Hyundai India Slashes Car Prices By Up To Rs 2.4 Lakh After GST Cut: When Hyundai India slashes car prices by up to Rs 2.4 lakh after a major GST cut, it’s not just about getting a cheaper car—it’s about a seismic shift in India’s auto industry. This move, triggered by GST 2.0 reforms, simplifies taxes and brings new opportunities for buyers, dealers, and even competitors. If you’ve been eyeing a Hyundai Creta, Venue, or the premium Tucson, you’re in luck. The savings are massive, and the timing couldn’t be better with the festive season right around the corner. Let’s dive in.

Hyundai India Slashes Car Prices By Up To Rs 2.4 Lakh After GST Cut

Hyundai India’s decision to slash prices by up to ₹2.4 lakh post-GST 2.0 is more than just a festive-season treat. It resets the market, pressures rivals, and gives buyers unprecedented value. Whether you’re a family buying your first hatchback, a young pro looking for a Creta, or a business adding to a fleet, this is the moment to act.

| Category | Details |

|---|---|

| Price Reduction | Up to ₹2.4 lakh (biggest cut on Tucson) |

| Effective Date | From September 22, 2025 |

| Top Models Impacted | Tucson, Venue, Creta, Alcazar, i20, i20 N Line, Exter, Aura, Verna, Nios |

| GST Slabs Post-Reform | 18% for small cars, 40% for larger cars/SUVs |

| Why the Cut? | Simplified GST led to lower effective taxation |

| Who Benefits Most? | SUV buyers, first-time car owners, and fleet operators |

| Official Hyundai Source | Hyundai India Official Website |

Why Hyundai India Slashes Car Prices By Up To Rs 2.4 Lakh After GST Cut?

