ICEA Pushes Govt to Slash GST on ACs & TVs: When it comes to air conditioners (ACs) and televisions (TVs), most American households see them as essentials. But in India, these very same appliances are still treated like luxury goods because of high taxation. At the heart of the issue lies India’s Goods and Services Tax (GST), which places ACs and larger TVs under the highest bracket of 28%. The India Cellular & Electronics Association (ICEA) is now making a strong case to the government: reduce the GST to 18%. This proposal is not only about cheaper TVs or ACs—it’s about fair access, industrial growth, and economic modernization. If implemented, this move could reshape India’s consumer electronics landscape, much like how U.S. tax reforms helped appliances become affordable for every household.

ICEA Pushes Govt to Slash GST on ACs & TVs

The ICEA’s demand to reduce GST on ACs and TVs from 28% to 18% is more than a tax cut. It’s about affordability for families, growth for businesses, and competitiveness for India’s economy. With ACs becoming climate necessities and TVs doubling as educational and entertainment tools, keeping them in the luxury tax bracket no longer makes sense.

If approved, this change will not just reduce prices but also transform consumer behavior, boost domestic manufacturing, and align India with global tax practices. Much like in the United States, where these appliances are everyday basics, India is on the verge of treating them as essentials. All eyes are now on the GST Council. A positive decision before Diwali could mark a turning point—making this festive season not just brighter but also cooler and smarter.

| Aspect | Details |

|---|---|

| Proposed By | India Cellular & Electronics Association (ICEA) |

| Target Products | Air Conditioners, Televisions (mainly above 32 inches) |

| Current GST Rate | 28% |

| Proposed GST Rate | 18% |

| Consumer Impact | 7–10% price cut (₹1,500–₹2,500 or $20–$30 per unit) |

| AC Penetration in India | Only 8% of households own an AC |

| TV Market in 2024 | 12.1 million units shipped; 91% were smart TVs |

| Industry Growth Potential | Blue Star projects 20% sales growth if cut is approved |

| Long-Term Benefits | Boost formal sales, reduce grey market, support Make in India |

| Official Reference | GST Council – Govt of India |

The GST Story: Why 28% Exists

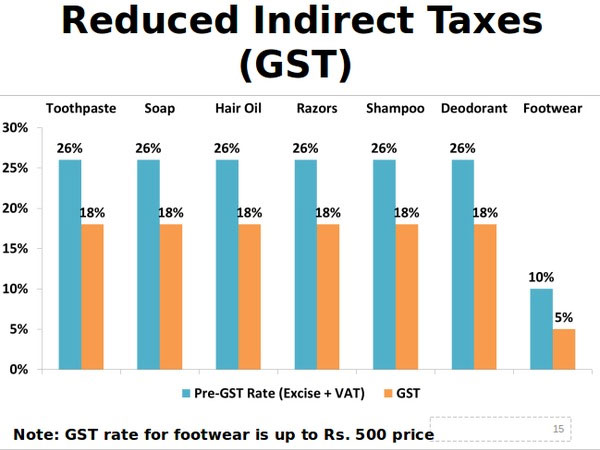

India introduced GST in 2017 to simplify its tax structure. At the time, policymakers classified goods into slabs: 5%, 12%, 18%, and 28%. Luxury and “sin goods” like high-end cars, tobacco, and premium furniture were placed in the 28% slab. Unfortunately, air conditioners and televisions above 32 inches were grouped into this category.

While this made sense years ago, today it feels outdated. Temperatures are hotter than ever, and TVs are as much an educational tool as an entertainment one. Treating them the same way as cigarettes or luxury cars no longer reflects reality.

Why ICEA Pushes Govt to Slash GST on ACs & TVs?

ACs Are Now a Necessity

India is experiencing longer and hotter summers. Heat waves routinely cross 100°F (38°C), and in some regions, over 110°F (43°C). Yet, only 8% of Indian households own an AC, compared to more than 90% in the U.S. and over 60% in China.

