How Strong Underwriting Is Shielding Canada’s Housing Market: When OSFI Chief Peter Routledge explained how strong underwriting is shielding Canada’s housing market, he wasn’t just speaking to policymakers. He was breaking down why Canada’s housing finance system has avoided the chaos seen in other countries. The Office of the Superintendent of Financial Institutions (OSFI) is Canada’s top banking regulator. Its rules, particularly around mortgage lending, have played a major role in keeping the system stable. Even as housing affordability challenges dominate headlines and global markets wobble, Canada has avoided a major collapse. For everyday Canadians and for observers in the United States, the lessons are worth paying attention to.

How Strong Underwriting Is Shielding Canada’s Housing Market

At the end of the day, strong underwriting is shielding Canada’s housing market from the kind of crises that shook other nations. By enforcing the B-20 stress test, requiring banks to maintain high capital buffers, and adjusting the Domestic Stability Buffer, OSFI has built resilience into the system. For U.S. readers, the message is simple: financial discipline pays off. Whether you’re a policymaker, lender, or just someone shopping for your first home, having safeguards in place today can prevent disaster tomorrow. Canada’s experience shows that guardrails may feel restrictive, but they make the entire system stronger.

| Topic | Key Insights | Sources/References |

|---|---|---|

| Underwriting Standards (B-20 Guideline) | Since 2012, requires lenders to stress test borrowers at higher rates. Helped keep mortgage delinquencies near record lows (0.15%). | OSFI Official Site |

| Market Resilience | About 25% of sellers pulled listings instead of slashing prices, showing financial strength. | Canadian Mortgage Trends |

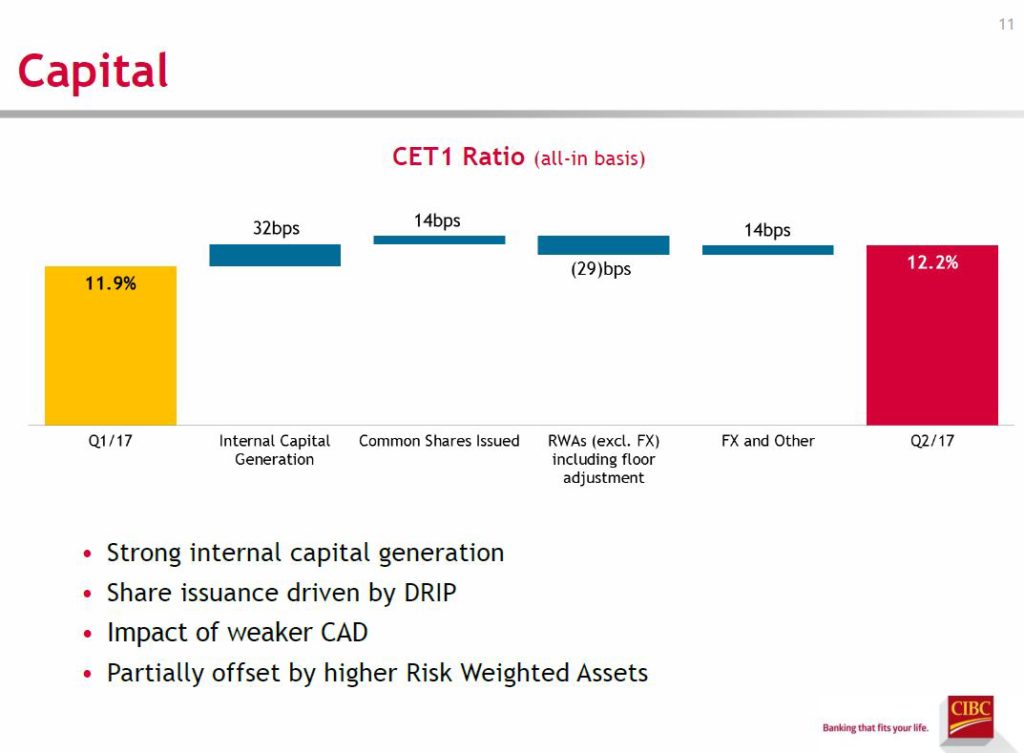

| Bank Capital Buffers | Banks hold an average 13.7% CET1 ratio vs. an 11.5% floor, meaning extra protection in downturns. | Bank of Canada |

| Condo Affordability | Price dips in Toronto & Vancouver condos may help younger buyers enter the market. | StatCan |

| Future Flexibility | OSFI may adjust the Domestic Stability Buffer (DSB) if household debt eases and banks stay profitable. | OSFI |

| Global Validation | IMF praised Canada’s stress tests as “critical to resilience.” | IMF Report |

Why Underwriting Matters: Guardrails Against Risk?

Underwriting might sound technical, but think of it like the guardrails on a steep mountain road. Without them, one wrong turn could lead to disaster. With them, even if the car swerves, you’re still protected.

Canada’s biggest guardrail is the B-20 guideline, introduced in 2012. It requires banks to “stress test” borrowers, meaning applicants must prove they can handle mortgage payments at interest rates higher than what they’re signing up for.

Example: if your contract rate is 5%, the lender must test your ability to pay at 7% or higher. This prevents households from getting in over their heads if interest rates rise.

The payoff has been clear. Mortgage delinquencies in Canada remain at about 0.15%, according to the Canada Mortgage and Housing Corporation (CMHC). That’s among the lowest levels globally. By contrast, during the 2008 U.S. housing crisis, delinquency rates soared past 10% in some states because underwriting standards were loose and many borrowers were approved for loans they couldn’t truly afford.

