ICAI Bhubaneswar Hosts Literacy Drive: When we talk about financial literacy and tax education, most of us imagine dry textbooks, complicated rules, and numbers that only accountants could love. But here’s the real deal—money and taxes affect every single one of us, from the college student swiping a debit card for snacks to the professional calculating retirement savings. That’s why the latest move by the Institute of Chartered Accountants of India (ICAI), Bhubaneswar Branch, has folks talking. During Vitiyagyan Mela Week 2025 (August 17–23), ICAI brought its Financial and Tax Literacy Drive straight to Rama Devi (RD) Women’s University in Bhubaneswar. The goal? To empower young students, especially women, with real-world knowledge about taxes, finance, and spotting frauds. And let me tell you—this wasn’t your typical boring seminar. It was practical, lively, and packed with lessons that matter whether you’re 19 or 59.

ICAI Bhubaneswar Hosts Literacy Drive

The ICAI Bhubaneswar Financial & Tax Literacy Drive at RD Women’s University wasn’t just another event—it was part of a larger movement to empower citizens with financial knowledge. By teaching fraud prevention, simplifying taxes, and encouraging smart money habits, ICAI is shaping both smarter students and stronger professionals. As India pushes toward digitalization and global integration, such initiatives are more than helpful—they’re essential. Whether you’re sipping coffee in Ohio or attending class in Odisha, the message is the same: financial literacy is power.

| Point | Details |

|---|---|

| Event | ICAI Bhubaneswar Financial & Tax Literacy Drive at RD Women’s University |

| Occasion | Part of Vitiyagyan Mela Week 2025 (Aug 17–23) |

| Focus | Financial fraud prevention, tax basics, personal finance management |

| Attendance | 200+ students and faculty |

| Key Speaker | CA S.K. Abu Saqueeb – “Identifying & Preventing Financial Fraud” |

| Organizers | CA Mahendra Kumar Sahoo (Chairman), CA Soumya Sunil Sahoo (Treasurer & EICASA Chairman) |

| Nationwide Effort | 150+ ICAI programs, 65+ in schools & universities |

| Official Portal | ICAI Financial Literacy Portal |

Why Financial Literacy Matters (and Why ICAI Is Stepping Up)?

In plain English, financial literacy is knowing how money works—earning, saving, spending, investing, and paying taxes without falling into scams. In the U.S., folks might compare it to high school “home economics,” but instead of baking cookies, you’re baking up a secure financial future.

The ICAI initiative, called “Vitiya Gyan – ICAI Ka Abhiyaan,” is designed to spread these lessons far and wide. And it’s not just lectures. We’re talking interactive workshops, campus drives, radio programs, and even an online portal that has already drawn in over 115,000 visitors.

Think of it as the Khan Academy of money management, but with the official seal of one of the most respected accounting institutes in the world.

ICAI’s Legacy: A Trusted Institution

The Institute of Chartered Accountants of India was founded in 1949 and today stands as one of the largest professional accounting bodies globally, with over 350,000 members and 800,000 students. Over its 75+ years of excellence, ICAI has influenced policy, educated professionals, and built trust in financial systems.

But ICAI’s mission is not limited to professionals alone. With campaigns like this, ICAI is extending its reach beyond classrooms of chartered accountancy into everyday households, ensuring that every citizen can make smart financial decisions.

Breaking Down the ICAI Bhubaneswar Hosts Literacy Drive at RD Women’s University

So, what exactly went down at RD Women’s University? Here’s a recap in plain words:

Spotting Financial Fraud

CA S.K. Abu Saqueeb gave the keynote, and he hit hard on scams. From phishing emails to fake investment schemes, he showed students how to spot red flags. He stressed the importance of critical thinking before clicking links or sharing sensitive information.

Common fraud examples include:

- Phishing Emails: Fake bank emails asking for login credentials.

- Ponzi Schemes: High-return investments that collapse eventually.

- UPI/Payment App Scams: Fake QR codes or requests that debit money instead of crediting.

- Lottery/Prize Frauds: Messages claiming “You won, but pay a fee first.”

Taxes Made Simple

The sessions explained how GST (Goods and Services Tax) works, why income tax filing matters, and how it links to financial credibility. For many students, this was the first time tax concepts were simplified without jargon.

Example: In India, filing income tax returns helps build credit history, crucial for getting loans or scholarships. In the U.S., filing incorrectly can lead to IRS penalties or missing out on refunds.

Personal Finance Basics

Students were introduced to budgeting, saving, and investing habits. Imagine a college student splitting her ₹10,000 stipend into essentials, savings, and fun money—that’s the kind of practical advice that sticks.

Tip: Follow the 50/30/20 Rule—50% for needs, 30% for wants, and 20% for savings/investments.

Student Voices

Students shared that the program was different from their usual classes. One said, “I always thought taxes were for adults, but now I see why it matters for me too.” Another added, “This session helped me understand how fraudsters work, and I feel more confident about handling money.”

The Bigger Picture: Nationwide Financial Literacy

ICAI isn’t stopping with just one university. Under the Financial & Tax Literacy Directorate, the initiative is massive:

- 150+ Programs Nationwide at ICAI’s branches.

- 65+ Programs in Schools & Universities across India.

- Radio Campaigns in 44 cities, reaching 3.93 crore listeners in 12 regional languages.

- Online Resources covering topics from GST to insurance basics.

The campaign is comprehensive, using both digital and offline methods, ensuring that awareness reaches not just students but also homemakers, small business owners, and rural populations.