ACs are no longer “luxuries”—they are vital for public health, productivity, and safety. Lowering GST would allow more households to purchase ACs, reducing heat-related illnesses and improving living conditions.

TVs Drive Digital Access

The TV market in India is huge—12.1 million units shipped in 2024, and 91% were smart TVs. Streaming services, online learning, and even e-governance initiatives depend on smart screens. Yet, larger TVs still face heavy taxation.

This mismatch discourages buyers, driving many to grey markets where warranties and safety standards are compromised. By cutting GST, the government can support digital access while strengthening regulated retail channels.

The Global Comparison: India vs. The World

Let’s look at how India compares with other economies:

- United States: Appliances are subject only to state sales tax, usually 4–8%.

- European Union: VAT ranges 17–25%, but eco-friendly appliances often qualify for reduced rates.

- China: Applies 13% VAT, making appliances more affordable than in India.

- Japan: Standard consumption tax is 10%, with incentives for energy-efficient goods.

India’s 28% rate is one of the highest in the world, making even essential electronics unnecessarily expensive.

How Consumers Will Benefit?

If GST drops from 28% to 18%, here’s what consumers can expect:

- A 1.5-ton AC, now at ₹40,000 ($480), could fall by ₹3,000 ($36).

- A 50-inch smart TV, priced at ₹55,000 ($660), may reduce by about ₹4,500 ($54).

- Across the board, a 7–10% reduction in prices is expected.

For middle-class families, that’s the difference between waiting for years and buying right away.

Industry Impact: Why Companies Are Excited

Blue Star Raises Forecasts

Blue Star, a leading AC maker, revised its growth target from 10–15% to nearly 20%, anticipating a surge in demand if GST is cut.

Samsung and LG

Global giants like Samsung and LG also support the move, expecting stronger demand for premium large-screen TVs in India’s growing middle-class segment.

Leveling the Playing Field

Currently, refrigerators, washing machines, and microwaves are taxed at 18%, while ACs and TVs remain at 28%. A reduction would align these appliances and simplify consumer decisions.

Festive Season Connection: India’s Black Friday Moment

In India, Diwali is the ultimate shopping season. Families often save up all year for big-ticket items. If the GST cut is approved before Diwali 2025, it could trigger record-breaking sales of TVs and ACs.

Like Black Friday in the U.S., where electronics fly off shelves, Indians would likely rush to retailers and e-commerce platforms for deals. For businesses, this means higher sales volumes. For consumers, it means holiday savings with long-term comfort.

Economic Ripple Effects

Reducing GST has wider benefits beyond consumer savings:

- Boost in Manufacturing – More demand fuels higher domestic production.

- Job Creation – From factory workers to logistics staff, the supply chain grows.

- Energy Efficiency – Families replace outdated, power-hungry appliances with modern, efficient ones.

- Grey Market Reduction – Lower official prices reduce illegal imports, increasing formal sector sales.

- Government Revenue Stability – Though per-unit tax drops, higher sales can balance overall revenue.

The Policy Lens: Alignment with National Goals

This tax change supports three major Indian government campaigns:

- Make in India – Encourages local production of electronics.

- Digital India – Expands access to digital platforms via smart TVs.

- Climate Goals – Encourages energy-efficient appliances, reducing power consumption.

Thus, lowering GST is both an economic reform and a strategic policy move.

Practical Tips for Buyers

If you’re planning to buy an AC or TV in India, here’s what you should do:

- Wait for the next GST Council decision (expected before Diwali).

- Shortlist models now so you can buy quickly once prices drop.

- Look for 5-star energy ratings—saving on electricity bills matters as much as upfront discounts.

- Shop smart: combine tax cuts with seasonal offers on Amazon, Flipkart, and offline retailers.

- Always buy from authorized dealers for warranty and installation support.

Big GST Cuts, But Who Really Benefits? Profiteering Worries Raise Red Flags

Will Modi’s GST Reforms Tame Inflation and Push RBI Toward Cuts?

GST Cuts Could Boost Consumption by ₹2 Lakh Cr – Can Economic Growth Offset Losses?