A Historical Contrast: Canada vs. U.S. in 2008

The difference between Canada’s cautious approach and the U.S. mortgage meltdown is striking. In the mid-2000s, American lenders offered “no-doc” or “liar loans,” where applicants didn’t need to fully verify their income. Adjustable-rate mortgages with teaser rates encouraged borrowers to stretch beyond their means.

When interest rates rose, millions couldn’t keep up, triggering a wave of foreclosures and the 2008 global financial crisis.

Canada largely avoided this fate. OSFI had already begun tightening rules in the early 2010s, and the B-20 guideline formalized stricter requirements. Instead of an implosion, Canada experienced a slowdown but kept defaults minimal. That decision more than a decade ago is still paying dividends today.

Sellers Showing Financial Muscle

Another sign of strength is how Canadian homeowners respond when markets soften. OSFI recently noted that about 25% of home listings are being pulled instead of being sold at steep discounts.

This shows sellers are not so financially strained that they’re forced to sell at any cost. They have the ability to keep paying their mortgages and wait for a better opportunity.

This behavior keeps the market from spiraling downward. Instead of fire sales and panic, price adjustments happen gradually. For professionals, this means less volatility. For families, it means fewer foreclosures in their neighborhoods.

Condo Markets: Resetting for Affordability

Not all areas of the housing market are booming. Condo markets in Toronto and Vancouver, Canada’s two most expensive cities, have seen increased supply and declining prices.

While this may concern investors, it also has an upside. Lower condo prices improve affordability for younger buyers. For many millennials and Gen Z Canadians, condos are the most realistic path to homeownership.

This mirrors trends in U.S. markets like Phoenix and Las Vegas, where condo corrections after 2008 created new opportunities. Price dips are painful for some but necessary for long-term balance.

Banking Buffers: The Unsung Hero

Canada’s banks are also a big part of the story. OSFI requires them to hold minimum capital ratios to protect against downturns.

The current Common Equity Tier 1 (CET1) floor is 11.5%, but Canadian banks average around 13.7%. That extra cushion may sound small, but it represents billions in reserves.

This means if defaults rise, banks can absorb the losses instead of failing. During the 2008 U.S. crisis, smaller banks without similar cushions collapsed, and taxpayers funded massive bailouts. Canada’s conservative culture helped avoid that outcome.

Domestic Stability Buffer (DSB): The Shock Absorber

The Domestic Stability Buffer (DSB) is another critical tool. It currently sits at 3.5%, requiring banks to hold even more capital as protection.

Think of it as shocks on a car. Without them, every pothole rattles you. With them, the ride is smoother.

OSFI adjusts the DSB depending on economic conditions:

- If risks rise, the buffer stays high or increases.

- If risks ease, it can be lowered, freeing banks to lend more.

This flexibility allows regulators to manage risk proactively. In fact, during the COVID-19 crisis in 2020, OSFI temporarily lowered the DSB, freeing up lending capacity to help households and businesses survive the shock.

Case Study: How Stress Tests Paid Off in 2020

The pandemic was the ultimate stress test for the housing market. With job losses, reduced incomes, and economic uncertainty, many expected a wave of defaults.

But thanks to the B-20 stress test, most borrowers had already proven they could afford higher payments. Even as interest rates fluctuated, delinquency rates barely moved. While the U.S. relied heavily on mortgage forbearance programs, Canada’s market absorbed the shock more smoothly.

Lesson learned: strict rules may feel tough upfront but prevent much larger problems down the road.

International Recognition

Canada’s framework hasn’t just drawn domestic praise. The International Monetary Fund (IMF) has highlighted Canada’s mortgage stress tests as a “critical safeguard” for global financial stability. Other countries, from the U.K. to Australia, have studied similar models.

This global recognition reinforces that Canada’s system is not overly cautious—it’s smart risk management that other nations could replicate.

What the U.S. Can Learn?

Canada’s housing resilience offers clear lessons for the United States:

- Stress Testing Works – Borrowers must prove they can handle rate hikes.

- Capital Buffers Build Confidence – Banks stay strong even in downturns.

- Flexibility Matters – Adjustable tools like the DSB help manage evolving risks.

- Corrections Can Help Buyers – Falling condo prices improve access for new entrants.

- Discipline Pays Off – Conservative rules may feel restrictive but reduce crisis risk.

Practical Advice for Buyers and Professionals On How Strong Underwriting Is Shielding Canada’s Housing Market

If you’re considering a mortgage, whether in Canada or the U.S., here’s what you can take away:

- Stress Test Yourself: Don’t just budget at today’s rates. Add 2–3% and see if it’s still affordable.

- Save a Cushion: Keep three to six months of living expenses saved for emergencies.

- Borrow Conservatively: Just because you qualify for the maximum doesn’t mean you should borrow it.

- Follow Market Signals: In Canada, OSFI’s DSB decisions matter. In the U.S., Fed interest rate policy sets the tone.

- Think Long-Term: Housing is cyclical. Short-term dips can create opportunities for buyers.

Outrage Erupts as Federal Union Slams Cuts to CRA Call Centres

Union Blames Job Cuts for CRA’s Call Centre Collapse—Taxpayers Left in Limbo

Centre Promises a Consumer-Centric GST Makeover — What’s in It for You?