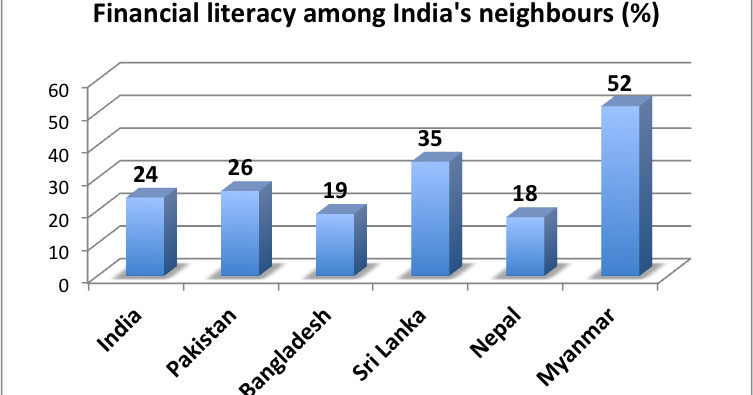

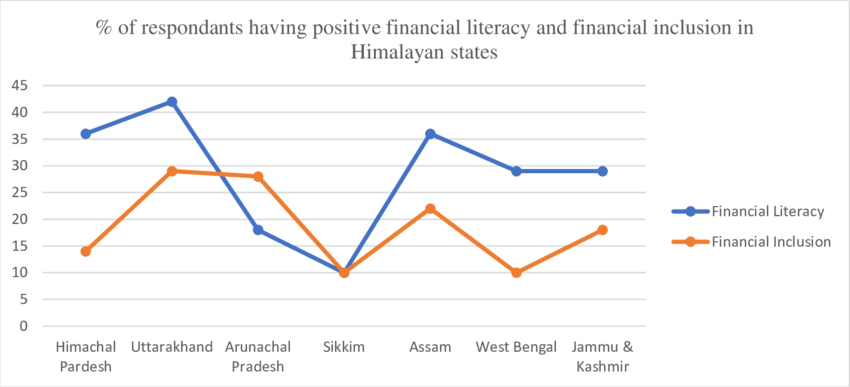

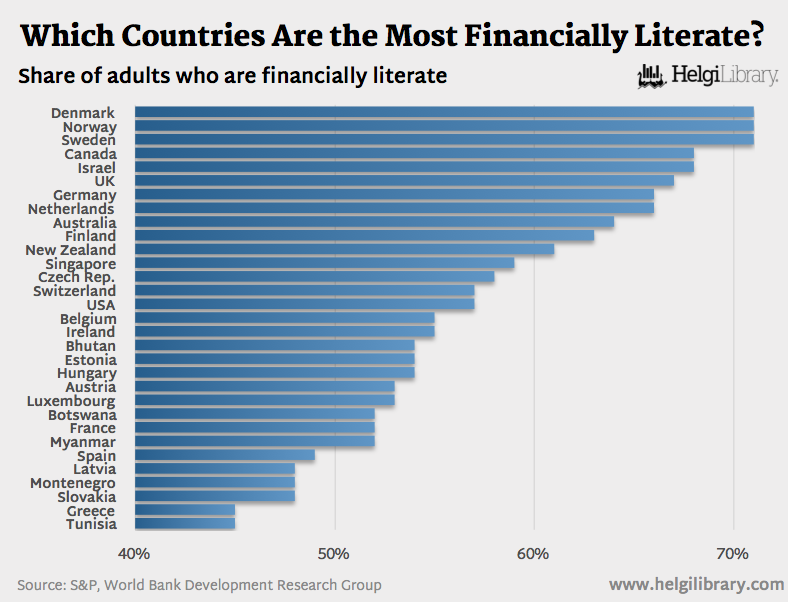

How India Compares Globally?

According to the Standard & Poor’s Global Financial Literacy Survey, only 27% of Indian adults are financially literate. Compare this to 57% in the U.S. or 71% in countries like Denmark and Sweden. The gap is significant, but initiatives like ICAI’s literacy drives are steps toward bridging it.

The OECD also highlights that financial education is now as critical as reading and writing for modern societies. With increasing digitalization, exposure to scams and complex financial products is rising, making education a necessity.

Step-by-Step Guide: 6 Ways to Build Financial Literacy

Inspired by ICAI’s program, here’s a roadmap:

- Track Spending Weekly: Use apps like Mint (U.S.) or Walnut (India).

- Understand Taxes: Learn about deductions, credits, and deadlines.

- Save Consistently: Keep at least 3–6 months of expenses as emergency funds.

- Start Investing Early: Explore SIPs in India or Roth IRAs in the U.S.

- Beware of Scams: Double-check every “too good to be true” offer.

- Keep Learning: Use trusted portals like ICAI, IRS.gov, and RBI.

Career Impact: Why Students Should Care

Financial literacy is not just personal—it’s professional. Employers value candidates who understand budgeting, taxes, and financial planning. For entrepreneurs, literacy can be the difference between success and failure.

Ways financial literacy helps careers:

- Resume Boost: Adds a skill that shows real-world readiness.

- Job Interviews: Financial awareness can shine in problem-solving questions.

- Entrepreneurship: Helps avoid mistakes like ignoring tax compliance or poor cash flow planning.

For example, a student who knows how to manage taxes may confidently launch a startup, while others struggle with compliance costs later.

CA vs CMA: ICAI’s Audit Mandate Expansion Sparks Fresh Professional Turf War

Income Tax Department Raids Over 10 Locations Across Tamil Nadu