Hope Travels Dragged Into Prosecution: When news broke that Hope Travels was being dragged into prosecution over a major tax fraud case, it didn’t just make waves in the Maldives—it sent ripples across the global business community. Tax fraud is no small-time mistake. It’s like skipping out on the check at a diner, except instead of a $20 meal, we’re talking about tens of millions of dollars in unpaid taxes.

According to the Maldives Inland Revenue Authority (MIRA), Hope Travels allegedly failed to report almost 89% of its income between July 1, 2020, and May 31, 2023. That’s not a minor oversight—it’s like saying you only made $10,000 when you actually pulled in $100,000. Authorities claim the company omitted MVR 54 million in income and more than MVR 3 million in Goods and Services Tax (GST). On top of that, another MVR 29 million was left out of income tax returns for 2020 and 2021. This case is more than just numbers. It touches on issues of corporate integrity, governance, and trust. Let’s break it down.

Hope Travels Dragged Into Prosecution

The Hope Travels tax fraud case is more than just a business scandal—it’s a reminder of the real consequences of cutting corners. From small businesses in the U.S. to large ferry operators in the Maldives, the principle is the same: taxes fund the systems we all rely on. The message is simple: play fair, keep honest records, and meet your obligations. Transparency builds trust, while fraud destroys it. Hope Travels is now learning that lesson the hard way.

| Key Point | Details |

|---|---|

| Company | Hope Travels (Maldives) |

| Accusation | Major Tax Fraud |

| Investigating Authority | Maldives Inland Revenue Authority (MIRA) |

| Period Under Investigation | July 2020 – May 2023 |

| Alleged Income Omitted | MVR 54 million |

| GST Not Paid | MVR 3+ million |

| Additional Omission | MVR 29 million (2020–2021) |

| Individuals Involved | Partners of Hope Holdings: Shahud Ibrahim Manik & Mohammed Ali |

| Penalty (if proven) | Up to 3 years’ imprisonment under Article 64 of the Administrative Taxation Act |

Who Is Hope Travels?

Hope Travels isn’t a tiny startup; it’s a significant ferry operator in the Maldives, especially active in the Shaviyani and Noonu atolls. In the Maldives, ferries are the lifeline of communities. They connect islands, move goods, and ensure tourists can hop between resorts.

So when a company this central to daily life and tourism is accused of fraud, the impact goes far beyond courtroom drama. It’s like if Amtrak in the U.S. got caught in a massive tax scandal—the shockwaves would affect commuters, travelers, employees, and state funding alike.

Breaking Down the Hope Travels Dragged Into Prosecution

What Went Wrong?

This wasn’t a simple accounting error. According to MIRA, investigators raided Hope Travels’ office, seized business records, and interviewed multiple people tied to the company. Their deep dive revealed systematic underreporting of revenue, not just a typo on a spreadsheet.

The case has since been forwarded to the Prosecutor General’s Office, with specific charges against two company partners: Shahud Ibrahim Manik and Mohammed Ali. Under Article 64 of the Administrative Taxation Act, intentionally evading taxes is a criminal offense that can carry prison time.

Why It Matters?

This isn’t just about one company ducking taxes. When businesses skip out, it leaves governments short of money for roads, schools, hospitals, and tourism infrastructure. And when governments collect less, the burden often shifts to citizens or law-abiding businesses.

Economic Impact

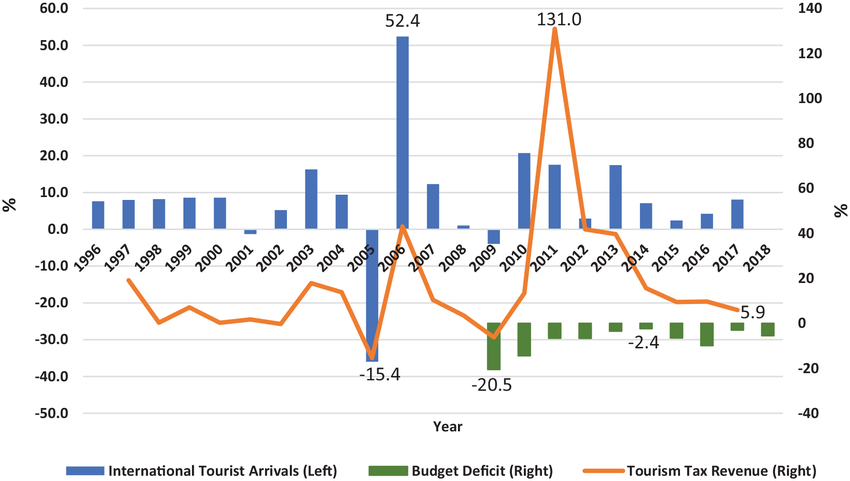

The Maldives is one of the world’s most tourism-dependent economies, with more than 30% of GDP and around 60% of foreign exchange earnings coming directly from the tourism sector. Taxes, especially GST from hospitality and transport services, are critical revenue streams.