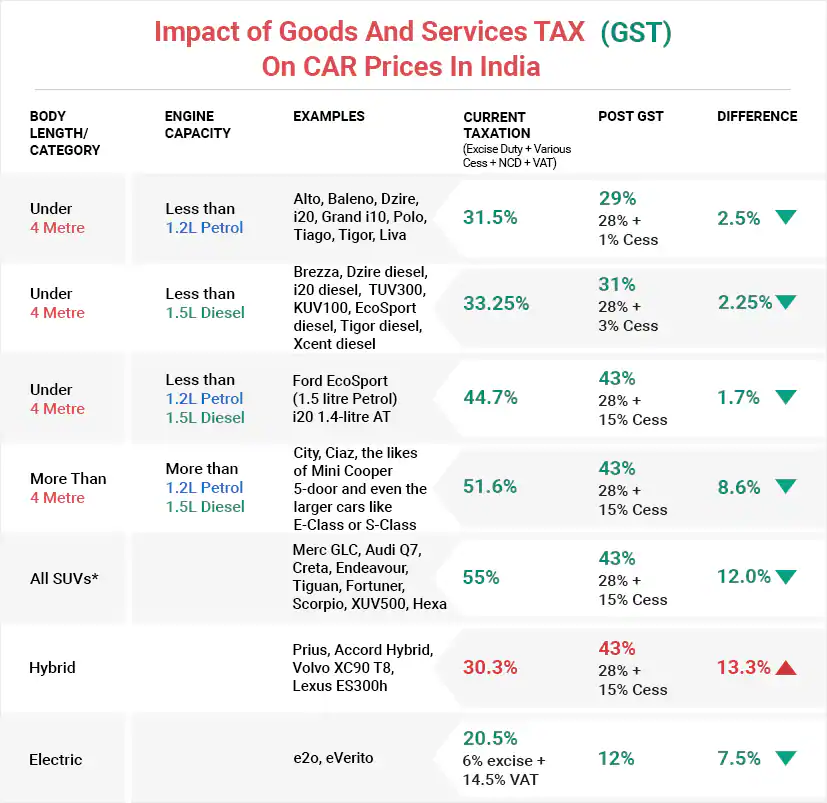

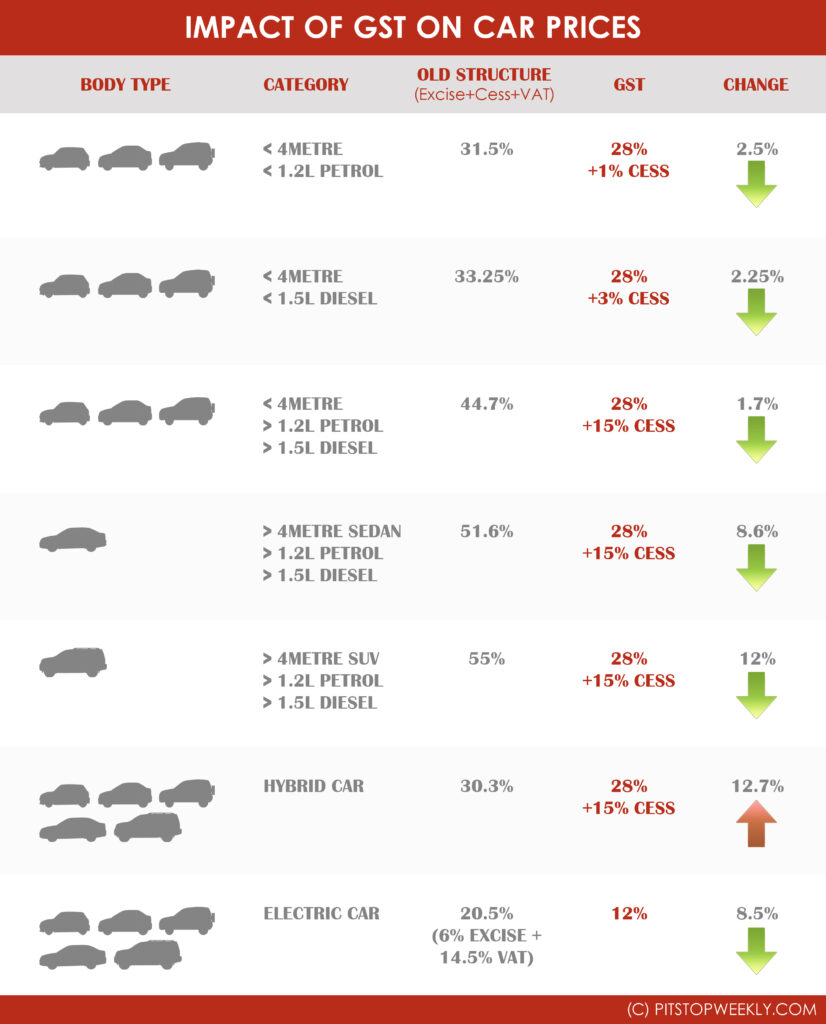

Before GST 2.0, India’s car buyers dealt with a messy system: 28% GST + a cess up to 22% on bigger cars. That meant luxury SUVs could see tax rates soar above 50%. Compare that to the U.S., where sales tax averages 6–9% depending on the state, and you see why Indian cars were so pricey.

With GST 2.0 (2025):

- Small cars → Now taxed at 18% flat.

- Larger cars/SUVs → 40% GST, but no cess.

This makes cars cheaper to produce and sell, and Hyundai wasted no time passing savings to customers.

Hyundai’s Model-Wise Price Cuts

Big Winners

- Tucson – Up to ₹2.4 lakh off. Once considered premium, it now appeals to professionals and families who wanted luxury without stretching their wallets.

- Venue & Venue N Line – ₹1.2 lakh cheaper. Already the go-to SUV for young families and first-time buyers, now even more attractive.

Mid-Range Favorites

- i20 N Line – Savings of ₹1.08 lakh. The sporty hatchback is now more budget-friendly.

- i20 – Nearly ₹98k off, appealing to both college students and working professionals.

- Creta & Creta N Line – About ₹72k cheaper. With Creta already India’s best-selling SUV, this ensures it holds the crown.

Family-Friendly Choices

- Exter, Aura, Grand i10 Nios – Discounts of ₹73k–89k. Great city cars and family rides at reduced costs.

- Verna – ₹60k reduction makes this sedan a strong contender again.

- Alcazar – ₹75k less, ideal for larger families.

Hyundai’s History With Price Cuts

Hyundai isn’t new to aggressive pricing. Back in 2017, when the first GST reforms hit, Hyundai slashed prices of models like Creta and i20 by up to ₹1 lakh. In 2020, during the pandemic slump, Hyundai offered interest-free EMI holidays to maintain demand.

This history shows Hyundai understands Indian buyers: value matters more than flashy features. By moving fast with GST 2.0 cuts, Hyundai reinforces its reputation as a customer-first company.

Impact on Different Buyer Segments

Urban Buyers

Metro buyers, especially in Delhi, Mumbai, and Bangalore, will see SUVs like Creta and Tucson become more attainable. Expect to see more white-collar professionals trading up from hatchbacks.

