HP Pushes for Separate E-Way Bill to Track Narcotics Under GST: When Himachal Pradesh (HP) recently urged the GST Council to roll out a dedicated e-way bill system for narcotic drugs and psychotropic substances, it wasn’t just another bureaucratic update—it was a calculated policy move to close one of India’s most dangerous loopholes: the diversion of legal pharmaceutical products into the illegal drug trade. Himachal’s Baddi-Barotiwala-Nalagarh belt is Asia’s largest pharmaceutical manufacturing hub, home to hundreds of plants producing everything from antibiotics to potent opioids. While the majority of these medicines are destined for legitimate hospitals and pharmacies, some inevitably leak into the black market. HP’s new proposal aims to ensure that once a narcotic substance leaves a factory, it can be traced every step of the way.

HP Pushes for Separate E-Way Bill to Track Narcotics Under GST

Himachal Pradesh’s push for a separate e-way bill for narcotics under GST is more than a state initiative—it’s a potential national model for closing the drug diversion loophole. By marrying GST’s digital backbone with NDPS enforcement, India can significantly tighten control over its legal narcotics supply chain. If implemented with care—balancing enforcement with industry support—it could reduce illegal diversion, improve public health outcomes, and create new professional opportunities in compliance and logistics.

| Aspect | Details |

|---|---|

| Proposal | Himachal Pradesh wants a special GST e-way bill to track narcotics and psychotropic drugs separately from other goods. |

| Goal | Stop diversion of legal drugs into illegal markets using real-time supply chain monitoring. |

| Key Enforcement Tool | Supervisory committees led by SDMs, including Excise, Police, and Drug Control Authority officials. |

| Added Measures | Quantity caps for license holders, NDPS Rule updates, grassroots anti-drug programs. |

| Data Point | India seized over 2,000 kg heroin and 3,000 kg opium in 2023 (NCB). |

| Global Reference | Similar to U.S. DEA’s ARCOS system for tracking opioids. |

| Official Source | Read official coverage here |

How the GST E-Way Bill System Works Today?

The GST e-way bill, introduced nationwide in April 2018, is a digital permit for transporting goods valued over ₹50,000. It contains details like the consignor, consignee, goods description, origin, destination, and vehicle number. Currently, it treats all goods the same way—whether it’s 10 tons of steel or a batch of morphine tablets.

This “one size fits all” approach works for most industries but leaves narcotics vulnerable to diversion. Once a shipment leaves a licensed plant, there is no special monitoring unless enforcement agencies conduct physical checks. HP’s proposed system would create a separate category with enhanced monitoring and automatic oversight.

Historical Context: NDPS Act and the Drug Diversion Challenge

India’s Narcotic Drugs and Psychotropic Substances (NDPS) Act of 1985 is one of the strictest anti-drug laws globally. It regulates cultivation, production, sale, and possession of narcotics and psychotropics. Amendments in 1988, 2001, and 2014 introduced harsher penalties and provisions for medical and scientific use.

Despite this, diversion continues to be a problem. For example:

- In 2019, police in Punjab seized over 100,000 tablets of tramadol diverted from a legal supply.

- In 2022, the CBI uncovered a network illegally exporting pseudoephedrine to foreign methamphetamine labs.

The weakness lies in monitoring transit—a gap the special e-way bill could close.

HP Pushes for Separate E-Way Bill to Track Narcotics Under GST: What Will Change

Himachal Pradesh is advocating for:

- Special Narcotics E-Way Bill Category

Available only to licensed handlers under NDPS rules.

Mandatory for all shipments of narcotics and psychotropics, regardless of value. - Real-Time GPS Tracking

Trucks carrying these substances must be GPS-enabled, transmitting location updates every few minutes. - Automated Alerts

If a shipment deviates from its planned route or stops in an unapproved location, alerts go to enforcement teams. - Data Integration

The GST portal would cross-check licenses against NDPS and Drug Controller databases. - Strict Stock Limits

License holders can store only approved quantities at a time to reduce hoarding risks.

How It Would Work: A Step-by-Step Example

Consider a licensed pharma plant in Baddi shipping 100 kg of codeine-based cough syrup to a hospital in Lucknow:

- Bill Creation – The manufacturer logs into the GST portal, selects “Special Narcotics E-Way Bill,” and enters license, batch, and vehicle details.

- Verification – The system cross-references NDPS licenses and flags any irregularities.

- GPS Monitoring – The vehicle’s GPS sends live data to a central dashboard.

- Route Enforcement – If the truck stops for more than 15 minutes outside approved zones, the Excise and Police receive a real-time alert.

- Digital Receipt – Upon delivery, the consignee signs electronically, closing the tracking loop.

Enforcement Beyond the Portal

HP is pairing technology with human oversight:

- Supervisory Committees: Led by Sub-Divisional Magistrates with Excise, Police, and Drug Control Authority members to inspect plants and records.

- District Committees: Headed by District Magistrates for coordination and public outreach.

- Public Campaigns: Targeting youth in rural areas through schools and community programs.

Global Lessons and Case Studies

- United States – The DEA’s ARCOS system tracks every opioid pill from factory to pharmacy. Data from ARCOS was instrumental in exposing oversupply in certain counties during the opioid crisis.