When companies like Hope Travels underreport income:

- The government loses millions needed for public projects.

- Law-abiding competitors get squeezed because they pay their fair share while fraudsters cut corners.

- Investor confidence takes a hit, since global markets watch closely to see how serious the Maldives is about enforcing compliance.

Think of it like running two restaurants side by side. One pays all its taxes, the other hides half its earnings. The cheat can charge lower prices, drawing more customers. It’s unfair competition—and ultimately harmful to the whole market.

Public Reaction and Reputation Damage

In smaller nations, scandals spread fast. Local communities, business owners, and even tourists are buzzing about the case. For Hope Travels, the reputation fallout could be just as damaging as the legal penalties.

Once your name is tied to tax fraud, it’s hard to rebuild trust. In today’s digital age, Google never forgets. Even if Hope Travels manages to survive legally, its brand may remain scarred in the public eye for years.

Understanding Tax Fraud in Plain English

At its simplest, tax fraud is lying to avoid paying taxes. Some of the most common methods include:

- Underreporting income – Saying you earned less than you did.

- Overstating expenses – Claiming fake or exaggerated costs.

- Hiding cash transactions – Not reporting money received in cash.

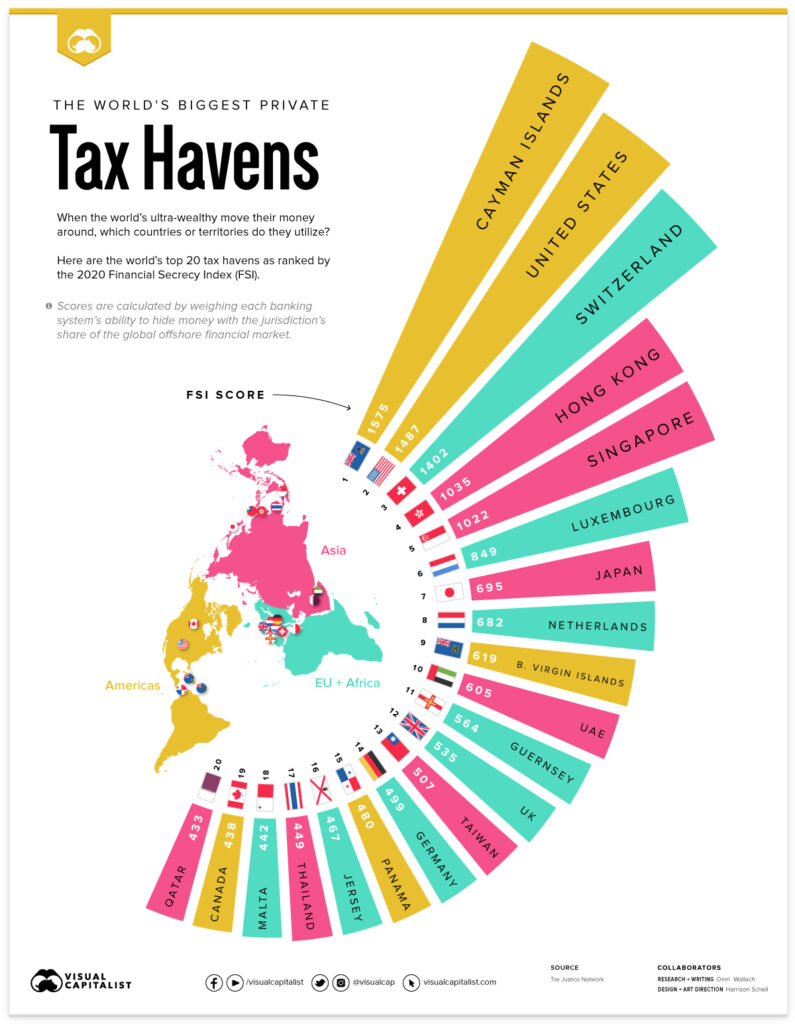

- Using shell companies – Moving profits through fake businesses to dodge taxes.

Hope Travels’ alleged crime fits squarely in the underreporting income category, and on a large scale.

Lessons for Businesses Everywhere

Even if you’re not running ferries in the Maldives, there are lessons here for all businesses.

Keep Clean Records

Messy books are a recipe for disaster. Whether you’re a freelancer or a Fortune 500 company, invest in reliable accounting software or professional bookkeeping.

