricity.

- Simplify Business Regulations – Cut down on red tape and offer predictable, business-friendly policies.

- Boost Global Mobility – Strengthen the Indian passport with more visa-free agreements.

- Engage the Diaspora – Instead of shaming those who leave, build programs that encourage them to invest and contribute back to India.

- Encourage Wealth Retention – Offer tax incentives for investments in Indian startups, infrastructure, and philanthropy.

How India’s Broken Tax System Is Crippling the Circular Economy Revolution

Shocking Demand – Should Tax Crimes Lead to Citizenship Denaturalization?

Jane Street Tax Probe Deepens as EY Pulled Into Investigation

Practical Advice for Professionals Considering a Move

If you’re among India’s wealthy or high-earning professionals and considering moving abroad, here’s how to prepare:

Step 1: Research Your Options

Look into Henley Passport Index and global visa programs.

Step 2: Factor in Family Needs

Think long-term: schooling for kids, healthcare for aging parents, cultural adjustment.

Step 3: Get Expert Guidance

Consult financial advisors and immigration experts to understand tax implications and wealth management abroad.

Step 4: Keep India in Your Plan

Even if you relocate, consider keeping investments, property, or philanthropic projects in India.