I-T Department Cracks Down On Tax Evasion: When the Income Tax (I-T) Department says it’s about to crack down, folks in India know it’s no bluff. Over the past few months, the I-T Department has unleashed one of its biggest clean-up drives, targeting not only tax evasion schemes but also the shady misuse of Corporate Social Responsibility (CSR) donations. The message is loud and clear: dodging taxes and siphoning funds in the name of charity just won’t fly anymore. This sweeping crackdown is shaking up businesses, politicians, and even some nonprofits. From ₹800 crore in CSR scams to fake political donation claims worth thousands of crores, the scale is massive—and it’s catching headlines everywhere.

I-T Department Cracks Down On Tax Evasion

The I-T Department’s crackdown on tax evasion and CSR donation misuse is more than a one-off sweep—it’s a new era of enforcement. With AI-powered detection, stricter laws, and global coordination, the tax net is tighter than ever. For professionals and businesses, the lesson is simple: play by the rules, keep your books transparent, and treat CSR as a responsibility, not a loophole.

| Key Issue | Details & Impact |

|---|---|

| CSR Donation Misuse | Over ₹800 crore siphoned via bogus trusts across six states. |

| Real Estate Tax Evasion | Former MP Ranjith Reddy & DSR Group raided; ₹7 crore cash seized. |

| Fake Deduction Scams | 200+ raids nationwide exposed bogus claims under political donations, HRA, loans, and more. |

| Voluntary Corrections | 40,000 taxpayers withdrew false claims worth ₹1,045 crore. |

| Political Donations | ₹4,500 crore in dubious political donations flagged; ₹1,400 crore recovered. |

| AI-Driven Enforcement | CBDT ramps up artificial intelligence to spot fraud faster. Economic Times |

What’s Going Down with CSR Misuse?

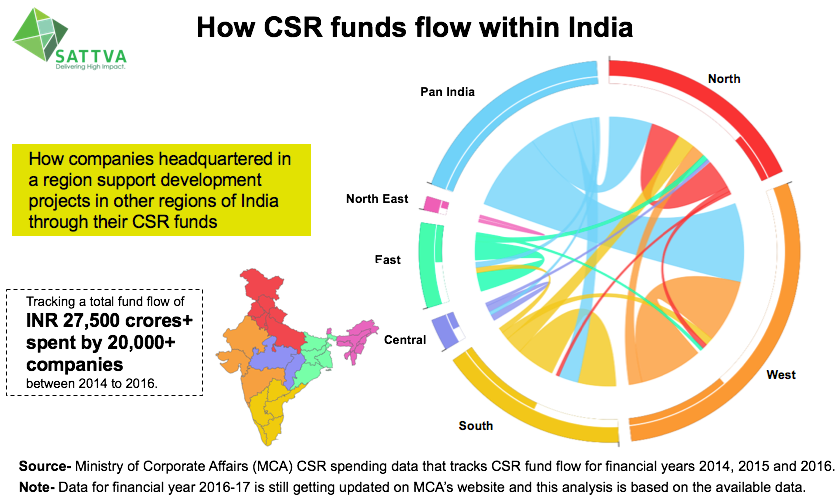

CSR in India was designed to make companies give back to society—funding schools, hospitals, and social causes. But recent investigations show that some trusts were just fronts to launder money.

- Three trusts—Jan Jagriti Sevarth Sansthan, Dr. Brajmohan Sapoot Kala Sanskriti Seva Sansthan, and Raginiben Bipinchandra Sevakarya Trust—were allegedly caught diverting CSR funds abroad.

- The racket siphoned ₹800 crore, with funds routed through shell companies into accounts in UAE, Hong Kong, Singapore, and China.

- These trusts claimed to be working in education and health but delivered zero charitable activity.

This discovery is alarming because CSR was meant to be a bridge between corporates and communities. Instead, it turned into a loophole for siphoning cash out of the system.

Real Estate Evasion: The DSR Group Story

Real estate has always been a hotspot for cash dealings. This time, the DSR Group and former MP Ranjith Reddy found themselves under the I-T lens.

- Properties sold at ₹12,000–₹13,000 per sq. ft. were recorded as ₹7,000—masking cash transactions.

- Raids in Hyderabad and Bengaluru uncovered ₹7 crore in unaccounted cash.

Underreporting property values isn’t new, but the scale of concealment here shows how entrenched the practice is. It not only robs the government of revenue but also distorts property market prices.