Learn Local Laws

Every country has unique tax codes. In the U.S., the IRS warns that tax fraud can result in up to 5 years in prison and fines up to $250,000. In the Maldives, it’s 3 years under Article 64. Ignorance of the law isn’t a defense.

Don’t Assume You’re Invisible

With digital auditing tools, cross-border banking oversight, and whistleblower programs, hiding money is harder than ever. Authorities have more resources to catch fraudsters.

Honesty Pays

Sure, dodging taxes might save you in the short run. But when you add fines, penalties, legal costs, and reputation loss, it’s far more expensive in the long run.

Expert Insights

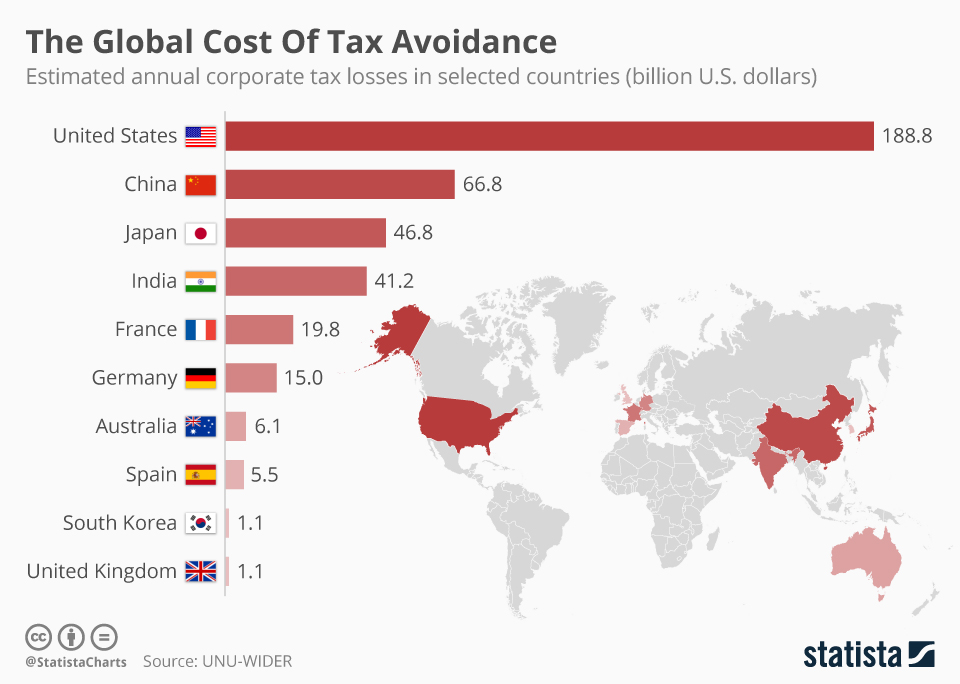

Tax experts say the Hope Travels case is part of a global crackdown on financial crimes. According to the OECD (Organization for Economic Cooperation and Development), tax evasion costs governments over $427 billion every year.

A Maldivian economist explained:

“Tax compliance is about more than following the law—it’s about fairness. When businesses dodge taxes, they undermine the very system that supports them.”

Global Context: Other Tax Fraud Cases

This isn’t the first big tax scandal.

- In the U.S., actor Wesley Snipes served three years in prison for willfully failing to file tax returns.

- In 2016, the Panama Papers leak exposed how billionaires and corporations worldwide stashed money offshore.

- In India, the government has launched multiple high-profile raids on large corporations accused of hiding income.

The point is clear: tax fraud is a global issue, and governments are stepping up enforcement.

Step-By-Step Guide: Staying Out of Tax Trouble

- Report All Income – Don’t “forget” to declare side hustles, freelance gigs, or digital payments.

- Track Expenses Correctly – Keep receipts and separate personal from business spending.

- Hire a Professional – Accountants and CPAs save money and keep you compliant.

- File and Pay on Time – Avoid late fees and legal consequences.

- Stay Updated – Tax laws change; check IRS.gov in the U.S. or your country’s equivalent.

Future Outlook

The Hope Travels case is far from over. The Prosecutor General will decide how to proceed, and if convicted, penalties may include:

- Prison sentences for key leaders.

- Heavy financial penalties and back taxes.

- Suspension or revocation of licenses.

For other businesses in the Maldives, the case is a clear warning: get compliant or risk prosecution.

Two Company Directors Arrested in Mumbai Over Major Tax Fraud Cases

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

ED Cracks Down on Fake ‘Input Tax Credit’ Fraud in West Bengal, Maharashtra, and Jharkhand!