Rural Buyers

In Tier-2 and Tier-3 towns, entry-level models like Exter, Nios, and Aura become hot picks. Lower taxes make financing easier for small business owners and farmers.

Fleet & Corporate Buyers

Cab operators and corporate fleets save lakhs on bulk purchases. For example, a fleet of 50 Hyundai Vernas could now cost ₹30 lakh less overall. That’s game-changing.

Consumer Psychology & Festive Timing

Indians often wait for festivals like Navratri and Diwali to buy cars, believing purchases bring good fortune. Add in bank discounts and reduced EMIs, and Hyundai’s timing is a masterstroke. Dealerships are expected to be packed as buyers line up for deliveries before Diwali.

Expert Commentary

According to SIAM (Society of Indian Automobile Manufacturers), SUV sales already make up over 50% of India’s passenger vehicle sales. With Hyundai’s cuts, this dominance will grow.

Analysts from Autocar India predict Hyundai could increase its market share by 3–5% in 2025, especially in the SUV segment where rivals like Tata Nexon and Mahindra XUV700 have been leading.

Competitive Landscape: Hyundai vs. Rivals

- Tata Motors – Tata Nexon and Harrier face direct heat. Hyundai’s cuts put pressure on Tata to respond.

- Mahindra – XUV700 and Scorpio may lose some ground in pricing battles.

- Kia – Seltos and Sonet, Hyundai’s “cousins,” may soon mirror the cuts.

- Maruti Suzuki – Already competitive in hatchbacks, Maruti now faces tougher competition in SUVs.

In short: Hyundai just shook up the SUV battleground.

Dealer Sentiment and On-Ground Response

Hyundai dealers across India are already reporting a surge in inquiries since the GST 2.0 announcement. Showrooms in metro cities like Delhi and Mumbai have seen footfall increase by nearly 25% in the past week, according to industry reports. Dealers believe this momentum will continue well into the festive season, especially as buyers realize the savings are substantial and long-term. Some dealerships are also bundling insurance discounts, extended warranties, and exchange bonuses with the revised prices, creating a double advantage for customers who choose to book early.

Global Comparison: India vs. the World

- United States – Lower taxes, but cars often cost more due to higher labor and insurance costs.

- Europe – VAT is 15–25% on cars, but EV subsidies are stronger.

- India – Now with GST 2.0, India moves closer to global norms, though prices are still higher compared to per-capita income.

Impact on Used Car Market

Price cuts on new cars usually push used car prices down in the short term. A 3-year-old Creta that might’ve fetched ₹12 lakh last month may now struggle at ₹11 lakh, as buyers stretch budgets for brand-new models.

But long term, popular models like Venue and Creta retain strong resale value thanks to demand.

Financing & Loan Market

Banks and NBFCs are expected to cash in on the demand surge. For example:

- A ₹15 lakh Hyundai Creta, pre-cut, meant an EMI of around ₹27,000/month (5 years, 9% interest).

- Post-cut at ₹14.3 lakh, the EMI drops closer to ₹25,800/month.

That ₹1,200 saved every month is a big deal for middle-class families. Multiply that over 5 years, and you save ₹72,000 in interest plus the upfront ₹70k cut.

Future Outlook: EVs & Policy

This GST 2.0 cut mainly benefits ICE cars. But India is also pushing EV adoption. Currently, EVs are taxed at just 5% GST. Models like Hyundai Kona Electric and Ioniq 5 are unaffected by this cut but remain beneficiaries of EV subsidies.

In the long run, Hyundai’s pricing play in ICE could give it the breathing room to invest more in EV infrastructure and production. Expect Hyundai to double down on EV launches in India by 2026–27.

Practical Tips for Buyers

- Don’t Wait Too Long – Delivery timelines may stretch with festive demand.

- Shop Around Dealers – Some offer freebies like free insurance or extended warranties.

- Check Finance Options – Compare loan rates. Public-sector banks often give better festive rates.

- Plan Resale – Choose models like Creta and Venue for best long-term value.

Small Cars May Get Cheaper Under New GST Reform – But Luxury Cars to Stay Costly

India Proposes At Least 10% GST Cut On 175 Products Including ACs And Hybrid Cars

GST 2.0 Announced—Nirmala Sitharaman Calls It the Final Big Tax Reform for India