Bogus Deductions: A Nationwide Epidemic

This crackdown goes beyond corporates. Everyday taxpayers also got tangled, claiming fake deductions under:

- Section 80GGC (political donations)

- Section 10(13A) (house rent allowance)

- Section 80E (education loan interest)

- Section 80D (medical expenses)

- Section 80G (charitable donations)

Over 200 locations across India were raided. Investigators found networks of chartered accountants, intermediaries, and fake NGOs providing receipts to inflate tax deductions.

In just four months, around 40,000 taxpayers voluntarily updated returns, correcting ₹1,045 crore worth of false claims. Yet, thousands more remain under the scanner.

Political Donations: A Major Scam

One of the biggest revelations was around political donations.

- The I-T Department flagged ₹4,500 crore in dubious donations, with ₹1,400 crore already recovered.

- A small political party in Aurangabad allegedly acted as a conduit, issuing fake donation receipts in exchange for kickbacks.

- Hyderabad emerged as a hotspot, with fraudulent deductions exceeding ₹1,353 crore in mid-2025 alone.

This case highlights how loopholes in Section 80GGC were exploited, turning political donations into a tax evasion tool.

Legal Penalties: What Happens if You’re Caught?

The Income Tax Act isn’t just about collecting money—it has serious consequences for offenders.

- Penalty for underreporting income: 50% of tax payable.

- Penalty for misreporting (fraudulent claims): 200% of tax payable.

- Prosecution: Jail term of 3 months to 7 years under Section 276C for willful evasion.

- CSR non-compliance: Fines up to ₹25 lakh and jail time for officers under the Companies Act, 2013.

For perspective, in 2024, over 1,200 individuals and businesses faced prosecution for tax fraud. That number is expected to rise sharply in 2025 with AI-driven enforcement.

How AI is Changing the Game?

The Central Board of Direct Taxes (CBDT) is leaning heavily on Artificial Intelligence (AI) and data analytics.

- AI cross-checks third-party data such as banking, GST, and property records.

- It detects unusual spikes in donations, HRA claims, or loan deductions.

- It builds networks to spot repeat offenders and collusion between intermediaries.

AI isn’t replacing human inspectors, but it’s giving them sharper tools. It’s like giving the taxman night-vision goggles in a pitch-dark room.

Global Context: Not Just an Indian Problem

Tax evasion and charity scams are a global issue.

- In the United States, the IRS cracked down on “sham charities” and fake deductions, denying $1.2 billion in false claims in 2023.

- In the UK, HMRC identified fraudulent gift aid claims worth £560 million in 2022.

- The OECD has repeatedly flagged tax evasion as one of the biggest threats to global financial fairness, urging nations to adopt tech-driven enforcement.

India’s crackdown is in step with these global trends, showing that the fight against evasion is becoming borderless.

I-T Department Cracks Down On Tax Evasion: How to Stay Compliant

For Companies

- Verify CSR partners: Check authenticity on the CSR Portal.

- Maintain records: Keep digital receipts, impact reports, and MoUs.

- Check tax sections: Ensure CSR donations qualify under Sections 80G and 35AC.

- Conduct internal audits: Review CSR expenditures annually.

- Educate teams: Train finance staff on compliance best practices.

For Individuals

- Be honest with HRA claims: File actual rent receipts with landlord PAN.

- Cross-check donations: Donate only to registered NGOs.

- Keep loan and medical proofs: Ensure bank and hospital records match.

- Avoid “package deals”: Never buy fake receipts from intermediaries.

- File early: Avoid last-minute mistakes that attract scrutiny.

Broader Impact on Businesses and Society

The crackdown is more than just a tax collection exercise. It’s reshaping corporate behavior.

- Companies are now more cautious in selecting CSR partners.

- Chartered accountants face stricter scrutiny, pushing them toward greater transparency.

- Politicians, too, are feeling the heat, as donation channels tighten.

For society, the upside is clear. Funds meant for hospitals, education, and welfare may finally reach the people who need them, rather than being funneled into offshore accounts.

Filing ITR This Year? – 4 Key Points Every Salaried Taxpayer Must Remember

Half-Yearly Income Tax Digest 2025: Key ITAT Decisions Every Taxpayer Should Know

Ration Crackdown: Centre Flags Over 1 Crore Ineligible Beneficiaries—Action Expected Now