- Australia – The SafeScript program monitors prescriptions in real time, alerting pharmacists to potential misuse.

- European Union – The EMCDDA maintains a centralized drug monitoring database for all member states, aiding cross-border enforcement.

India’s proposed model borrows elements from all three, but will need to adapt for its larger, more fragmented supply chain.

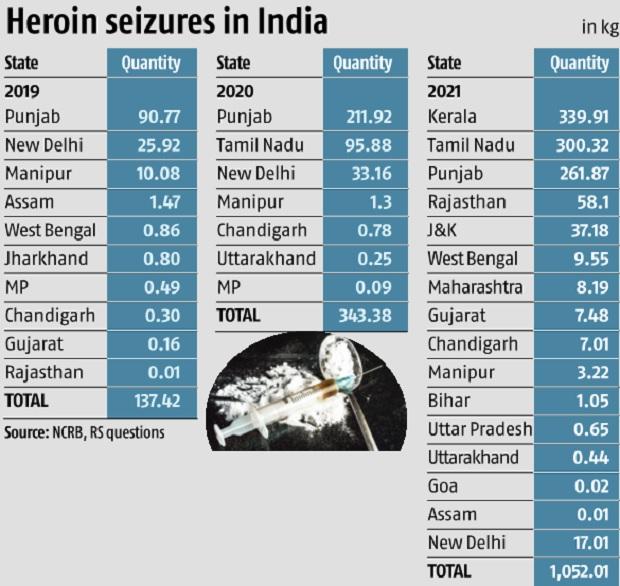

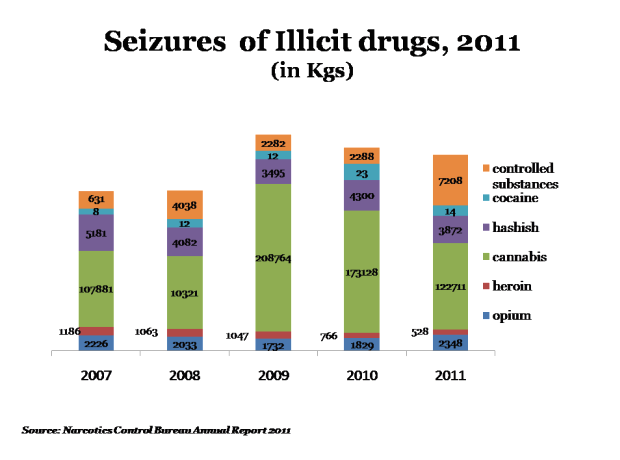

The Scale of the Problem in India

According to the Narcotics Control Bureau’s 2023 report:

- Over 2,000 kg of heroin and 3,000 kg of opium were seized in a single year.

- Diversion of synthetic opioids like tramadol and fentanyl is on the rise.

- Licensed opium production for medical use makes India a target for traffickers.

The UNODC has warned that South Asia’s growing pharmaceutical industry could be exploited for illegal drug manufacturing without stringent supply chain controls.

What It Means for Businesses and Professionals?

For those in pharma manufacturing, logistics, or compliance:

- Higher Compliance Costs – GPS systems, software upgrades, and staff training.

- Tighter Audit Trails – Easier to prove legitimate supply chain activities.

- New Career Roles – Increased demand for compliance managers, data analysts, and enforcement tech support.

- Reputational Shield – Transparency can protect against regulatory penalties and public backlash.

Transport companies will face mandatory GPS installation, driver verification protocols, and possibly higher insurance requirements.

Economic and Social Impacts

Economically, a transparent supply chain reduces losses from theft or diversion and can improve investor confidence in the pharmaceutical sector. Socially, reducing the illegal narcotics supply helps curb addiction rates, lowers healthcare costs, and improves community safety.

In the United States, tightening opioid supply tracking contributed to a decline in prescription opioid misuse rates from 4.7% in 2015 to 3.5% in 2020, according to the CDC. While India’s situation differs, similar benefits could follow.

Risks and Challenges

- Technology Gaps – Smaller firms may lack the hardware or IT skills for integration.

Solution: Government subsidies or phased rollout. - Privacy Concerns – GPS and license data must be secured to prevent misuse.

Solution: Encrypted data transmission and access controls. - Criminal Adaptation – Traffickers may shift to non-monitored substances.

Solution: Broaden monitoring scope and stay ahead of trends. - Implementation Delays – GST Council’s approval process can be slow.

Solution: Pilot projects in high-risk states like HP and Punjab.

Preparation Guide for Businesses

- Audit NDPS Licenses – Ensure they are valid and up to date.

- Upgrade Logistics Tech – Install GPS and integrate with GST systems.

- Train Staff – From warehouse clerks to drivers, everyone needs to understand compliance.

- Secure Storage – Strengthen physical security and monitoring in warehouses.

- Maintain Digital Logs – Keep daily inventory and movement records for quick retrieval.

Government Appoints 33 Experts to GST Appellate Tribunal – What This Means for GST Appeals!

GST Council Considers Amnesty That Could Save Small Businesses Lakhs in Penalties

GST Notification 56/2023 Declared Illegal by Madras HC in Major Setback to Tax Authorities